Today at work I was a bit distracted. This was entirely due to my anticipation regarding my earlier promise to finish this four-part series with a quick summary of my net worth. I hope most of you can forgive me; it’s just that I feel like the lead actor in the latest Judd Apatow movie. 😉

Those of you who have seen Forgetting Sarah Marshall or a few of Mr. Apatow’s other movies know what I am talking about here. For those who haven’t, quite simply, I was rather apprehensive today about doing my financial blogger nude scene, so to speak. But after some last-minute moral support from the Honeybee and a couple of other bloggers I have come to terms with it. So let’s get it on. Lights, camera, action!

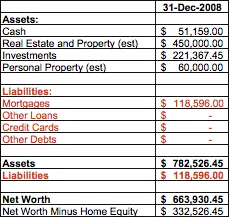

Well, there it is for all the world to see. My net worth, that is. As of 31 December 2008 my net worth was approximately $660,000. As you can see I estimated our household personal property, which includes things like our two cars, furnishings, jewelry, and collections. I also estimated the value of our home at the time. I know this number is very close because we are currently refinancing and I just had the house appraised. The appraisal came back at $440,000.

Our investments are in good shape as I managed to foresee the financial meltdown coming. At the end of 2007, I pulled all of our investments out of stocks and placed them into a safe haven, avoiding the big losses that occurred in late summer and early fall of 2008. We still lost about 5% on the year, because I chose to start putting some of our money back into the market in November after the bulk of the market carnage was over. Still, as you can see, the bear is still out there.

On the liabilities side, we have no loans, credit card debt or any other obligations other than the mortgage. As the household CEO, I choose to track both our total net worth as well as net worth minus home equity. I do this as a simple reminder to myself that our house is not to be considered a piggy bank that can be tapped whenever we have an urge to scratch an itch.

Well, that’s it. My scene is over. I hope I did alright.

Now, will somebody please hand me my robe? 🙂

If you liked this article, please be sure to subscribe to my RSS feed.

Like I said we have around $92k in cash equivalents and $141k in home equity. Not good. If the market hadn’t tanked we were on track for $100k+. To put into perspective we are 29 and 31 and we were not able to save in retirement accounts until 2005 really 2006 due to circumstances (ie visa and job).

Preferentially, I am not sure if my SMART goals will be accomplished by the time I hit 40. But we’ll see. I believe that we might be able to depending a on few lucky breaks including moving back to the west coast.

LAL,

I think you are doing a great job! Congratulations on doing so well so early in life! 🙂

Len