It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had an enjoyable week. Without further ado, let’s get right to this week’s commentary …

Every cloud has its silver lining, but sometimes it’s difficult to get it to the mint.

– Don Marquis

Credits and Debits

Debit: Did you see this? Social Security (SS) was originally created to provide a relatively comfortable retirement safety net, but times have changed, as 2 in 5 people who collect that retirement benefit say they are still working. The question is: What percentage of them are working because their SS benefits aren’t enough to cover the bills. Oh, and speaking of changing times…

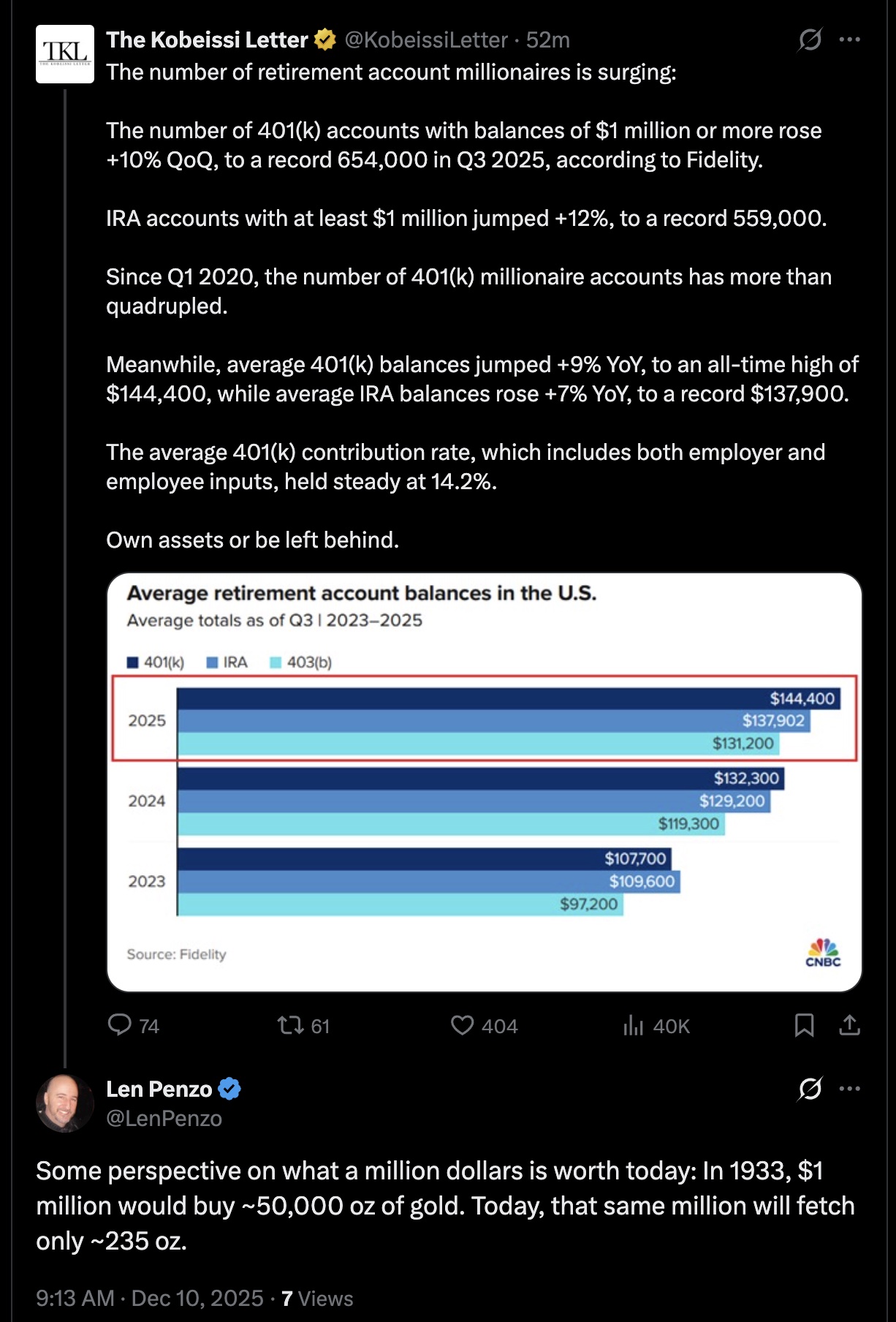

Debit: Perhaps not coincidentally, Dollar Store reported this week that roughly 60% of its shoppers earn more than $100,000. That’s up from 50% of new shoppers earlier this year in the first quarter. Another 30% of those shoppers earn between $60,000 and $100,000. More to the point, just as being a millionaire is no longer holds the same cachet it once did, the $100,000 income benchmark isn’t what it used to be either. The moral of the story: Your career choice matters. In more ways than one…

Debit: Car repossessions are on track to hit three million in 2025, matching Great Recession levels and making it the third-worst year on record. Q2 alone saw 706,393 repossessions, the largest Q2 volume ever recorded. Meanwhile, auto loan delinquencies are at their highest since 2010, with subprime rates at their highest level since 1994. Frankly, that doesn’t sound like a booming economy to us – but what do we know?

h/t: @SpillTheMemes

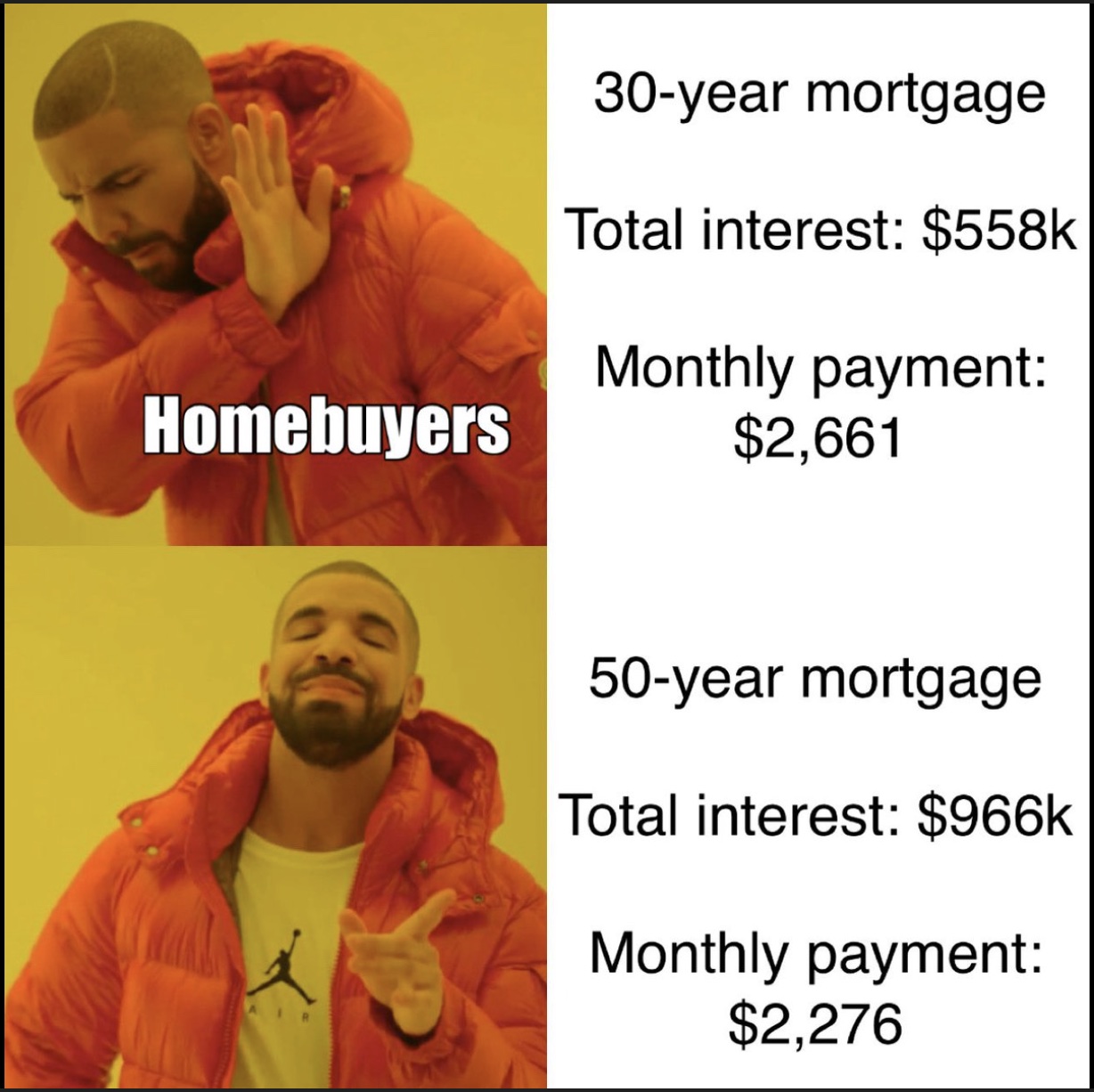

Credit: In other news, market conditions now favor homebuyers. In fact, home sellers are outnumbering buyers nationwide by 37% – that makes it the strongest buyers’ market since 2013. Now for the punchline: Despite these conditions, prospective homebuyers are exiting the market faster than sellers. As YahooFinance reports, “The shift underscores how small affordability gains aren’t enough to unfreeze a housing market where prices are more than 50% higher than pre-pandemic levels and mortgage rates are above 6%.” And, no, this isn’t the answer…

Debit: Since 2008, GDP has more than doubled. However, with the exception of service industries, many of which add little value, the expansion of credit is responsible for funding excess consumption and government spending. The proof is in the pudding, as US industrial production is now lower than it was in 2008, while the debt-to-GDP ratio continues to rise.

h/t: Jesse Colombo Substack

Credit: As macro analyst Alasdair Macleod observes, in the US, all “government spending is now 40% of GDP, with 23% at the federal level. Today, the easiest way to grow GDP is for the federal government to increase its useless and economically destructive spending. At least state government spending is relevant to their communities. But federal government spending isn’t – and that’s where the trouble is mounting.” Oh, sure… the politicians inhabiting Congress keep insisting they’re going to reduce their spendthrift ways. The response to which can be summed up thusly:

Debit: Unfortunately, the US GDP figures are misleading because the US government understates the true inflation rate. As a result, GDP now represents credit and not economic progress. For example, as Mr. Macleod points out, “The current US inflation rate is calculated by the Bureau of Labor Statistics (BLS) to be 3%, while using the original 1980 measurement criteria computes it as 12%. Taking nominal GDP growth currently estimated by the Congressional Budget Office of 4.5%, this changes “real” GDP growth from 1.5% to minus 7.5%. Then again, this isn’t the only economic deception we’re being subjected to. (Never mind the corruption.)

Gary Larson – The Far Side

Debit: Of course, there are only three ways out of the debt bubble now gripping government finance: 1) default; 2) financial repression over decades; or 3) hyperinflation. Does anyone care that these end games are now mathematical certainties? Not yet, it seems. Which is why it’s important that you, like this guy, carefully assess your risk before deciding how to respond …

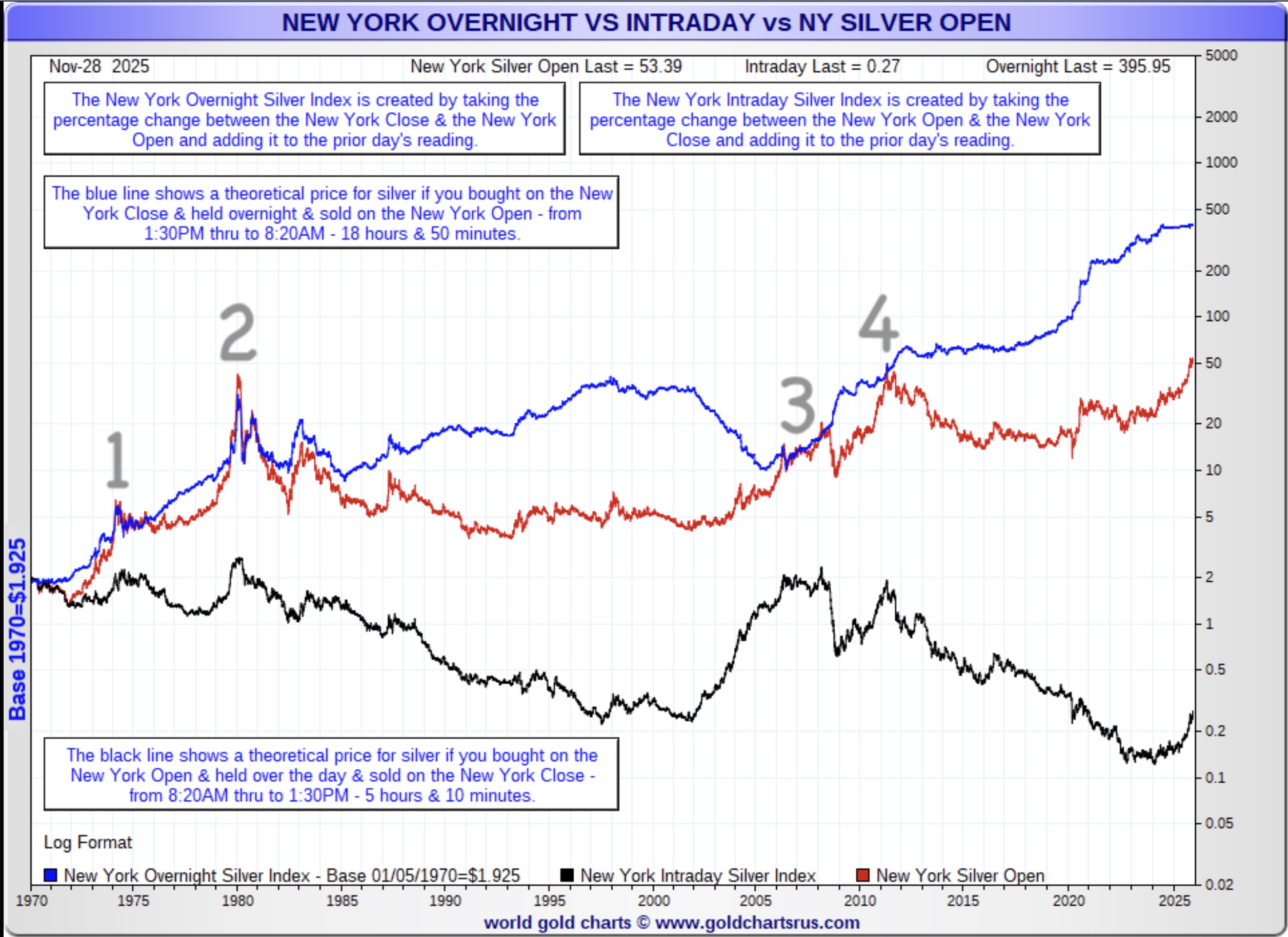

Credit: So how did we get here? How did the citizenry even allow such gross monetary malpractice to continue? The answer is decades of government-sanctioned manipulation in the gold and silver markets. As precious metals analyst David Jensen explains, they did this via “the use of trading promissory notes for gold and silver in lieu of allocated and segregated vault metal for each contract sold into the market.” And that manipulation “has allowed tremendous leverage to build in claims for each ounce of metal actually available in bullion bank vaults.”

“Nothing to see here!” says the Commodity Futures Trading Commission, which has been looking the other way since 1975 regarding the shenanigans going on in the silver market in order to protect the fiat US dollar. Government corruption at its finest. (h/t: @jameshenryand)

Credit: Not surprisingly, Jensen notes that decades of price fixing the silver and gold markets disabled “these important warning signals of loose monetary policy by central banks, (thereby) allowing the gross inflation of the world’s currency stock and capital markets.” Although the undeniable shortage in physical metal now seems to be slowly unraveling the elites’ paper shenanigans. That will greatly benefit everyone in the long run – if only because it should wake up even the most economically illiterate members of the public regarding the fiat currency fraud that is robbing them blind.

Credit: Meanwhile, enough capital has migrated into physical precious metals that silver, for instance, has increased in price by more than 100% in 2025. Gold’s up 62%. Remember, silver and gold are wealth insurance par excellence – not just colors for decorating your Christmas tree.

h/t: @Duediligenceguy

By the Numbers

On average, South Dakota currently has the shortest work commute at just 18 minutes. That may be useful news for people who live in the following ten states with the longest average work commutes (in minutes):

26.8 Washington

27.0 Virginia

27.6 Illinois

27.9 Florida

28.0 Georgia

28.3 California

28.7 Massachusetts

30.1 New Jersey

30.5 Maryland

32.4 New York

Source: BLS

The Question of the Week

Last Week’s Poll Result

-

Longer than 3 years 83%

-

Every 2 to 3 years 16%

-

Every year 1%

More than 1700 Len Penzo dot Com readers answered last week’s question and it turns out that 1 in 6 of you replace your phone every three years or sooner. To give a sense of how long yours truly goes between phone upgrades, I finally got a brand new iPhone 16 this year – it replaced my iPhone 8. (Yes, eight.) I suspect I’ll get my next phone upgrade in another 10 years or so, assuming the good Lord’s plans still have me here then.

If you have a question you’d like to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Supply Chain

Back in the days of the old Soviet Union, a Russian man walked into a local Moscow shop and noticed that all of the store’s display cases were completely devoid of any products whatsoever. So he asked the clerk, “You don’t have any meat?”

“Actually,” the clerk replied, “this is the place that doesn’t have any fruits or vegetables. The store that doesn’t have any meat is across the street.”

(h/t: Gregga)

Squirrel Cam

How low can you go?

.

Buy me a coffee? Thank you so much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Whether you enjoy what you’re reading here – or not – please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Lola dropped me a note that included an observation on all of the negative comments that I received on this old article explaining why I believe private schools are a rip off:

Wow, Len, you took a lot of flak on this one!

I can take it. After almost 30 years of marriage to the Honeybee, I’m battle-tested.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len, and thanks for another good, rich cup of coffee (about the ONLY thing that’s “RICH” around here these days! 😉 )

Re: your 3 ways out of the debt bubble, is it possible that the Powers That Be could create a situation (i.e., war, terrorist attacks, another virus, etc.) wherein the rest of the world once again turns to the U.S. Dollar as the LEAST likely to crash, given history and tradition? I don’t put anything past the folks who’ve been running things for the last several decades, and desperate times call for desperate measures, you know…

Re: SD having the shortest commutes, that may be due to so many folks working on their own ranches/farms. 🙂

Enjoy your week, everyone!

Hi Lauren! The problem with that alternative scenario for escaping the debt bubble, is that even if everyone piles back into the USD out of fear, its purchasing power versus real goods (commodities, but especially gold, which is the value of all other commodities are measured by) will still be declining. That is, the USD would be the “strongest” fiat currency – but only in the sense that it would be the best looking horse in the glue factory.

The fact is, we are witnessing a once-in-a-lifetime historic paradigm shift from a debt-based monetary system – and the acceptance of credit (trust) – back to one based on real wealth (gold, silver, oil, other commodities). In other words, the power is rapidly shifting from those who issue IOUs – fiat currency – to those who produce real goods and services and hold gold and silver as receipts for that production.

100% agree, Len. I guess the only GOOD thing about those scenarios is maybe they’d buy some time to prepare for folks who are just catching on (like a few family mbrs!)

It is also good for our kids and grandkids, who will once again be able to afford a home in their 20s and – once our manufacturing base returns from overseas – support a family easily on a single income. On the other hand, it’s not so good for people whose income is derived primarily from US Treasury bonds and/or government support checks, which is why at least one prominent financial institution is now recommending a portfolio allocation change from 60/40 stocks/bonds to 60/20/20 stocks/bonds/gold. Yes; they’re a few years late, but better late than never!

Social Security was never intended to be a person’s sole source of retirement income; it was designed as a foundation for old-age security, meant to be supplemented by personal savings, pensions, and investments to provide a minimum standard of living, replacing only about 40% of the average earner’s pre-retirement income. We can argue about the benefits/drawbacks of SS, but it keeps millions off the streets. Most who collect it did pay into it, so not a handout for a bulk of recipients. SS is a minimal amount but many rely on it entirely for retirement income, imagine what would happen w/o SS. Yes, for the super savers and financial savvy it is it is a waste of money, we could have managed it better, but unfortunately a significant number of Americans are not…

Good comments, Frank. I think SS’s biggest unintended consequence is that it gives a lot of people a misguided sense of complacency regarding their need to save for retirement. Like you said, at best it is a last ditch safety net.