It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had a wonderful week. And with that, let’s get right to this week’s commentary, shall we?

The hardest thing to explain is the glaringly evident which everybody has decided not to see.

―

Credits and Debits

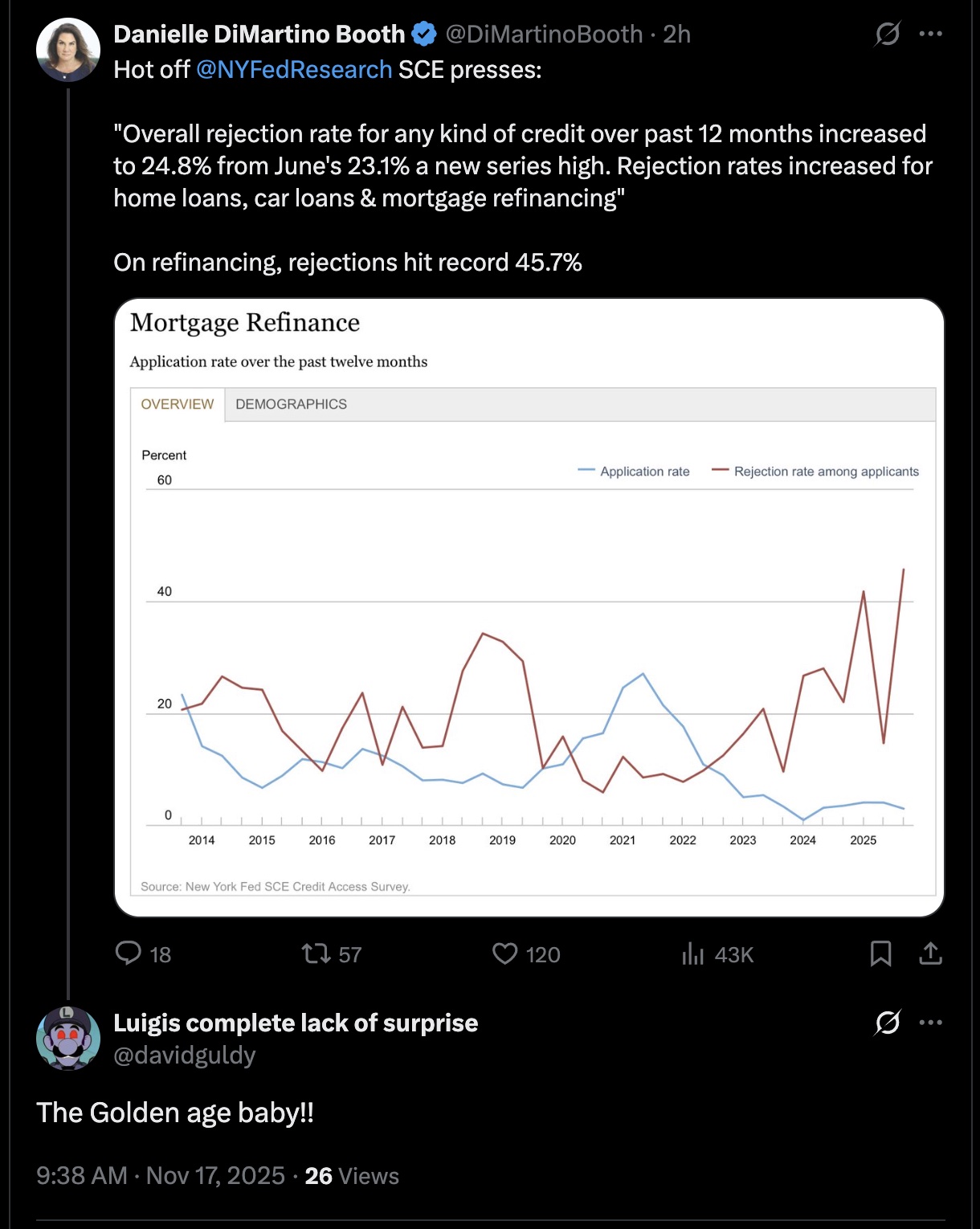

Debit: Did you see this? According to Kelly Blue Book, “The $20,000-vehicle is now mostly extinct, and many price-conscious buyers are sidelined or cruising in the used-vehicle market.” Imagine that. And here’s one big reason why:

Debit: Meanwhile, a new study has found that just 40% of workers between age 61 and 65 are financially on track for retirement and will have enough income to fund their current lifestyle into retirement. The rest are expected to fall short. In fact, the median 61- to 65-year-old will have a $9000 annual deficit in retirement, representing a 24% shortfall in their funding needs. As for the reason why so many near-retirees have underfunded retirement savings, well… that’s easy to explain:

h/t: @duediligenceguy

Credit: The good news is that, here in America, 401(k) contribution limit for workers under 50 increases to $24,500 in 2026. Workers 50 and older can deposit up to $32,500 in their 401(k)s next year, while the limit for employees aged 60 to 63 is even higher at $35,750. Even better, that’s before the taxman gets to take a bite from the apple. Not that anyone should feel sorry for him these days…

Credit: Of course, near-retirees who find themselves with insufficient savings do have a few other options available to them. For instance, working longer, tapping home equity and spending less are just three examples – but those strategies won’t be palatable for everyone. Especially the last one. Well… at least when it comes to couples like this:

Debit: Speaking of home equity – or lack thereof – nearly 875,000 homeowners now have underwater mortgages. That is: they owe more on their home loans than their properties are worth. That’s the highest level in three years. Economists are blaming softening home prices and elevated borrowing costs that are squeezing household finances. The good news is there’s no need to panic. We’ve got the Fed and its cadre of supporting federal bureaucrats to guide us away from any financial storms on the horizon. Oh, wait…

Debit: On a related note, the number of housing foreclosures is also creeping higher. In fact, more than 101,000 properties received filings in the third quarter – that’s 17% higher than a year earlier. The good news is that these numbers are coming off all-time low readings. Perhaps that will being to fix the so-called housing “shortage” (which is actually a case of market mispricing, courtesy of the Fed). Ahem…

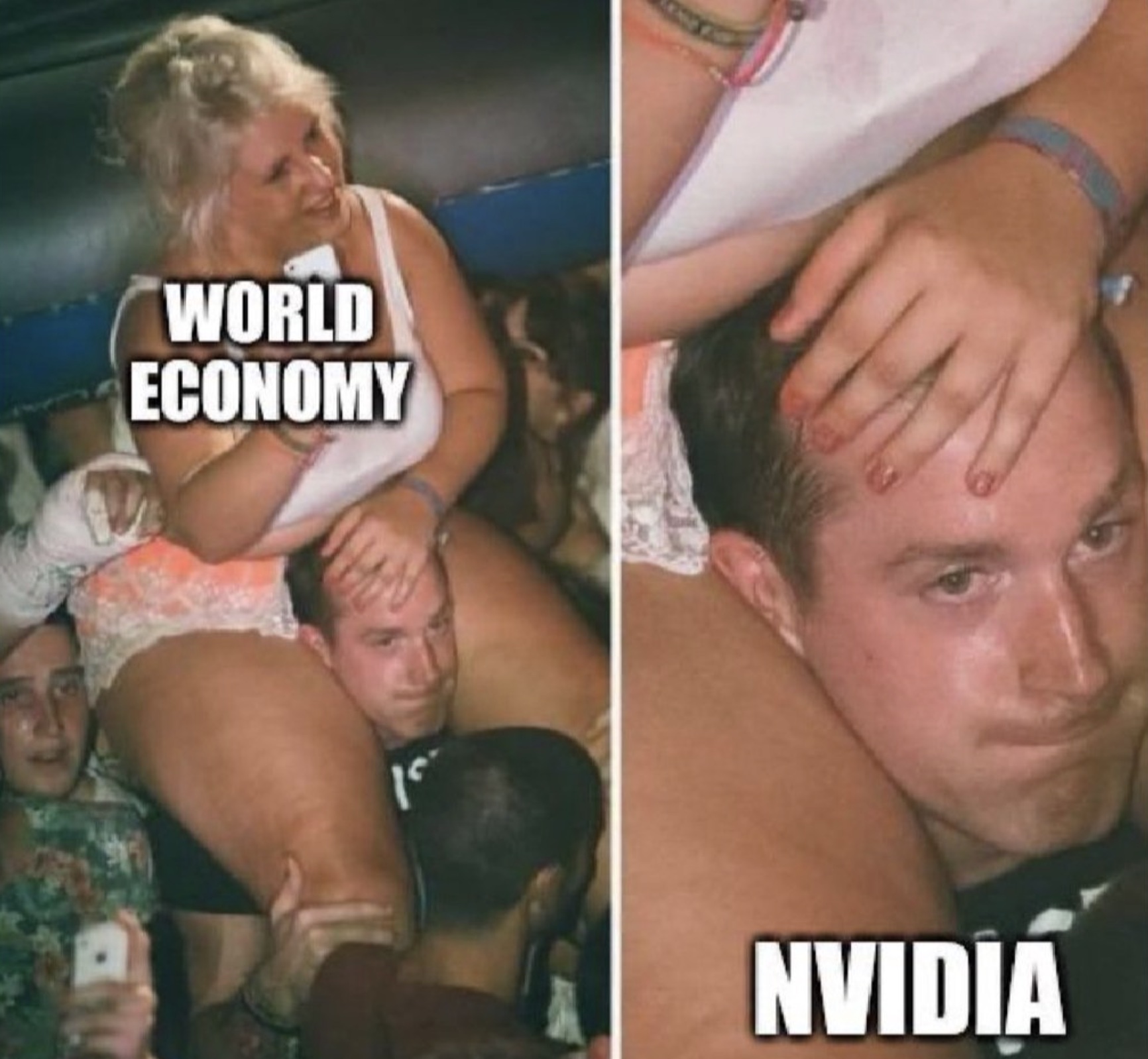

Debit: Despite a strong finish on Friday, the three major stock indices still posted big losses for the week. In fact,both the S&P 500 and Dow finished in the red to the tune of 2%, while the Nasdaq shed 2.7% during the five-day period. By the way, did you know that the so-called “Magnificent 7 stocks” currently make up more than 36% of the S&P 500 total market capitalization – and 20% due solely to NVIDIA? It’s true. Hey… that’s the sign of a healthy market! Or not…

h/t: @TerraBytw

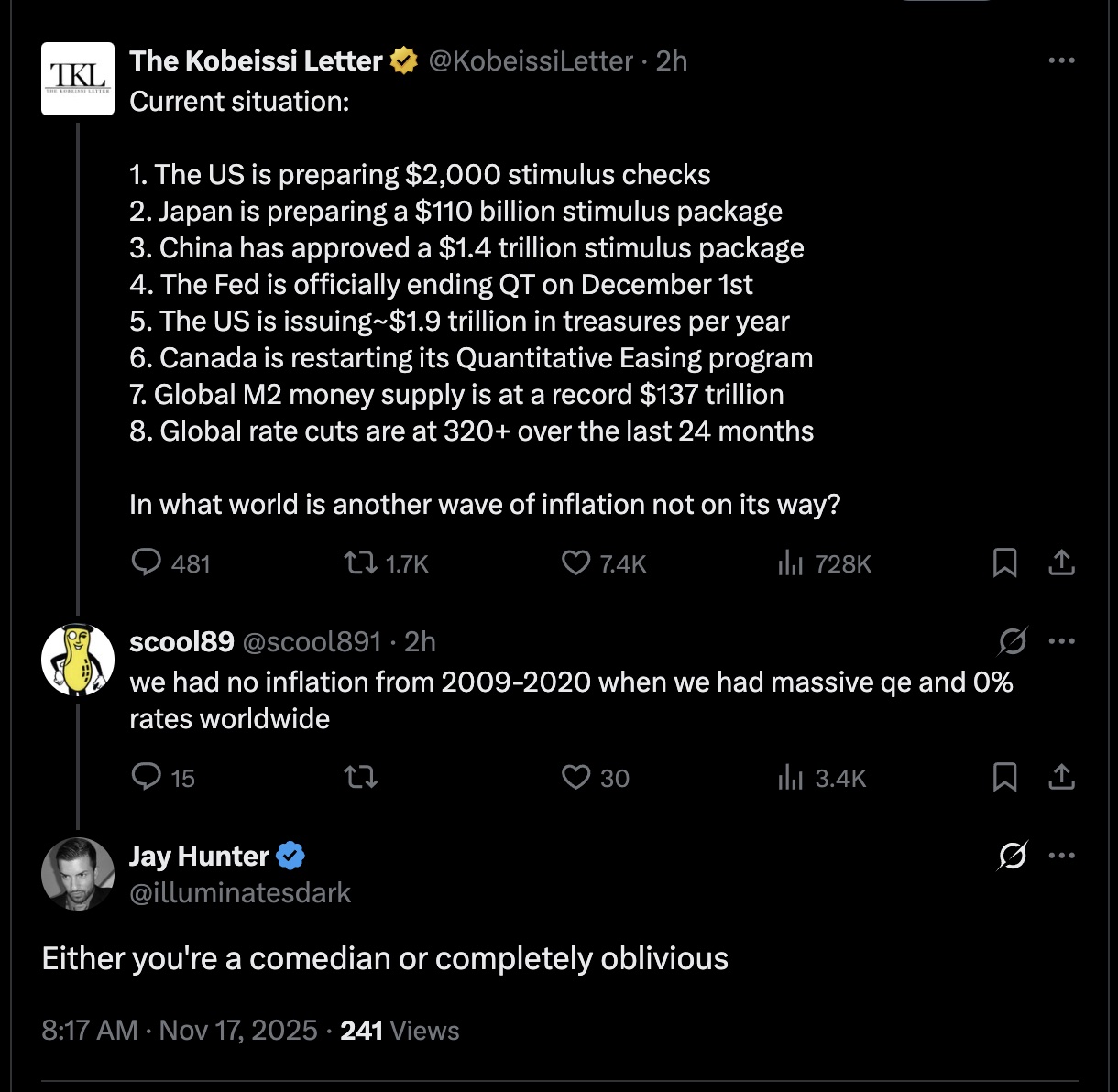

Credit: So… is Wall St. beginning to feel the strain of a struggling economy? Well… as macro analyst Greg Mannarino points out, our fraudulent debt-based monetary system “now requires repeated liquidity injections via a crisis-to-crisis engineered mechanism. That (financial) life support is an end-stage tell that’s hollowing out the US economy, middle-class, small businesses and industry. Once you’re issuing debt to buy your own debt – that’s exactly what is being done now – you’ve confessed that purchasing power destruction is the final lever.” That’s no joke, folks. And we’re pretty sure most people would agree that neither is this:

Credit: Not coincidentally, sagacious macro analyst Franklin Sanders came to the same conclusion, but from a different perspective, pointing out that, “After 232 years, the US mint has finally stopped making pennies; it cost 3.7 cents to make. Don’t kid yourself – this is the kiss of death for the US dollar (USD).” Well… it’s certainly yet another sign of the USD’s failure as a long-term store of value. The good news is the move will save the US $56 million annually. Never mind that, with $7 trillion in annual expenditures, the federal government is spending that much every three days. Let’s just hope the gold in Fort Knox is still there…

Credit: We’ll close this week by letting Mr. Sanders finish his thoughts on the failing USD. he says, “Historically debasing and outright removing metal content from coinage is a sign that the (currency) is dying. Think of the progression: In 1934 gold was confiscated and removed from US coinage. In 1964, silver was removed from US dimes, quarters, and halves. And in 1982 they removed copper from the penny, replacing it with copper-coated zinc. Now the US Mint has even stopped striking zinc pennies. History is warning y’all. Heed it.” It’s sage advice, but the clock is ticking. Whether you follow it in time – or not – is entirely up to you.

By the Numbers

A new study has identified where people are most at risk of credit score damage and foreclosure in America’s 100 largest cities by analyzing proprietary user data from the first two quarters of this year. The US city with the lowest delinquency rate is San Francisco at 2.8%. Here are the 10 cities with the highest mortgage delinquency rates in 2025:

14.5% Lubbock, TX

14.7% El Paso, TX

14.8% Greensboro, NC

15.0% New Orleans, LA

15.4% Baltimore, MD

15.8% Philadelphia, PA

15.9% Baton Rouge, LA

16.8% Newark, NJ

18.7% Detroit,MI

23.9% Laredo, TX

Source: WalletHub

The Question of the Week

Last Week’s Poll Results

I forgot to post a question last week. Sorry about that!

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: The 19th Hole

Two guys grow up together, but after college one moves to Georgia and the other to Texas. They agree to meet every ten years in Florida to play golf and catch up with each other’s stories.

At age 32 they meet, finish their round of golf and head for lunch.

“Where you wanna go?”

“Hooters!”

“Why Hooters?”

“They have those servers with the big boobs, tight shorts and gorgeous legs.”

“Perfect!”

At age 42, they meet and play golf again. When the round ended, it was time once again to hit the 19th hole.

“Where you wanna go for lunch?”

“Hooters!”

“Again? Why?”

“They have cold beer, big screen TVs, and side action on the games.”

“Yeah, boy! Let’s do it!”

At age 52 they meet and play again. When the round was over, it was time to eat.

“So, where you wanna go for lunch?”

“Hooters.”

“Why?”

“The food is pretty good and there’s plenty of parking.”

“OK.”

At age 62 they meet again. After the round of golf, one says, “Where you wanna go?”

“Hooters.”

“Why?”

“Wings are half price and the food isn’t too spicy.”

“Good choice.”

At age 72 they meet again. Once again, after a round of golf, one says, “Where shall we go for lunch?”

“Hooters.”

“Why?”

“They have six handicapped parking spaces right by the door and they have senior discounts.”

“Great choice.”

At age 82 they meet and play again.

“Where should we go for lunch?”

“Hooters.”

“Why?”

“Because we’ve never been there before.”

“I can’t argue with that. Let’s give it a try!”

(h/t: GLH)

Squirrel Cam

Sometimes the meeker squirrels are forced to wait their turn…

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top five articles viewed by my 52,021 weekly email subscribers and other followers over the past 30 days (excluding Black Coffee posts):

- 11 Retirement Savings Tips for Everyone

- Be Careful, Priceline Users! Name a Wrong Price and You May Go To Jail

- How to Buy and Sell Precious Metals Legally in the United States

- Outrageous Pizza Delivery Fees Are Here to Stay (and It’s Your Fault)

- Don’t Be a Wimp! Here Are 22 Things You Should Always Haggle For

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Thank you!!!! 😊

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

I recently got a message from long-time reader Dan who sent me this note after getting my weekly blog round-up in his mailbox last Monday:

Len, I can’t find Black Coffee. It’s usually the best part.

Sorry about that, Dan. There was a… hey… wait a minute. “Usually”?

If you enjoyed this, please forward it to your friends and family. 😊

I’m Len Penzo and I approved this message.

Photo Credit: public domain

Hi Len,

I laughed out loud when I saw that meme about kids leaving the lights on. If I had a penny (they’re no longer minting anymore!) for every time I turned off lights that my kids left on I’d probably have enough for a nice vacation somewhere!

Have a great weekend everybody!

Sara

Sara, my daughter is now an adult and she still leaves the lights on in her room!

I’m with Sara on the “Dad after the kids leave home” pic! SO true in our family! Thanks for the great “Coffee” AND the chuckles, Len; BOTH much needed these days! I hope everyone counts their blessings this Thanksgiving week. In spite of economic and other news, we have MUCH to be thankful for, inc. your blog, Len. 🙂

Safe travel and enjoy your week, y’all!

Thank you, Lauren! And a Happy Thanksgiving to you and all the readers here!