Teaching kids about personal finance is not an easy job. Even so, as a parent I believe it is my responsibility to ensure that my kids have a thorough understanding of good personal finance practices before they leave the nest.

Ultimately it will be up to them to decide if they want to heed the stories and lessons I have been tirelessly passing on to them ad nauseum since they were old enough to apply for a loan at the Bank of Dad.

That concerns me because so far, in the case of my soon-to-be 14-year-old son Matthew, all of the proselytizing and instruction has seemingly been for naught.

My son is an impulsive shopper and, as a result, he has a serious spending problem. He continues to spend money as fast as he earns it, usually on the first thing that even remotely interests him. As I type this, Matthew’s account with the Bank of Dad shows that he is $4.50 in the hole — despite the fact that he often earns as much as $40 per month doing chores.

Needless to say, the Honeybee and I are both getting a bit nervous because if that light bulb doesn’t turn on before he becomes an adult, Matthew is going to be in for a rough time. After all, I keep telling my son that I’ll never cosign a loan for him — so it is imperative that he can show his credit worthiness as a young adult and eventually build up his credit score.

As for my 11-year-old daughter, a few months ago Nina informed me that she was going to start saving her money to buy a brand new iPod Touch. She also told me she intended to do extra chores around the house so she could have enough cash saved up to buy it by this summer.

Although I admired her enthusiasm at the time, I really didn’t think she was that serious.

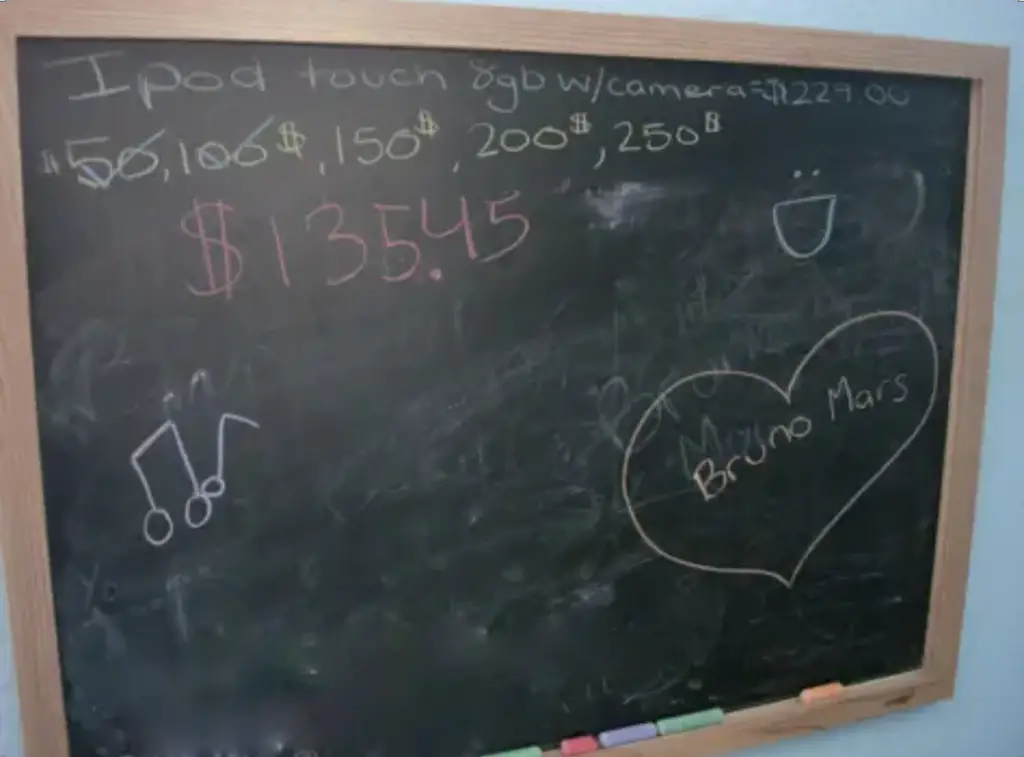

Well, check out what I saw on the little blackboard hanging on her bedroom wall this week:

Overlooking for a moment the fact that my little girl happens to have a crush on some two-bit fedora-donning hoodlum-crooner named Bruno Mars, take a gander at the top portion of her blackboard. For it is there that Nina neatly wrote the following: Ipod touch 8gb w/camera=$229.00.

She also has proudly marked down her hard-earned progress to-date: $135.45 — a fact that I verified in her very own ledger that she faithfully maintains to track her income and outgo. So even though summer is still officially more than two months away, Nina’s already well over half-way toward her goal.

I have to admit, when it comes my dogged determination to ensure I raise financially literate kids, I’ve often felt as if I’ve been fighting a losing battle. Nina’s blackboard is a happy indication that maybe things aren’t going quite as badly as I thought.

***

(This article was originally posted on April 13, 2011.)

Awe that’s so cute!

Congratulations- teaching kids about financial literacy must be a difficult task- I look forward to it when I get the chance to have children.

Bruno Mars is a great singer, I can see why your little girl has a crush on him.

One way that I see many parents do it is:

Make them divide the money they get from chores into three parts:

1) instant gratification type stuff (like candy or CD’s)

2) long term savings (where they can’t touch it)

3) longish term gratification (like the ipod)

This must be such a rewarding feeling for you. I think if that was my son I would be over the moon seeing something like that (minus the Bruno Mars things).

Yes, Glen, I am very proud of how my daughter manages her money. As an added bonus, she is also good at finding creative ways of making money too!

I know this is an old post, but giving a generous allowance and then making your son pay for ALL his needs (beyond food and shelter) might help. 🙂

I loved this story, Len. I have the same issue you do. Three kids (14,12,10), one a saver, one a spender and the other can’t make up his mind!

Teaching kids about how to control their impulse shopping can be the hardest job as a parent. But then again adults do more such shopping than kids. When grown-ups do it, it affects the whole family. It affects the kids and the spouse.

The best teaching I have found that might work is by example. Kids watch adults how they spend their money.

It might not affect their DNA but still kids learn from their adults by watching what the grown-ups do.

You’re right about teaching financial discipline by example; I try to do it every day.

I’ve been told by a few of my readers that they were wild spenders as kids, but they became better money managers after they grew up and moved out of the house — and they attributed it to watching their parents’ commitment to financial responsibility.

Well done to Nina; on our side the experience is more akin to the one with your son – though our son is not exactly ‘compulsive’; more ‘bulimic’ . He saves for ages and then blows his money on something that is…well, so much 12 year old boyish. I think they will all learn.

Congratulations to you and your daughter! We must admit that raising financially responsible children nowadays is indeed difficult. My kids, ages 9, 7, and 6, have different views and opinions on savings, investment, and expenses. I hope they will learn their lesson before it is too late.

I hope my son, Matthew, will learn his lesson too before he moves out. Unfortunately, he still has trouble saving his money.

Having raised 3 daughters I have seen both successes and failures in money management. My greatest reward however has been that none of them has had to move back home!

Help! My 17 yr old girl is my spender, with a quite consciencious 14 yr old little brother watching her every move…problem is he watches her with her hand out every couple days for gas, and soccer cleats, and this, that and the other. It is more important to us that she 1) maintains her studies, & 2)participates in extra-curricular activities than work, however she has no conscience about her spending. Plus her driving is often a convenience for us! IE: Picking her brother up, going to the store, etc.

Your daughter is a smart cookie and she’s learning young. I am trying to teach my 11 year old niece about the prudence of not spending all of one’s money and keeping some in reserve. Of course it’s difficult when her father preaches the benefits of a brand new porche (that he can’t afford). I just pray that she develops common sense like your daughter.

My kids get sick of me giving mini-lectures about money and how they WILL start out poor right out of college. Still hasn’t sunk into their brains though.