It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I was out of town and didn’t get back until late on Friday. As a result, I have a special jet lag edition for you this week. So please excuse the typos.

“Bubbles make believers of the unbelievers, make bears look like idiots, and the reckless look like geniuses.”

— Northman Trader

Credits and Debits

Credit: Don’t look now, but despite sky-high valuations, the stock markets continue to defy gravity. The S&P 500 and Nasdaq Composite both closed at record highs on Friday. In fact, the S&P ended in green figures for the seventh consecutive week — that’s its longest weekly win streak since 2014. Hooray!

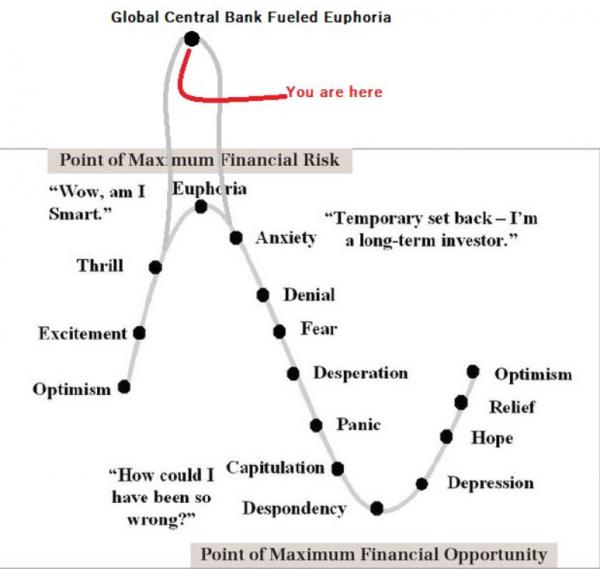

Credit: In case you’re wondering how euphoric stock, bond and housing investors are at the moment, please refer to the following chart, courtesy of Stalingrad & Poorski:

Credit: Meanwhile, financial analyst Albert Edwards points out that the US manufacturing index recently hit 60, which is an extremely rare event; in the past 30 years it’s happened three times. For what it’s worth, the index hit 60 in 1987 — right before Black Monday. Coincidence? Probably.

Credit: Investors don’t seem to be too worried about a market crash; after all, market volatility as measured by the VIX is at a multi-generational all-time low. Asset manager Christopher Cole suggests the record-low volatility is proof that the stock markets’ price discovery function is broken. He calls it, “A valuation illusion built on share buyback alchemy” — essentially, a snake eating itself.

Debit: Of course, that “valuation illusion” isn’t due solely to stock buybacks. The Fed has printed more than $4 trillion dollars to buy Treasury bonds and mortgage securities — driving down rates in the process, and enabling an unprecedented credit bubble that has fueled the rampant inflation in stocks, bonds and housing.

Credit: Curiously, despite all of the Fed bond-buying, this was the week that the world’s credit markets finally pierced a 36-year trend line on interest rates. We’ll see if this is a sign that the long bull market in bonds is finally over — or simply a false breakout. For now, I’m betting on the latter.

Credit: On the other hand, if the bond market bull is finally dead, we’re in for some interesting times ahead. As Bill Holter notes, the resulting “higher interest rates will act as a ‘reveal’ to who is solvent and who is not. This will morph into ‘everyone’ being insolvent, because higher rates will bankrupt sovereign treasuries and central banks.” In other words, when the tide goes out, we’ll all see who’s been swimming naked. Ew.

Debit: Uncle Sam is certainly skinny dipping in an ocean of red ink. The National Debt recently surpassed $21 trillion, in part due to the US running up a $666 billion deficit for the fiscal year that ended last month. And next year will be more of the same.

Debit: Needless to say, after more than five decades of unlimited credit issuance to governments that insist on living above their means, the world’s central banks are finally cornered: They can stop printing fiat currency and let stocks collapse — or they can keep the printing presses on hyperdrive, which will eventually unleash inflation, and hasten the inevitable popping of the bond bubble.

Credit: As Hugo Salinas Price sadly reminds us, “One highly important result of the monetary system we are forced to endure, has been the progressive moral deterioration of society in general.” Go ahead and scoff if you wish — but the man is absolutely correct.

Credit: It’s really quite simple. As Price notes, “Honesty prevails where real money — gold or silver — prevails. When nations make their living with (fiat currency), honesty weakens and vice flourishes, caused by the loss of reality that accompanies fake money that loses its value.” Fortunately, returning to a monetary system based upon precious metals will fix things faster than any politician ever could. Believe it … or not.

By the Numbers

The most popular Halloween costumes of 2017, based on search results from Google Trends:

1 Wonder Woman

2 Harley Quinn

3 A clown.

4 A unicorn.

5 A rabbit.

6 A witch.

7 A mouse.

8 A pirate.

9 A zombie.

10 A dinosaur.

Source: Fortune

The Question of the Week

[poll id="186"]

Last Week’s Poll Results

How many kids are you expecting this year for Halloween?

- Less than 25 (52%)

- 25 to 50 (21%)

- 51 to 100 (17%)

- More than 100 (10%)

More than 1100 people responded to last week’s question and it turns out that a slim majority of Len Penzo dot Com readers expect fewer than 25 little goblins for the coming Halloween. The number of trick-or-treaters in my neighborhood typical varies between 50 and 150. I’m always happy when the number is on the low side if only because it means more candy for me!

Other Useless News

Here are the top five articles viewed by my 16,222 RSS feed, weekly email subscribers, and other followers over the past 30 days (excluding Black Coffee posts):

- 4 Really Dumb Ways to Pay Down Your Debt

- The Pros and Cons of Freezing Your Credit Report: Is It Really Worth It?

- 18 Curious Facts You Didn’t Know About Hyperinflation

- 100 Famous Quotes About Debt

- 7 Tips to Help Ensure Your Bills Are Always Paid On-Time and In Full

Hey, while you’re here, please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my post explaining why expensive luxury cars don’t impress smart people, Rafael said:

“I wish people were half as enlightened as you.”

Thank you, Rafael … but if you listen to my detractors, they’ll say your wish would make most folks quarter-wits.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

One highly important result of the monetary system we are forced to endure, has been the progressive moral deterioration of society in general. Go ahead and scoff if you wish

SCOFF?

I thank God for those who share and defend our traditional morality.

Me too, Dave.

Len,

I know the economic/monetary system is all an illusion, but who says they cant keep this illusion going for decades longer? The sheep of the world are many and dont care as long as they continue to pray to their central bank gods! Until the sheep start caring about Real money (precious metals) Im afraid this will continue. What could possibly cause the central banks to lose control as long as they can create electronic money unabated?

Jared

Jared, the vast majority of people will not begin caring about real money until after our current fraudulant debt-based Ponzi-scheme-masquerading-as-a-monetary-system finally collapses. Of course, that will be too late to save whatever wealth they accumulated during their lifetime up to that point.

To answer your question: The central banks will lose control when enough people lose confidence in the dollar. The unknown factor is how many is “enough”? Keep in mind, it could be a very small number. If only a few individuals running various nations insist on receiving gold for their exports, rather than dollars, or future dollars (via Treasuries), that would do the trick. As would the leader of Saudi Arabia agreeing to accept payment for oil in something other than US dollars.

The current stock/bond/housing markets are in the euphoria phase on that diagram you posted. You should also point out that the gold and silver markets are in the despondency section.

Clarification: speculators who buy precious metals for a quick profit, rather than as wealth insurance, may be in the despondency area. That being said, I think they are more likely in the “depression” zone, as the multi-year downtrend in precious metals seems to have bottomed out in December 2015.

The rest of us who buy PMs for insurance sleep well regardless of how much fiat it takes on a daily basis to buy a troy ounce!

Len, I’m with Jared. I’m beginning to think the central bankers grip on the markets is so tight that they will never go down. Glad you got back from your trip safe and sound!

Sara

It’s always darkest right before the dawn, Sara.

That more and more people feel as you and Jared do is actually a promising sign that the central bankers’ grip on the system may be coming to an end sooner than you think.

Who says you can’t solve too much indebtedness by borrowing more and more and more? I think you can as long as the public is willing to accept zero or negative interest rates. But is that sustainable?

No, it is not sustainable, Kenny. In the end, mathematic reality will prevail.

I’d agree…..you can’t outrun math in the end…..but it may take a while for the fight to end.

The trick the FED/Treasury has been using since 2008 is the FED has printed (digitized) up to 50% of the ‘money’ needed to fund federal spending and managed to keep interest rates low on it by doing so since they were the largest buyer.

But the US Treasury issued actual debt to the FED, and anyone else along the way willing to buy it. 9 years ago today, the federal debt was 10.5 trillion bucks….today, it’s 20.45 trillion, 650 billion (0.65t) in the last year, a year of supposed good economy, low unemployment, blah, blah, blah.

Let’s assume we don’t have a recession for the next 20 years (which would blow all historical norms to pieces), nor major war spending (seems hardly likely given the saber rattling going on all over the globe), find a replacement for dwindling supplies of oil, find a solution for the impact of massive amounts needed to payout to retiring Boomers, and so on…..in other words, one miracle after another….and the debt only increases the amount of this past year for the next 20.

We should be somewhere in the 33 trillion debt range….best case. Based on the last 9 years growth, it looks like more like doubling twice, or near 80 trillion. Split the difference and call it around 50 trillion.

Total federal tax income 2015 ran around 3.5 trillion. Assume interest rates averaged 3.5% on 20 trillion in debt, interest payments consumed 700 billion of the 3, 500 (3.5t) income….about 20%.

If the same conditions hold for the next 20 years, 3.5% of 50trillion is 1.75 trillion……50% of current federal income.

SO, either inflation is going to have to increase quite a bit to overcome this (the traditional game plan), or tax revenue is going to have to increase quite a bit (seems unlikely w/o inflation) or there is going to be a lot less federal money to spend since so much is going just to service the debt.

At some point, the math catches up.

Good summary, Andy. That pie-in-the-sky best-case “rosy” scenario you pointed out is precisely why I am confident that a currency crisis is coming down the pike — and I’ll be amazed if it doesn’t get here by the end of this decade, if not shortly thereafter.

Len,

I grew up in the 50s and 60s and one of the top tv shows was “The Fugitive.” Barry Morse, who played the relentless police detective, later in life offered the following quote which I have always thought was so wise and insightful. “The world is full of people who think the purpose of life on this planet is the accumulation of green pieces of paper called ‘bucks’. They’re just mislead, you have to help them the best you can.”

That’s a little before my time, Jack — but not by much!

I like the quote!

Who or what is a Harley Quinn?

Apparently, she is a comic book villain. Until I saw the Google costume rankings, I had never heard of her either.

Wilson, she’s a character that started on the 90s cartoon “Batman : the Animated Series” as the Joker’s Off-and-on girlfriend/minion. She became so popular that she was incorporated into the Batman comics but evolved into an anti-hero, similar to DeadPool.

She was one of the main characters in the live-action 2016 movie “Suicide Squad.”

Hope this helps!

“This will morph into everyone being insolvent, because higher rates will bankrupt sovereign treasuries and central banks.”

Can a central bank truly go bankrupt when it prints its own money?

Technically it can’t go bankrupt for the reason you mention. But if massive printing causes people to lose confidence in a central bank’s currency and refuse to accept it for payment, then for all intents and purposes, they most certainly are bankrupt!

re Halloween costumes: Has Grandfather ever got one for you!

Coming later …

Can’t wait to see it, Dave!

I agree that the markets are frothy, OK maybe beyond frothy at the moment, but I have to wonder how much upside you’ve missed given how long you’ve had a pessimistic outlook. If the markets fall 50%, would they still be ahead of your first call to fear the market?

That’s a fair question, Scott. I admit I have missed the opportunity to maximize the stock (and bond) market gains since I began reducing my exposure to those asset classes in late 2012; I’ve still been partially invested in stocks and bonds since then — gradually decreasing my exposure in favor of precious metals.

For what it’s worth … to pick one index, if the Dow fell 50% during the next bear market, then it would pull back somewhere in the neighborhood of 11,500 — which is where it was at the end of 2010. At the end of 2012, it was around 13,000.

I am not worried about the gains I’ve missed over that time; I am absolutely confident that my moves will ultimately leave me in a better position financially than if I had stayed 100% in the paper markets. My biggest fear is getting caught with my paper pants down in a fast-moving currency crisis that will leave me with no time to save my current wealth.

Frank question. Since we are always talking gloom and doom:

How are you protecting yourself from this imminent currency crash?

Please give me real breakdown that would help us …. % stocks, % bonds, % metals, % cash

It appears to me that anything less than 100% of assets in precious metals is not protecting yourself adequately. Do you have anything besides precious metals?

Kyron, you asked this question a few months ago. I answered it here: https://lenpenzo.com/blog/id43015-black-coffee-27-may-2017.html

The allocation hasn’t changed much since then. And I disagree with your assessment that anything less than 100% of assets in PMs is not protecting yourself adequately. In the event of a total meltdown, a portfolio with a significantly smaller exposure to precious metals will fully cover all paper losses.

Downside risk and quality of life separate from the price of my assets have always been uppermost in my mind as I appraise a possible financial move.

After I acquired a bitcoin wallet a few years ago, I demurred buying any bitcoins for it when their price jumped from $90 or so to $200 in a matter of hours. Too much downside risk, so I missed a huge run-up in price.

Am I sorry? No!

Over the last 60 years or so, all of my (ours, really – my wife and I) financial decisions now find me financially and emotionally secure in my old age.

I missed the speculation boat on bitcoin too, Dave. That being said, I am still not certain if bitcoin will survive a currency crisis, since it’s only means of valuation is via fiat currency.

China has recently announced plans to back their currency (the yuan) with gold for the oil trade. I think this is a huge development, starting the decline of the dollar as the reserve currency.

Thank you, Karen … I highlighted this very topic for my readers about a month ago.