It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I’ve got another busy weekend ahead of me, so let’s get right to this week’s commentary …

The future is already here – it’s just not evenly distributed.

―

If you don’t know where you’re going, you’ll end up someplace else.

―

Credits and Debits

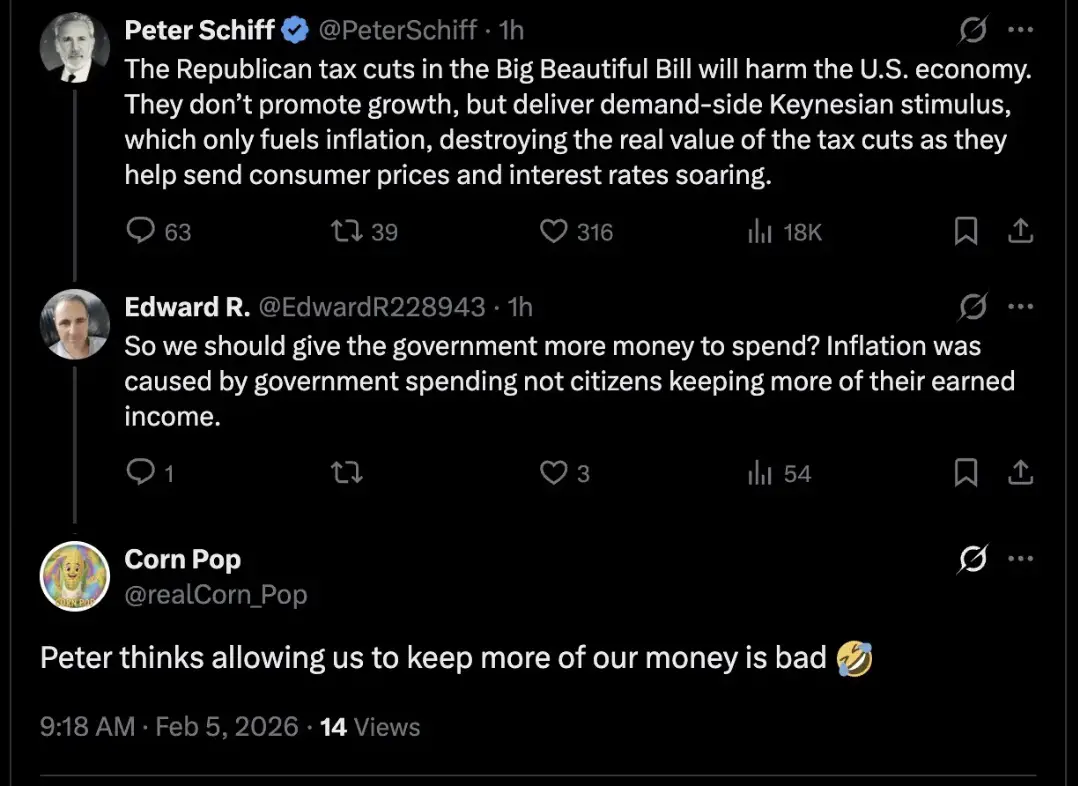

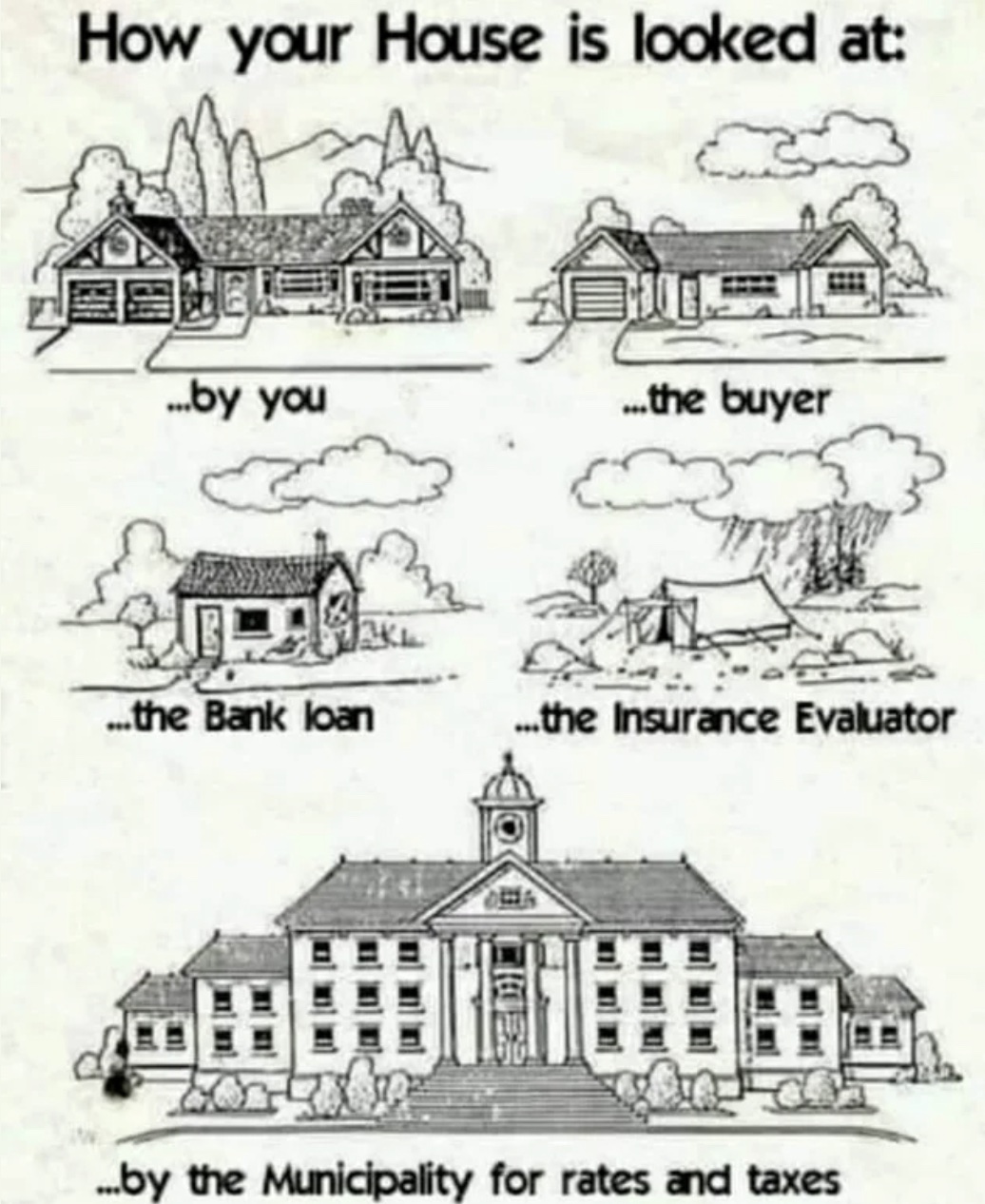

Credit: Did you see this? The move to abolish property taxes is growing with efforts in states including Florida, Texas, Georgia and North Dakota aiming to reduce homeowner cost burdens. Supporters argue that property taxes undermine true ownership – particularly when unpaid bills can lead to foreclosure. Even so, critics warn those plans threaten funding for schools and local governments that rely heavily on property taxes. Then again, many of those same critics aren’t in favor of tax cuts of any type. Or worse…

Credit: In other news, after factoring in projected rates for asset-class returns and inflation, Morningstar analysts say the highest “safe” starting withdrawal rate for people retiring in 2026 is 3.9% of portfolio assets – that’s up 20 basis points from Morningstar’s 2025 recommended rate of 3.7%. The rate was just 3.3% in 2021. By “safe,” Morningstar means the highest rate that gives people a 90% chance of having some money left at the end of a 30-year retirement. However, depending on subsequent withdrawals schemes, it is possible to succeed with a higher initial withdrawal rate. But caution is always advised as wealth can drain easily drain away quicker than expected:

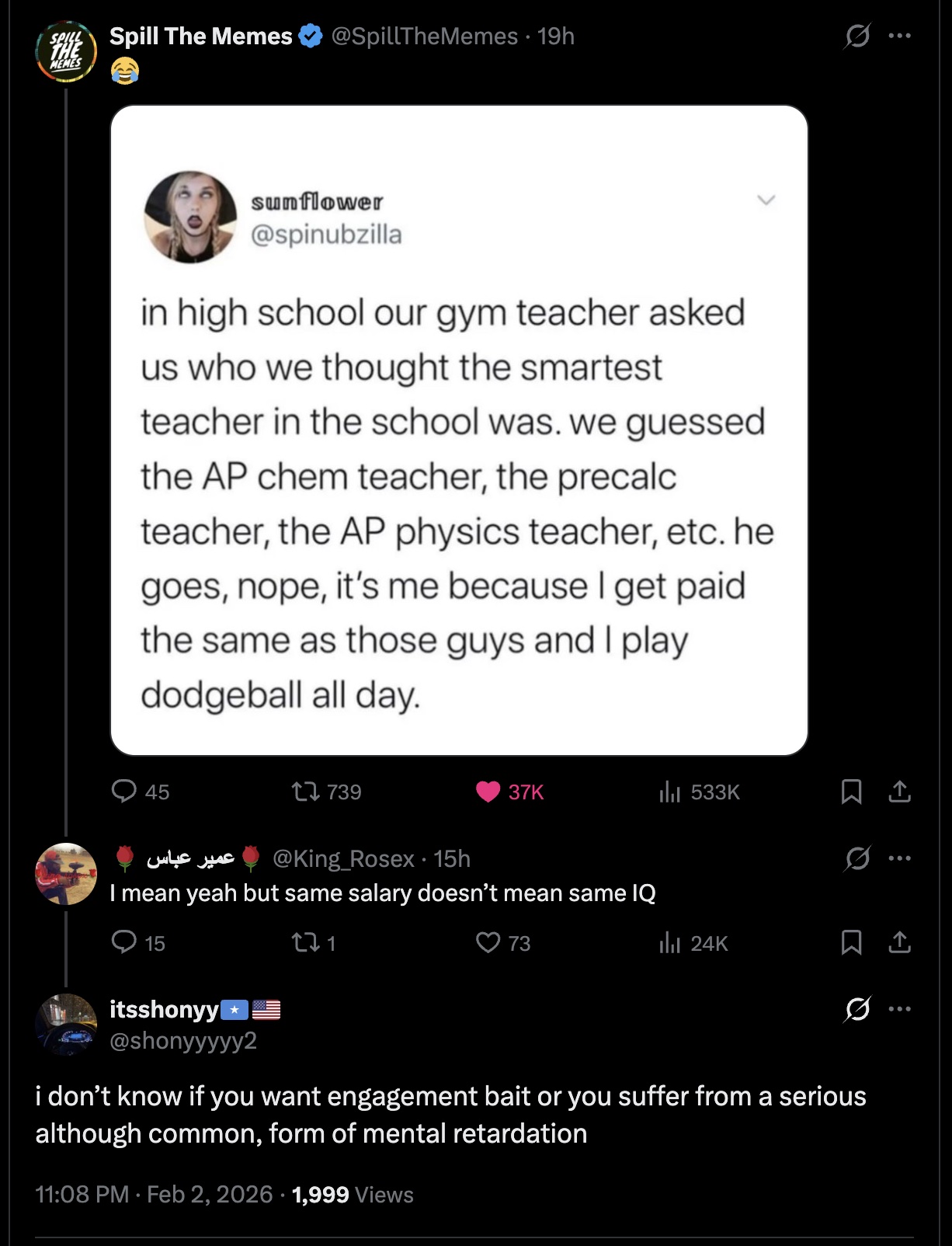

Credit: By the way, you should be aware that, when it comes to retirement withdrawal rates, recent Monte Carlo simulations predict that, while retirees who follow the generic “4% rule” would have more to spend now, those retirees would have just a 72% success rate over 30 years, compared with a 92% chance of their money lasting for the group that followed Morningstar’s guidance. Hopefully, most people are smart enough to figure out the implications of those results when planning life in those so-called “golden years.” And just to be clear: We said “most”…

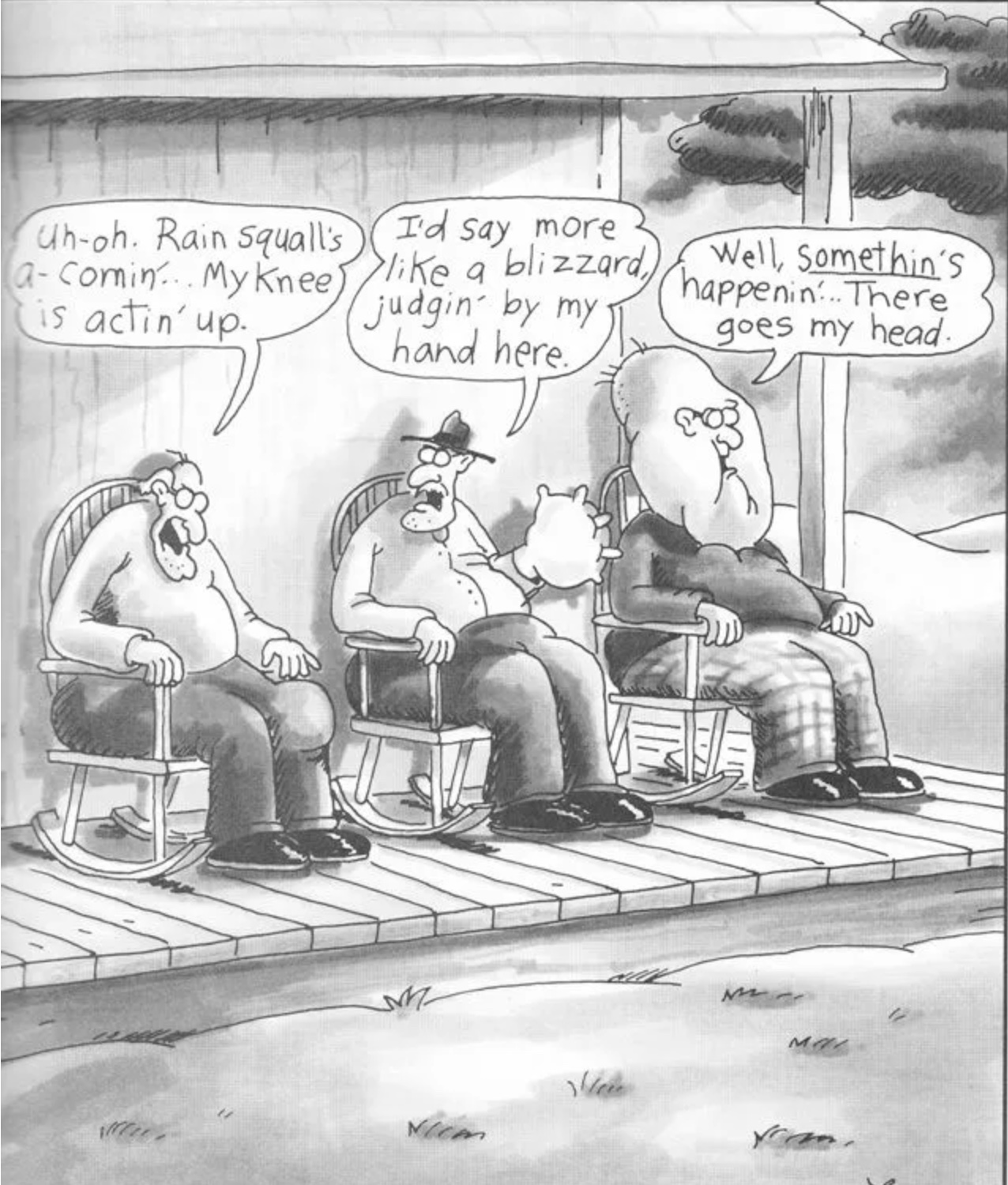

Gary Larson – The Far Side

Debit: Curiously, despite a growing number of major financial analysts recommending a portfolio of 60% stocks, 20% bonds, and 20% physical gold to replace the previous popular “60/40” stock-bonds paradigm, the Morningstar model doesn’t have a gold component included in its calculation. If it did, we strongly suspect the recommended “safe” withdrawal rate in retirement would be slightly higher than what they calculated for this year. And although the general public and Wall Street are slow to understand this, we’re very thankful that the current US Treasury Secretary does get it.

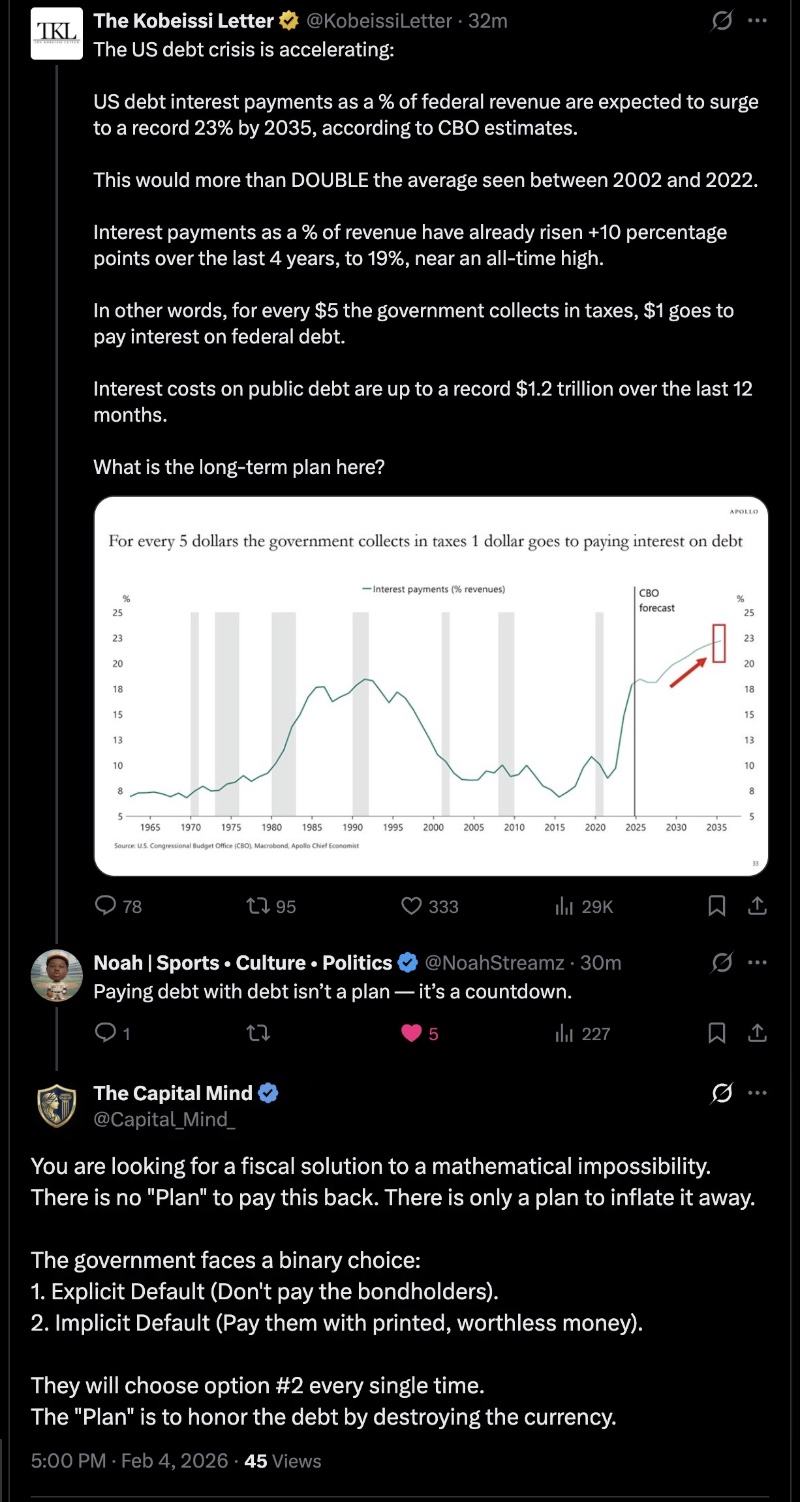

Debit: Sadly, what the general public no longer understands is that, since 1971, the entire debt-based monetary system has been predicated on debt expansion and artificially low interet rates to sustain it. That’s because that was the year authorities at the Fed and US Treasury who were entrusted to protect the long-term purchasing power of the US dollar (USD) decided the benefits of breaking its anchor to the yellow metal outweighed the consequences. Well… as we now know, they were wrong. And to think I thought these guys had cornered the market on bad ideas …

Credit: For what it’s worth, in January the S&P 500 gained 1.4%, the Dow advanced 1.7% and the Nasdaq finished 1% in the green. Many investors focus on the “January barometer” and its associated saying: “As goes January, so goes the year” – and the January barometer has a pretty good track record. Since 1945, whenever the S&P 500 has ended the first month of the new year with gains, the market on average increased 16% that year, versus an average annual advance of 9.3%. Then again…

h/t: @julz5421980

h/t: @florintruth

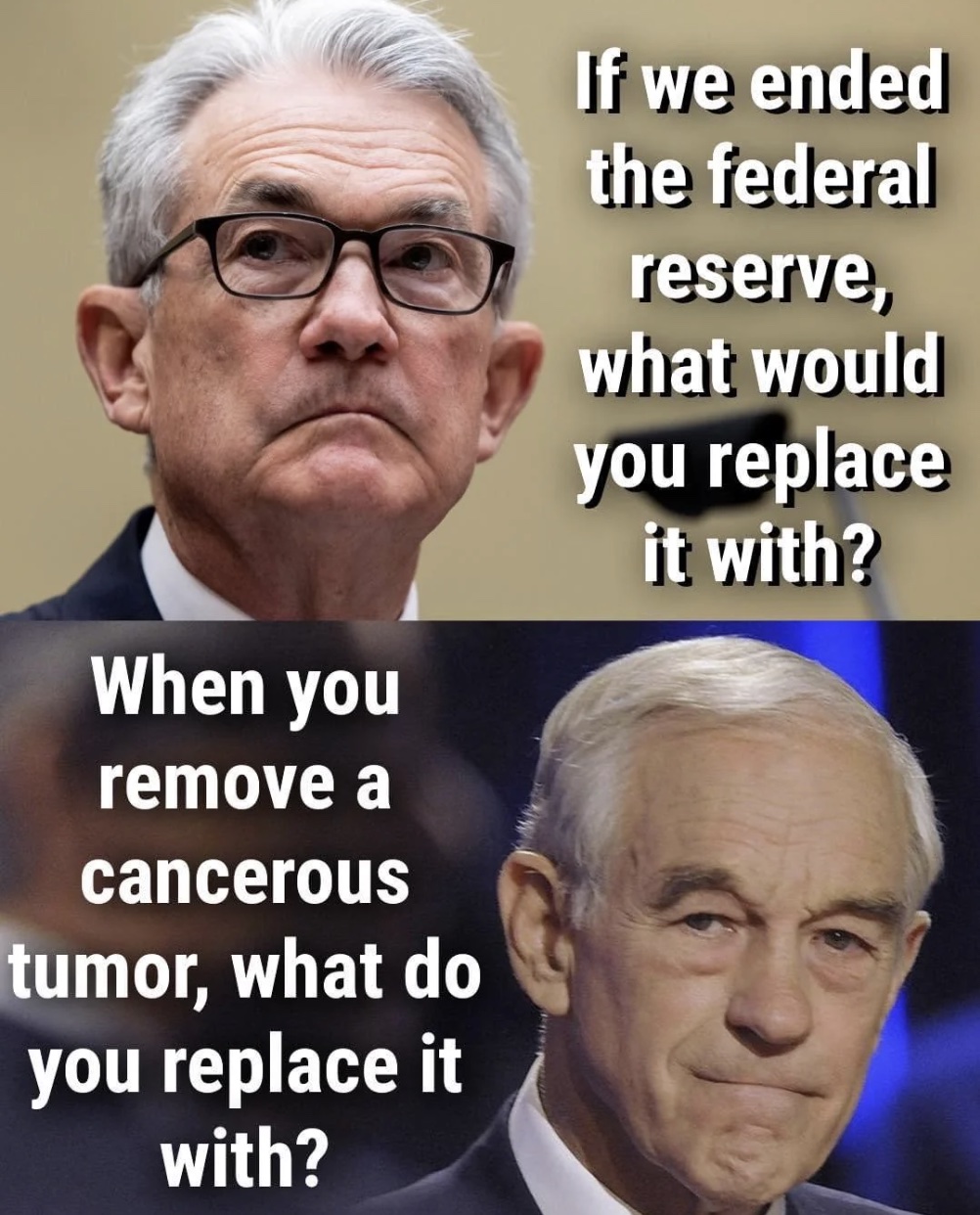

Credit: On a related note… remember when all of the markets on Wall Street plunged last week after Kevin Warsh was made the incoming Fed Chair nominee? We sure do. Anyway… that got sagacious macro analyst Franklin Sanders wondering, “Why the wild reaction? Harsh is perceived as opposing inflation. This is much the same as appointing a new madam to run a bordello because she is tough on fornication. After all, what, pray, is the Fed’s purpose except to inflate?” Indeed. It’s just a pity most people remain blissfully unaware of this fact and believe the Fed works in their best financial interest.

Credit: By the way, Mr. Sanders also passed along a little advice that we’d probably all be wise to heed: “Stop trying to make sense out of this stuff because you can’t, it’s all a tissue of lies and legerdemain to make the public believe the Fed will curtail inflation when they not only will not but also, they cannot. To stop inflation would be to stop the US government which can’t survive without the Fed monetizing its deficits, which is inflation.” And we all know the US government’s only interest at this point is in ensuring that it continues to expand with each new annual budget.

Credit: Speaking of senseless, after the Western paper silver market lost 30% on January 30th, the price for physical silver in China, continued to trade at a 29% premium. What a farce! Macro analyst Matthew Piepenberg admitted that, “The CME may have won a paper battle, but rising demand for physical silver and gold will win the war as the paper system loses credibility, power and options with each tick of the global debt time-bomb because the rising preeminence of physical gold and silver will steadily outpace the increasingly desperate mechanizations of the heavily-leveraged paper exchanges.” Yep. And it appears that, after almost 60 years, time is finally running out.

Credit: Indeed, despite the historic silver market decline on January 30th, there were no new discoveries – or even a single new silver mine that came online to erase the current four-year-old structural supply deficits caused by decades of artificially suppressed prices. Or, as Mr. Piepenberg put it: “For those who hold physical gold and silver as part of a long game of wealth preservation against the short game of desperate yet dying paper money, the speed bump on January 30th was nothing more than that: A bump in an otherwise wide-open road forward.” Got gold?

By the Numbers

The most popular Valentine’s gifts this year are, in order: a greeting card, a box of chocolates, diamond earrings, a dozen roses, and dinner for two, totaling $774 for the full package. That’s $262 more than the top Valentine’s gifts of 2016, which were, in order: a box of chocolates, diamond earrings, a dozen roses, dinner for two, and a bottle of champagne. Here are their respective price increases of those same gifts over the past decade:

31% Greeting card

36% Diamond earrings

66% Roses

127% Champagne

160% Dinner for two (excluding tax & tip)

236% Chocolates

Source: Investors Observer

The Question of the Week

Was your last big splurge worth the expense?

- Yes – and I would do it again! 71%

- Meh. It was nice but never again. 18%

- No – it wasn’t worth it. 11%

More than 2000 Len Penzo dot Com readers responded to last week’s question and it turns out that, for 3 in 10 of you, your last big splurge was underwhelming – or worse. On the other hand, that also means that, for a significant majority, breaking the bank for an expensive item or experience was worth it.

Last week’s question was once again submitted by reader Frank. Thank you, sir! If you have a question you’d like me to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Grizzly Bear Warning

After the rising frequency of conflicts between humans and grizzly bears last year, the Montana Department of Fish & Game is now officially warning all hikers, hunters, and fishermen to take extra precautions and keep alert for bears while in the field this summer. Here is the official public advisory from the state’s chief game warden in Helena:

“We advise all hikers to make noise and wear small bells on their clothing, so as not to startle bears that aren’t expecting them. Furthermore, we advise all outdoorsmen to carry pepper spray with them in case of an unexpected bear encounter. It’s also a good idea to be aware of fresh signs of bear activity; hunters and hikers alike should be able to recognize the difference between black bear and grizzly bear poop. For example, black bear poop is smaller and contains mainly berries and squirrel fur. In contrast, grizzly bear poop is much larger, smells like pepper and has little bells in it.”

(h/t: Cowpoke)

Squirrel Cam

It’s only four seconds long, but when the camera was on, this little fella was ready for his close-up!

.

Buy Me a Coffee? Thank You!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

I found this message in my inbox from Heather Madison:

I’m reaching out to you because I’m looking for a Bozo who is interested in taking on more clients.

I’ll have to pass, Heather — the clown car is in the shop and my calendar is completely booked.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: public domain

My experience has been that states with low or no property taxes make it up with high income and sales taxes. States with no income taxes make it up with high property taxes. The government ensures it gets what it needs.

That sounds about right, Cowpoke. For example, I hear people in Texas (a no-income-tax state) complaining about absurdly high property taxes.

Read the grizzly joke and had a personal laugh as grizzlies have now moved into the area where I live and are now full time residents. (north Vancouver Island). It used to be just the occasional male would swim over from the mainland inlets, but now there are sows and cubs making themselves at home. Plus, this winter has been so warm and mild we expect to see them any day. They head for the estuary to start feeding after hibernation. And yes, we have walked into them on our property and believe me when I say you quickly snap to and pay attention when they stand up to check you out. Plus, I live on a major salmon river so come August it will be very interesting. Last year a family hung out on the elementary school fields for a while. They definitely make themselves at home.

The first sign they are around are no black bears….those critters get eaten or driven off. Anyway, interesting walks every morning with my dog. Cougars year round, plus bears Feb/March – November. We keep an eye out for sure.

Be careful out there, Paul. I know grizzlies are the apex predators out there and must be respected. We have lots of black bears here in Southern California and they often come down to the foothill residential areas to take a dip in pools or forage through trash cans, but the last California Grizzly bear was seen about 100 years ago.