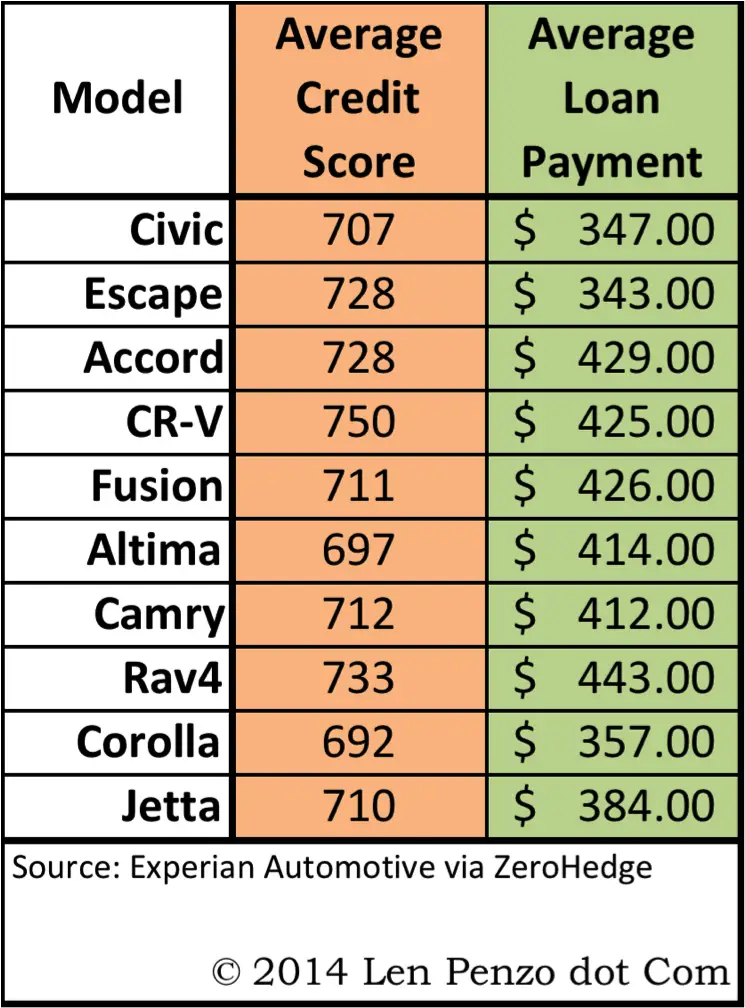

In case you missed it, the other day ZeroHedge published a story on the soaring car repossession rate that included some interesting data from Experian comparing the average credit scores and loan payments for owners of ten popular car models. I don’t have much to add, although I am a bit surprised as some of the credit numbers — especially the high average score for CR-V owners compared to some of the other cars on the list.

If you see anything in these figures that seem out of the ordinary or otherwise stand out to you, feel free to share your thoughts below.

The only “unusual” thing I notice is how close my numbers were to the average when I bought a Ford Escape a few years ago.

just curious are these based on monthly payments or bi-weekly??

Monthly.

Very interesting! I work in the auto finance industry and I’ll tell you that the average score drops significantly for other cars. But now that I see the numbers for the ones you listed, it does sound about right.

Cool. Thanks for the affirmation, Ben.

I’d be curious to know what the credit scores are for people who pay cash and buy used. That info would be harder to come by. Another question, this one for Ben (The Wealth Gospel), in your experience, what are the scores for people who buy Jaguars?

That would be interesting to know, Olivia. If I had to guess, I bet the average score is 750, if not higher.

Hmm…I don’t really know what to think about this. Does it really matter? As far as I can tell, all of these cars fall into about the same category.