It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I’m helping my father-in-law move into a new apartment this weekend, so let’s get right to it …

Credits and Debits

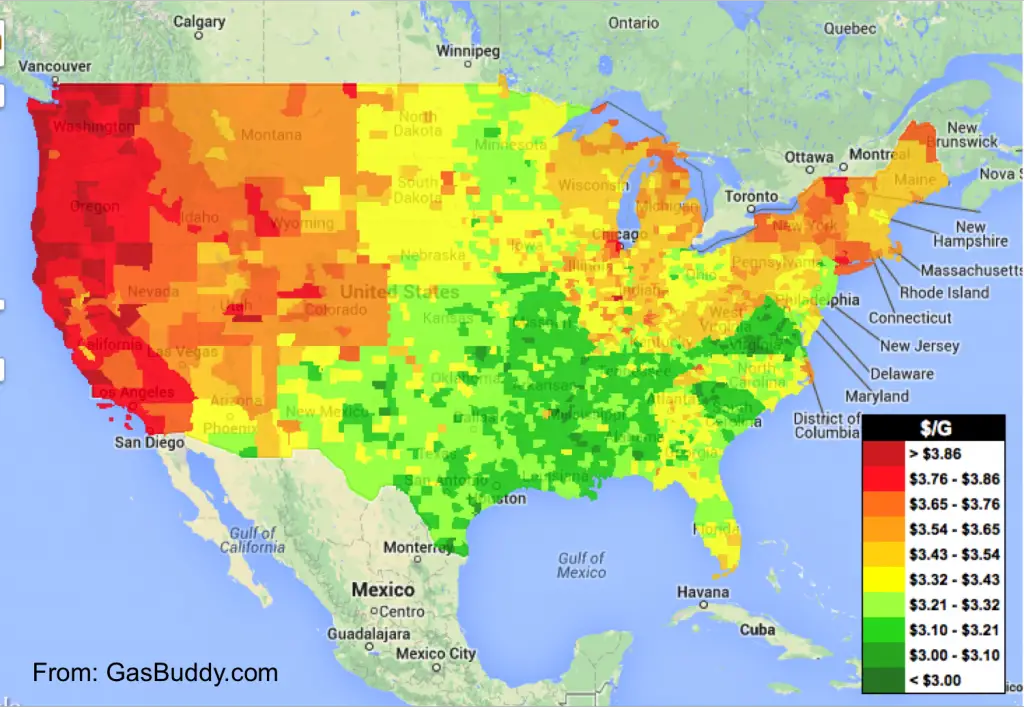

Credit: Check out this national heat map from Gas Buddy. It provides a terrific comparison of the latest gasoline prices across the United States: (They have a similar map for Canada.)

Debit: Unfortunately for me, I live in Southern California, where this week the average price for a gallon of unleaded topped out at $3.80 per gallon.

Credit: In case you’re wondering, Gas Buddy reports that Roanoke, Virginia, currently enjoys the lowest average pump price: $3.08 per gallon.

Debit: Believe it or not, since 1998, gasoline prices have climbed 290%, which is too bad because you can bet most people’s paychecks haven’t increased that much over the same period.

Debit: It’s not just gasoline; over the past 16 years, college tuition has skyrocketed 140%, electricity is up 75%, healthcare is 54% more expensive, and milk is up 60%. In fact, this week milk futures hit an all-time high; and that portends higher pizza prices. Just in time for football season, right?

Debit: You know the American economy is in dire straits when Vice President Biden’s former chief economist, Jared Bernstein, floats a trial balloon in the New York Times calling for the end of the US dollar as the world’s reserve currency. Oh yes, he really did.

Credit: Of course, having a reserve currency is the so-called exorbitant privilege that has allowed the US to accrue a massive debt load over the past 50 years without destroying the dollar — and with it, Americans’ high standard of living. So why would Mr. Bernstein make such a suggestion?

Credit: Mr. Bernstein is no dummy; I suspect he knows the dollar’s reserve currency status is a privilege that can no longer be sustained. For such an article to come out in the New York Times suggests to me that the dollar’s demise — at least as we know it — is closer than most people think.

Debit: Then again, there are plenty of people who didn’t need Mr. Bernstein’s op-ed piece to become aware of the decline of America, the looming demise of the dollar, and the end of the current international monetary system — the signs are everywhere.

Debit: For example, the unwanted attention surrounding the United States’ alarming amount of unfunded liabilities — $205 trillion and counting — finally forced the federal government to stop publishing the statistics.

Debit: Meanwhile, as CNS reports, government “assistance” is apparently so generous now that: “An unemployed American is more likely to be shopping — for stuff other than gas or groceries — than to be looking for a new job.” Must be nice.

Credit: With 92 million Americans currently out of the labor force, the welfare benefits being handed out are enormous — but the financial consequences of maintaining them will only remain manageable as long as the US government can continue abusing its exorbitant privilege via unfettered money printing.

Debit: Here’s another indication that the US economy is in a free fall: Outside of healthcare and education, guess how many net new jobs have been created in America since July 2000. If you said “one,” um … try again — your estimate was too high.

Debit: The Fed has painted itself in a corner with its reckless monetary policies, and it is clearly frustrated. We truly live in a bizarro financial world when the Fed is blaming lackluster GDP growth on consumers “hoarding” cash. Heh. In the old days we called that “saving.”

Debit: Needless to say, with today’s zero- and negative-interest rate policies — which are necessary to keep the international monetary system from imploding — the world’s central banks are doing everything they can to discourage people from hoarding money … I mean saving.

Debit: As Simon Black points out, the banking system is so absurd now that ANZ bank actually placed a newspaper ad touting a 0% interest rate. Yes, zero. As in zero-point-zero.

Credit: Naturally, there are minimum deposit requirements to qualify for that premium interest rate; for example, those saving in Japanese yen need the equivalent of $223,000 US dollars. If inflation and taxes cost 5%, the depositor loses more than $11,000 the first year alone. Sheesh. Talk about an exorbitant privilege.

By the Numbers

Some scary facts about how little Americans save today:

$240,000 According to Fidelity Investments, the amount of money a couple aged 65 should have on hand to cover medical expenses throughout their retirement.

11 According to Aon Hewitt, the rule-of-thumb salary-multiple required to maintain your standard of living if retiring at 65.

6.7 According to Aon Hewitt, the salary multiple the average American will actually save upon retirement.

$1327 The average Social Security benefit for retired workers, according to the Social Security Administration.

50 Percentage of American workers in 1991 who planned to retire before age 65.

23 Percentage of American workers today who plan to retire before 65.

Source: Timothy Sykes

The Question of the Week

[poll id="25"]

Last Week’s Poll Result

Credit or Debit: Which payment method do you usually use?

- Credit (69%)

- Debit (23%)

- I only use cash and checks. (8%)

Almost 200 people answered last week’s question, and it turns out that the majority of them use credit instead of debit. I think credit is the better choice because it offers several advantages over choosing debit, including important consumer protections. That being said, most small business owners would rather you hit the debit button. I’ll be posting an article later this week from one small-business owner who will try to convince you why debit is the way to go.

POLL NOTE: I’ve received multiple reports over the past couple of weeks from my readers telling me that the “VOTE” button is not working on their browser. I did some testing and confirmed the error. I believe there is a bug in the polling software that I’m using; I am working to fix this as quickly as possible. Thanks all, for your patience!

Other Useless News

Here are the top — and bottom — five states in terms of he average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. North Dakota (3.83 pages/visit)

2. Utah (2.11)

3. Maine (2.10)

4. District of Columbia (2.01)

5. Montana (1.99)

46. Louisiana (1.52)

47. Oklahoma (1.51)

48. Idaho (1.49)

49. New Hampshire (1.45)

50. Vermont (1.34)

Whether you happen to enjoy what you’re reading (like North Dakota, for the third month in a row!!! woo hoo!!) — or not (ahem, Ben & Jerry, likewise … three in a row … I guess I’m officially switching to Haagen Dazs) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

And last, but not least…

3. Don’t forget to subscribe via email too! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Michelle had a suggestion regarding my article on 19 things your suburban millionaire neighbor won’t tell you:

You forgot #20: (He’s a) cheap bastard that doesn’t tip well or pay his service tradesmen what they worked for.

Uh oh … does somebody need a hug?

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

So Len, is it now past time to lay in survival gear? Food, water, clothing, tools, etc.? Maybe seeds and a chicken coop, too.

It’s never too late to be preparing, Suzy. Well … until it finally is.

North Dakota #1, Vermont #50. That’s funny. My family and played a game when we took our kids to Disneyland for my 8 year old’s birthday. To keep him busy in the car, we looked for license plates and wrote them down.

We are still doing it, but now, for MONTHS we’ve had ALL except…ND and VT. Can’t find them! I think the people in ND are too busy working.

So we hoarders are the problem. On one hand, the government tells me that I’ll need $3 million to retire. On the other, they say I’m hoarding. Pick one!

Hey, at least living in So. Cal., we can bike to work, right? Don’t need gas.

Hey … that’s quite a coincidence!

As for the “to hoard or not to hoard” conundrum, all I will add is … we are living in interesting times.

I think most Americans have no idea that we’ll all be living in a vastly different financial world here in the relatively-near future.

So in light of the Federal deficit, devaluation of the dollar, lack of jobs, etc., what’s your view of U.S. Savings Bonds these days? I have some, and can’t find anyone talking about whether they’re still a good investment. Yes, they earn relatively good interest, but are they a safe investment NOW (or should I cash them in for tangible assets?) Thanks!

I don’t need a hug. I am just observing my neighbor….and those few bad apples that have stiffed my husband out of hard-earned cash for a job well done. The secret to being a millionaire is KEEPING your money in your pocket, I see. (or…is that hoarding….?) Those with the most money are always the ones that pay the least, give the least, and take the most.