Perhaps the most deceiving force in the entire universe is the exponential function. It’s not surprising when people insist that my warnings about the end of the debt-based dollar monetary system are nonsense. Usually they argue that it’s because “the system is still functioning” – despite the endless currency printing, debt accumulation, and quantitative easing (QE).

Perhaps the most deceiving force in the entire universe is the exponential function. It’s not surprising when people insist that my warnings about the end of the debt-based dollar monetary system are nonsense. Usually they argue that it’s because “the system is still functioning” – despite the endless currency printing, debt accumulation, and quantitative easing (QE).

By the way, I never take offense when people tell me I am being hysterical. I understand that most people who don’t realize that the dollar is in peril are not mathematically inclined. As a result, they’re less likely to understand the insidious nature of exponential curves.

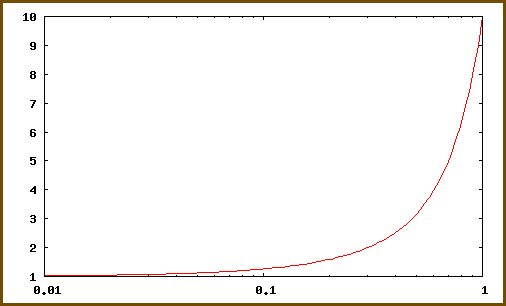

So, without getting into the mathematical details, let’s take a look at a typical exponential curve.

So how does this relate to the eventual end of the dollar? Well … let’s look at the US federal debt between 1966 and 2022. Keep in mind the “official” debt of more than $31 trillion doesn’t include unfunded liabilities of more than $200 trillion.

What’s so diabolical about an exponential function is the curve’s flat section; the part where the rate of change isn’t noticeable. Naturally, that quiescent period usually leads to a misguided sense of complacency. As a result, a dangerous practice such as unfettered debt accumulation can carry on for many years with little effect. Eventually, however, you get to the “business end” of the curve, where the slope increases at an alarming rate. This is the point where the illusion of stability suddenly ends, and chaos takes over.

There are plenty of signs that indicate our debt-based monetary system is approaching the “business end” of the exponential curve. From this point forward, the crises will be coming at us faster and in increasing size with each passing day until the financial system suddenly breaks. Most people won’t know what hit them — or why their life savings were suddenly annihilated “without warning.”

What most people fail to realize is how fast instability strikes once the exponential curve reaches its “business end.” Here’s a notional example that clearly demonstrates this process:

Economist Chris Martenson likes to use the example of a giant water pipe that feeds a water-tight domed football stadium of typical dimensions. At some point, the pipe springs a leak that grows exponentially worse over time; doubling every second without limit. So one drop of water leaks during the first second, then two drops, then four drops and so on. Now … imagine that you’re sitting at the very top of the domed stadium when the dripping starts. How long do you think it would take before the stadium completely fills with water, drowning you in the process?

The answer is about 50 minutes. Yes, just 50.

And while that’s impressive all by itself, the real takeaway here is that, fully 46 minutes after the leaking starts, just 10% of that domed water-tight stadium will be filled water. At that point, looking down from the relative safety of your nosebleed seat, it would be logical to assume you still have a lot of time before the water reached the top of the stadium. Of course, you’d be very very wrong — since the math shows that the remaining 90% of the stadium fills with water in the final four minutes.

The End of the Dollar

Keep that in mind the next time somebody tells you our ever-increasing debt is fine because, despite all of that red ink, “nothing bad has happened so far.”

The truth is, something bad is happening right now. In fact, it’s been happening for a long long time — it’s just that most people haven’t figured it out yet. And they won’t because, for most people, the “business end” of an exponential function is hard to see until it’s too late.

Photo Credit: stock photo

This explains it pretty well imo, Len. As you say, this has been building for quite a while, and I’m glad we began to take action back around 2008, because we’re now in a better position than most.

You were on this before me, Lauren. I didn’t wake up to what was going on until 2010. I’ve been preparing ever since – and yet I still feel like I am not prepared enough.

All I can say is “WOW!” Very scary when you look at the stadium example.

It is, Eddie … for me it’s because, when it comes to the debt, I really don’t know for sure where the proverbial top of the stadium is. I know we are in the final moments – but are we at minute number 47? Or 48? Or 49?

The national debt has been doubling every eight years for a long time. We’ll be at $50 trillion before the 2020s are finished.

I wonder if the monetary system will still be intact seven years from now to the point where the National Debt will actually matter – or will a monetary reset make it moot?

” …most people … are not mathematically inclined.” And they won’t get any enlightenment from establishment sources.

The exponential function is not a difficult mathematical concept, but its application to compounded debt creation is deliberately obscured. It is a plague to be avoided by “progressive” monetary theorists.

Very true, Dave. To acknowledge it is to reveal the flaw in the Magic Money Tree theory.

Striking evidence of the operation of the exponential function in Social Security’s financing can be found in this Wolf Street article.

Note the chart showing S.S. income vs. outgo. The green line shows income, the red line shoes outgo. The green line is substantially linearly increasing; the red line is exponentially increasing!

Great observation, Dave!

Winter is coming….very soon. I have never understood how our “leaders” never discuss repayment of Principal borrowed. I agree that time is of the essence to prepare or become better prepared. Most people remain distracted….turn back to your regularly scheduled Hollywood or Sports, Political crisis de jure. Thanks for the reminder.

It is a verboten discussion, CO2. Just like the central bankers refuse to discuss the impossibility of the debt ever being paid back because, mathematically, it can never be paid back under their debt-based monetary system!

Thank Len, what are your main suggestions to prepare?

Thanks, Tim. I provide a thorough summary in this post.