Who doesn’t love getting behind the wheel of a car every once in a while and just drive for the sake of driving? Cars provide a sense of freedom that other modes of transportation can’t.

Who doesn’t love getting behind the wheel of a car every once in a while and just drive for the sake of driving? Cars provide a sense of freedom that other modes of transportation can’t.

Then again, nothing can put a damper on the joys of driving faster than an accident on the highway — whether it’s your fault or the unintended work of somebody else.

The truth is, a car accident of some kind will happen to most of us at least once in our lives.

With gasoline prices at their lowest point in six years and favorable interest rates still driving auto sales, my friends at WalletHub decided to conduct an in-depth analysis on the cost impacts of risk on drivers’ wallets, based upon where you live.

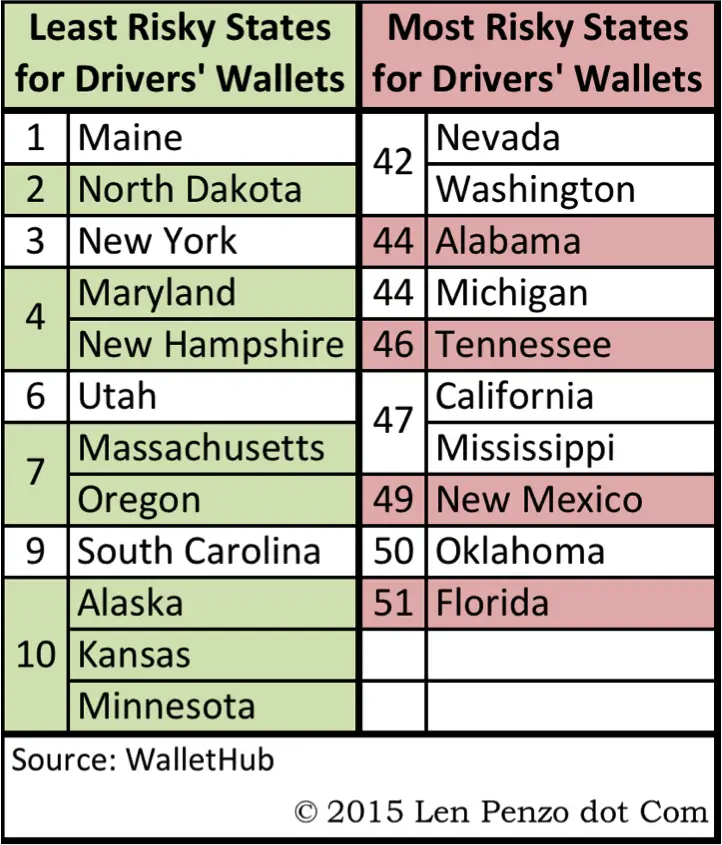

To do this, WalletHub ranked the 50 states and the District of Columbia in terms of several risk factors including the minimum coverage requirements for the mandatory forms of auto insurance, and the percentage of uninsured drivers. They then used those factors to come up with a an overall risk ranking.

Here is a summary of the top- and bottom-ranked states:

If you are wondering what you can do, it might be a good idea to to review these key findings from WalletHub based on their analysis:

- Somewhat surprisingly, WalletHub found no correlation between liability insurance requirements and the percentage of drivers without insurance in that state.

- The worst place to have an accident is Florida. Despite having some of the lowest insurance requirements of any state, 23.8% of Florida drivers have no insurance at all.

- Maine is at the other end of the spectrum. Only 4.7% of Maine drivers are uninsured. The Pine Tree State also requires drivers to carry medical payments and uninsured motorist protection, as well as $50,000/$100,000/$25,000 liability insurance.

- Only 3.9% of Massachusetts drivers are uninsured; that’s the lowest rate in the US. On the other hand, an estimated 25.9% of all Oklahoma drivers have no insurance.

Say … You don’t think most people who retire in Florida come from the Sooner State, do you?

Hey, it’s just a thought.

Photo Credit: JJ_the_Jester

Oh, that’s totally crazy, driving without an insurance?! My aunt is currently living in Florida but I didn’t know about that.

I am not surprised at our poor ranking here in the Sooner State. Most folks around here seem to think mandatory auto insurance is merely a suggestion rather than the law. You almost want to ask for hazard pay for the commute into work, what with all of the uninsured motorists, drunk drivers, meth heads driving stolen cars and the general asshattery of those who text while driving.

Dang, I have become my grandfather a few years earlier than I hoped. LOL

I do find the mix of very different political leaning states in the lists interesting.

We got rear ended in California a few years ago and it might have well been a 3rd world country. Police refused to show up at the accident because nobody was injured even though the other driver was uninsured. Lucky for us, her car wasn’t drivable, otherwise I’m certain she would have taken off. She ended up going to a shop with us for an estimate and paying us in cash on the spot. Was a totally crazy morning and just by dumb luck it worked out for us.

I at least feel lucky that I don’t live in those states. I can’t imagine if I could afford it just in care I got into a car accident. Yay

Interesting facts. I can’t imagine driving w/o insurance!

This appears to be percentage of licensed drivers without insurance. If you add in the illegal aliens who drive without licenses the numbers are much higher. You’ve got to take responsibility for them (once again!) by buying “uninsured motorist” and “under insured motorist” coverage for your own policy.

Yeah, but there is a lot of wide-open highway, Crystal. I’d think that would mean less accidents!