Last summer my 12-year-old daughter, Nina, was extolling the fashion virtues of her hot pink Converse Chuck Taylor All-Star high-top sneakers, better known to many as simply, “Chucks.”

Last summer my 12-year-old daughter, Nina, was extolling the fashion virtues of her hot pink Converse Chuck Taylor All-Star high-top sneakers, better known to many as simply, “Chucks.”

What I found amusing was while Nina really thought she was on the cutting edge of sartorial style, she was really just riding the latest fashion wave that has seen the popularity of those venerable basketball shoes rise and fall multiple times since they were first produced way back in 1917.

When I told her that dear old Dad used to wear Chucks when he was a kid growing up in the 1970s, she was completely amazed. And when I told her none of my friends would be caught dead wearing them by the time the 80s rolled around, she couldn’t believe it.

“It’s that way with a lot of things in life, Sweetie,” I reminded her. “What goes around eventually comes around, no matter how unlikely it may seem. Just wait, they’ll eventually fall out of favor again.”

Despite what I told her, Nina refused to believe me. She just couldn’t envision how the colorful canvas high-tops she was wearing would ever go out of style again.

Interest Rates: These Are the Good Old Days

I get the same reaction from younger people when I remind them that interest rates weren’t always ridiculously low. In fact, last week a friend of mine was complaining that he couldn’t refinance his 30-year mortgage to a lower rate because he was upside down. He was “stuck” and it really had him depressed.

“What kind of interest rate do you have?” I asked.

“Five-and-a-half percent,” he said.

“What’s wrong with that?”

“The interest rate is way too high!”

Really?

When it comes to interest rates, everything is relative.

True; if my buddy had an acceptable loan-to-value ratio he could secure a 30-year loan right now for four percent or so. But let’s face it, looking back over time, his current 5.5 percent interest rate is nothing to scoff at.

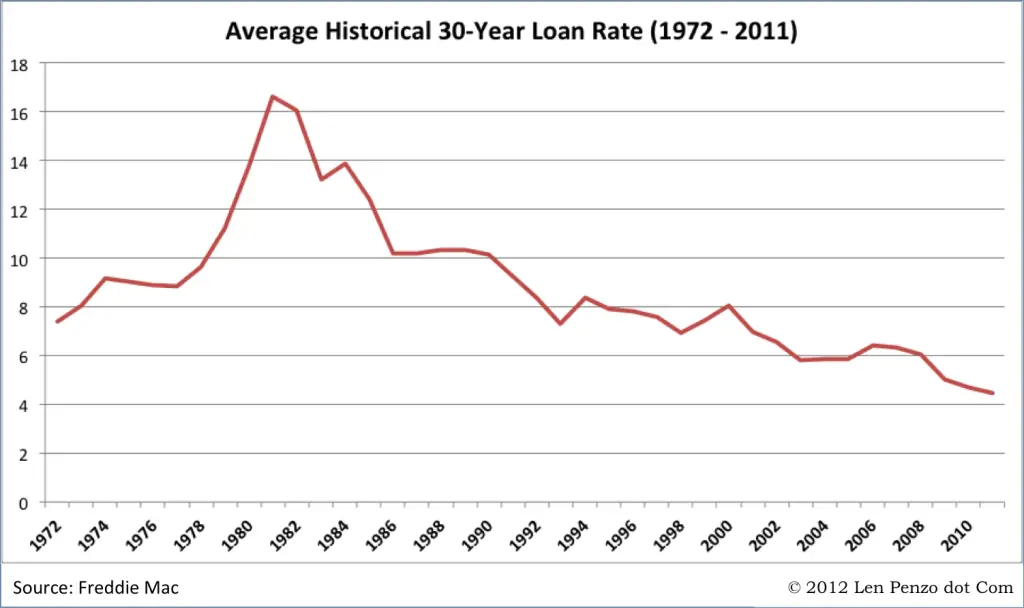

Here is a chart I put together with data from Freddie Mac that shows how interest rates for 30-year home loans have varied over the years:

As you can see, in 1981, average interest rates reached 16.63 percent. And although Freddie Mac’s data only goes back to 1972, during the early 1960s average interest rates were closer to what we currently have today; in the neighborhood of 5 percent.

I remember when I bought my first house back in 1990. With the interest rate on my 30-year $104,000 loan a whopping 10.75 percent, my monthly principal and interest payment was $970. If you had told me that I could have had a 30-year loan for 5.5 percent way back then, I would have felt like I had just won the lottery. After all, at that interest rate my house payment would have only been $590.

Interest Rates: Those Were the Good Old Days

If I had a nickel for every person who has complained about the pitiful interest rates that savers are currently earning, I’d be a thousandaire by now.

Savers have a right to be upset. I have a savings account with about $2000 in it that I keep as a special quick-access emergency fund; it earned a whopping $16 in interest last year.

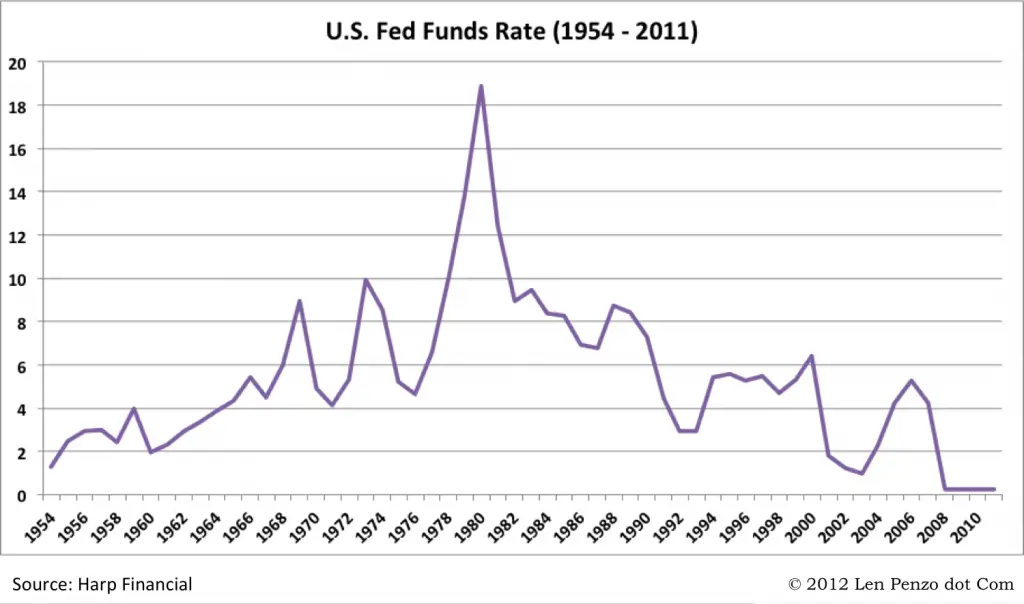

Returns on certificates of deposit, savings accounts, and money market accounts are influenced by the US fed funds rate, which is generally influenced by the inflation rate. Today the rate sits between 0 and 0.25 percent, so it’s no wonder most people nowadays consider themselves lucky when they can find a bank that pays more than one percent for a high-interest savings account.

For a lot of you this may seem hard to believe, but it wasn’t always that way. Here is a historical look at the fed funds rate between 1954 and 2011:

As a teenager, I remember the money in my savings account earning double-digit interest rates in the early 1980s when the fed funds rate peaked at 19.1 percent in response to high inflation.

For a kid with no real financial obligations at the time, those high interest rates were a rich reward that helped reinforce the benefits of saving.

If I had earned, say, 17 percent interest on my $2000 emergency fund last year, I’d have an additional $400.42 in my account this year, as opposed to the $16 it actually earned.

The Bottom Line

What goes around eventually comes around — whether it’s stainless steel appliances, bell bottom jeans, or those venerable “Chucks” that have repeatedly fallen in and out of fashion for almost 100 years.

Interest rates are no different. Although they’ve been at historic lows for so long now that many folks have forgotten that it wasn’t always this way, history tells us that inflation and the higher interest rates that come with it will eventually return.

While that may be considered good news for folks with savings accounts, for those looking to get a loan … not so much.

Photo Credit: Tiffany Terry

I don’t believe interest rates will ever return to the levels they were during the 70s and early 80s.

Cynic,

Never say never. Back in the late 1970’s and early 80’s, we believed the days of single-digit mortgage interest rates (below 10%) would never be seen again.

I am certain they will return, Cynic. Once the economy finally turns itself around with the appropriate post-recession vigor — and I am certain it will, once we get some policy changes — I expect a good chunk of the money that has been “printed” by the Fed over the past four years will finally be unleashed into the economy. How can that not end up being inflationary? Just sayin’.

Lol!

All of my real estate investing experience has been in this crazy market of mass foreclosures and cheap money. It will be interesting to see how my strategies evolve as the market turns (whenever that may be..)

Those higher interest rates will definitely make things tougher. I remember when I was looking to buy my first house, I was literally tracking interest rates daily, hoping that they wouldn’t price me out of the market. It was very nerve-wracking. It also forced me to agonize on this tough decision: Whether to lock in my rate, or gamble and hope interest rates would drop before the deal closed, thereby saving me money on my monthly payments.

I too remember proudly wearing my “Chucks” but they didn’t help me jump any higher. And my PF Flyers didn’t help me run faster in the 60’s…

I am going to go on record here at Penzo.com and say within 24 mos the 30 year bond will be between 6 and 7% and FedFunds will hit 2-3%. Take that Magic 8 Ball!

If I was a betting man, I’d say your estimates are a bit low. I’m expecting the fed funds rate will be closer to 5% within 24 months and 7% by the end of 2015, Dr. Dean.

Such a good call. My parents always say that prices can come down still, and they are usually right. Higher interest rates are coming, and so are better stock market returns. But then, you know what, they will all go back down again too!

The trick is buying low and selling high. It sounds so easy, doesn’t it?

I still have some Savings Bonds purchased prior to June 1995 that started off at 6%, and still earn a minimum 4% to this day. They were originally purchased with college expenses in mind, but we found the money elsewhere.

I’ll be keeping these babies until they either mature or interest rates climb back up to that level, whichever happens first. 🙂

Yeah, those savings bonds are looking pretty good now, aren’t they, DC? LOL

I remember back in the 90s being asked by my employer to buy savings bonds as part of its annual savings bond drive, and I always passed because I thought the returns were paltry.

Who knows? In a few years they may seem paltry again. LOL

I think the inflation is already here; it’s just not being reported properly. My grocery bill is proof — and that’s despite manufacturers shrinking package sizes to try and keep the illusion of stable prices!

Considering we are working on a lot of debt right now, the low interest rates are a big benefit. I’m hoping they stay down for another few years to allow us to right our debt and refinance our mortgage one more time before they go too high!

Just remember, Kris: If you have a fixed rate mortgage, then high inflation is your friend — even if it is short-lived (say, a year or two).

My point is, you won’t need to worry about refinancing (assuming you have a fixed rate loan) because inflation will reduce the real value of your remaining mortgage balance.

I’m one of those folks who now expect a significant bout of high inflation down the road, so I no longer make extra principal payments to payoff my mortgage early. I figure why pay my mortgage with more valuable dollars today when I can pay it with much cheaper money down the road?

It’s sadly funny but true. I talk to a lot of people who make financials decisions today with the assumption that interest rates will be low from now until the day they die. I would be making no long-term bets or lock up money in bonds based on low interest rates 5 or 10 years into the future.

I moved to the States in the 70s and inflation, interest, unemployment have gone up and have come down.

So have the politician talk. For almost 40 years, I keep hearing the same things over and over. Bad has always accompanied good.

Nothing is always bad and nothing has always remained good.

Has anyone done anything for the poor, the financially orphan, and the destitute? In the 40 years that I have been living here, the answer is a BIG NO!

All this banter is premised on the assumption that cycles always repeat, which is a fallacy – circumstances can and do change to change the nature of or put and end altogether to cyclical events. Nations fall and economies collapse all the time. Our nation is flirting with – nay, practically making out with – outright socialism, which has previously run economies into the ground. Ignore what is going on in our country and assume the cycle will simply keep going at your own peril.

Oscar, you said: “All this banter is premised on the assumption that cycles always repeat, which is a fallacy…”

That’s what they said before the Dot Com and recent housing bubbles burst too.

I have to believe that you are correct and interest rates will increase secondary to inflation. It would be prudent to protect yourself.

Who ever thought bell bottoms would return?

Yup, I see them as inevitable, as well. In fact, didn’t they just rise in the last few weeks – by a tiny margin, but still?

Given the situation with the monetization of our debt, I see inflation going waaaaaaaay up in the near future. What do you think that’s going to do to interest rates?

Interesting article written over 24 months ago. Interest rates are still low and seem to be staying low for the foreseeable future. This article does not take into account the weak recovery we have had. To the Doable Finance’s point, maybe if the system actually tried to bring everyone along, the “Have and the Have Nots” maybe we would be in a better position. But as has been seen over the past few years the jobs that have come back primarily have been low wage. The bottom 40% have seen their incomes decline by and average of 5% since 2013. I think this article, particularly Len Penzo is a bit biased and to his own fault wildly optimistic, I would have said it 2 years ago and I am saying it now. Until this country learns how to pass legislation and move the majority of its citizens forward instead of only being concerned with what they need to say to get elected and stay in office. This DO NOTHING congress has been a complete joke. My 2 cents.

Thanks for the comments, KG. Since writing this article over two years ago, I see things a bit more clearly now. The Fed’s zero-interest rate policy and quantitative easing programs, coupled with the President’s continued expansion of big-government (and expanding the national debt by more than all of the other presidents combined from Washington to Bush Jr.) has the Fed in a corner. Because of the US’s massive debt, the Fed CANNOT raise interest rates now — otherwise the interest payments would overwhelm the federal budget. We will not see significantly higher interest rates now until the current dollar-based financial system implodes and a new system is put in its place. There is simply too much debt on the books that can never be paid back.

As for the DO NOTHING Congress, it is a complete joke. We need to talk to Senate leader Harry Reid (D-Nevada) — he has stopped almost every bill that has originated in the House of Representatives since 2010 from even going to the Senate floor for a vote.