It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Can you believe Thanksgiving is almost here? Wow! Where did this year go?

“Inflation is taxation without legislation.”

— Milton Friedman

“The last duty of a central banker is to tell the public the truth.”

— Alan Blinder, former Fed Vice-Chairman

Credits and Debits

Credit: Don’t look now, but John Hussman is warning of a very significant convergence of the ‘Hindenberg Omen’ and the ‘Titanic Syndrome.’ I know. But that’s the first time that’s happened since July 2007, which is very close to the last time the markets topped. Uh oh. On second thought, it’s probably nothing. Again.

Debit: Did you see this? For the first time since 2012, real average hourly earnings have declined for three straight months, dragging the year-over-year growth in real earnings down to just 0.4% — that’s the weakest growth since April. Then again, for most Americans, real wages — and the purchasing power it represents — have been flat for nearly 50 years.

Debit: In fact, stagnant real wages is one reason why the average American worker must now work more than 111 hours to earn enough cash to purchase an equivalent quantity of S&P 500 stocks. That is the highest level ever.

Debit: In other news, I see that hyperinflation has returned to Zimbabwe. Supermarket prices have skyrocketed by as much as 150% during the last two months alone. Not surprisingly, the Zimbabwe central bank is blaming the price hikes on “greedy” retailers. In reality, hyperinflation is always the result of a greedy government printing funny money to live far beyond its means. Imagine that.

Debit: Then again, signs of hyperinflation are everywhere. At least a strong case can be made when a daVinci painting sells for half a billion dollars, as it did this week — even though some scholars doubt the work’s authenticity. No, really.

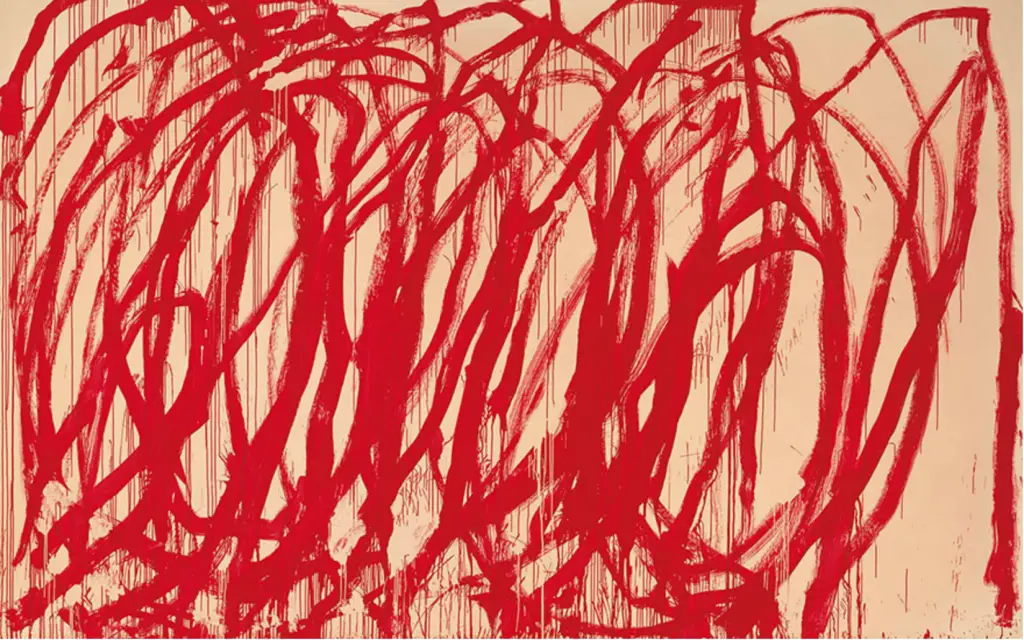

Credit: With that in mind, how much would you pay for this painting by Cy Twombly that was sold at Christie’s auction house on November 15th?

Debit: If you said you’d be willing to sacrifice $45 million of your hard-earned money for that particular piece of, um … “art,” then you would have been more than a million dollars under the winning bid. Yep. The world has lost its collective marbles, folks. And if that doesn’t convince you that the US dollar is a mere shadow of its former “almighty” self, then I don’t know what will.

Debit: On the other hand, most people know how to get a lot more bang for their bucks than the schmo who threw away $45 million on a canvas that looks like it was painted by a toddler. Take the Florida woman who was charged with fraud after she walked into a Walmart and bought $1800 worth of electronics for $3.70 by allegedly replacing the bar codes with other clearance item price tags. (h/t: Tom Draper)

Credit: Then again, that kind of chicanery is nothing compared to the stuff happening at Christie’s. Don’t ya think?

Debit: Speaking of scams, Simon Black observed this week that the American pension fund Ponzi scheme is currently 113 times larger than Bernie Madoff’s financial con job — and growing every day. That’s pretty scary when you consider that Madoff bilked investors out of $65 billion. (Yes, the reader is expected to solve this particular math problem on their own. Go ahead; it’s worth the effort.)

Debit: Of course, when it comes to Ponzi schemes, nothing compares to the dollar-based international monetary system. And there’s a good chance that the coming financial avalanche, which is also growing larger with each passing day, will eventually be the trigger that results in the implosion of the world’s major fiat currencies. If not all of them.

By the Numbers

Thanksgiving is America’s second favorite holiday. Here are some numbers to know about turkey day:

1621 The year of the first Thanksgiving, a three-day feast.

46,000,000 The estimated number of turkeys killed annually for Thanksgiving.

5 The number of days required to thaw a frozen 16-pound turkey in the refrigerator.

4500 Calories the average American will consume at a traditional Thanksgiving feast.

229 Grams of fat the average American will consume on Thanksgiving.

$4,450,000,000 The amount of money spent online during Thanksgiving weekend last year.

Source: USA Today

The Question of the Week

[poll id="189"]

Last Week’s Poll Result

Do you have insurance for your cell phone(s)?

- No (89%)

- Yes (11%)

More than 1100 people answered this week’s survey question and it turns out that just 1 in 9 Len Penzo dot Com readers say they have insurance for their cell phones. Unless you have younger kids who are more likely to be careless with their phones, I think you’re better off foregoing the insurance. Apparently, most of you agree.

Useless News

The good folks over at CashFind.com put together a nifty post with lots of tips on how to get rid of credit card debt quickly — and I was one of their featured “experts.” If you get a chance, stop on by and check it out.

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Alberta (2.23 pages/visit)

2. Saskatchewan (1.91)

3. New Brunswick (1.86)

4. Manitoba (1.78)

5. Newfoundland and Labrador (1.51)

9. Quebec (1.40)

10. Yukon Territory (1.33)

11. Nova Scotia (1.28)

12. Northwest Territories (1.25)

13. Nunavut (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Alberta, eh) — or not (ahem, you hosers living on the frozen Nunavut tundra) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

After reading my article explaining why Southern California’s famous In ‘N Out Burger chain isn’t as good as it used to be, MRB left this lamentation:

In & Out’s quality has gone down since the owner died. I will never go back. Everything from smaller fries and meat patties to poor service. Total disappointment from the old days when quialty (sic) mattered.

Oh, the irony.

I’m Len Penzo and I approved this message.

Photo Credit: (coffee) brendan-c

That painting! I bet the “artist” is having a good laugh about that one. Just proves that not all people who are filthy rich have brains.

The fact that someone would spend so much money on something that anybody could duplicate in a few minutes is absolutely surreal, Kathy.

Hi Len! I think a case can be made for a daVinci painting selling for millions of dollars. But how in the world does that scribble job sell for $45+ million, let alone $4500!

Sara

I think it goes back to my premise that there are simply too many dollars floating around the world today. This simply shines a light on the fact that there are far more dollars in the world than there are real goods and services available to purchase. It’s the reason there is price inflation almost everywhere you look.

The emperor (i.e. the Almighty US Dollar) has no clothes. Until enough people wake up and acknowledge that obvious truth, this charade will continue.

Sara, As soon as the ink dried on the check for the 45 million dollar “daVinci” painting, every art expert in old master paintings crawled out of the woodwork mentioning that the portrait was most likely done by an assistant and also over painted a bunch of times, that there was nothing original left of the artwork, that it was a “joke” daVinci. The painting sold not too long ago for ten thousand dollars at an estate sale and the sellers were thrilled to get that much for the fake daVinci. Seems like there is too much money floating around these days chasing too few things of real value.

I did the math and the answer is $7.345 trillion. That’s quite a large number.

ps – do I get a prize?

No.

Thanks to fiat money and the current system, my goal of retiring at 60 or 65 with a fat nest egg is a dream. Almost everybody still buys into that dream, which is why your blog Len is the ONLY one I know of that doesn’t peddle the myth of long term saving in dollars. I am preparing myself for this eventuality and am hopeful that gold and silver will be my saving grace.

Opps. To clarify, yours is the only PERSONAL FINANCE blog I know of that doesn’t peddle the myth!

I knew what you meant, Steve. Thank you for the comment.

Im afraid the many followers of Dave Ramsey are going to be greatly disappointed! Dave is a lover of saving in the almighty Dollar and detest precious metals. He seems like a nice guy that means well, but in reality he is destroying millions:(

Ramsey knows how to manage household finances, understands the secret to personal finance management is spending less than you earn, and has some good (and not so good) ideas on how to extricate oneself from a large amount of credit card and other bad debt — but he is utterly clueless on macroeconomics. And that makes him dangerous because so many people take his advice on precious metals as the gospel truth.

Hyperinflation can always be staved off by revaluing gold. Such a move could be done over the weekend to put budgets back in place. FDR revalued gold in 1933 and it went up about 75%. Today it will take a much bigger revaluation which could end up with gold selling for 5 times or more what it does today.

Agreed. Of course, revaluing gold also devalues the dollar by a corresponding amount — so the end result is essentially the same: an equivalent loss of purchasing power for those stuck holding dollars in the bank, and other dollar-based paper assets.

FDR revalued gold in 1933 after confiscating it from citizens.

It doesn’t do anything for inflation unless most of your savings are in gold. The folks in paper dollars are still having to use a lot more of their paper to buy anything.

As Jared noted above, the conventional financial advisor is telling folks “start early, take advantage of compound interest, and you’ll have a million bucks at retirement”. While even very few have followed that advice (if published statistics on retirement savings are true), the ones that do go down that road are bound to be disappointed if they reach that goal and find that bread, for example, is then $50/loaf.

Given the govt/private debt now in place, and the un-funded liabilities of future promises, massive inflation is the ONLY option out, short of complete monetary collapse. People saving in any vehicle that does not index itself to that inflation will be destroyed financially…..there are countless examples of this throughout the history of paper money.

Gold and silver are highly manipulated in price right now, to the downside. Folks wishing to save for the long term ought to take advantage of that and stack up ounces. At some point, when demand for physical metals can not be met, the manipulation via paper metals will end, and those with lots of stacked ounces will hopefully at least stay even in purchasing power.

Yep. Inflation is the least painful and quickest way out of this mess — which is why the Fed and other central banks are so desperate for it. There are other options, but they are politically or economically infeasible:

1. A drastic (say, 50%) long-term reduction in federal spending for many years

2. A huge increase in taxation (which would kill the economy and ultimately not result in any additional revenue for the government anyway; as the Laffer curve proves)

The debt will be paid; it always is. But it will be at the expense of the dollar and other fiat currencies, which will become worthless. History tells us that every previous fiat currency ever created has ultimately returned to its intrinsic value: zero.

Sara, re valuation of art, see comments after:

https://lenpenzo.com/blog/id1400-art-investment-tips-to-buy-fine-art.html

IMO, the answer to your question “How in the world (etc)”, is because some fashionable “expert(s)” praised the artist for awhile.

The literati and the intelligentsia feed off each other within their own kens. Common sense need not apply.

Good point, Dave. (And thanks for relinking to that recent article I published by art dealer Gayle Tate on tips for buying fine art. I had already forgot about that one!)

To add to your comment regarding how expensive the S&P is right now, Bob Hoye who is a market historian that I follow, says that in 2007 at the market peak it took the average worker 80 hours to buy one unit of the S&P. At the bear market low in 1982, it took 4 hours and we are up to 111 now. He thinks this is the best way to gauge how expensive the market is.

I agree with Mr. Hoye, Jack. Thank you for sharing that.

“Debit: Of course, when it comes to Ponzi schemes, nothing compares to the dollar-based international monetary system.” -Len Penzo

“Insanity Cubed: Keith Noreika, the acting head of the Office of the Comptroller of the Currency (OCC), the Federal agency responsible for supervising national banks and inspecting them for safety and soundness. Suggests Merging Taxpayer-Backed Banks With Corporate Conglomerates” –

https://riggedgame.blog/2017/11/14/insanity-cubed-trump-official-suggests-merging-taxpayer-backed-banks-with-corporate-conglomerates/#comments

As the world moved away from gold-based currency (body blows delivered along the way by FDR and Nixon) the collapse of the fiat currency-based financial system became inevitable. It has always been just a matter of when. Currency valuation had fallen into corruptible human hands.

If two of the elites financial power bases join forces, it will just hasten the day when common folks have been driven far enough down into penury to take to the streets and bring the edifice down.

I have no doubt that we will see the torches and pitchforks come out at some point down the road, Dave. When people see that 90% or more of everything they had saved for their entire lives has suddenly vanished, more than a few will be looking for retribution. Debt was the ultimate reason behind the birth of the French Revolution; it’s not out of the realm of possibility that a second American Revolution could be birthed from a collapse of the dollar.

Len, I think that along with fiat currency collapse, will come the realization that most of the world’s precious metal and other non-money assets is held by the elites.

Cy Twombly paintings will be scorned, but vast holdings in land for example, and hideaways in new Zealand, won’t be.

That will be the égalité portion of the impetus.

Jared, Dave Ramsey’s importance is how he teaches people to get out of debt. A person drowning in debt can’t invest in gold, or silver. He / she has no money! Following Dave Ramsey’s method can get a person debt free, and teach him / her how to stay that way. Dave does encourage home ownership, and saving. He has mentioned investments, and it’s up to his newly debt free followers to learn where to put their money. You need some cash in case the grid goes down. It’s comforting to have an emergency fund. After that you decide for yourself: a house with land to grow food, gold, silver, a combination, or whatever.