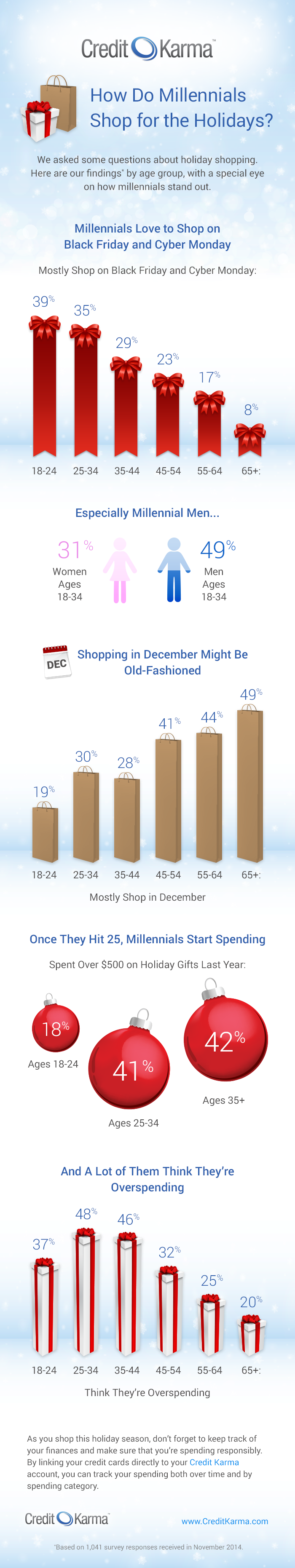

With Black Friday behind us, the traditional start of the holiday shopping frenzy is finally here. But, as a recent survey by Credit Karma suggests, holiday shopping habits are heavily dependent on how old you are. For example, it turns out that the so-called Millennials are much more likely to shop on Black Friday and Cyber Monday than older Baby Boomers and Gen X’ers.

With Black Friday behind us, the traditional start of the holiday shopping frenzy is finally here. But, as a recent survey by Credit Karma suggests, holiday shopping habits are heavily dependent on how old you are. For example, it turns out that the so-called Millennials are much more likely to shop on Black Friday and Cyber Monday than older Baby Boomers and Gen X’ers.

As for those who can look forward to that holiday-spending hangover that hits a lot of people when the first credit card bills arrive in the mailbox in January, well … almost half of all Millennials aged 25-34 say they’re guilty of overspending during the holidays — compared to one in five folks 65 and older, which strongly suggests that, for most people, self-control takes time to master. And lots of it.

Here’s an infographic that further summarizes the results of Credit Karma’s latest holiday survey:

Photo Credit: Dave416; Infographic: Credit Karma

I guess I am really outside these metrics then. As a 30-year old, I have only been out on Black Friday twice in the life, 2009 and 2011.