It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had a wonderful week. And with that, let’s get right to this week’s commentary, shall we?

A girl phoned me the other day and said, ‘Come on over, there’s nobody home.’ I went over. Nobody was home.

– Rodney Dangerfield

Credits and Debits

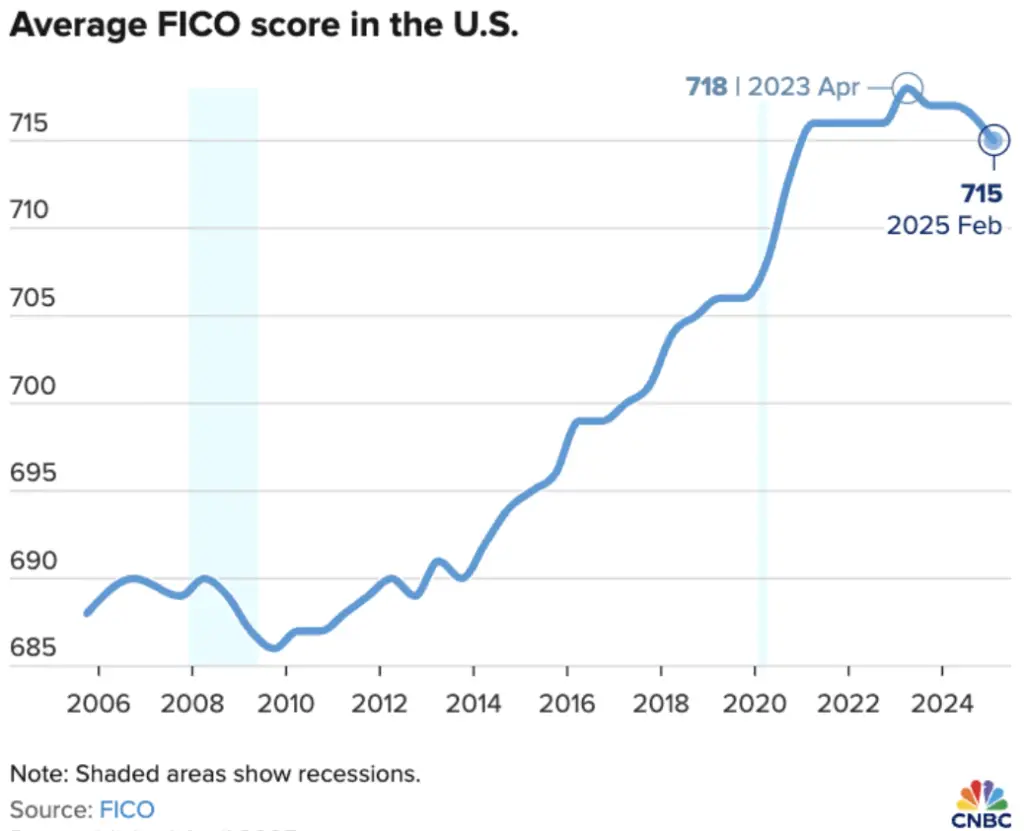

Credit: Did you see this? When it comes to household credit ratings, there are “free” credit scores offered by companies like Credit Karma – and then there is the industry standard, FICO, which is used by the lending industry. With that in mind, the average FICO score for Americans now stands at 715. While that score is respectable, it’s still 25 points below what is typically considered the threshold for an “excellent” credit score by lenders – and the corresponding best lending rates that come with it. For those of you not tracking this at home, the decline is one point lower than the January 2025 average, and a two-point drop from April 2024.

Credit: For those who are wondering if they’re saving enough money every year, perhaps this look at the latest generational saving habits will help. It turns out that in 2024 the millennials socked away an average of $12,004, Gen X set aside more than $7000 saved, and Gen Z squirreled an average of $6165. As for the baby boomers, they managed to save $3400. Take that for what it’s worth – which probably isn’t much. But “help” is on the way. At least according to one rocket surgeon …

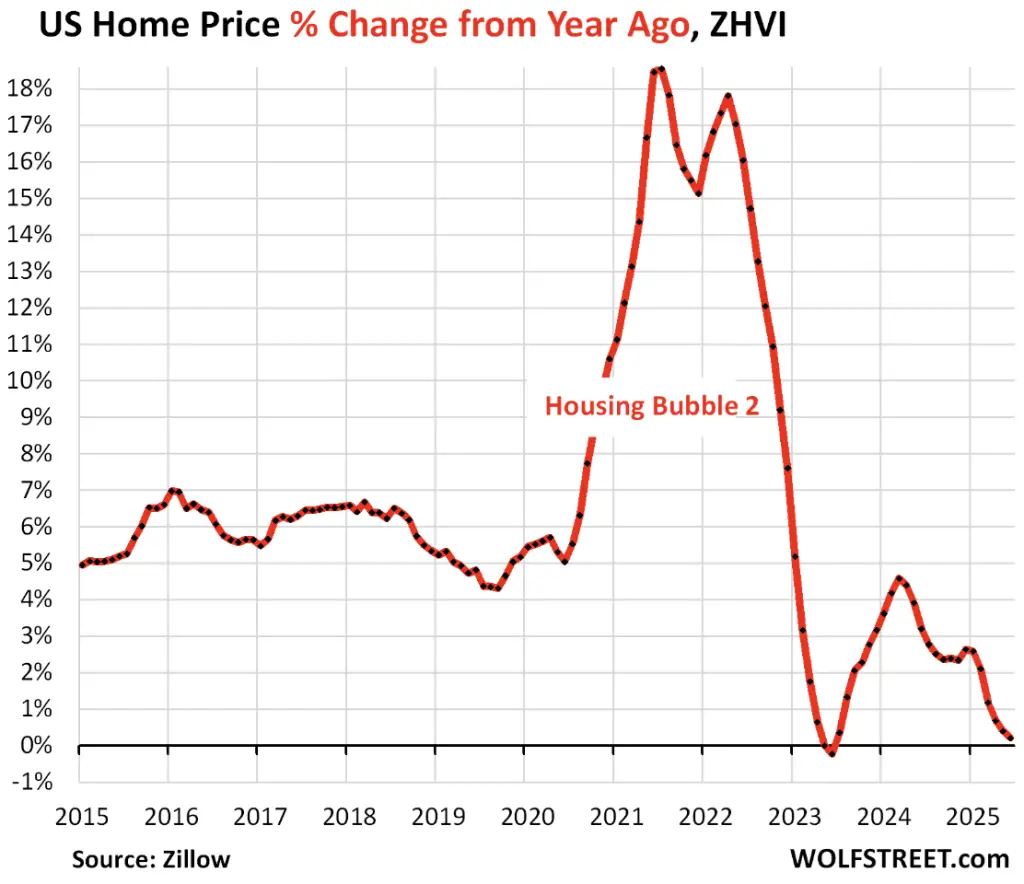

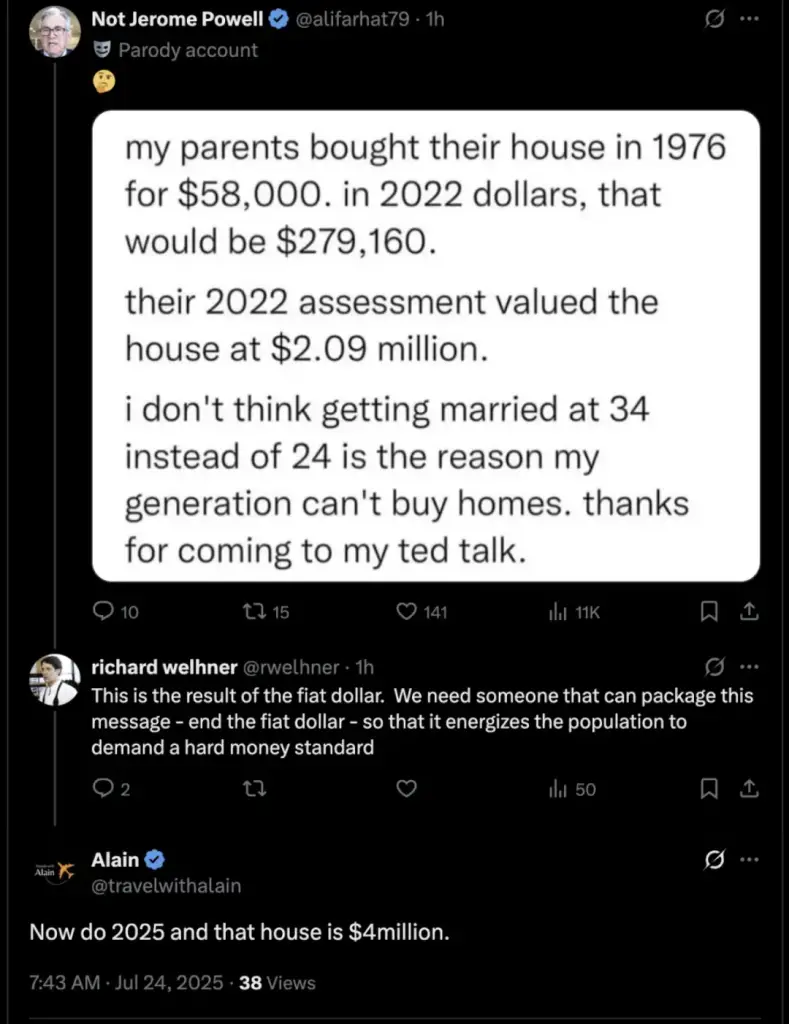

Credit: Of course, it’s hard to buy your first home if you don’t have a lot of savings for a down payment – and first-time homebuyers need a lot of savings these days, especially at today’s elevated prices. But iaccording to financial analyst Wolf Richter, the housing market may be starting to show the first signs of cracking. According to him, “The year-over-year (YoY) price gains of mid-tier single-family homes, condos, and co-ops in the US nearly vanished in June: prices rose by just 0.2% compared to June a year ago.” Only time will tell. On the other hand, what’s that we see over yonder?

Debit: One thing is certain: The cost to keep a roof over your head in the Big Apple is higher than ever – especially for renters. The median rent for a Manhattan one-bedroom apartment in June was a record-breaking $4625. What’s more, 25% of Manhattan tenants ultimately paid above the landlord’s list price – that’s an all-time high for June. It’s no better in Queens, where bidding wars nearly matched Manhattan at 24%. Then there’s Brooklyn, which outpaced both with a whopping 32% of tenants facing bidding wars. Meanwhile, over at the Home & Garden Television help desk…

Credit: By the way, Richter also notes that the price moves were highly dependent on the local market. He says, “Of the 33 metropolitan areas that we track, the number with YoY price drops has expanded every month this year. At the end of 2024, only 6 of the 33 metros had YoY price drops. In June, the number rose to 21 (from 18 in May). The three additions: Los Angeles, San Jose, and Nashville. And the YoY price drops worsened in nearly all of them, including in San Diego (from 1.9% in May to 2.4% in June).” Needless to say, many people are actually rooting for a much broader and deeper downturn – if not an outright market collapse.

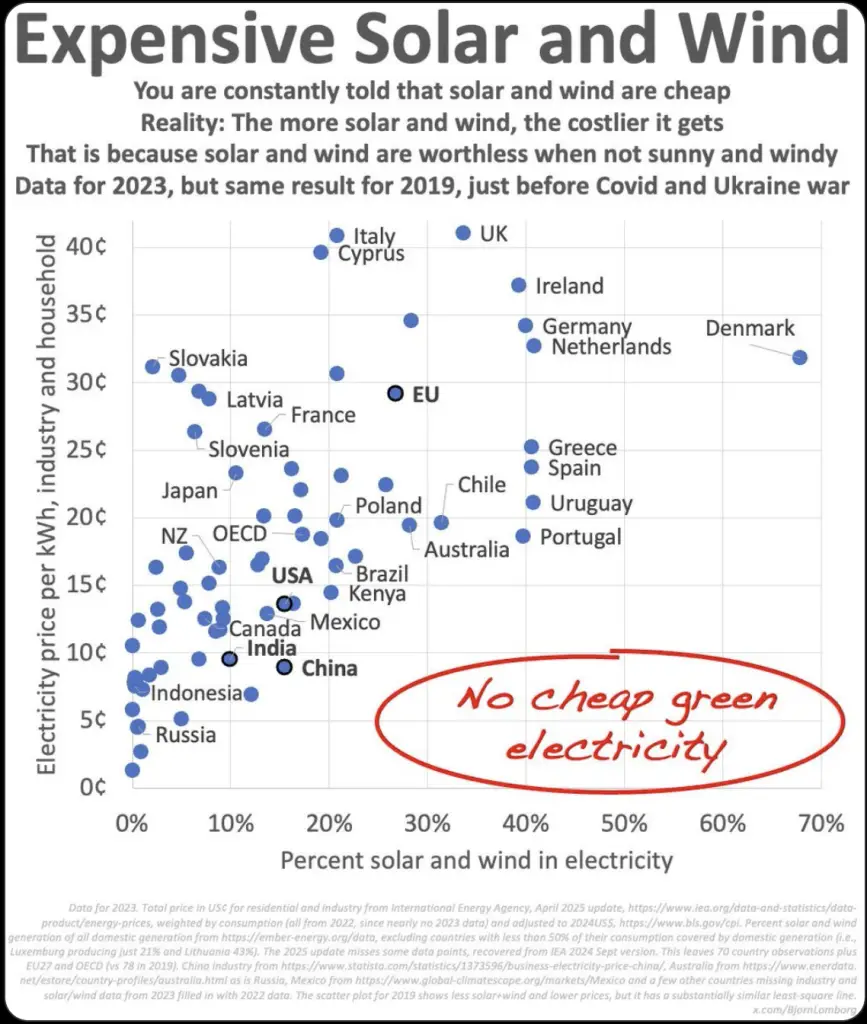

Debit: Speaking of local markets, the green agenda is backfiring. The average summer wholesale power prices across the US northeast grids – which are more dependent on green energy than the rest of the country – are the highest in the nation, far exceeding those in Texas, the US average, and even the traditionally high-cost West Coast markets. As for the rest of the world …

Debit: In fact, Zero Hedge notes that electricity prices are so high in the northeast that 1 in 3 households in central Maryland are behind on their utility payments. Imagine that. Then again, here in the Golden State, there are probably just as many residents who find themselves in the same boat, thanks to similar green energy policies (along with a big dollop of excessive energy taxes and political graft) …

Debit: Meanwhile, back on the West Coast, California’s unemployment rate rose to 5.4% in June, tying Nevada for the highest rate in America, and strongly suggesting that the Golden State’s economy is underperforming relative to the rest of the country. Well… at least for some people:

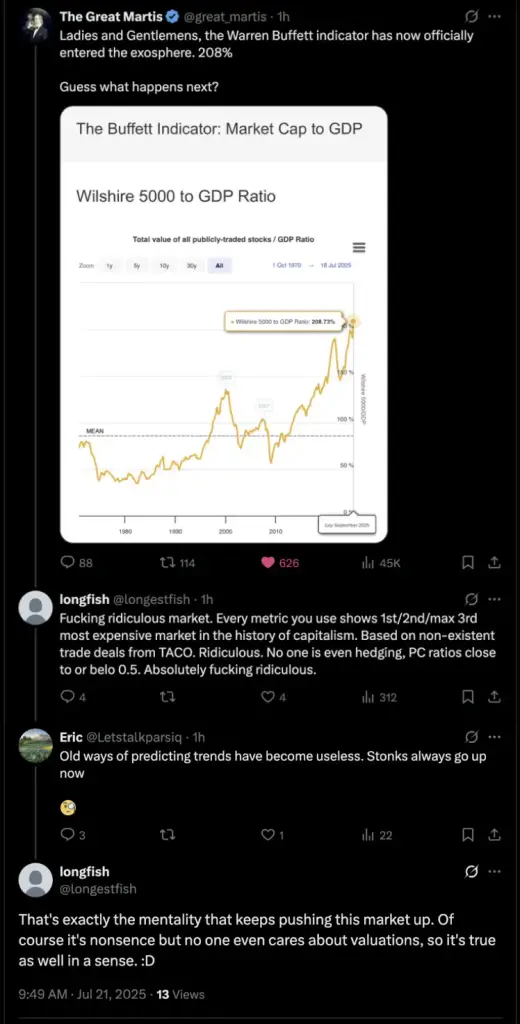

Credit: On Wall Street, this Friday the S&P 500 posted its 14th record close of 2025, while the Nasdaq hit its 15th record close for the year. The Dow wasn’t as fortunate, but it still ended the session just 0.25% off its record December 2024 close. For the week, the Dow posted a 1.3% gain, the tech-heavy Nasdaq rose 1% and the broad market S&P 500 closed 1.5% higher.

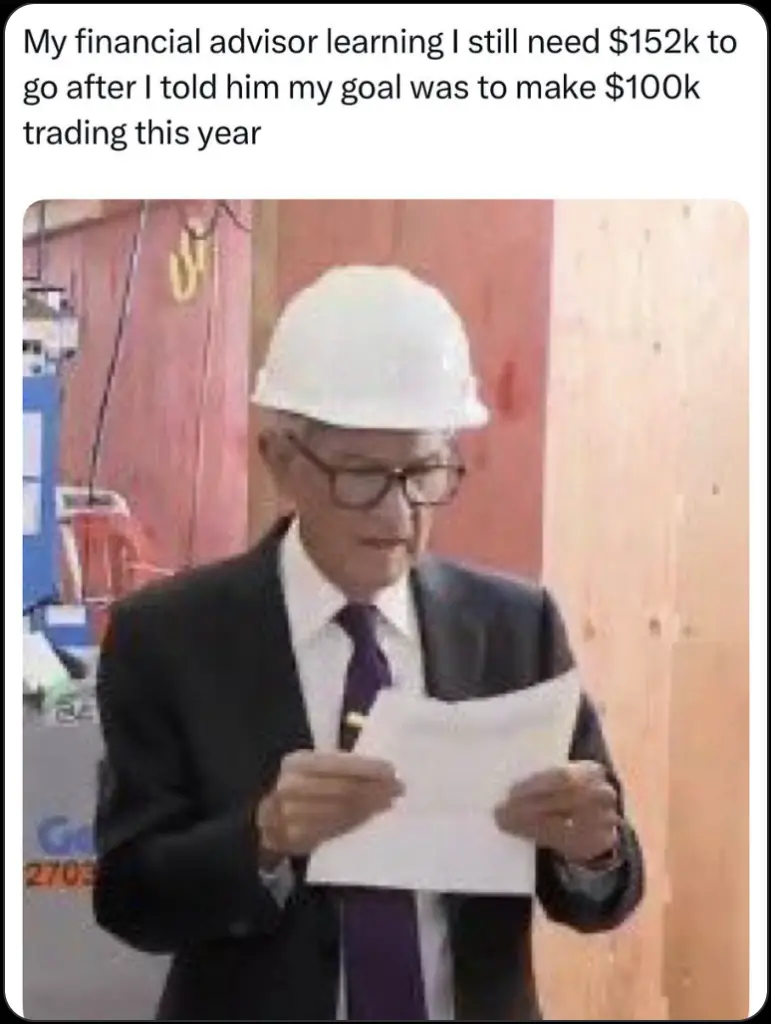

h/t: @HOF_meme

Credit: According to macro analyst Nomi Prins, the US government is considering a study to stockpile silver again. “If that happens,” Prins says, “we very well could see that from this administration. And that would definitely boost the demand for silver and the price of silver and the mining companies involved in that process.” Well… we certainly didn’t see that coming. Then again, that seems to happen to everybody from time to time. But especially people who like to ride bicycles…

Credit: We’ll close this week with precious metals analyst Craig Hemke who summed up the current monetary system situation for Sprott thusly, “a structural shift is coming to how the US conducts its monetary policy and these events are very likely to drive the next massive wave within the ongoing bull market for precious metals.” That it is. The only question is: “When?” Got gold?

By the Numbers

Researchers analyzed data from the US Courts on business bankruptcy filings from the past two years. Here are the ten states currently experiencing the highest rates of corporate financial distress, based on the highest percentage change in bankruptcy filings from the previous year:

20.5% California

20.6% Maine

21.0% Texas

21.1%Delaware

22.2% Washington

23.2% Florida

25.7% New Hampshire

26.3% Colorado

26.4% Idaho

27.4% Rhode Island

Source: Techr

The Question of the Week

Last Week’s Poll Results

-

$1000 to $5000 42%

-

$5000 to $10,000 27%

-

More than $10,000 19%

-

Less than $1000 12%

More than 1800 Len Penzo dot Com readers responded to last week’s question and it turns out that slightly less than half have experienced an emergency expense exceeding $5000. Frankly, I am shocked that the share of respondents isn’t much higher. Maybe they’re just lucky!

This week’s question was submitted by reader Frank. If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: True Confessions

Wife’s diary …

Dear Diary:

Tonight, I thought my husband was acting weird.

We had made plans to meet at a nice restaurant for dinner. I was shopping with my friends all day long, so, I thought he was upset at the fact that I was a bit late, but he made no comment on it. Conversation wasn’t flowing, so I suggested that we go somewhere quiet so we could talk. He agreed, but he didn’t say much. I asked him what was wrong. He said, ‘Nothing.’ Then I asked him if it was my fault that he was upset. He said again that he wasn’t upset, that it had nothing to do with me, and not to worry about it.

On the way home, I told him that I loved him. He smiled slightly, and kept driving. I can’t explain his behavior. I don’t know why he didn’t say, ‘I love you, too.’

When we got home, I felt as if I had lost him completely, as if he wanted nothing to do with me anymore.

He just sat there quietly, and watched TV. He continued to seem distant and absent. Finally, with silence all around us, I decided to go to bed. About 15 minutes later, he came to bed. But I still felt that he was distracted, and his thoughts were somewhere else.

He fell asleep; I cried. I don’t know what to do. I’m almost sure that his thoughts are with someone else. My life is a disaster!

Husband’s diary …

A one-foot putt. Who the hell misses a one-foot putt?

(h/t: RD Blakeslee)

Squirrel Cam

Sometimes, our squirrels get lucky and find a little extra at the buffet table. This time, it was a hazelnut (a.k.a. filbert) …

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top five articles viewed by my 51,585 weekly email subscribers and other followers over the past 30 days (excluding Black Coffee posts):

- Five Misleading Grocery Products Shoppers Waste Money On

- Good Personal Finance Habits Everyone Should Follow

- How to Maximize Savings Interest with Minimal Risk

- 14 Things You Shouldn’t Buy When Traveling

- Is It Okay to Eat Food Past Its Expiration Date?

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X (Twitter).

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by patronizing my sponsors!

Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After finding my blog and reading more than a few articles, Prometheus sent this:

You do realize how demeaning it is to refer to your wife as Honeybee?

If that’s really true then I suppose I’m lucky she hasn’t caught on yet.

If you enjoyed this, please forward it to your friends and family. 😊

I’m Len Penzo and I approved this message.

Photo Credit: public domain

Hi Len,

Thanks for the cuppa! Very tasty, as usual.

I discovered last month that my credit score dipped below 800 for the first time in a long time. Not sure why. I guess I have nothing to worry about as long as it stays above 740?

Have a great weekend everybody!

Sara

Hi Sara! You’re right. Any score above and beyond 740 is icing on the cake. You get the same lending rate with a credit score of 850 as other consumers who have a 740 rating.

SMH. How do those bike riders not see that gate as they approach it?

I know, right? It boggles the mind. The only plausible explanation I can come up with is they believe the gate isn’t locked and so they expect it to fling open when their front tire hits it.

Congrats on the book, Len. I preordered it on Monday. Looking forward to reading it.

Thank you so much, Stan!

Len, no Wallace & Grommet this week? I thoroughly enjoyed that little clip in last week’s Black Coffee; forgot how much fun they were to watch!

I’ve given up trying to understand the stock markets anymore. As someone said, they only seem to go UP, and with no rhyme or reason attached. I’ve discovered a good and HONEST pawn shop that will sell PMs (coins AND jewelry) for reasonable prices, and consider that a much better ‘gamble’. 🙂

I’ve also added your book to my birthday list, thanks to Stan’s mention (CONGRATS!) If anyone looking for it, “True Money Stories: Madcap Musings about Family Life & Personal Finance”, Kindle version available 8/1 at Amazon!

Hi Lauren! First off … thank you for the donation. (Again!). You keep spoiling me! 🙂

As for Wallace & Grommit, I promise to look for some other clips that I can blend into Black Coffee. They are the best.

I saw a chart that superimposed money supply with S&P 500 index and the two correlated almost perfectly – which suggests the US stock market is a better indicator of government currency printing than economic health.

Finally … thank you for the book shout out! I hope you enjoy it! 🙂

By the way, for those who are interested, I placed a big banner at the top right corner of the blog page that links directly to the book’s description page on Amazon. The eBook is available now; the paperback is available this Friday.

Well Len, I feel kind of stupid and Pavlovian right now; I’m so used to NOT looking at ads, I completely missed your book ad at the top of this page! Can’t wait to read it. 🙂