It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had an enjoyable week. Without further ado, let’s get right to this week’s commentary …

Courage is willingness to take the risk once you know the odds.

– Daniel Kahneman

Credits and Debits

Debit: Did you see this? A new consumer study has found that the average American spends nearly $1900 a year on subscriptions. Now for the punchline: The average American has so many subscriptions that they can’t keep up with them. So much so that they underestimated their monthly subscription spending by nearly $52 per month. (For those who averaged less than a C in math, that’s almost $624 per year.) Ouch. The good news is they can get some of that back with a little savvy shopping elsewhere …

h/t: Reddit (u/Not_a_Cardboard_Box)

Debit: In other news … a new study of more than 1500 adult American adults aged 18 to 40 who still live with their parents discovered that more than half (52%) actually receive a monthly allowance from parents. In fact, 31% of those adults admit to receiving a monthly allowance of more than $200. Even more astounding is that another similar study found that more than half of all adult kids are receiving a monthly allowance of $1500. Yikes. Fingers crossed that our adult kids don’t know about this. That being said, we suspect it’s probably too late…

Debit: We wonder how many of those parents who are still doling out an allowance to their adult kids are aware that, since February of this year, Americans born in the US have gained approximately 1.25 million jobs, while foreign-born workers have seen a net loss of nearly 200,000 jobs. This reverses a trend since 2021 of foreign-born workers gaining more jobs than US-born citizens. And on a related note …

Credit: Meanwhile, on Wall Street, stocks closed the end of the week on a down note after hostilities in the Middle East broke out; Friday’s losses were big enough to wipe out the major indices’ gains accrued through Thursday. For the week, the S&P 500 finished 0.4% lower, the Nasdaq shed 0.6%, and the Dow was down 1.3%. As for those of you looking for the perfect portfolio mix, well… Vanguard has turned the popular 60/40 stock-to-bonds ratio on its head:

h/t: demystifyingmarkets.com

Credit: Now over to Washington DC, where macro analyst Jessie Columbo points out that, “Since late 2023, the US M2 money supply has resumed its upward trajectory, expanding by $1.2 trillion. This renewed surge is one of the key drivers behind gold’s powerful bull market during that time. It also underscores a broader truth: the long-term direction of the money supply is relentlessly upward, with pullbacks being both rare and short-lived.” Yes; that’s extremely alarming. On the other hand, they’ve got to pay for all that government spending some how.

h/t: Jesse Columbo

Debit: Of course, there’s are costs for conjuring all of those “free” US dollars (USD) out of thin air. One of the biggest is the interest payments. And it’s only going to get worse from here as the federal debt is now firmly entrenched in the business portion of a very frightening exponential curve. The only saving grace is that the US government debt is “backed” by more than 8000 tons of gold to ensure global creditors’ continued faith in the currency – so it’s good for it. Or so they say …

(h/t: KingWorldNews)

Credit: Unfortunately, macro analyst Doug Casey points out that “the deficits are going to rise from $2 trillion to $3 trillion. And when the economy takes a downward turn, the government’s tax revenues will fall as its obligations rise.” Even worse, Mr. Casey says expects the US will have annual deficits approaching $6 trillion by the end of this decade. If he’s right, he says “bonds are in a world of trouble.” Frankly, we find it to be a complete mystery as to how the system has continued to function with even $1 trillion deficits – although maybe not as mysterious as this:

Credit: Speaking of deficits, Sprott market strategist Paul Wong reiterated this week that, “The foundation on which the USD has built its dominance as the world’s reserve currency for the last 80 years is shifting, undermined by America’s rising fiscal deficits and the current administration’s erratic trade policies.” Uh huh. Now you know why gold has surged from around $2100 to $3400 in a little more than a year – for those not counting at home, that’s a remarkable 62% gain. And if you think that’s impressive, then get a load of this:

Credit: What’s truly undeniable is the fact that even America’s allies are now quietly diversifying away from USD assets. In fact, in an interview last week the CEO of JP Morgan, Jamie Dimon, openly admitted that “a global restructuring” of the current debt-based USD-centric monetary system is well underway. Wait … what? You know… as little as several years ago, no businessman or mainstream economist wanting to be accused of wearing a tin foil hate would ever be caught making such a provocative comment like that – especially not in public. Then again, they wouldn’t have been caught making a statement like this either …

h/t: @leadlagreport

Credit: By the way, macro analyst Greg Mannarino astutely points out that when Mr. Dimon made his surprising statement, “he didn’t say ‘might have,’ or ‘may have,’ or ‘could have’ – he said ‘will have.’ Which is a polite way of saying: ‘We’re about to shut down the old system. The future is in place; now we just have to wait for the trigger.’ He’s admitting this debt-based system is done. It’s also a direct acknowledgment of the endgame and that they’re moving chess pieces into checkmate position.” Indeed. It’s a keen observation. Just don’t tell that to the always-optimistic fiat currency fans out there – despite the obviously long odds they now face. You know the type…

Credit: Maybe that’s why legislation was introduced in the House last week by Thomas Massie. The measure – dubbed the “Gold Reserve Transparency Act” – would create an audit of the gold held at Fort Knox, West Point, the Denver Mint and any other sites where America’s monetary metal is supposed to be stored. Unfortunately, the odds are good that his bill is dead-on-arrival. Even so, that shouldn’t be an excuse to avoid holding a little wealth insurance.

h/t: @duedilligenceguy

By the Numbers

Here are the states with the current highest life-expectancy (in years) at birth:

78.5 California

78.6 Vermont

78.7 New Hampshire

78.8 Rhode Island

79.0 Minnesota

79.2 New Jersey

79.3 Connecticut

79.4 New York

79.8 Massachusetts

80.9 Hawaii

Source: 2025 US Mortality Database via Wikipedia

The Question of the Week

Last Week’s Poll Result

Which of these ice cream treats have you had in the past year?

- Cone 35%

- Shake 23%

- Sundae 20%

- None 13%

- Banana split 9%

More than 1200 Len Penzo dot Com readers answered last week’s question and it turns out that slightly more than 6 in 7 of you have enjoyed an ice cream cone, shake, sundae and/or banana split in the past year. As for yours truly, you can put me down for all four of those specialties. Yeah … I love ice cream. 🙂

If you have a question you’d like to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Modern Medicine

A woman went to the hospital and was seen by one of the new young doctors on the staff. After about four minutes in the examination room, the lady started screaming and ran down the corridor.

An older doctor who had been at the hospital for many years stopped her and asked what the problem was; so she told him her story.

After listening intently, the veteran doctor escorted her to his office. “Please sit down and try to relax,” instructed the doctor. “I promise I’ll be back shortly.”

The older doctor then marched directly to the young doctor’s office and demanded, “Doctor! What’s the matter with you? Mrs. Terry is 63-years-old. She has four grown children and seven grandchildren — and you told her she was pregnant?”

The new doctor, who finishing up his notes on Mrs. Terry’s chart, said without looking up, “Does she still have the hiccups?”

(h/t: Cowpoke)

Squirrel Cam

This poor California ground squirrel was enjoying a nice peaceful breakfast. Then this happened …

.

Buy me a coffee? Thank you so much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top — and bottom — five states in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Washington (2.14 pages/visit)

2. Idaho (2.09)

3. Nevada (2.05)

4. Wyoming (2.00)

5. North Dakota (1.92)

46. New Hampshire (1.40)

47. Nebraska (1.38)

48. West Virginia (1.25)

49. Mississippi (1.14)

50. Montana (1.12)

Whether you happen to enjoy what you’re reading (like my friends in Washington) — or not (ahem, Montana …) — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X.

3. You can also friend me on Facebook too!

And last, but not least …

4. Please support this website by checking out my sponsors’ ads!

Thank you!!!! 😊

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading a Len Penzo dot Com oldie-but-goodie entitled, Your Big Fat Expensive Wedding: Stupid Is As Stupid Does, Ellis shared this:

There’s an old saying that politics is show business for ugly people.

Let me just say that, despite being eminently qualified, I have no intention of running for office.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Good morning Len, and happy Father’s Day weekend! Between the nation’s debt, the political theater on BOTH coasts and the Middle East situation, I think it’s time to stock up on coffee, chocolate and popcorn as we wait for the economy’s Main Event!

Meanwhile, I hope y’all are out of harm’s way in California’s latest “temper tantrums”, and wish you and all the other dads a GOOD weekend! 🙂

Hi Lauren! Thank you for the Father’s Day wishes. Same to your hubby!

As for those temper tantrums, I in a part of SoCal where the closest supposed tantrum is more than 15 miles from where I live. But I’m staying home anyway – no need to get caught up in any craziness if I don’t have to!

Interesting that the highest life expectancy states are all coastal blues. hmmmm.

Challenging times…to say the least. Economic and personal finance habits including preps are more important every day. Best of luck to readers.

I’ll trade a couple of extra years at the tail end of life for 76 years of freedom any day of the week.

We do live in interesting times, Paul!

That dog is amazing! I like his name too. Monkey. Ha!

I’m so glad you like it, Susan … I enjoyed that video too! Big props to Monkey’s trainer … that dog only learned how to do all of those tricks because his trainer put in a lot of time with that dog.

Hi Len,

Thanks for the cuppa!

I have to say, I’m in minority when it comes to loving winter. Maybe more people need to live in the sun belt.

And I agree, Susan. Love the dog!

Have a great weekend everybody!

Sara

Hi Sara. I know what you mean. However, I live in the sun belt and I prefer spring … winter tends to have far more wind and rain. (Summer is my last choice.)

The moment the first blip went past the squirrel I knew it was a Mockingbird. Squirrels will eat the bird’s eggs.

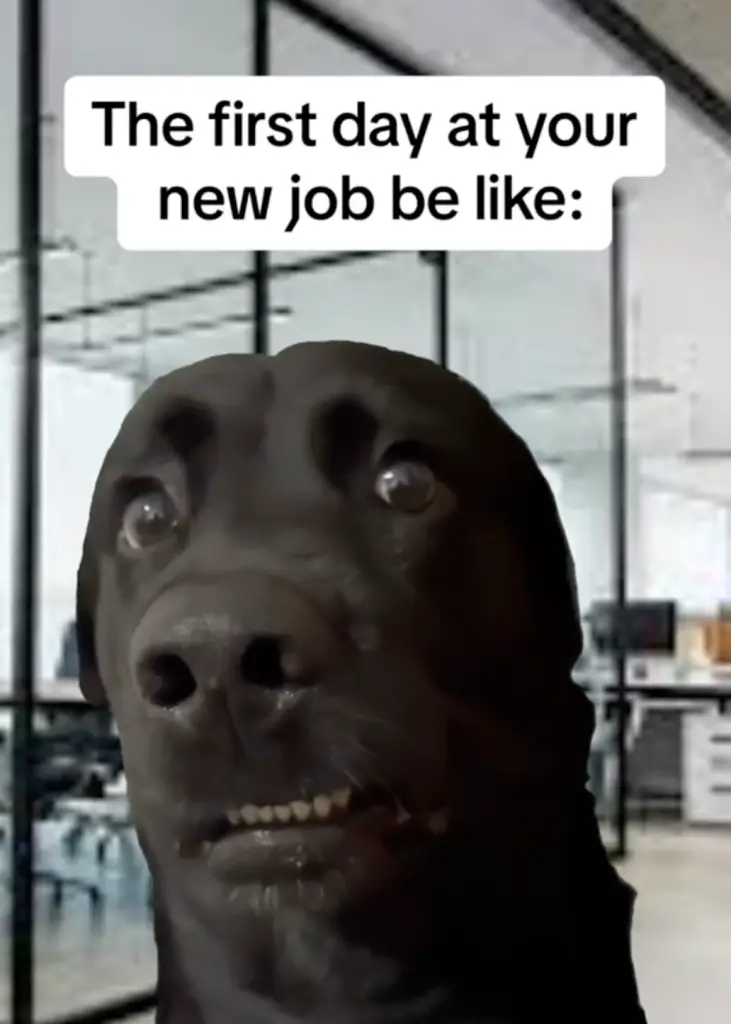

The photo of the labrador first day at the new job was my reaction for 15 years. Then, I became the GOAT. Every day was SOS DD!

I need caffeine. My brain said “After the woman had been in the exam room 5 years…”. Sometimes, it feels like that.

A mockingbird! So that’s what it’s called! Thanks for that, Bill. That makes you an expert on birds and fruitcake! 🙂

Don’t put a fruitcake out Len. Mockingbirds are too smart to eat it. They’re small but fierce fighters. The males are beautiful singers. They must be Irish.