Welcome to Part 2 of my four-part State of the Household Financial Report. If you missed it, be sure to check out Part 1 first!

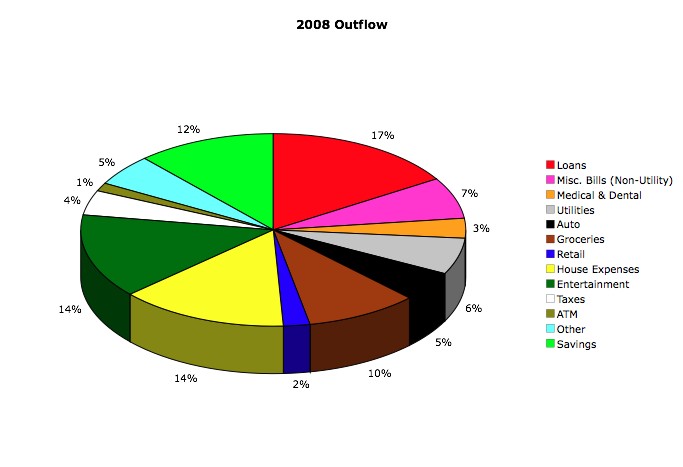

Once again, here is the illustrative breakdown of my “outflow”, or expenses, for the year in the form of a pie chart. The money that makes up the pie chart primarily comes from my take-home pay, which excludes withheld taxes, paycheck deductions for health and other benefits such as additional life insurance, and contributions to my 401(k) plan.

The pie chart shown below, in essence, represents exactly how we chose to allocate our take-home pay for the year:

As you can see, the chart is broken up into various categories. In Part 1, I dissected and discussed the four biggest categories that consumed our annual household income. Those categories being the “Loans”, “House Expenses”, “Entertainment”, and “Savings.” I will now review of the remaining categories which, although make up a smaller percentage of the pie, are no less important. And as I stated in Part 1, this section includes the most important category of them all. Did you guess which one? (Hint: It will be the last category I address in this post).

Groceries

In pure dollar terms, my grocery bill has gone up 2.4 times since 1999; that far exceeds the rate of inflation over that same period. So why the increase? Quite simply, the main reason can be attributed to my two growing kids who are currently aged 11 and 9.

I anticipate that the annual grocery bill will really start to skyrocket once my 11 year-old son gets into his teen years. Heck, he already is eating me out of house and home! Scary. I shouldn’t be surprised though. I know I am guilty of eating my mom and dad out of house and home too. I guess it’s payback time! I’d be interested in hearing how big the grocery bills are for some of you with teenagers out there so I can properly prepare myself for the coming onslaught! 🙂

Miscellaneous Bills

Ah, yes. The old “Miscellaneous Bills” category. This category could easily be called “Life”. We spent roughly 7% of our take-home pay in 2008 on such things as association fees, life insurance, newspaper and magazine subscriptions, haircuts, stamps and other postage costs, Girl Scout cookies and cash donations to charities. It also includes Christmas, birthday, graduation and wedding gifts, and even the vet and grooming bills for our Rhodesian Ridgeback, Major.

Utility Bills

Utilities eat up 6% of our annual household take-home pay. There is really no mystery here as to what this category entails, but for the sake of completeness I’ll break it out for you. In addition to natural gas, electricity, phone, sewer, trash and water, other utilities here include our Internet service, and satellite television. This category is extremely fascinating to me when I look at the 10-year numbers. I’ll explain more in Part 3 when I will breakdown and focus on the long-term trends. But if you had to guess right now, how much would you say cumulative utility prices have risen over the past decade? Can you guess which utilities went up faster than the others?

Automobile

We’re not free of auto expenses just because our household doesn’t have a car payment or two. We still spent 5% of our annual income on auto-related items like gasoline, registration fees, car insurance, the auto club membership, and servicing and maintenance on the Honeybee’s 2001 Honda Odyssey and my 1997 Honda Civic. Luckily they’re Hondas, so they are extremely reliable.

Taxes

This section covers all taxes not already withheld from my paychecks by my employer, although for all intents and purposes, this consists entirely of my property taxes. In 2008, those property taxes accounted for roughly 4% of my annual take-home pay. How does that compare with you? Luckily, I live in California, where property taxes are limited by Prop 13. For those of us in California and other states with laws similar to Prop 13 who can manage to stay in their home for 20 or 30 years, the benefits can be truly substantial.

Medical Bills

This category accounted for roughly 3% of our take-home income in 2008. It does not include the small deductions that my employer takes out of my paycheck for the insurance, but it does include all of the deductibles and other non-covered expenses that we encounter each year.

Retail

This category covers retail items not covered in other categories that you might get at places like Target, Wal-Mart, K-Mart, Kohl’s, etc.

ATM

To me, this is the most important category of them all; it certainly is the one category that every household should track like a hawk. In my experience helping others get their household finances in order, cash withdrawals from an automated bank teller machine are the biggest single source of what I call “income leakage.” It seems like not a day goes by when I talk with someone who says they are trying so hard to make ends meet, but for the life of them they can’t figure out where all their money is going. The first place I always tell these folks to look is at their ATM receipts. Why? Because cash in the wallet or purse is susceptible to impulsive spending that can bust a budget.

In 2008 we withdrew only 1.5% of our annual take-home pay from the ATM. I strongly recommend all households that have trouble keeping cash in their wallets and purses strive to keep this number to 2.5% of their take home pay or less. Basically, what this does is put a budgetary cap on your impulsive spending — assuming you can stick to it, of course. 🙂

And yes, I realize that by tracking an “ATM” category I slightly affect the accuracy of my other categories! For example, money I might spend on a movie with cash I got from the ATM doesn’t get tracked in the “Entertainment” category. But as long as the amount of money in the ATM category remains relatively small, its effect on the other categories will be negligible. It’s a trade I am more than willing to live with.

I hope you enjoyed going over my 2008 State of the Household Financial Report with me. Hopefully this may give you some ideas for how to track your expenses and income. Remember that there is no correct way to do this with respect to how you break out your expenses. But my philosophy is, if you want to do it right, you should be as thorough as possible.

Next, in Part 3, I will look at my long-term trends over the last ten years for these same categories as they pertain to my household expenses. I am sure you’ll agree that the data, spanning from 1999 to 2008, are extremely interesting. After all, it is those long-term trends where the real insight comes into view regarding the wisdom of living within your means.

If you liked this article, please be sure to subscribe to my RSS feed.

Question of the Week