It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had an enjoyable week. Without further ado, let’s get right to this week’s commentary …

A storm is brewing and most people have paper umbrellas.

— Herman Mills

Credits and Debits

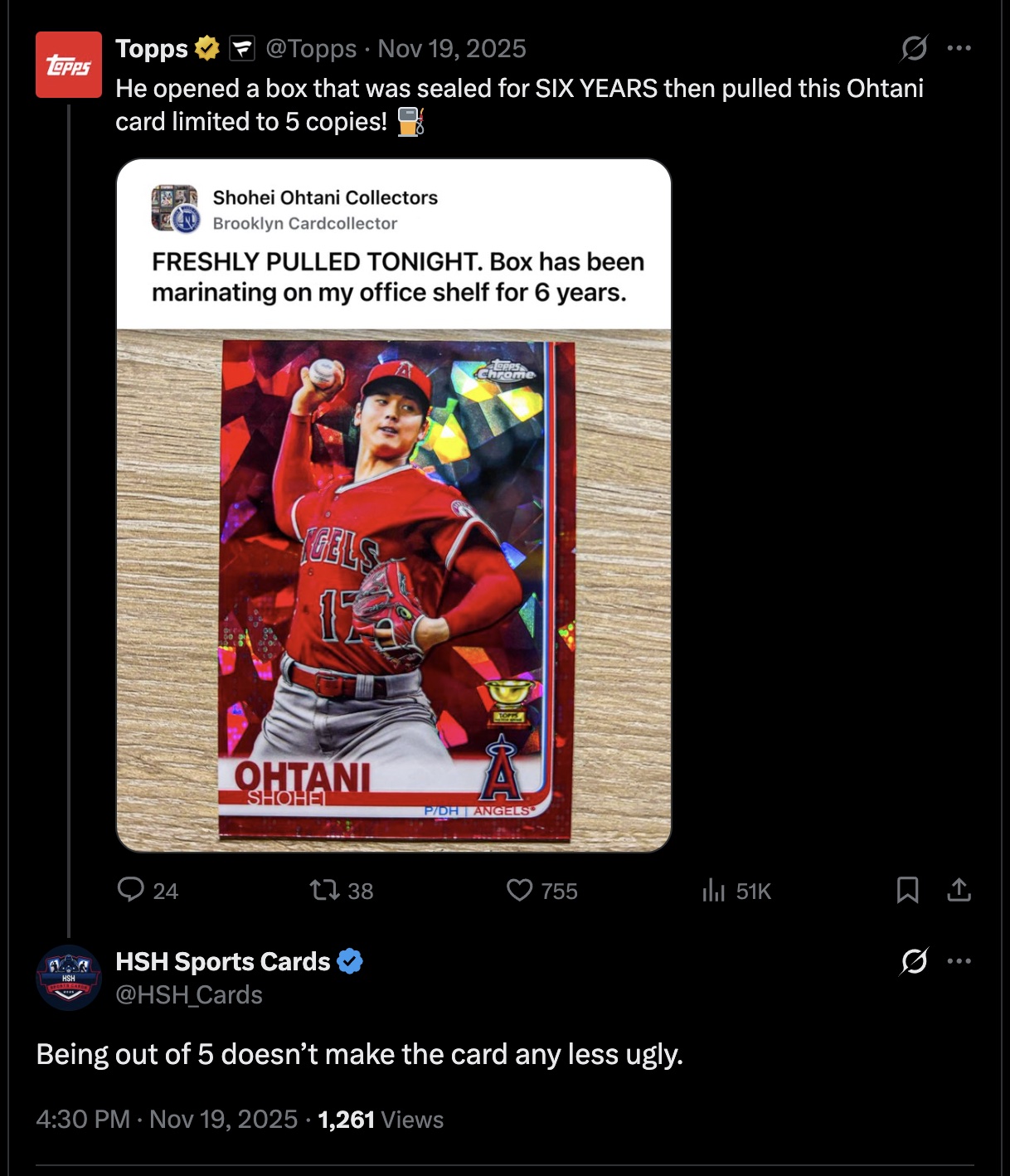

Credit: Did you see this? A single-issue special edition baseball card of Los Angeles Dodger superstar Shohei Ohtani auctioned for $3 million. The card includes a gold logo patch that adorned a uniform worn by Ohtani to commemorate his 2024 National League MVP Award. Despite the high price tag, it doesn’t come close to the 1952 Mickey Mantle #311 card that sold for a record $12.6 million in 2022. Then again, that’s only because nobody knows about the one I’m still holding in my private collection…

Of course, “ugly” is always in the eye of the beholder.

Debit: Then again, there are others who aren’t in the chips. For example, take the New Jersey firm known as United Site Services. They’re a portable toilet provider that filed for bankruptcy after finding themselves in a debt hole to the tune of $2.4 billion. We know what you’re thinking: Since everybody has to take a potty break every now and then, how is this even possible, you ask? Well… apparently, we can only conclude that Americans aren’t getting enough fiber in their diets.

Debit: After a full year, the results are in on the 2025 California law that raised the minimum wage for fast food workers to $20 per hour. Despite sector grown in the rest of the nation, 18,000 fast food jobs were eliminated in the Golden State, while those who managed to remain employed saw their hours decrease by almost two months per year. At the same time, fast food prices in California are up more than 13% since the law took effect. We can only imagine how “successful” the law would have been if they had mandated a $100/hr minimum wage. Besides, the law was probably this guys’s idea…

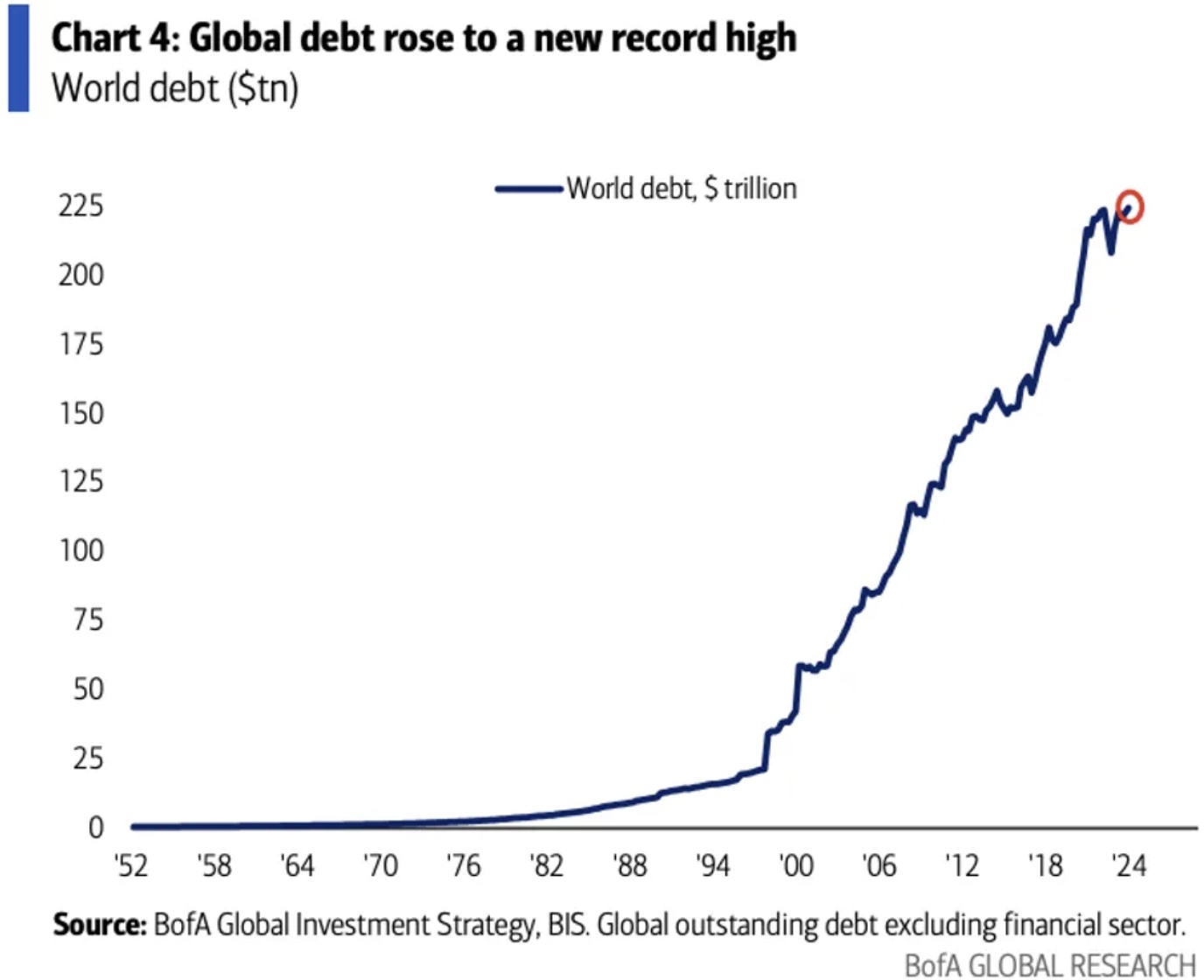

Debit: Whether it’s meddling in the fast food business or gumming up the private enterprise in other ways, government is indeed the gift that keeps on giving. Unfortunately, the bloated state and federal bureaucracies now controlling every aspect of society doesn’t come cheaply, with the federal debt now quickly approaching $39 trillion. Never mind the $100+ trillion in unallocated expenses. Or the clowns who say there’s nothing to worry about because “we owe the debt to ourselves.” Heh. Right… try telling that to our foreign creditors.

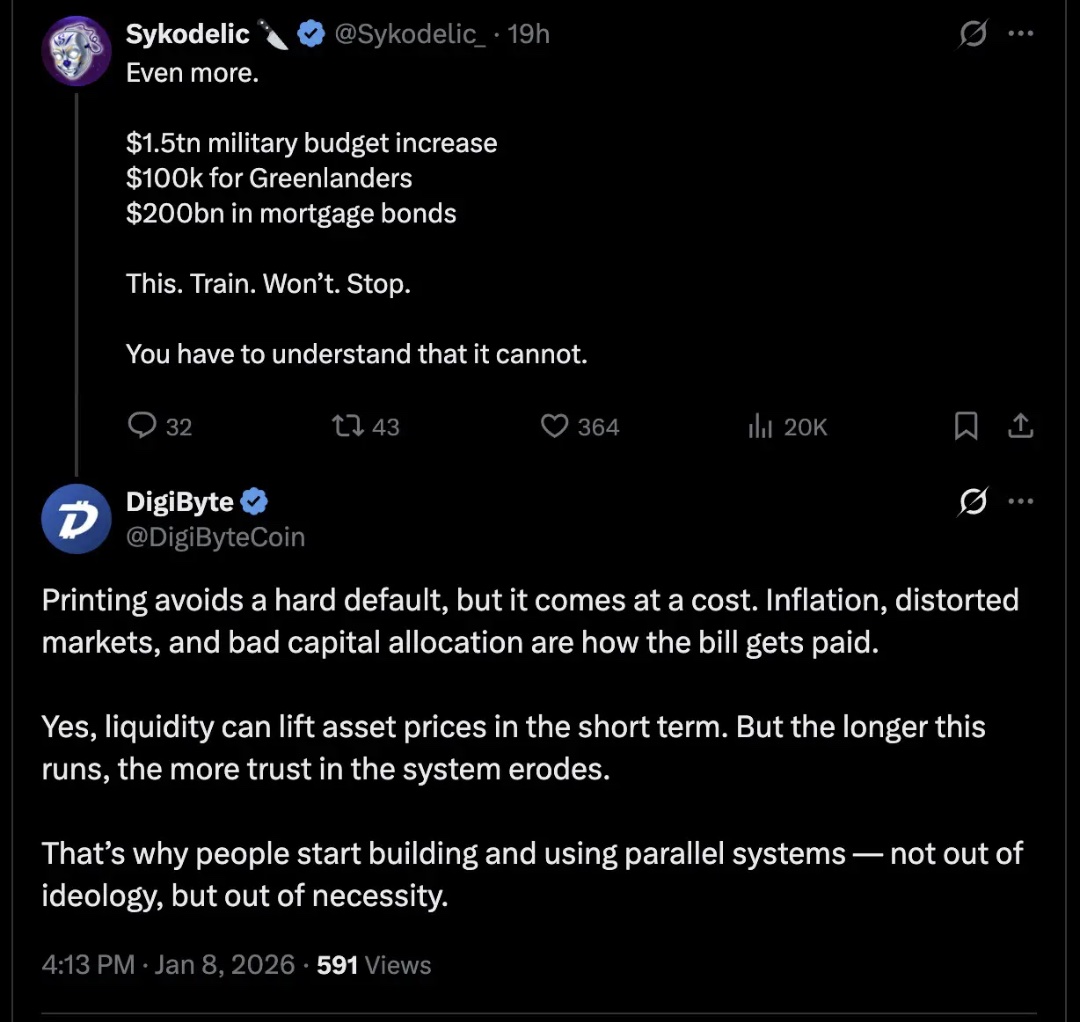

Debit: Needless to say, nobody should expect US debt accrual to ever slow down, let alone decrease. In fact, US federal spending has skyrocketed from $4.4 trillion in 2019 to $7 trillion in 2025. That’s an alarming increase over a relatively short period of time. Then again, you’ll never convince the modern monetary theory (MMT; a.k.a. “Magic Money Tree”) fanboys that’s true – at least until the current fraudulent debt-based monetary system’s wheels completely fall off. Oh, look! Here’s one of ’em now:

Debit: Unfortunately for the US, its Treasury is in a debt trap, with gross debt now rising nearly three times faster than GDP, and almost four times federal government revenue; it’s a fatal dichotomy that’s rapidly accelerating. Clearly, central bankers around the world can see this, which is why they’re fleeing the US dollar (USD) as fast as they can and buying physical gold – not to be confused with gold’s paper contract counterpart, which is rife with counterparty risk, just like the fiat USD and USD-denominated bonds. As for the US Treasury extricating itself from this seemingly intractable problem, well… there’s always hope. We think…

Credit: As macro analyst Matthew Piepenburg points out, with America $38 trillion in debt versus $250 billion in 1971, “and a debt/GDP ratio at 124% (vs. 38% in 1971), the US and its weaponized USD is clearly not the same hegemon today that it was when John Connolly famously claimed, ‘Our currency, your problem.’ In short, the US went too far, and the world knows it. Nobody wants an IOU from a broke issuer.” True. Well… except for maybe this guy.

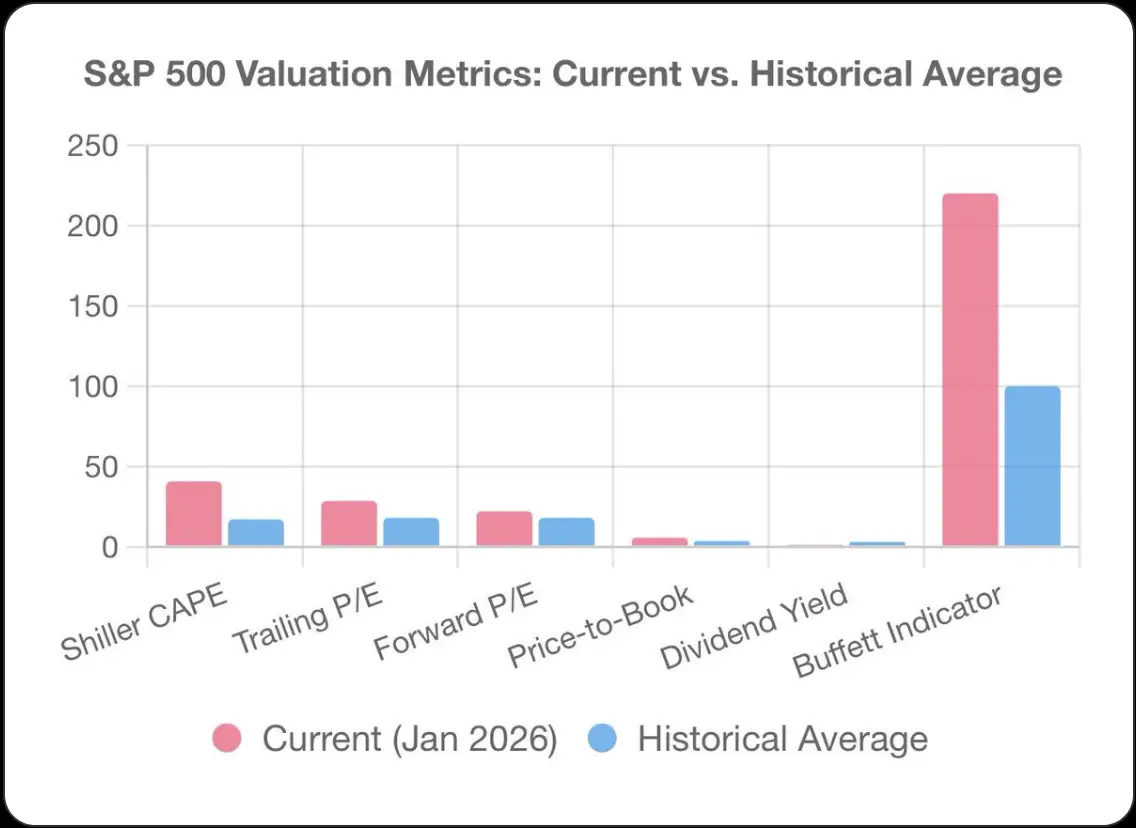

Credit: By the way, the US isn’t the only nation in severe fiscal distress. That’s because, as Mr. Piepenburg warns, “The global financial system, after decades of buying time with mouse-click currencies, is finally hitting its Waterloo Moment as physical silver and gold steadily rise above the rubble of a broken monetary system.” Uh huh. As a result, all fiat currencies are losing purchasing power when measured against real money – that is, gold. The same applies to assets that are denominated in fiat currencies. Just don’t tell that to the stock market bulls on Wall Street who always become giddy when the global money printers go into overdrive…

h/t: @great_martis

Credit: Of course, there are other voices in the wilderness who see what’s happening and are sounding the alarm. For instance, sagacious precious metals analyst Franklin Sanders shared the following wisdom with his readers: “I will make this point without which you cannot understand gold and silver. This is not a common, garden variety bull market but an historic revaluation after decades, nay, hundreds of years of price suppression, counting all the years central banks have been puking out a tsunami of fiat money. The fiat monetary system is dying before your eyes.” Indeed it is. And yet, most people still don’t recognize it.

Credit: Since he’s on a roll, we’ll close this week with one final comment from Mr. Piepenburg, who reminds us that, “Rising precious metals are an open middle finger to governments who have grossly and negligently mismanaged the national currencies by which most citizens measure their wealth.” Sadly, this will only become clear to most people after the nest egg that is feathered with their life savings has lost a financially catastrophic chunk of its purchasing power. Got gold?

By the Numbers

Here is the final 2025 scorecard for the returns of select asset classes. Needless to say, it was a very good year for those of you holding a little wealth insurance in the form of physical precious metals (and an even better one if you invested in the companies that mine them):

-9.0% 10-year T-Note proxy (TNX)

-6.4% bitcoin

13% Dow Industrials

16% S&P 500

20% Nasdaq

64% Gold

146% Silver

154% Gold miners proxy (GDX)

164% Silver miners proxy (SIL)

Source: Yahoo!Finance

The Question of the Week

Last Week’s Poll Result

-

Better 39%

-

About the same 31%

-

Worse 30%

More than 1700 Len Penzo dot Com readers answered last week’s question and it turns out that 7 in 10 of you expect this year to be, generally speaking, similar or better than last year. We shall see. As for me, I am expecting another wave of higher inflation to surface later in the year. We’ll see…

If you have a question you’d like to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: The Farmer’s Pig

A farmer had a three legged pig and his neighbor asked him why the pig had only three legs. “I’ll tell you,” the farmer replied. “One day I was plowing my field and the tractor turned over and pinned me underneath. Believe it or not, that pig actually ran for help. He saved my life!”

“And that’s how he lost his leg?” the neighbor drawled.

“Nope. One night my wife and I were sound asleep and the house caught on fire. Despite the flames, that pig came into our burning house and woke us up. I tell ya, he saved our lives!”

“Oh, I see. So that’s how he lost his leg!” exclaimed the neighbor.

“Nope. That wasn’t how either,” the farmer said.

Exasperated, the neighbor demanded, “Okay … so how in the heck did that pig lose his leg?”

“Well …” the farmer replied, “when you’ve got a pig that good, you don’t eat him all at once.”

(h/t: Susan)

Squirrel Cam

With the picnic table devoid of nuts, this squirrel decided to focus his attention on the umbrella.

.

Buy me a coffee? Thank you so much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Whether you enjoy what you’re reading here – or not – please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my article highlighting 18 facts about ATM machines Jack offered this suggestion:

Don’t forget about all the gold-dispensing ATMs a la Gold-To-Go. How else are you going to get your 24-karat fix when you’re jonesing for the yellow metal?

No need to explain yourself — you had me at “gold-dispensing ATM.”

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len,

Happy New Year!

I enjoyed my first cuppa of 2026. So glad you’re back!

Have a great weekend everybody!

Sara

Thank you, Sara!

Holy smokes! Look at the gains on silver and the gold and silver mining proxies. Those are crazy returns.

Yep. I know I’m a happy camper! I’ve been investing in the miners for quite a few years. There’s been some pain along the way. You need a cast iron stomach to hold them; they are very volatile.

Hi Len, and happy 2026, everyone!

I agree with Cowpoke; those mining proxy gains are CRAZY, and I need to educate myself about them as an option.

Also, it’s pretty crappy that the port-o-potty company is underwater… 😉

I also think y’all need to get that squirrel a parasol of her very own!

Y’all enjoy your week! 🙂

When venturing into the miners, be aware they are very very volatile – they are not for the faint of heart. Any newbies who want to dip their toe in the mining water would be best served by, rather than trying to buy individual stocks, buy the gold- and silver-miner indices (GDX and SIL, respectively) first. If you want to take an even bigger risk, you can try the junior gold- and junior silver-miners, which are even more volatile (GDXJ and SILJ). Or you can let the mining experts do all the work and invest your cash in a professionally-managed mining investment account. I have one that is actively managed on a daily basis by Sprott; they charge 1.5% annually, but for me, they are worth it. This year they outperformed the GDX and SIL – in fact, they more than doubled the annual performance of those indices! (They also outperformed my self-managed miners portfolio.) DISCLAIMER: This is not investment advice.

Thanks for the thoughts, Len. I know these are simply your thoughts and experiences and not pro advice, but I appreciate the food for thought! I’m not sure I’m up for ANY high volatility items right now, but it’s always interesting to see what’s out there and learn about new/different options. 🙂

US Debt isn’t 38T. It’s much closer to a 100T. Stating it’s 38T is the equivalent of saying I paid my monthly 5K mortgage payment so I have no debt – forgetting that one owes a cool Million on that loan.

Absolutely, Celia! That total includes America’s unfunded liabilities, which is excluded from the “official” National Debt figure – and we all know why!