It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

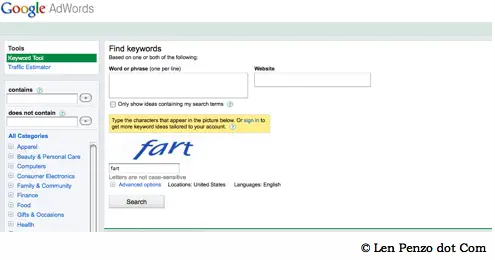

You know those annoying “captcha” tests that a lot of websites use to make sure you’re not a spambot? I know. Everybody hates them — although they really are a necessary evil, in my not so humble opinion. Anyway, sometimes captcha does manage to entertain me with the test words they come up with. For example, check out this screen shot I took of a captcha test word that I received:

Oh, look! It’s time for the credits and debits — and not a moment too soon …

Credits and Debits

Credit: The S&P 500 just completed its biggest 16-day gain ever — that includes the periods during those huge economic expansions of the 1980s and late 1990s, which suggests we are in the middle of a booming economy, the likes of which that’s never been seen before. Hooray!

Credit: Then again, judging by the results of last Tuesday’s elections, voters aren’t buying it. At all. Even so, not much will change — at least not significantly.

Debit: I suspect the election results have at least a little something to do with the fact that America will soon have more bartenders and waiters than manufacturing workers. Oh, how far we’ve fallen …

Credit: Meanwhile, the end of the Fed’s quantitative easing (QE) program has seen the US dollar surge to a four-year high — and that has some analysts saying the dollar is poised to become significantly stronger in the future. Of course, strength is relative: the dollar is just the cleanest dirty shirt in the laundry basket.

Debit: Russia certainly isn’t impressed with the “strength” of the US dollar. It’s currently considering a law to ban the circulation of greenbacks within its borders. I guess they’re no longer big believers in the full faith and credit of the United States government.

Credit: The Russians aren’t the only ones who are losing confidence in the US dollar — apparently, so are a growing number of Americans, if the increasing sales of Silver Eagles are any indication; October was the US Mint’s biggest month in almost two years.

Credit: The demand for silver bullion is even more frantic this month. In fact, it’s so strong that the US Mint temporarily sold out of Silver Eagles this week after selling more than three million coins during the first three days of November alone. No, really.

Debit: Despite record silver and gold demand, bullion prices have declined precipitously. I know. According to Paul Craig Roberts, who was an Assistant Secretary of the Treasury under Ronald Reagan, this proves that American financial markets no longer have any relationship to reality. I agree.

Credit: We’re not the only ones who think that way: Billionaire Paul Singer said this week that the government is cooking up stories of “fake growth, fake money, fake jobs, fake financial stability, fake inflation numbers and fake income growth.” Harumph!

Credit: Even worse, Mr. Singer notes that the cooked data is being eaten up by a “careless citizenry” that one can only assume is, presumably, preoccupied with “more important” matters — or in complete denial. Heh. Maybe us doom-and-gloomers aren’t so crazy after all.

Debit: Besides, there is plenty of circumstantial evidence to suggest Messrs. Roberts and Singer are correct — but such cozening behavior is expected because the world’s central banks are taking increasingly desperate measures to keep the world’s debt-based financial system from imploding.

Debit: Perhaps no central bank is exhibiting greater signs of desperation than the Bank of Japan, which doubled down last week on its plans to create the world’s largest bond bubble — even though the move significantly increases the risk of destroying the nation’s currency.

Debit: The bottom line is that our financial system is broken beyond repair; we are witnessing a global economy in its death throes. Yes, I realize that’s disturbing news; the unpleasant implications are why most people refuse to believe it — or mock those who are brave enough to point out that the emperor has no clothes.

Credit: The longer the financial shenanigans continue, the harder it is to deny this stark reality: After decades of living beyond our means, the US — and much of the world — finally face the day of reckoning. Will it be painful? Yes; extremely — especially for Americans. But the sooner we own up to that, the sooner we can return to healthy economic behavior and a promising future of real growth.

(The Best of) By the Numbers

All this doom and gloom talk made me hungry. Here’s a brief look at the American snack food market:

$760 million Annual sales of natural chips, pretzels and related snacks.

1.5 Pounds of pretzels consumed per person per year in the United States.

300 Cookies the average American consumes per year.

1 Sales rank of Nabisco’s Oreo cookie.

500 billion Oreos sold since their invention in 1912.

6 Round trips to the moon and back that 500 billion Oreo cookies would stretch, if they were stacked together.

Source: NewHope360

The Question of the Week

[poll id="33"]

Last Week’s Poll Result

How many trick-or-treaters came to your door this year?

- 0 (37%)

- 1 – 25 (26%)

- 26 – 50 (23%)

- More than 100 (9%)

- 51 – 100 (5%)

Almost 400 people answered last week’s question, and more than one in three of them didn’t have a single goblin show up at their door this Halloween. In my neighborhood, the number has been dwindling for several years now — we received 42 trick-or-treaters. When our neighborhood was brand new back in the late 90s, there were a couple of times we received more than 100 kids; but over time, neighborhoods age like everything else. Of course, most neighborhoods eventually experience a renaissance as empty nesters move away — or die — and new families move in. Then the whole cycle starts anew.

Other Useless News

Here are the top — and bottom — five states in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Maine (2.09 pages/visit)

2. Delaware (2.07)

3. Wyoming (1.99)

4. Arkansas (1.98)

5. Utah (1.97)

46. Alaska (1.41)

47. South Dakota (1.39)

48. Rhode Island (1.38)

49. Vermont (1.35)

50. Oregon (1.09)

Whether you happen to enjoy what you’re reading (like all of my friends in Maine) — or not (ahem, you hippies in Oregon … for the second month in a row!) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

And last, but not least…

3. Don’t forget to subscribe via email too! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Michael left this comment after reading last week’s Black Coffee article on the rapidly-escalating world currency war:

I just want to say what a relief it is to find someone who actually knows what they’re talking about.

Thank you, Michael, but I think you’ve got me confused with somebody else.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Hi Len-

Isn’t Russia’s action against the dollar more of a political retaliation than Russia losing faith in the dollar? Russia has been pretty vocal about targeting the dollar if the U.S. pushed economic sanctions against them for the Ukraine invasion.

MJ: Yes, it is more of a political action. Russia has been losing faith in the dollar since before they joined the BRICS monetary union. I think this move, however, can also be considered the point where Russia is now overtly telegraphing its complete and total repudiation of the dollar.

If the dollar does lose it’s status as the global reserve, what replaces it? The Euro countries and Japan have pretty much the same issues as we do. I do not have full faith in Russia or China from a political standpoint. If the dollar does loses global reserve status, then it’s a complete disaster on global economic stage and i retreat to the woods, grow a beard and live off the land. 🙂

More bartenders and waiters. So sad. My manufacturing startup is failing, and we were just all joking about becoming bartenders.

Yeah, Ross Perot wasn’t kidding back in 1992 when he talked about the perils of NAFTA and the resulting “giant sucking sound” that would be caused by all those fleeing manufacturing jobs if it ever became law.

Perot, while socially awkward, and Ron Paul (probably socially awkward too), are my heroes: Let me adjust my own tin foil hat. If anything, they attempted to inform and alert. I respect that, regardless if they are proven right or wrong. Unfortunately, I can’t independently pick the winners. They are what has proved America still exists (to me).

I agree, Kim. They are still lonely voices in the wilderness. I just pray that their Libertarian principles will be embraced by a majority of the American public after the dollar dies and the resulting economic upheaval — and lower living standards — finally awaken the majority from their slumber. If not, the country will lurch even farther to the left, as more people decide to beg the government for even more help, providing for their every need (ignoring the fact that that is the reason the economy eventually collapsed in the first place.)

For what it’s worth, I voted for Perot in 92. Remember, he got 20% of the popular vote that year, which actually cost Bush 41 the election, and put Clinton in the White House.