It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I’ve got another busy weekend ahead of me, so let’s get right to this week’s commentary …

The fundamental cause of the trouble is that in the modern world the stupid are cocksure while the intelligent are full of doubt.

– Bertrand Russell

The stupid neither forgive nor forget; the naive forgive and forget; the wise forgive but do not forget.

– Thomas Szasz

Credits and Debits

Debit: Did you see this? A new study finds that only 46% of adult Americans have enough emergency savings to cover three months of expenses. Additionally, 30% of people have some emergency savings but not enough to cover three months’ expenses, and 24% have no emergency savings at all. In the meantime …

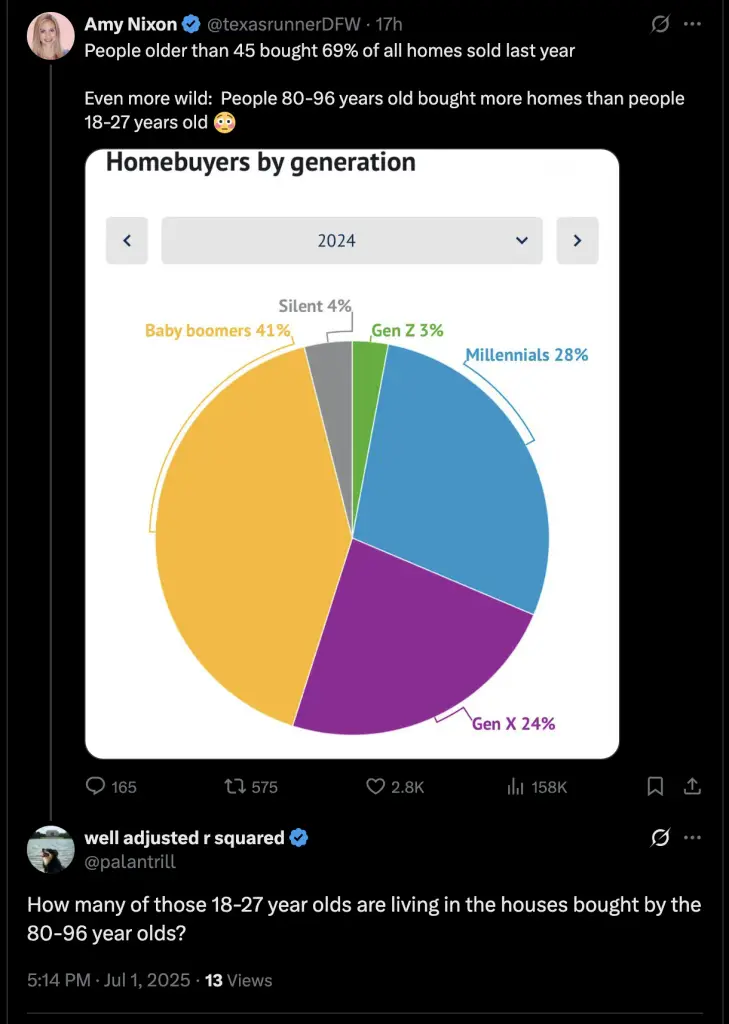

Debit: By the way, the same study also found that 33% of adult Americans have more credit card debt than emergency savings, down from 36% in 2024 and 2023. That percentage is still higher than in 2022, when 22% of Americans had more credit card debt than emergency savings. Anybody else wonder if housing expenses have anything to do with this?

Credit: In other news, Raising Cane’s has quietly surpassed KFC in annual sales, becoming the third-largest chicken chain in the country. The accomplishment follows a recent winning streak for the 28-year-old company, which has spent the last decade expanding outside its home bases in Louisiana and Texas. Its restaurant footprint has grown to more than 900 locations, up from just over 500 in 2020. About 100 more are expected to open this year, with another 200 or so in the development pipeline. That’s going to require a lot of employees. Then again, Raising Cane’s isn’t the only employer who is hiring…

Credit: On Wall Street, the three major stock indices are finished higher for the week, with the S&P 500 and Nasdaq both hitting all-time intraday highs on Friday before pulling back a bit. The Dow also finished up for the week, but just short of its last all-time high. Some economists are saying the current stock markets rally is primarily in reaction to the federal government’s continuing debasement of the US dollar (USD), rather than a booming economy. Okay … and maybe this, too:

Debit: In other news, with the $9 trillion in debt that is due this year, the federal government is planning to refinance the $9 trillion as short-term debt in an attempt to avoid having to pay for 10 years of debt at a higher rate. Needless to say, this is extremely reckless due to its potential to increase interest rate volatility, and strain government cash flow. Although probably not as reckless as this …

Gary Larson – The Far Side

Debit: Not coincidentally, the Fed announced changes last week to something called the commercial banks’ supplementary leverage ratio (SLR). According to the Fed, the goal is rather mundane; that is, “ensure there is always enough liquidity in the markets.” Then again, we all know central bankers like to lie – especially by omission. After all, it’s the best way to keep most people completely confused. Kind of like this lady …

Credit: Thankfully, market analyst Franklin Sanders explains the Fed’s intentions in plain English for us: “The bottom line is that the change will allow banks to buy more US Treasury (UST) securities. The nightmare that keeps US Treasury Secretary Scott Bessent’s awake is that the Treasury might at some time find no buyers for its debt. The bond market must be kept well fed and alive or else the USD’s whole game goes kaput in bankruptcy and hyperinflation. Thus, the banks must be encouraged to buy bonds.” Not that it’s really going to matter in the long run, as even the Fed admits …

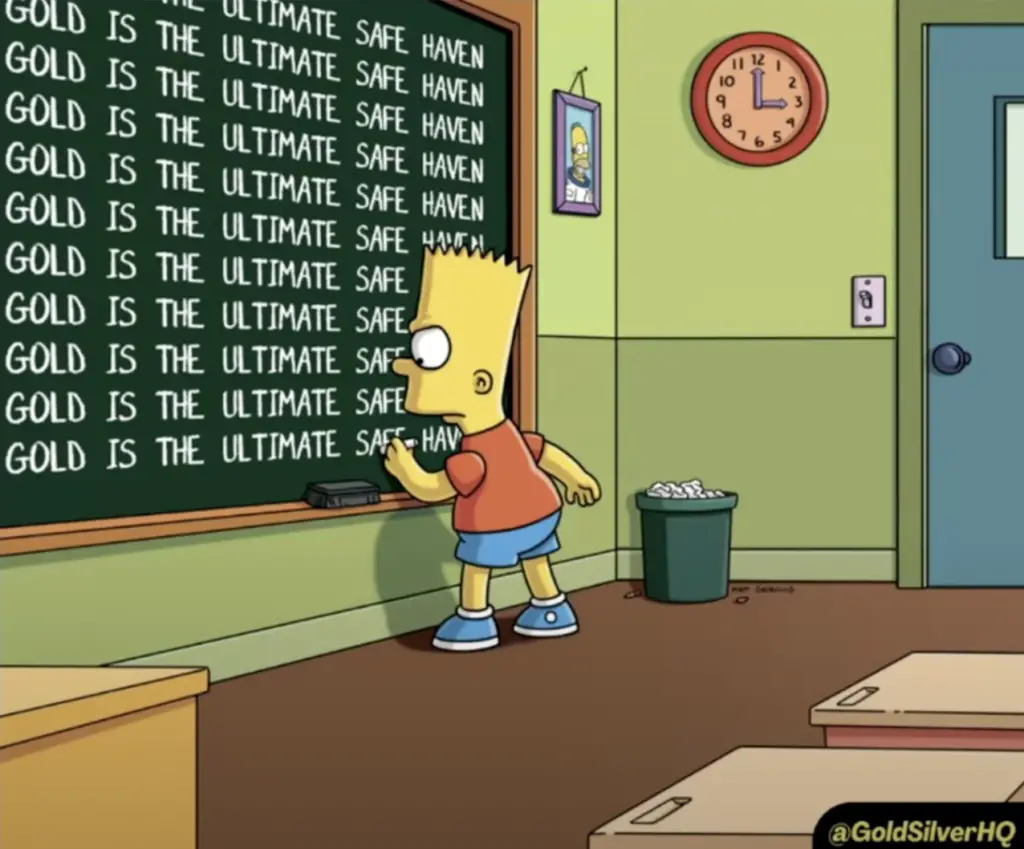

h/t: @WallStreetMav

Debit: Professional traders are shorting the US dollar at levels not seen in 20 years, while central banks buying gold at record rates signal a deeper loss of confidence in fiat currency. As for those of you who still claim that nobody can really explain the central banks’ buying spree, well, don’t make us send you to the chalkboard …

h/t: Alan Hibbard via GoldSilver.com

Credit: Meanwhile, Bessent recently claimed that stablecoins could “reinforce dollar supremacy.” His argument centers on the so-called “Genius Act” circulating around the US Congress which would force stablecoin issuers to back their tokens with US Treasuries and other “safe” dollar-denominated assets. But as macro analyst Mike Maloney points out, “It’s like two guys skydiving without parachutes, worried that they’re somehow volatile relative to each other.” Uh-huh. It’s all a scam perpetrated by an army of shills and grifters – and we’re not just talking about stablecoins either. Behold, Exhibit A-1:

Debit: And while the Genius Act purports to remedy the monetary issues that will ultimately result from the UST’s waning demand among the world’s nations, there is a fundamental problem: Stablecoins pegged to the USD are only as stable as the USD itself. That’s not good news when the USD without an anchor to gold, has consistently lost significant purchasing power over time. In fact, the only legitimate stable coins proven to maintain their purchasing power over millennia are the ones containing physical gold and silver. Unfortunately, the general public is completely clueless regarding that basic economic law …

Credit: In a world where currencies are racing to the bottom, gold isn’t just an investment – it’s wealth insurance for your hard-earned nest egg. Gold is the premier safe haven … no matter what others might claim.

By the Numbers

For those of you who ever wanted to enter a speakeasy but didn’t know the password, you’re in luck. We recently came across the top ten speakeasy passwords. The odds are one of these will probably work:

10 “Mrs. Doubtfire”

9 “Please let me in.”

8 “867-5309”

7 “This is Neo – I need an exit.”

6 “Open sesame.”

5 “123456”

4 “Your mother was a hamster, and your father smelt of elderberries.”

3 “Eureka!”

2 “Swordfish”

1 “Voila!”

Source: Klugness

The Question of the Week

Last Week’s Poll Results

How many different addresses have you lived at during your lifetime?

- More than 12: 68%

- 9 to 12: 12%

- 6 to 8: 8%

- 3 to 5: 7%

- Less than 3: 5%

More than 2000 Len Penzo dot Com readers responded to last week’s question and it turns out that slightly more than 4 in 5 of you have called at least nine residences “home” during your lifetime. According to the US Census Bureau, on average, Americans put roots down somewhere between 11 and 12 different locations during their lifetime. I’ve called seven different addresses home over the years.

If you have a question you’d like me to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Great News

Four people were living in a four-plex apartment building. On the first floor lived a boxer; on the second, a professional football player; on the third, a blind man; and on the fourth, a beautiful woman named Leah.

One particularly gorgeous day, Leah was in the shower when she heard the doorbell ring. So she yelled, “Who is it?” The person answered, “It’s Carson, the boxer!” So Leah exited the shower with a towel and opened the door.

“Great news, Leah!” said Carson, “I won this morning’s fight!”

Leah replied, “Well, congrats to you, Carson! See you tomorrow!” And with that she shut the door and went back to finish her shower.

Just then, she heard the doorbell ring again. “Who is it?” Leah yelled. The person behind the door yelled back, “It’s Marcel, the football player!” So Leah once again exited the shower with a towel and opened the door.

“Great news, Leah!” Marcel said, “My team won today’s game!”

“Well, congrats to you!” Leah replied. “But as you can see, I’m kind of busy at the moment. Gotta go!” She then shut the door and raced back into the shower.

As Leah began washing her hair, she thought to herself: Wow. So much good news in one day — incredible! Just then, she heard the doorbell ring yet again. Exasperated, Leah once again yelled out, “Who is it?”

This time the person behind the door yelled back, “It’s your neighbor, Eddie!”

As you might expect, Leah thought about sending Eddie away but, because he was blind, she decided to exit the shower one more time — this time without the towel, for obvious reasons. Leah then opened the door and, sure enough, there was Eddie, full of excitement. “Hi, Eddie!” Leah said. “What’s happening?”

“Great news!” Eddie said. Then he stood silent for several seconds.

“Well?” Leah said, “What is it?”

Eddie replied, “I can see now!”

(h/t: Sam I Am)

Squirrel Cam

We caught Ricky doing a little dance earlier this week as he enjoyed his breakfast …

.

Buy Me a Coffee? Thank You!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X.

3. Become a fan of Len Penzo dot Com on Facebook too!And last, but not least …

4. Please support this website by clicking on my sponsors’ ads! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Gina wasn’t too happy after reading my article explaining how to know when it’s better to buy or rent a home:

We just bought a new house. After running the P/R test you (suggested), it looks like we should have kept renting. I’m so confused!

Hey, Gina! You’re supposed to do the test before you buy.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: public domain

A few of those speakeasy passwords look very familiar to me.

You talking about the hamster one?

I’m not going to tell you that. That would be poor security practice.

OK. Yes.

Why did I know that, Cowpoke?

Hi Len,

Thanks for another tasty cuppa!

Those Mark Dice videos do a good job of showing how unloved precious metals are. Almost everyone I know thinks money are the dollars in their purse or wallet. It doesn’t even dawn on them just how wrong they really are!

Have a great weekend everybody!

Sara

Thanks, Sara! Yes, those videos are proof that our public school system has completely failed society; this is the most fundamental information there is to know. No child should graduate from high school who lacks a critical understanding about money – and it doesn’t have to be a year-long economics course either.

A high school history teacher could do this in a single week by simply covering historical instances of hyperinflation (late 18th century France; 20th century Weimar, Argentina, and Brazil; and 21st century Zimbabwe) and then delve into the causes and remedies. It’s not rocket science.

Finance reminds me of “musical chairs”…when the music stops you need a quick safe place…and then the music starts all over again, but this time it’s a different tune with the same result.

Good analogy, Mik!

How come I get vote on the survey? It says vote not allowed. Put me down for dogs and cats and fish

Dan, sometimes the voting algorithm blocks IP addresses that have multiple entries. The trouble is, many ISPs share a single IP address, so it can appear that a single person is submitting multiple votes, when they really aren’t. I cleared the blocked list, so your vote should work now.

Len Simpson, my siblings are suing you for unauthorized use of their names in the title of this article.

Ha ha … we must be related.