House Hunters or Property Brothers?

Some questions can be answered with relative ease by almost everyone.

On the other hand, when it comes to paying down mortgages early, a much more perplexing question for many current and aspiring homeowners is whether it’s better to make a single large extra principal payment annually – or 12 smaller ones each month.

So … is one method better than another? And does one prepayment method save more interest and result in a quicker loan payoff date than the other?

To answer those questions, let’s do a little math using a couple of hypothetical scenarios.

Let’s assume we have a 30-year loan for $200,000 at an interest rate of 6%. After crunching the numbers (and rounding them just a bit for clarity) we get the following results:

It would take 297 months (24.75 years) to retire your loan if you make one extra payment of $1200 annually. On the other hand, choosing to make 12 additional monthly principal payments of $100 each year would allow the loan to be paid off two months sooner, saving an additional $1830 interest in the process.

Then again, over a 24-year period, that’s almost a wash considering the amount of interest paid overall, not to mention inflation’s insidious impact on the dollar’s purchasing power over time.

Surprised?

Now, I know what you’re thinking: But Len, is the impact any different for a shorter loan?

Not really.

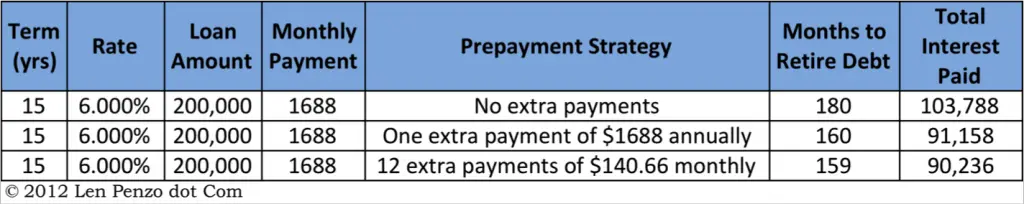

Again, let’s assume we have the same loan amount and interest rate as in our first example, however this time we have a 15-year mortgage. Here are the results:

As you can see, no matter which path you choose, it’s essentially the same answer once again, although the difference between the two methods is even less pronounced with the shorter loan. In this case, making 12 equal extra payments of $140.66 every month would retire the loan in 160 months (13.33 years) — that’s one month sooner than making single annual payments of $1688.

So there you have it. When it comes to making extra mortgage principal payments, there is very little difference between the two methods, regardless of whether or not you have a 30-year or 15-year mortgage.

Now if you’ll excuse me, I have to go downstairs; the Honeybee wants me to order us a pizza for dinner.

The trouble is, I’m not sure if I should make it sausage or pepperoni.

Photo Credit: Woodley Wonderworks

The real question is will the sausage or pepperoni pizza result in a faster mortgage pay off.

Best I remember I think I heard you say you plan to pay off your mortgage as slow as possible. Is that still your plan?

Yep, that�s still the plan, Lance. Even so, I wrote this post for folks who want the peace of mind that comes with paying off their home loan early.

Don’t blame you one bit for that! Was just curious if that was still the plan 😀

Choose veggie and save yourself a few fat calories! Of course there’s all that cheese…

I know you’re presenting a hypothetical, but the big potential savings for the scenarios you present is refinancing that 6% mortgage, yes?

I love veggie pizzas, Kurt. In fact, I prefer them to meat pizzas! The rest of my family … sadly, not so much. When it comes to pizza, they’re big-time meat lovers.

(And yes, a no-cost no-cash-out refi is always a great way to save a lot of interest — especially if you have a 6% loan and refi into one at 3.5%.)

When I first got my mortgage in 2003. Royal Bank would only allow you to have a lump sum payment once per anniversary date of the mortgage. Otherwise they would allow you to double up payments (with the added going right to principle). It sounds like it was a little different, but with the same outcome you described.

So they wouldn’t allow you to divide an entire extra mortgage payment into 12 smaller monthly extra principal payments? That’s really harsh, if true.

Can we slow down and back up a little? When did your example assume the annual payment was made: beginning or end of the year?

If you make the one annual payment at the END of the year, what you say should be true, and it stands to reason: the monthly payment chipped away at the principal, while the annual program left the $1,200 there for the entire year. So the interest burden will be higher, and it will take longer to pay off the loan.

However, if you make the payment at the BEGINNING of the year, wouldn’t you pay the loan off earlier, because the loan carries a lower debt burden during the year?

When you make 12 smaller payments, the difference between end of month and beginning of month isn’t that pronounced. But doesn’t it make a discernible difference (an entire year’s interest won or lost) if you make the annual payment Jan 1 or Dec 31?

That’s a fair question, William. It is at the END of the year. However … I just figured that was kind of self-evident since, if you had the money available to make the first annual extra principal payment with the very first mortgage payment — and then every year thereafter on the same day — then why wouldn’t one simply have reduced the original mortgage value by that first extra principal payment? 🙂

Or am I missing something?

You can also make 26 bi-weekly payments over a year – each will be same amount as your half monthly payment. It eases things a bit and pays off a bit early.

I think it’s more a preference of where the money is coming from. If it part of your monthly budget, put it on as a $100 extra payment. If you get a tax refund and want to use part of it for that, then do the once per year payment. Otherwise, as you said, very little difference.

I have about 100K left on my mortgage. I also have about 75K in cash in various liquid sources that I cantap into. Should I use the 75K(savings acct and Mutual funds) towards paying off my mortgage or should I just take my time to pay if off while investing the 75K more aggressively? I’m estimating that if I dont touch my savings, it’d take me 4-5 years to pay off my house. It’s a decision of pay off mortgage now vs 5 years. Which is better?

Well … you have to do what you feel is right for you, Bud. Everybody is different.

But I’m in the same position you are. Right now I have more than enough liquid assets and cash available to pay off the rest of my mortgage if I want to — but I choose not to. Instead, I’m investing the money I could be using to pay down the mortgage faster elsewhere right now. The beauty is, if I ever change my mind, I can always apply those funds I’ve accumulated to paying down the mortgage early.

Same here. Bummer thing is, our payoff timeline was 3.5 years from now, and the market tanking is changing the game. Hopefully a solid rally can make some of that loss up in the coming 3.5 years. Otherwise, it might just be a delayed payoff. Not too big a deal. We are already at the point in the amortization where the principal is higher than the interest. We count the little wins around here!

If you can combine a whole bunch of methods (more frequent payments, lump sum payments, refinancing) it’s the most beneficial – you can slay your mortgage a lot faster if you employ more than one method. It’s interesting to see that there isn’t much difference between the two methods.

To play devil’s advocate, if you could find a different place in which to invest the monthly payments, until it’s a lump sum, you may be able to put more on the lump sum.

I have been paying extra each month for 16 years and will retire my mortgage 9 years early. The reason I chose this method is because I didn’t have enough money for an extra payment when we were starting out. It was also very easy and conveneint to pay a little extra each month. I am so glad I did it.

The extra $100 principal payment per month would typically be less taxing for folks than to make one large payment of $1200 per year. One other option would be to make a larger principal payment when extra funds arrive such as a year end bonus or higher income from a seasonal business.

I like the idea of paying off mortgages early in most cases.

From my experience I can say, there are financial calculators which show you in detail how to payoff mortgage early. The calculator which I use is ” Smart Loan Calculator Pro ” which is available in app store for 2 bucks. It is awsome. It is not for one time. It is life time useful smart calculator. Give it a try. I guarantee, you would thank me after you download and check it. After checking this, I realized how easy to payoff martgage early.

I’ve found the most fun way to paying the mortgage down faster is matching the next month’s principle on your current payment. It essentially skips the interest you would have paid and should knock off a month on your loan. Taxes and insurance don’t matter since you have to pay those regardless. I just like to see all the interest I’m saving by doing this!

Our payment stubs have a line called “additional principal.”

However, elsewhere n the body of the monthly statement we are advised that any additional funds received will be held in a temporary account called “unapplied funds” until such time as enough have accrued to make a full payment. Then, and only then, will they be applied – as a normal payment.

Obviously we should refinance, we would have done, if we could have done.

Give her the sausage – pizza that is.

Yeah … lol … That’s always my first choice, Darryl.

My elderly friends lost their original house due to bad financial decisions. They were so fortunate to then inherit from his ancient, thrifty Mother, and an equally ancient and thrifty friend of the wife’s enough to buy a $400,000. house (It’s NJ so it was a tiny, older house.) free and clear. The taxes were $6,000. and the insurance $1000. a year so it was very cheap to live in the house. Instead of being content with this happy situation, they borrowed all the equity in the house (Just like they did with the previous house which they had lost.) and spent all the money fixing up a fancy bathroom, elaborate kitchen, trips around the country and over seas, money gift to an equally profligate adult child, toys and eating out constantly. The husband dropped dead and the wife is about to become homeless because she can not make the $2,400. monthly payment plus taxes and insurance. If they had kept the house mortgage free she would have been able to stay in the house for the rest of her life on her modest income. I think paying off a mortgage as soon as possible can be a good thing. I paid off my 20 year mortgage in 11 1/2 years and have never regretted it. I know that our savage inflation makes it appealing to borrow a lot and watch the inflation eat the value of the money. However my friend is going to be living in her car due to not having a paid off house.