Your credit score is one of the most important factors that determine your financial future. It affects everything from getting a loan for a new car to renting an apartment or even landing a job. But improving your credit score isn’t just about paying off debt; it’s a more personal and strategic process that depends on your unique financial situation. The steps you take to improve your credit score can vary, but understanding the key factors that influence your score can help you take control of your credit profile.

For some, taking out a debt consolidation loan is a helpful first step toward simplifying finances and boosting credit. However, there’s more to the picture than just consolidating debt. Let’s break down the key factors that affect your credit score and explore some actionable steps you can take to improve it.

Understanding Your Credit Score

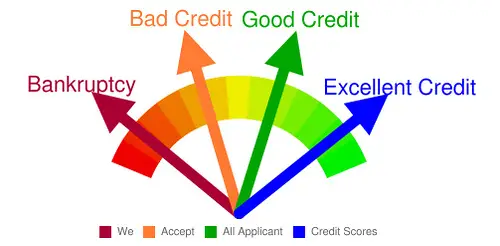

Before diving into strategies to improve your credit score, it’s important to understand how your score is calculated. Credit scores typically range from 300 to 850, with higher scores representing better creditworthiness. Lenders look at your credit score to evaluate the likelihood that you’ll repay borrowed money.

There are five main factors that influence your credit score:

- Payment History (35%): This is the most important factor. It includes whether you pay your bills on time and if you have any late payments, bankruptcies, or collections.

- Amounts Owed (30%): This factor looks at how much debt you have compared to your available credit, commonly known as your credit utilization ratio.

- Length of Credit History (15%): The longer you’ve had credit accounts, the better. This shows lenders you have experience managing debt.

- Credit Mix (10%): This refers to the variety of credit types you have, such as credit cards, loans, and mortgages.

- New Credit (10%): Opening new credit accounts can lower your score temporarily, especially if you apply for multiple accounts in a short period.

With these factors in mind, it becomes clear that improving your credit score is not about making one simple change. It’s about taking a comprehensive approach to manage all aspects of your credit profile.

Start by Addressing High-Interest Debt

One of the quickest ways to improve your credit score is by addressing any high-interest debt you might have. Credit cards with high balances and high-interest rates can be major roadblocks to a better score. High credit utilization – meaning you’re using a large percentage of your available credit – can significantly hurt your credit score.

If you find yourself in this situation, a debt consolidation loan could help. With a debt consolidation loan, you combine multiple debts into one single loan, often at a lower interest rate. This can make it easier to manage your payments and pay down debt faster, while also lowering your overall credit utilization ratio. Lowering your debt-to-credit ratio can have a positive impact on your score, as it shows you’re responsible with the credit you have.

Focus on Paying Bills on Time

It’s no surprise that your payment history is the most influential factor when it comes to your credit score. Missing payments, even by a few days, can cause a significant drop in your score. If you’ve missed any payments in the past, it’s important to get back on track and make sure your bills are paid on time moving forward.

Setting up reminders for payment dates or automating payments is a great way to ensure you never miss a due date. You can even set up automatic payments through your bank to take care of recurring bills like credit card payments, loans, and utility bills. Over time, making on-time payments consistently will have a positive impact on your credit score.

Don’t Open Too Many New Credit Accounts

While it might seem like a good idea to open new credit accounts to increase your credit mix, doing so can actually lower your credit score temporarily. Every time you apply for a new credit card or loan, the lender does a “hard inquiry” on your credit report. Multiple hard inquiries in a short time can hurt your score because it suggests that you may be in financial distress and are seeking a lot of credit at once.

If you’re trying to improve your score, avoid opening unnecessary new credit accounts. Instead, focus on the accounts you already have. If you must open a new account, try to space out your applications over time, so you don’t get too many inquiries at once.

Work on Reducing Credit Utilization

Another crucial factor in improving your score is reducing your credit utilization ratio. This is the percentage of your total available credit that you’re currently using. For example, if you have a credit card with a limit of $1,000 and you owe $500, your credit utilization is 50%. Most experts recommend keeping your credit utilization below 30%, and ideally under 10% if you want to maximize your score.

You can lower your credit utilization by paying down existing debt, requesting a credit limit increase from your credit card issuer (without increasing your spending), or moving balances to loans with lower interest rates. Keeping your credit card balances low relative to your limits demonstrates that you’re not overly reliant on credit, which is a good sign for lenders.

Review Your Credit Report Regularly

It’s always a good idea to review your credit report regularly to ensure all the information is accurate. Mistakes on your credit report, like incorrect accounts or outdated information, can hurt your score. Fortunately, you’re entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year.

By regularly reviewing your credit report, you can catch any errors early and dispute them with the credit bureaus. This simple step can help maintain the accuracy of your credit profile and ensure that your score reflects your true financial behavior.

Patience and Consistency Are Key

Improving your credit score is not an overnight process, but with consistent effort, it’s absolutely achievable. Depending on your current financial situation, it may take several months or even years to see significant improvement. The key is to stay patient and continue making positive changes to your credit habits.

By paying off high-interest debt, making on-time payments, reducing your credit utilization, and managing new credit wisely, you can steadily improve your credit score. It’s also essential to stay proactive about monitoring your credit report and making adjustments when necessary.

Conclusion: Take Control of Your Credit

Your credit score is one of the most powerful tools you have when it comes to managing your finances. The steps you take to improve your credit score should be tailored to your unique financial profile. Whether it’s consolidating your debts to lower your interest rates, reducing your credit utilization, or simply staying on top of payments, the changes you make will pay off in the long run.

Photo Credit: i am real estate photographer

Question of the Week