As required by our household constitution, the household CFO is required to deliver the family financial report to the household CEO each January. � 😉

As such, the ever-dependable Honeybee has painstakingly tracked and recorded our finances for over 10 years using Excel, which is a Microsoft spreadsheet tool that I highly recommend. � I’ve reviewed the numbers and I am quite pleased.

With her report for 2008 finished I thought you, too, might like to see a detailed breakdown of my household expenses for the past year. � � By doing this, hopefully some of you may also be able to gain some insight by looking at exactly how we track and manage our household finances.

Since I have detailed records going back to 1999, I will also show you data that reveals longer-term trends applicable to typical households with a genuine commitment to living within their means. � By observing this long-term data I hope you will be able to glean some additional insights regarding the long-term advantages and benefits of sticking to a disciplined budget. � This long-term data should also provide a strong dose of encouragement to those in their twenties and thirties, who may be questioning whether early scrimping and saving is really worth it (trust me, it is)! � 🙂

So without further ado, here is my State of the Penzo Household financial report for 2008:

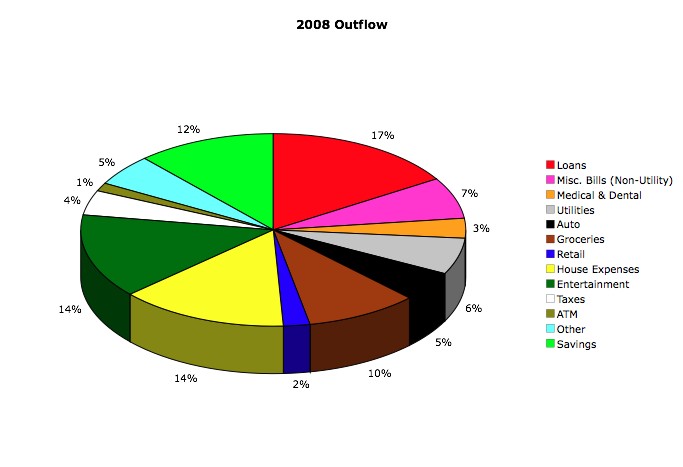

Let me start off by giving an illustrative breakdown of my “outflow”, or expenses, for the year in the form of a pie chart. � � As the Honeybee is a hard-working but unpaid stay-at-home mom, the money that makes up the pie chart primarily comes from my take-home pay, which excludes withheld taxes, paycheck deductions for health and other benefits such as additional life insurance, and contributions to my 401(k) plan.

The pie chart, in essence, represents exactly how we chose to allocate our take-home pay for the year. Here it is:

As you can see, the chart is broken up into various categories. � Let’s go over the categories, shall we?

Loans

The biggest chunk of our household income (17%) falls under this category. � This category is reserved for mortgage and auto loans. � Since both of our cars are paid for, this category basically reflects our mortgage payment. � Followers of this blog know that we are dedicated to paying off the mortgage early; in fact, the plan is to retire it by 2017. � � As a result, this number could have been reduced by a few percentage points if we chose to make the standard monthly payments. � However, because paying-off the mortgage early is a no-brainer, our long-term household strategic plan has us making additional payments. � � Those who are just starting out will find that this number can be frighteningly high (sometmes as much as 40% or more), but don’t depair! � Over time this number will drop considerably, as you will see when I show you my ten-year data in Part 3 of this report.

House Expenses

In 2008, the next biggest chunk of the expenses pie (14%) was allocated to the house. � Actually, it was a dead-heat with Entertainment percentage wise, but in dollars the house won out by a whisker this year. � For this category, we include home insurance, new furniture, home improvements, and general maintenance. � The biggest expenditures in this category for 2008 went to buying new front doors, repainting the exterior of the house, getting new stair balusters, and re-staining the wood cabinetry. � But anything that is used to improve or maintain the home goes here — including the two separate occasions last Spring we had to have a specialist come out (at $200 a crack) and remove bee swarms that tried to set up hives in our house. � Is that the Honeybee’s fault? � I am still trying to figure that one out. � 😉

Entertainment

Another significant piece of the pie (14%) came from this category as well. � This includes movies, vacations, trips to amusement parks, ball games, you name it. � If it’s fun, it probably went in this category. � A good chunk of entertainment costs in 2008 were a direct result of our 10-day trip to Maui. � I love Hawaii! � In fact, if I wasn’t writing this article I’d probably be on a plane heading back there. 😉

Savings

Is savings an expense? � Well, if you want to do it correctly then all of your income has to be tracked. Otherwise, how will you know if you have properly accounted for all of the money that passes through your hands? � It’s as simple as that. � � The “Savings” category is very important because it is a good indicator of your overall financial freedom.

This category represents money that is siphoned off to our emergency savings fund, and also any additional income that comes our way as a result of, for example, employer bonuses not part of my normal salary and income tax refunds. � My goal for this number is 10% per year but, because it depends on a lot of intangibles, I never rely on this number or even use the trend data when updating my household strategic plan. For those of you just starting out or buried under a pile of debt, 10% or more may look like an impossible number to achieve. � Please, let me assure you, once you commit to living within your means this number will not be hard to reach! � I promise! � 🙂

I’ve been fortunate to meet this goal most every year over the last decade. � � My luck can’t last forever though, and therefore it is important that I continue to build my emergency fund to handle the inevitable periods that will require me to greatly reduce, if not forgo completely, saving entirely.

So far I’ve covered the four categories that make up the biggest percentage of our pie. � The most critical piece of the pie has yet to be discussed though, and I will cover that in Part 2. � Can you guess which piece of the pie you should consider to be the most important of them all?

Later this week, in Part 3 of this series, we’ll also look at my household expenses over the 10-year period from 1999 to 2008. � We’ll then close out the series in Part 4 with a look at my overall financial status and current net worth.

If you liked this article, please be sure to subscribe to my RSS feed.

Aw, shucks. Thank you. And I hope you come back again!