You can’t make this stuff up, folks.

You can’t make this stuff up, folks.

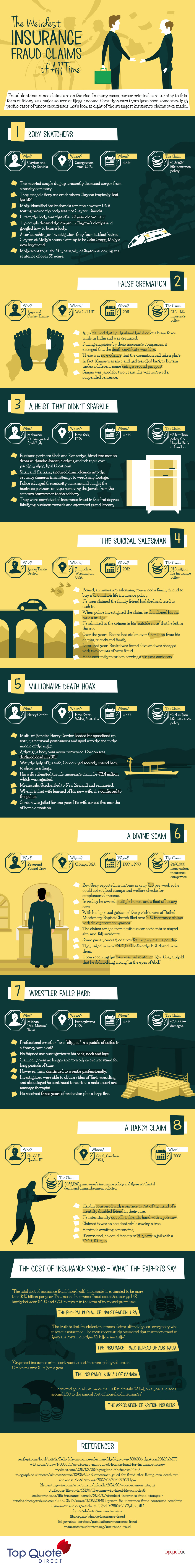

Insurance fraud claims drain more than $100 billion each year from the worldwide economy. For the most part, insurance fraud claims are generally committed by people in desperate need of money. And although it isn’t smart to commit the crime, insurance fraud does require a considerable amount of planning in addition to a somewhat convincing level of acting skills — so insurance fraud may not be as easy as it seems.

In a lot of cases, the fraudulent attempts carried out by these con artists are unsuccessful due to the ridiculousness of the claim itself.

Over the years there have been some very high-profile insurance fraud cases that have been uncovered — and the folks at Top Quote have trawled the headlines to bring you eight of the strangest ones.

From wrestlers to priests, and desperate wives to the unhinged, these swindlers prove that insurance crime comes in all shapes and sizes.

Photo Credit: The Only Anla; Infographic: TopQuote Direct

Bunch of clowns. This article gave me some great ideas. Len send me an email…. I have a great idea to make some quick cash.

lol! I know, right?

Most of these people got off easy! I wonder how much of that money was recovered?

I don’t know, Sam, but I bet it wasn’t much. These doofuses tend to spend it as fast as hey steal it … and don’t tend to save a lot.

Gustavo Woltmann thinks this is a fantastic blog! – Gustavo Woltmann

Thank you, Gustavo Woltmann!

The internet makes it easier to catch insurance fraudsters. A lot of retired New York city firemen and Police officers were going out on work related disability, oddly enough at the same time as they retired, which apparently gave them a double pension. Coincidentally, most of these men used the same disability lawyer and doctor. Finally someone thought to go to Facebook and there were photos of these poor, “crippled, unable to walk or stand for long periods of time, emotionally damaged men who could not leave their houses as they had PTSD” men sport fishing and landing fish weighing several hundreds of pounds, motorcycle racing, running a karate studio and being the lead instructor, surfing, jogging, partying, skydiving, drinking beer and partying outdoors on the taxpayer and insurance company money. It caused a momentary scandal, but it’s most likely back to normal again with the fake claims, the news story dropped from the news so quickly.

If you are about to be the victim of insurance fraud, be pro active and investigate for yourself. I was sued by two women tenants who had brawled with each other in the parking lot of my rental building. The ambulance was called and one had a broken leg during the fight. They sued me for $20,000. claiming the one had “fallen” in the poorly paved (their words) parking lot and I was responsible. I interviewed the other tenants who had witnessed the fight and the arrival of the ambulance. I interviewed the ambulance personnel. I contacted the PA Fraud Commission and gave them the information. I contacted my insurance company, gave them details and told them not to pay. I sent a certified letter to the lawyer who had instituted this bogus claim explaining that I’d contacted the Fraud Commission and my insurance company with the facts. Explained I was going to sue him for damages for extortion for his role in this fake case and press criminal charges against him. Within a day of that letter’s arrival the female perpetrator was on the phone begging me to drop the case so she would not go to jail since her lawyer had dropped her and her bogus case like a hot potato and jail for fraud for her was looming. If I hadn’t done the investigation the insurance company would have settled rather than spend the money required to do the investigation and to defend against the bogus case. Besides the leg work which I did, today I’d be combing social media and no doubt catch them bragging about how they scammed their landlord, or were in the process of doing so.

My mom was the victim of fraud twice. She was billed for physical therapy she hadn’t received (she was with us every Monday when this supposedly happened) and her signature was forged on the sign in sheet. I brought it to the nursing home’s attention and they told me the therapist was a private contractor. I called this person’s boss and they said they would only charge for half of the visits because there were signatures and they had no way of disputing it. The following year they charged Mom’s insurance and social security for the rest.

The second was a doctor my mom had never seen. When I called the hospital billing office they said they had never sent out the bill. When I called the supplemental insurance company, they said it was Medicare’s call. So I called Medicare and waited online for 45 minutes before they picked up. I explained the situation and they hung up on me. I called a second time, explained the situation and the woman asked if I really wanted this to be investigated. I said yes and that they should be concerned because it was their money. I got no word the charges had been reversed or even that it had been investigated. It would have been pretty obvious it had been fraud if they only called the billing office.

Needless to say those experiences were pretty frustrating.

Wow. I am sorry to hear that, Olivia. Sadly, I am positive your experience is not an uncommon one. And that is too bad because, ultimately, insurance fraud affects all of us through higher premiums.

Olivia you called Medicare which is in business to pay out as much as possible in order to justify hiring MORE workers. Next time call your State Insurance Fraud Commission for starters. Nowadays you can also use social media. Accuse no one, merely state the facts and your proof (That your Mom was with you and not at the therapy sessions.) and ask for clarification. All companies have a presence on social media