It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

And away we go …

Credits and Debits

Debit: Uh oh. The S&P 500 has dropped nine days in a row — that’s its longest losing streak since December 1980. No, really. By the way, the stawk market is now down compared to a year ago, and unchanged since December 2014.

Debit: Uh oh. Again. It turns out that the US budget deficit was an astounding $1.4 trillion last year — not the $587 billion claimed by politicians as twisted proof that government spending was, somehow, under control. That’s $5000 of additional debt for every man, woman, and child in America. Yeah, like that’s sustainable.

Debit: Obviously, the US makes up the budget shortfall by simply printing what it needs. And that’s a big reason why prices in the US are skyrocketing — but only for the stuff you really need, like food, housing, healthcare and education. Hey … is this a great country or what?

Debit: And while new cars have dropped in price relative to inflation over the past 20 years, that hasn’t stopped consumers from buying cars they can’t afford. I say that because auto repos are soaring. In fact, repos are now at the third highest level in 20 years — and climbing. Beep beep!

Credit: One thing is certain: You can bet the current repo epidemic would never have happened if there were lenders willing to offer 96-month car loans. Oh wait …

Debit: Frankly, it’s all but certain that pensions will implode during the next financial downturn. For example, the California Public Employees’ Retirement System returned only 0.6% on its investments during the last fiscal year — which is far less than the 7.5% that Calpers needs to stay solvent. The good news is, I’m sure it’s nothing that nine or ten consecutive years of 40%+ returns can’t fix.

Credit: For their part, Dallas peace officers are worried about their police pension’s precarious pecuniary position — so much so that they’ve been retiring in droves recently and taking lump-sum payouts due to fears that future financial-market losses will soon expose their generous benefits as being too good to be true. (Psst. They are.)

Debit: On a somewhat related note, earlier this week Moody’s warned that Deutsche Bank (DB) was dangerously close to being in default. That wouldn’t be so bad if DB was a local savings and loan — but they’re one of the largest banks in the world. Never mind that they’re also sitting on a $47 trillion derivatives book.

Debit: Whether it’s DB or some other trigger, the powers-that-be are woefully unprepared for the next financial crisis. Why? Well, according to economist Jim Rickards, it’s because the crisis will come so quickly that they’re not going to be able to reliquefy the system fast enough.

Debit: Unfortunately, the central banks will eventually “solve” the liquidity problem by pumping more cash into the system. But therein lies the rub, as that additional liquidity will be the final nail in the coffin of the world’s fiat currencies, leading to the final destination that has become the fate of every fiat currency ever created: hyperinflation.

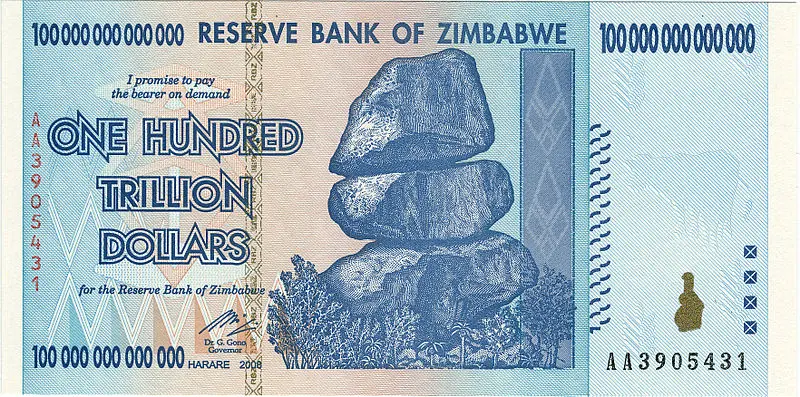

Debit: Of course, Zimbabwe knows all about hyperinflation; they suffered with it between 2006 and 2009 — and, if they’re not careful, they may be gearing up for round two. Apparently, the monetary officials there have already forgotten that it was just a few short years ago when this was required to purchase a bag of Hershey’s kisses in Zimbabwe:

Credit: Meanwhile, over in the People’s Socialist Paradise of VenezuelaTM, citizens have resorted to weighing their nearly-worthless cash for many daily transactions because prices are so high that it takes too long to count the bills. That’s what happens when the nation’s largest bill — 100 bolivars — has the purchasing power of a dime. Forward!

Debit: I know it’s hard to believe but, sadly, if the powers-that-be don’t reform the international monetary system soon, we’ll all discover what it’s like to walk in Venezuelans’ shoes. Yes, reform will be painful — especially for Americans — but it’s better than the alternative. And what’s truly infuriating is, with a little financial discipline, it didn’t have to be this way.

By the Numbers

In case you missed it, the Chicago Cubs just won their first World Series title since 1908. Needless to say, a lot has changed since then — especially with respect to prices:

$0.02 Cost of a Hershey candy bar in 1908.

$0.51 The cost of a 1908 Hershey candy bar in today’s dollars, after adjusting for inflation.

63 The value of the Dow Jones Industrial Index in 1908. (It’s currently hovering around 18,000.)

1 Number of today’s Dow components that were part of the index in 1908. (General Electric)

$3500 Salary of Cubs ace pitcher Mordecai “Three Finger” Brown in 1908. That’s $90,000 in today’s dollars.

$10,000,000 Current salary of the Cubs’ World Series MVP Ben Zobrist.

Source: CNN

Insider Notes: Why Getting Cash During the Next Crisis May Be Impossible

Hey! You need to be an Insider to view this section! If you’d like to join, please click “Insider Membership” at the top of my blog page.

Last Week’s Poll Results

How old were you when you first moved away from home?

- 18 (35%)

- 21 or older (25%)

- 19 (17%)

- 17 or younger (11%)

- 20 (11%)

More than 1200 Len Penzo dot Com readers responded to last week’s question. Not surprisingly, the winning plurality came from those who left home for the first time at age 18. Another 1 in 9 made up the adventurous group of independent souls who decided to leave the nest before becoming legal adults. As for me, I was 19 when I moved away for the first time — finally striking out on my own to attend college. After I graduated I moved back home for another year, before finally moving out for good and getting my own place.

The Question of the Week

[poll id="136"]

Other Useless News

Programming note: Unlike most blogs, I’m always open for the weekend here at Len Penzo dot Com. There’s a fresh new article waiting for you every Saturday afternoon. At least there should be. If not, somebody call 9-1-1.

Hey! If you happen to enjoy what you’re reading — or not — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Don’t forget to subscribe via email too! Thank you.

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider!

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Claire wrote in with this question:

I have $12,000 in credit card debt and $90,000 in school loans. I’m earning $37,000 a year. Any advice on the best way to erase these loans quickly?

Yes. Ask your boss for a really REALLY big raise.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Here is why those Deutsche Bank derivatives are a problem. Derivatives are considered assets by those who hold them. When you and I look at our assets, we see a number like a bank balance or a brokerage balance which lets us believe we have wealth in the form of money. Let’s say the total of what everyone believes they have is X.

The problem is that X is not even remotely related to actual wealth which is tangible stuff like real estate, productive businesses, and gold. Let’s say that the actual amount of real, tangible wealth is 1% of X (even though it’s probably much less than that).

If the system collapses, it means that that 1% of X is somehow divided up among the people who believe that they each own the “wealth” they see on their balance statements. If there are 100 people in total and all of the real wealth goes to one person, it means that person gets all they thought they had. It also means the other 99 get nothing. Their supposed assets vanish.

The key point is simply that X money has the illusion of existence, while X amount of wealth does not exist. The game of musical chairs is a pretty good analogy for this.

Exactly right, WA. Nicely done!

The stock market sure has sagged heading into this election. And as you mention, it really hasn’t gone anywhere for almost 2 years. There sure do seem to be a lot more debits than credits lining up….

Jay: If Trump wins on Tuesday, I expect markets to crash the next day. If Hillary wins, the markets will still crash, but it will just take a little while longer for reality to soak in.

“police pensions precarious pecuniary position”

That was great!

Have a good weekend Len!

To be honest, I think that was pretty good too, Sara. Er, if I do say so myself.

Len,

Whats your take on goldmoney account? I feel better about it since Schiff has joined the venture, still dont like the fact there isnt another person on the other end to talk to. Have you thought about opening an account with them or maybe you have? Just trying to get folks opinions about the situation.

Jared

Jared, I haven’t got one, but not because I think it is a bad idea. I just haven’t bothered to get one.

“I have $12,000 in credit card debt and $90,000 in school loans. Im earning $37,000 a year. Any advice on the best way to erase these loans quickly?” Oh this makes me so sad! Clair, WHAT WERE YOU THINKING? Len, your answer is funny. But Clair, IMMEDIATELY get Dave Ramsey’s book the total money makeover (buy it used to save money!) and start the debt snowball by getting a part time job evenings and weekends. Do not eat out, do not buy any clothes except at yard sales, do not take a vacation. GET THIS SECOND JOB, sell all your superfluous possessions. Pay the minimum on your student loans and pay extra on the credit cards until you get rid of that balance. Then tackle the student loans by pre paying. You will feel like you are being punished, and you ought to be punished for running up these terrible debts getting an education which is obviously not worth what you paid for it as evidenced by your salary. NO MORE TIME OFF FOR YOU GIRL, SPEND THE NEXT FIVE YEARS GETTING DEBT FREE. Cut up those credit cards today and cancel the account. You are not able to handle credit.

Thanks Karen for your straight shooting advice. Or Claire could get the book through her local public library or interlibrary loan for free.

Thanks for sharing your tips, Karen.

And, FWIW, I didn’t leave Claire hanging! I gave her some real advice too in my private reply to her.