Mary may be living on a tight budget, but as far as her finances are concerned, she’s looking at clear blue skies.

My name is Mary. I’m 58-years-old and I live in New Mexico. I’ve been working since I was 16 years old.

I have a bachelor’s degree, as well as a master’s degree. I was fortunate to attend college in the 1970s and 80s without accumulating any education debt.

Saving money has always been a priority for me because I grew up poor. Over the years, I’ve managed to put enough money away for my rainy day.

My savings are spread between bank and credit union accounts, and in certificate of deposits, and the money has grown despite the low interest rates. I also have a six-month emergency fund that is in a separate account and available for immediate access should I need it.

I was employed by the Federal government from 1992 to 2012. During that time I contributed the maximum allowed to my Thrift Savings Plan, a 401k-type retirement plan available to Federal employees. The balance has grown remarkably over the years. I also have Individual Retirement Accounts (IRAs), both traditional and Roth, which I invested in when I worked in the private sector.

Coping With Change

I had planned to continue working until age 60, but seven years ago, my department was eliminated and I was given a transfer. The change was not a good one for me, so I reread the book Your Money or Your Life and began preparing to quit my job as soon as I possibly could.

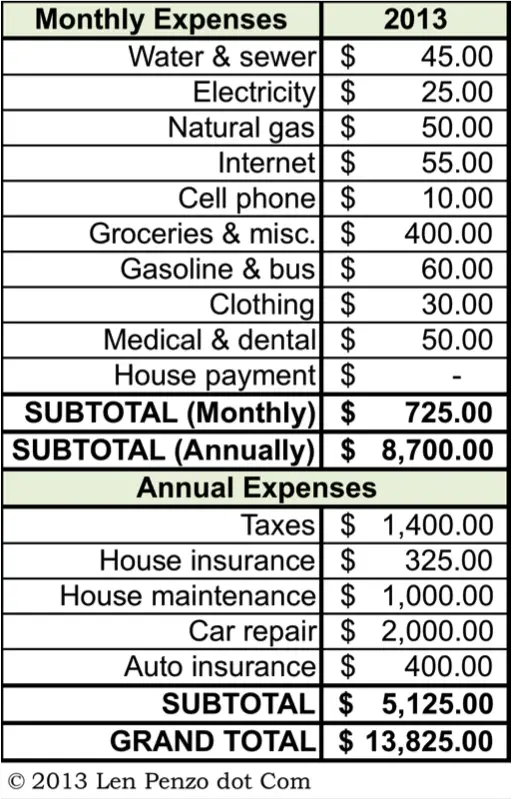

I then tracked every cent I spent and earned over the next six months in order to prepare a budget. I found that basic costs like food, utilities, clothing, vehicle operation, maintenance, and insurance were costing me $8,700 per year. Even with inflation, I’ve managed to live on this amount since 2005 by making adjustments such as baking from scratch, clipping coupons, shopping resale stores like Goodwill, and closing off unused rooms to save energy.

I was 12 years into a 30-year mortgage and carrying $3400 in credit card debt. I paid off the credit cards and then began making additional payments on the mortgage. At first, the balance seemed insurmountable, but by sticking to my budget and throwing every extra cent towards the mortgage, I was able to pay it off in October 2011.

Being freed from the burden of debt was incredible. A combination of sufficient savings and careful planning made it possible for me to resign in December 2012, two and a half years early.

My Annual Expenses

I have no major health issues, and I take no medication. I see an ophthalmologist and the dentist twice a year, and I pay them out-of-pocket from the funds I have budgeted. Oddly, it costs less now for checkups with my vision specialist than when I had insurance, $100 versus $206 (plus a $35 co-pay).

Home owner’s insurance, taxes, and maintenance costs on the house and car add $5,125 to my basic expenditures.

In all, my annual cost of living is $13,825. Here is a breakdown of my entire budget:

I’m currently living off my savings.

My IRAs will be available when I am 59 and a half, and I can tap into my Thrift Savings Plan if I need to supplement my income.

When I turn 60, I will begin drawing my Federal pension and I will also be covered for medical insurance.

I plan to delay collecting Social Security as long as possible in order to collect a higher monthly amount.

I currently drive a 10-year-old car that’s in excellent condition because I follow the recommended maintenance schedule, but I expect to replace it within the next two years. I plan to purchase the replacement vehicle with money from my savings.

Closing Tips and Thoughts

Don’t underestimate the value of time when it comes to providing for your retirement — especially when you’re younger. Over a long enough time horizon, you can save a considerable amount of money. When interest rates are low, even small IRA contributions will grow more than you might expect after 25 or 30 years.

If you’re looking to retire in the next five to ten years, I recommend planning ahead by eliminating your debt as soon as possible and then experimenting by living on your estimated retirement income.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card!

Photo Credit: dhererra_96

Amazing job, Mary!!!!!! Not only do you currently do a great job keeping your expenses low but you were smart when you starting saving early and letting all that compounding work for you! P.S. I’m envious of your electric and cell phone bills! 😀

Wow. You are light years ahead of me in debt and savings.

I need to get rid of my debt so I can follow your path to financial independence and early retirement.

Can someone help me to keep track of my every expense? I really have a hard time writing down every dime I spend… although there are days when neither hubby nor I spend any money at all. Are there any easy methods? Although we have no debt except for the mortgage, I feel like I could be doing more. THX

Kate~ I use Quicken to create my budget and track my expenses for our checking account, and I use an excel spreadsheet for our savings account. Some people use a “cash envelope” system with great success. There are so many tools out there for you, you just have to experiment and fnd what works best for you! Just don’t give up.

Hi Kate,

We use mint.com to track our spending, as well as tracking our income, investments and monthly budget. It’s a free website where you enter all of your account information and it tracks the info for you (the graphs and pie charts are awesome). We’ve used it for over 3 years and never had any trouble. But of course, we spend very little cash, so it makes sense for us to track spending through records of credit and debit purchases online.

Hope you find something that works for you!

FH

Kate, lots of people track their expenses on apps and programs like Mint, Quicken and Excel. I use an Excel spreadsheet now, but I started out just writing it all down on a sheet of notebook paper. In some ways, it was easier that way.

What is more important than what program you use is that you DO IT. Record EVERYTHING. It takes some getting used to, but after a while it becomes a lifelong habit. Find out what works best for you.

You’ve got a lot of good suggestions there, Kate.

Personally, I prefer an Excel spreadsheet — for two reasons:

1. Superior customization. Excel is unbeatable for customizing your budget and expenses.

2. Privacy. There is no need to entrust your info with others. All your data can be stored on your own computer — or even an encrypted thumb drive.

If you don’t want to buy Excel, you can get a free open source version from OpenOffice:

http://www.openoffice.org/product/calc.html

Kate,

Like you I just started trying to do a better job at tracking my expenses. I use ICloud Numbers. It’s essentially the same thing as an Excel spreadsheet but you have access from anywhere. I usually check my bank account and add the items to my spreadsheet as they appear on my bank. So far it has been going well and you don’t have to pay for any program or app.

Mary~ You are certainly one of those few people that have their ducks in a row…Kudos to you! I think you have done a great job of planning and saving, and now that you are debt free and have an emergency fund, living on less than $40,000 is a piece of cake since you are diligent about where your money goes. It is refreshing to read stories such as yours as it gives me the fuel to keep working on our plan. Sometimes it’s not always fun, but I know it will pay off in the future. Thank you for sharing your story!

Hi Mary, did you mean that you will covered under federal medical insurance when you turn 60? I was curious if that’s possible, given that it sounds like you resigned and deferred your pension, rather than retired early. Congratulations, by the way!

And here I was so proud of how well I was doing.

I’m glad I decided to stop in and see who the celebrity of the day was.

What great advice! Fantastic to see how well you do. Inspirational piece.

Am I understanding this right?

Mary doesn’t currently have health insurance even though she has enough money for it, but that’s okay, because she will have it in a couple years? As a person over 50 myself, this does not seem like a smart financial choice – more like an unnecessary financial gamble.

Maybe I just read this wrong.

Technically, having health insurance is a gamble of its own. Diskworld: The Colour Of Magic summed up insurance pretty well. By buying insurance, you are making a wager that you are going to get injured and it will cost more to patch you up than the monthly cost of the insurance, while the insurance company is making a wager that it won’t happen.

Life’s all a gamble. You take the bets you think will benefit you the most. If Mary thinks she won’t need health insurance, then by all means, she shouldn’t buy it.

Worth noting, more and more medical offices are switching to no-insurance policies, so there’s a good chance that it won’t matter at all very soon.

I see your point. I have a tendency to be cautious and not much of a risk taker. I am glad this is working so well for Mary, even though it’s something I wouldn’t be comfortable with, myself.

In engineering, we always ask this question when we’re designing a system: What is the cost to buy down a perceived risk?

Oftentimes, doing nothing is preferable to spending additional money to mitigate the risk — especially when the likelihood and/or consequence of a perceived risk is deemed to be low, or moderately low.

And, BOOM!! That’s what I’m talkin’ about, people! Well done, Mary–you’re a rock star! All these news articles with yuppies and soccer moms crying (often literally) that they can’t make ends meet on $150K and here’s an educated woman comfortably retired on $13.8 a year. $13.8K?!! You’ve truly given me something to aspire to.

We need more stories like this on the Net and less of those jokers who say ridiculous things like, “You can’t even retire with $2 million these days.” Mary could live the next 150 years without lifting a finger with $2 million in the bank.

Great story!

What helps her the most is that she has low taxes, unlike in NY where our school and property taxes are right now $9000.00 per year. And- we live in a rural area!We have no mortgage (we are 59 and 57 years old), but those taxes are a killer! In addition, she has a Federal pension coming, whereas many of us have no pensions to rely on, or, as is in my husband’s case, a pension that the company is slashing by more than 25%!In addition, the author doesn’t have to pay for health insurance, again- something that is not an option for most people.And- we had to buy 2 cars this year because our old beaters finally died and we are still working and have to commute. We have no debt, and are big savers, but things are getting increasingly difficult. If one of us lost a job, I doubt we would be ok financially until we are 85 or 90 years old….

I agree with Len- use an excel spreadsheet or something similar. I use a Microsoft Works spreadsheet and it is just fine. Plus, as he mentioned- it is more private and customizable.

Great job Mary, really well planned and executed. If you wanted to take a part time job and earn $6500. (after taxes) a year you could dump the entire $6,500. a year into your ROTH until you were too old for part time work or bored with working part time. You could of course work less and earn Less, and put that amount into your ROTH every year. Part time work for the retired is a fine idea, gives some structure to your life, and plumps out that ROTH without having to work full time.

As to Mary Ann with those killer NY taxes, MOVE! Move to a state with LOW taxes and a better climate for old people than upstate NY’s frigid winters. Move to a warmer climate with real estate taxes of $2,000/$2500 per year.

Easier said than done to say “move to a lower cost of living area.” My field is professional publishing, and publishers are concentrated in the expensive Northeast. If you have a transportable skill set, then by all means, do so. I simply don’t have that option.

Hi Mary,

I think you have done a super job with not only your retirement account (that has grown over the years) but with your expenses as well.

Great job Mary! One thought,you should never had any credit card debt!

My budget can always be adjusted up-right now I am content and enjoying a simple lifestyle. Less is more. I do have plans that involve major expenses (trip to Greece next year, Italy in 2015), but these costs are covered under my savings.