The holidays come with a host of stressors, the most Xanax-inducing of which is perhaps overspending. Sure, we make our lists and check them twice, but we’re still human. Sales, discounts and deals are flashed furiously before your eyes while you’re in the holiday spirit and the next thing you know the back of the pickup is filled with supposedly thrifty gifts galore for your family, friends, neighbors, coworkers, and church congregation – plus a few things for you. (Mm hmm; I know what you’re up to).

The holidays come with a host of stressors, the most Xanax-inducing of which is perhaps overspending. Sure, we make our lists and check them twice, but we’re still human. Sales, discounts and deals are flashed furiously before your eyes while you’re in the holiday spirit and the next thing you know the back of the pickup is filled with supposedly thrifty gifts galore for your family, friends, neighbors, coworkers, and church congregation – plus a few things for you. (Mm hmm; I know what you’re up to).

So to avoid a debt hangover in the new year that will only serve to set you off on the wrong foot, nip that impulse-buying issue in the bud this holiday season by making a strict shopping plan — and sticking to it. Here’s how:

Differentiate Wants from Needs

If you have children you probably constantly hear how they need something or other. And every time they throw that little tantrum, you remind them that they don’t need it, but rather want it — and since it’s not a necessity, they’re probably not getting it.

But what about you? Do you follow your own rules on the want-versus-need dichotomy?

Finance expert Pamela Yellen agrees. “Those slick Madison Avenue types would have us believe that we ‘need’ lots of things, from the latest techno-gadget to that trendy new shoe,” she says. “They tell us that we’re not sexy, successful or cool without it. Take a time-out to think about whether you really need it.”

Curb Impulse Buying

Impulse buying can be hard to resist, especially if it’s a can’t-be-beat deal, but if you go through life snatching up everything at clearance prices just because they’re virtual steals, you’ll eventually end up broke — and probably a hoarder.

To curb this habit, Yell says to bust out the guns.”Next time you feel the urge to buy something you hadn’t planned to buy, simply clench your fist or flex your bicep,” she suggests. “Voila! The spell will be broken and you can actually think clearly again.”

Wrap Your Charge Cards

“Some financial advisors tell you to leave your cards at home to avoid temptation, but I prefer to wrap my cards in my goals,” Yellen says. “Every time I take a card out, I see a picture or some words that represent a goal that’s important to me. I get the opportunity to stop and decide whether what I’m about to purchase is more important than that goal. If it is, or it doesn’t undermine my goal, then I might go ahead and buy it. If it isn’t, then I get the satisfaction of knowing I’m a step closer to my goal because I chose to not purchase the item.”

Or, you could do it my way and wrap the cards in Post-it Notes that explain to your weak ass how cold it’s gonna be to sleep on the streets because you can’t seem to mind a budget when Christmas shopping.

Be Grateful

When we practice gratitude, we feel wealthier and more prosperous. Our self-esteem is greater and we just generally feel happy and appreciative of many aspects of our lives. Because of this, we’re less likely to crave material goods to feed an emotional need. And, studies have shown that having a grateful attitude actually enhances our ability to make good decisions.

Create Value Comparisons

How much is that tangible thing worth to you? What about a particular experience? If you start assigning value to things in your life, you may start to better recognize what’s worth the cost and what’s not.

“Rather than falling for some marketer’s value comparison, how about setting up your own?” Yellen asks. “Put a price tag on some things you really enjoy and value.”

When you realize how much you’re spending on things that you really don’t love that much, you’ll start to pull back your spending and make smarter choices.

Know Your Spending Triggers

Ask yourself these questions:

- Do you feel driven to buy extravagant gifts as soon as the mall’s Santa shows up or when holiday decorations pop up in the stores?

- When you have a rough day at work, do you crave retail therapy to feel better?

- When you’re out with old friends, do you order the most expensive item on the menu?

- Are you triggered to overspend in your favorite stores?

There’s no right or wrong answer to these questions; they’re posed to help put your spending in perspective. If certain items or little luxuries will influence you to overspend, then try to avoid them. This takes willpower, but refraining from the purchase will give you more satisfaction over time than the instant gratification will provide you in the moment — especially when you don’t receive a bill for it.

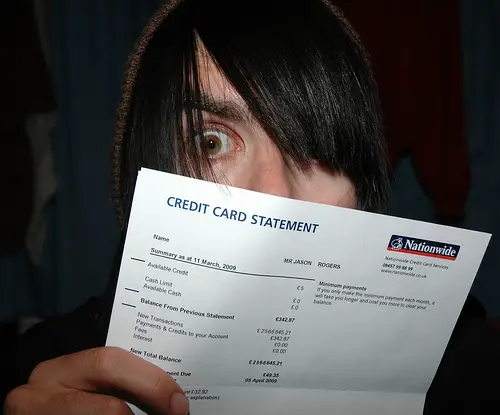

Photo Credit: xJason.Rogersx

Excellent points that are well worth a read.

If you drive through a subdivision on a sunny day and see people with their garage doors open you will see the garages bursting with crap. They are often lined with industrial shelving to hold everything.. And experiences? Destination weddings? Eating out too often? Overspending at Christmas? Crazy waste of life as every dollar spent represents moments of your life used to pay for this stuff. I live in an area that tourists flock to, or drive through. Big trucks with a quad in the back…towing a trailer with kayaks strapped down on top. Even leisure time is a race to acquire. Crazy.

Sunny today after a big rain storm, yesterday. I think I’ll take my dog for a walk and look for elk. Free. Christmas spending? Family dinner at the outlaws with everyone saying, “Please don’t buy us anything”. Maybe bring desert. Boxing day the kids are coming up. Same thing, no one needs anything.