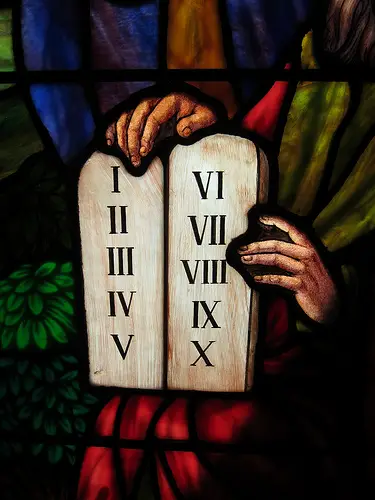

Maybe you heard about that infamous Kelton study that found Americans could identify more ingredients in a Big Mac than the individual Ten Commandments.

Maybe you heard about that infamous Kelton study that found Americans could identify more ingredients in a Big Mac than the individual Ten Commandments.

It’s true, folks; 80% of Americans knew there were two all-beef patties in a Big Mac — but just six in ten could identify “Thou shalt not kill” as one of the Ten Commandments. No, really.

Unfortunately, my anecdotal research verifies the Kelton study.

I know a Big Mac has two all-beef patties, special sauce, lettuce, cheese, pickles and onions — all on a sesame seed bun, no less — but I can only name eight of the Ten Commandments. (Don’t tell my third grade catechism teacher, Sister Nora.)

I wonder if Sister Nora would feel better if I told her I can name my Ten Personal Finance Commandments.

That’s right; in order to keep my life running as smoothly as possible, I faithfully follow these ten little nuggets of financial wisdom every day:

1. Spend less than you earn.

It’s the first personal finance commandment for a reason: Those that follow it are destined for financial freedom. It helps to be a frugality disciple. Remember, the word disciple is derived from its root word “discipline.” There is a lesson there for those who are willing to take it.

2. Behold the power of compounding growth.

The greatest lesson you can ever bestow upon your children is the power of compound growth. True, the power is somewhat diminished in today’s upside-down financial environment of near-zero interest rates and lower investment returns, but working teenagers with the financial discipline to let their accrued savings grow over time still have a golden opportunity to set themselves up for life by making relatively smaller up-front contributions.

3. Always pay thyself first.

Your creditors are not more important than you. The truth is, it’s a lot harder trying to save money from what’s left over after you’ve paid all the bills — which is why you should contribute to your retirement nest egg and emergency savings fund before you sit down to pay your first creditor every month.

4. Faithfully track thy household income and expenses.

Trying to take control of your personal finances without knowing how much money you’re earning — and where it’s all going — is tantamount to trying to drive with a blindfold around your eyes. Eventually, both practices end in disaster.

5. Knoweth the difference between wants and needs.

Being able to distinguish between wants and needs is directly tied to your ability to accept personal responsibility. At the most basic level, all of us have but a handful of primary needs: food, water, clothing, shelter, healthcare, and — for most of us — transportation. Everything else, folks, is a want.

6. Keep thy budget holy.

Budgets aren’t for everybody — but they are essential for those who lack financial discipline. A budget is an important tool that helps control spending. It’s easy to make a budget — but they only work for those who agree to follow them.

7. Thou shalt avoid paying interest.

If you can’t afford to fully pay for something you want, then you must save for it — that includes a car. My only exceptions to this rule apply if you need a loan to buy a new home, start a new business or, in some cases, pay for higher education.

8. Keepeth thy spouse involved in the financial decision process.

It’s absolutely critical that married couples keep their communication lines open — especially when it comes to the household finances. Regularly assess and update your goals and progress, and be willing to compromise. Better yet, split up the financial duties; the Honeybee and I do. In fact, we work as a team and run our household like a business.

9. Blessed are those who knoweth a high income doesn’t beget financial freedom.

Financial freedom is a state of mind, as much as it is a state of being; so it can be achieved regardless of household income. Those who understand that have a much easier time keeping their personal finances under control than those who don’t.

10. Undertake thy chosen vocation for love, not money.

We achieve satisfaction at our vocation, whatever it may be, through a job well done; but for most people to be able to do this on a consistent basis, they have to love what they do. So do what you love and, if you’re patient, the money will eventually follow.

Photo Credit: @jbtaylor

Amen on number 10! I followed a path in medicine because it was what my parents wanted me to do. I wasted 8 years of my life going to college before I finally realized that it wasn’t what I really really wanted to do. Now I own a small business of my own, but I couldn’t be happier. I’m not as wealthy as I would have been if I stayed in medicine, but I am happily content.

Thank you sharing this. I had read it before.1 and five are my favorite. I plan to share this with my grown children .

I think you’ve really captured the key points here. You are so right about spending less than you earn. If everybody just stuck to that one, there would be no need for the others.

This is a great post.

I highly recommend Item 2, which is to Pay Yourself First.

So, many people are working their lives away, in jobs they like or don’t like, just to give away all of their income to others.

It’s so very simple, but most people don’t get this one point.

Work for yourself, no matter what you do for a living.

Awesome post! I recently found your website and I’m in heaven! Great information on just about everything. I still don’t understand how our Government spends more than it takes in and remains solvent….maybe your thoughts on this sometime? Thanks again for a website that provides extremely valuable information.

Amen

Your budget should be treated like the bible. You keep it with you at all times and live it, breath it

I agree with your viewpoint, and would just expand point 5:

Strictly follow golden rules of budget distribution between wants and needs.

I follow this formula: 50% – needs (inclusive emergency fund and insurance), 30% – wants, 20% – savings. Here 100% are post-tax income plus cash equivalent of the benefits. All ingredients are inclusive benefits.

Press the needs below 50%, or increase income to keep it there.

I certainly agree: Amen on #10. It’s true that money doesn’t buy love, happiness, health or peace of mind. If you love what you do, and get money from it, that’s more than three fourth the battle. You offer all valid points and involving your spouse and the family in what’s happening with the family’s finances is always important. Communication is key and having a budget in place that everyone is privy to is essential. Thanks for sharing this.

I just love part where you will have Pay Yourself First.It’s the truth!

Bang on for everything, except number 3.

Greatest force in the universe? Depends wholly on the interest rate. For instance, if you were to invest at the current average compounding bank rate of about 0.5% for 20 years, your total return would be 10.5%. That’s a whopping 0.5% higher than the same non-compounding interest rate. If you were to have invested in a non-compounding 1%, your return would of course be 20%, almost twice as much, despite the fact that it is not the “greatest force in the universe.”

As always, interest rate is key.

Not sure why you are discounting time. That type of reasoning can go both ways; if interest rates are high and you have a short timeline, then time is the limiting factor. Compounding requires both variables to work.

I think you are saying that because you are assuming interest rates will always be pitifully low (or you’ll never have any years with decent investment returns). The former is most certainly not true; higher interest rates will return again eventually. As for the latter, that would require an extraordinary lengthy string of bad luck coupled with a abnormally long bear market. (In bull markets, everybody is an investment guru, to paraphrase the old saying.)

Len:

I am studying the Dave Ramsey program and he holds many of the same tenets as you. Are you familiar with his program and do you take exception to any of his teachings?

Hi Melissa,

I do disagree with him on some points:

https://lenpenzo.com/blog/id11642-debt-elimination-the-pros-and-cons-of-dave-ramseys-baby-steps.html

Some great rules to live by here – it’s amazing that simply following the first commandment means that most of the others will fall into place by themselves. The amount of people who don’t realise that spending less than they earn is required to built wealth is amazing!

This is excellent.

By the way, the reason why people know the ingredients of a Big Mac is due to an extraordinarily catchy jingle. In Massachusetts everyone knows the number of a windshield replacement company called Giant Glass for the same reason. I don’t know anyone who has actually used their service.

Change the study to being about the ingredients in a Whopper and I bet the results are very different.

Number 8 is so true – keep your spouse involved. You won’t get anywhere if you’re not “singing from the same hymn sheet”

Great set of commandments Len. Regarding naming Big Mac ingredients vs. The Ten Commandments: the difference is McDonalds has a much better ad agency than Moses ever did! 🙂

Great post, for a second I almost thought I saw Chucky Heston LOL.

Amen for nine and ten. And I am very surprised Americans can’t identify the ten commandments: we here think of you as a very Godly tribe. Then again, we have an education system that allow people to get A levels and ask in which country is Amsterdam …

I love 10. I was telling a bunch of wide-eyed interns the same thing last week. Follow your heart, and don’t sell your soul. Remember why we picked our paths in life. At the end of their rotation I also reminded them to open up a Roth!

These are great tips and I like how you’ve used ‘old English’ to make them sound more authentic, like ‘Keep thy budget holy’. I agree that knowing the difference between wants and needs is perhaps the biggest solution to living within your means. Many people confuse the two and think newer phones, upgraded software and new clothes are needs, when they are clearly wants that are luxuries for many people in less developed countries.

The borrower is servant to the lender. Proverbs 22:7 Your 10 Commandments is what everyone should read. I Remember when. My wife first got married and needed to borrow some money and I asked an Uncle and he flat out said no. I Was hurt but it was the best thing he said to me . I made a commitment to never be broke again.

I could not refrain from commenting, Len. This was perfect!

Well, considering that most people spend more time watching TV or surfing the internet that is not surprising, But your list of 10 is a good one.

I’m a financial agnostic; I haven’t accepted Len as my financial savior. If I die, will I end up in bankruptcy court? Or are my financial sins absolved?

It’s just a marketing problem. Maybe the church needs to write a catchy jingle.

When challenged by the Pharisees as to which was the greatest commandment, Jesus essentially said, “The first is the greatest and the second is like it. On these two, depend all the others.” Pretty much the same could be said of this great list. Thanks Len.