It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Okay, off we go …

There is no cause to worry. The high tide of prosperity will continue.

— Andrew Mellon, US Secretary of the Treasury, September 1929

Tradition means giving votes to the most obscure of all classes — our ancestors. It is the democracy of the dead. Tradition refuses to submit to the small and arrogant oligarchy of those who merely happen to be walking around.

— G.K. Chesterton

Credits and Debits

Credit: Many people believe that the US is currently in a stealth economic depression. It’s possible. Especially if you consider that, unlike during the 1930s, the symptoms can be easily masked today through the use of EBT cards to eliminate bread lines, and government assistance checks that keep the unemployed off the streets.

Debit: Think about it: There are currently 47.8 million Americans with an EBT card in their wallet and 94 million who aren’t in the labor force — incredibly, despite unemployment figures being near an eight-year low. I just hope I’m not the only one wondering how those numbers are supposed to make sense.

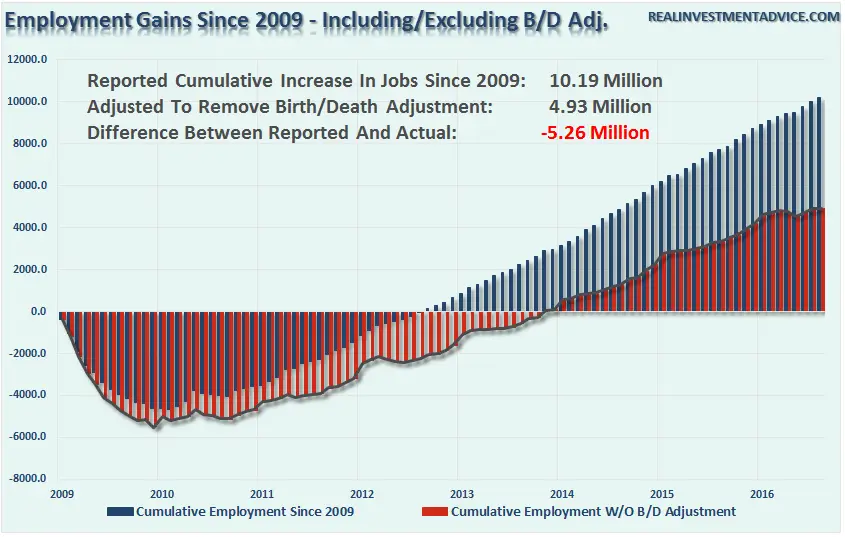

Credit: Then again, as David Stockman observed this week: “It’s quite evident something’s amiss with the BLS employment reports. The disparity between the continued addition of business startups to the employment adjustments is likely creating a rather large dislocation between the data and reality.” Hmm. So I guess my tin foil hat isn’t on too tight after all.

Debit: The government misrepresentation of the jobs data is so bad its almost comical. In fact, since 2009, government “adjustments” have resulted in 5.26 million more jobs being reported than the actual data indicated. In other words, more than half of all the supposed employment gains since 2009 are imaginary. Take a look:

Debit: Although it’s not definitive proof that we’re in a depression, the fact that 60,000 people stayed in New York City homeless shelters in a single day last week — breaking a single-night occupancy record in the process — is a sign that tough economic times are here.

Debit: Frankly, that really shouldn’t be too surprising when you consider a 40 square-foot apartment in the Big Apple is currently fetching $450 per month. Tenants say it ain’t all bad, though — without an annoying kitchen or any bathrooms to keep clean that leaves more free time for entertaining!

Debit: Believe it or not, as rents continue to climb to evermore ridiculous levels, a growing number of people across America are deciding to ditch their cramped apartments for vans and buses instead. No, really.

Debit: Perhaps sky-high rents are “proof” that the US economy is perfectly fine. Even so, the national debt expanded last month at its fastest rate since 2012 — and one of the fastest rates in history. As Simon Black points out: “If the debt is growing this quickly in good times, imagine how dire the debt situation will become when the economy slows down.” I’d rather not, Simon.

Credit: Of course, high rents are a result of the latest housing bubble driven by the Fed’s absurd monetary policies, including zero interest rates and unrestrained currency printing. And as financial analyst Dave Kranzler notes, the Fed’s blatant intervention has “completely destroyed the markets.” I disagree. “Completely destroyed” is a gross understatement.

Debit: I’m sure the buyers who pushed Amazon stock to an all-time high of $804.70 per share on Thursday also disagree — although for different reasons. They’ll tell you that Amazon’s stock price doubling in just 17 months was driven by fundamentals. Or was it?

Credit: On the other hand, there are those who agree with Kranzler, too. Take mega-billion-dollar hedge fund manager Tad Rivelle, who says: “The central banking emperors have no clothes. When the solutions to the Fed’s dilemma are merely new problems, you know the time has come to leave the dance floor. In our view, that time has already come.” Sheesh. Talk about peeing in the punch bowl.

Credit: Say … You don’t think that’s why the world’s central banks have been, as MarketWatch says, buying gold again with a vengeance, do you?

By the Numbers

It may be September, but for the Germans, Oktoberfest is already in full swing. Here’s a closer look at some data on the famous Munich festival:

1810 Year that the first Oktoberfest was held.

17 Number of festival days this year; the festival runs from Sept 17 through October 3.

9 Oxen consumed during this year’s opening Oktoberfest weekend.

114 Number of oxen consumed during last years Oktoberfest.

34 Number of brewery tents serving beer at this year’s festival.

$10 Average price for a litre of Oktoberfest beer.

7,700,000 Litres of beer consumed by Oktoberfest’s 5.9 million visitors in 2015.

4500 Items turned into the Oktoberfest lost and found in 2015 including: 600 passports, 580 wallets, 320 mobile phones, 230 pairs of glasses, two wedding rings and one dog.

Source: AccuWeather

The Question of the Week

[poll id="130"]

Last Week’s Poll Results

What was your FICO credit score the last time you checked?

- 800 or higher (41%)

- 750 to 799 (25%)

- 700 to 749 (13%)

- I’ve never checked my credit score (11%)

- Less than 650 (5%)

- 650 to 699 (3%)

More than 1100 Len Penzo dot Com readers responded to last week’s question and it turns out that two-thirds of you have excellent credit scores of 750 or higher — and 2 in 5 have a score of 800 or higher! Very impressive, folks. Keep up the great work! As for the 1 in 9 who have yet to check their credit score for the first time — these days you can get them at no charge, so what are you waiting for?

Other Useless News

Here are the top 5 articles viewed by my 10,909 RSS feed, weekly email subscribers and followers over the past 30 days (excluding Black Coffee posts):

- Is It Okay to Eat Foods Past Their Expiration Date?

- How to Splurge Without Breaking the Bank

- 3 Things That People Pay for That Cost More Than They Should

- A Few Thoughts from Aunt Doris: How to Make Ends Meet

- 10 Things You Should Be Doing Now So You Can Retire on Time

Hey, while you’re here, please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Looks like Sharon found my About page this week:

My fat sister looks better than you.

Okay … but if you’re trying to impress me, you’ll need to set the bar a lot higher than that.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-

I loved Bernanke’s face when Ron Paul asked him if gold was money. Thanks for sharing that video. Have a good weekend!

My pleasure … and you have a nice weekend too, Sara.

The P/E ratio for Amazon stock is almost 200. I wouldn’t touch that stock with a 10 foot pole.

You don’t understand, John … this time is different. No, really.

Thanks for another great summary Len. And I’m glad you mentioned Amazon stock. I can’t get over the impressive performance… or the nosebleed valuation! Hope you had a great weekend.

Len, I’m curious, what % of your investments are in gold, silver, stocks, bonds and other things?

Joe: Right now I am split approximately 40% gold, 20% silver, 20% bonds and 20% stocks.