In order to talk about what is considered when calculating your credit score you need to first understand what shows up in your credit report. Your credit report is a history of how you have used or abused your credit. This report is created by one of three primary credit-reporting agencies: TransUnion, Equifax, and Experian. As a result, you actually have three reports and, subsequently, three credit scores.

In order to talk about what is considered when calculating your credit score you need to first understand what shows up in your credit report. Your credit report is a history of how you have used or abused your credit. This report is created by one of three primary credit-reporting agencies: TransUnion, Equifax, and Experian. As a result, you actually have three reports and, subsequently, three credit scores.

What is my Credit Report?

Your credit report contains multiple types of information. The first is information that’s used to identify you, such as your name, birthday, employment history and addresses — past and present.

Your report also shows your credit accounts. Every time you set up an account, the lender reports on the type of account you opened, when you opened it, what limit they placed on the line of credit, your history of payments and the balance that you still owe.

There will also be information regarding whether or not you pay in a timely manner. For example, credit card payments that are a couple of days late will typically not show up on a credit report. However, credit card issuers will report payments that are a month late and this entry negatively affects the calculation of your credit score.

Every time you apply for a loan, apply to rent an apartment, or do anything else that involves using your credit, the person you are doing business with may request your credit report and credit score. Your credit report also contains information about who requested information regarding your credit within the last two years.

There will also be information about people who requested your credit report even though you never initiated any business with them. However, this is considered an involuntary inquiry and, therefore, doesn’t affect your credit score.

Finally, the report contains information regarding attempted collections and public record information, including bankruptcies, garnishments, judgments against you, liens, lawsuits, and foreclosures.

What is my Credit Score?

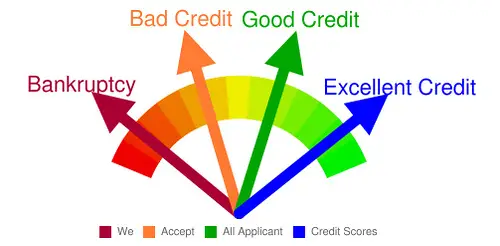

Your credit score is, in essence, an assessment of how risky it is for a lending institution to do business with you. Scores can range from 300 (the worst score) to 850 (the best). Low credit scores indicate a high credit risk, which makes it more likely that lenders will deny your application. High scores indicate that you’re likely to pay back a loan; as a result, lenders are willing to loan more money at a lower interest rate. You can get your credit score for free on the web from sites like Credit Sesame and Credit Karma.

Your credit score is called your FICO score. FICO is shorthand for the name of the company that invented the software that calculates credit scores: Fair Isaac Corporation. The FICO software makes these calculations using proprietary algorithms that, in general, compares everyone’s credit reports and then scores them.

Although all three credit reporting agencies use the same FICO software, they may be getting different information about your credit history — that’s why you’ll most likely have slightly different credit scores from each agency. If there is a drastic difference between the three scores, then there’s probably a reporting error. This is why it’s so important to keep track of all three of your credit scores.

What Information is used in the FICO Calculation?

FICO software uses multiple pieces of information from your credit report to calculate your score in the following manner:

History of payment (35%). This is information regarding whether or not you make payments on time, and if you have made late payments, how late they were. This part of the calculation also takes into account public record information regarding whether there are judgments, liens, collections, foreclosures, etc.

Available credit (30%). This piece of the puzzle considers how much money you owe in total, as well as how much money you owe on each individual account. It will also be relevant whether you have a balance on any of your accounts. For example, if you have a small balance on some of your accounts it can be seen as a good thing because it means that you use credit but are responsible with it. This portion of the calculation also considers the overall ratio of your total credit limit versus the total balance you owe. While it’s good to have a small balance with a lot of available credit, it’s not so good if you have a lot of credit and you’re using all of it. This makes you a higher risk because if you get into financial distress you’ll lack a credit cushion that could bail you out of trouble.

Overall credit history (15%). This is information regarding how long you’ve been using credit and how long to you keep credit accounts in general.

New credit (10%). If you have recently been obtaining a bunch of credit it may look as if you are in trouble and trying to climb out of a hole by using credit.

Forms of credit (10%). The more varied the forms of credit you have and use responsibly, the more favorable for your credit score.

Your credit score can have a major impact on your life. And knowing how it’s calculated and what’s in it can help you improve your credit score and make informed decisions regarding your credit.

Photo Credit: i am real estate photographer

This was very helpful, Len. Thank you.

You’re very welcome, Penny!

It’s ironic how high my credit score is when I haven’t borrowed anything in twenty years. No house payment, car payments and never in our entire lives have we ever carried debt on a credit card over from a prior month. But I suppose the $6,000 we charge on credit cards each month and pay off each month is enough to keep our score at 830. It’s the most useless number I track because we simply don’t borrow money. Great explanation of how it is arrived at though, one advantage of being an old coot is that you have years of great credit history.

Keep up the good work Len. Great explanation of how the credit score is figured.

It is kind of arbitrary in some aspects. My credit score was 819. They told me it wasn’t higher because I hadn’t had an installment loan in many years.

Transunion has its own score that isn’t your FICO score. They dropped me to 799 because I didn’t have a mortgage or HELOC. Insane but true.

I’ll just stay debt free, and let the number crunchers do what they want.

The wife loves to check her score at least two or three times a year. Last year it briefly dropped below 800 and that chapped her hide pretty good, although I keep telling her that 740 is the threshold for excellent credit, and that lenders give nothing extra for any score above that number — so somebody with a score of exactly 740 is going to get the same great interest rates offered to them as the person with a perfect score of 850.

Credit Scores are not totally meaningful or even tell an accurate tale. Last year I paid off my house mortgage and my credit score dropped the next month from 825 to 807. Nothing else had changed.

Transunion keeps hitting me because I don’t have a mortgage, and my credit card limits total under $20k. Yes, less than $20,000 is not good enough for them.

My Experian score is 840. I think they give a more accurate score than Transunion.

The biggest benefit for me is my insurance companies consider me a better risk, and charge me lower rates.