Last month our previous cell phone contract finally expired. That made the Honeybee happy because it meant we could finally move to a new carrier with better coverage.

Last month our previous cell phone contract finally expired. That made the Honeybee happy because it meant we could finally move to a new carrier with better coverage.

However, nobody was more excited than the kid with the fastest thumbs in the West, my son, Matthew, who no longer had to endure the supposed indignity of being stuck with an “uncool” Nokia Gravity phone because our new plan included three iPhones. True, they were older fourth-generation phones, but as far as my son was concerned, at least they weren’t made by Nokia.

Hey, don’t look at me; I’ve got nothing against Nokia. To me, a phone is a phone is a phone. Besides, I use a Blackberry that’s issued to me by my employer. But I digress.

Anyway, when signing up for the new contract, we were reminded by the sales associate that we had the option to insure the new iPhones. For $8 per phone per month, we’d get a replacement iPhone if ours were ever stolen, lost, run over by a car, or even accidentally submerged in a pool.

Sounds like a good deal, right?

Well, not necessarily. After looking into the dirty details, and then doing a little research and pulling out my trusty spreadsheet, I came to the conclusion that cell phone insurance can sometimes be a very iffy proposition.

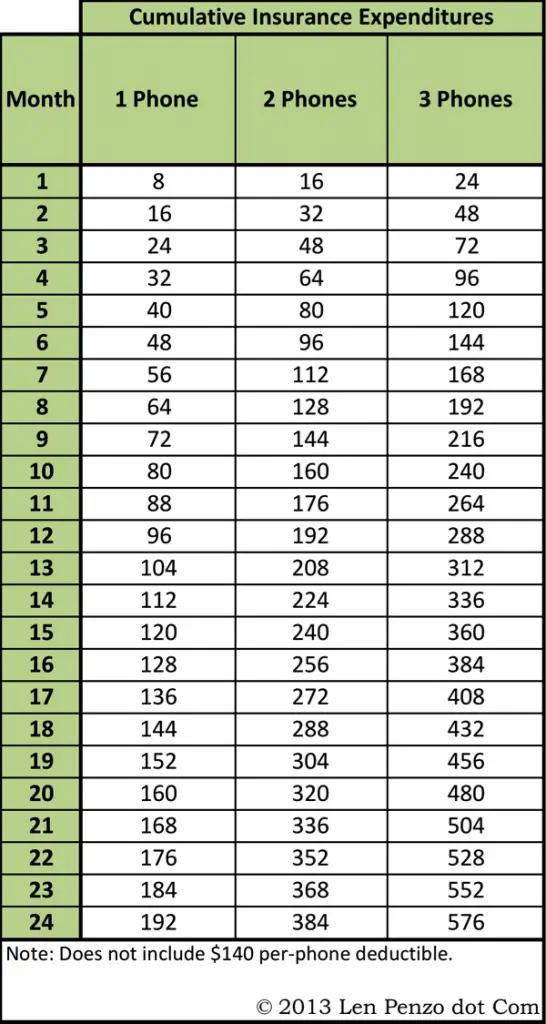

To help illustrate, here is a breakdown of the cumulative monthly premiums I would have to pay for insuring one, two and three phones over the two-year contract period:

Looking at numbers, the point that immediately stood out was that it was going to cost me $576 in premiums to insure three phones for two years. And while our previous cell phone insurance plans had reasonable deductibles ranging from $0 to $25, the plan offered by our new carrier has a deductible of $140 per phone. That’s a lot of money, folks — especially considering that you can currently buy a brand new version of the exact same iPhones my family has on eBay for between $189 and $240, depending on whether you want the phone only, or all the accessories too.

Another interesting tidbit is that our new carrier charges $80 to repair a cracked phone screen regardless of whether or not you have insurance.

With all that in mind, let’s consider the case where I buy the cell phone insurance on the first day of my contract, and then lose the phone the very next day. (Hey, it happens.) Let’s also assume I continue insuring my replacement phone for the full two years because I’m justifiably afraid of misfortune striking again at some point during the contract period.

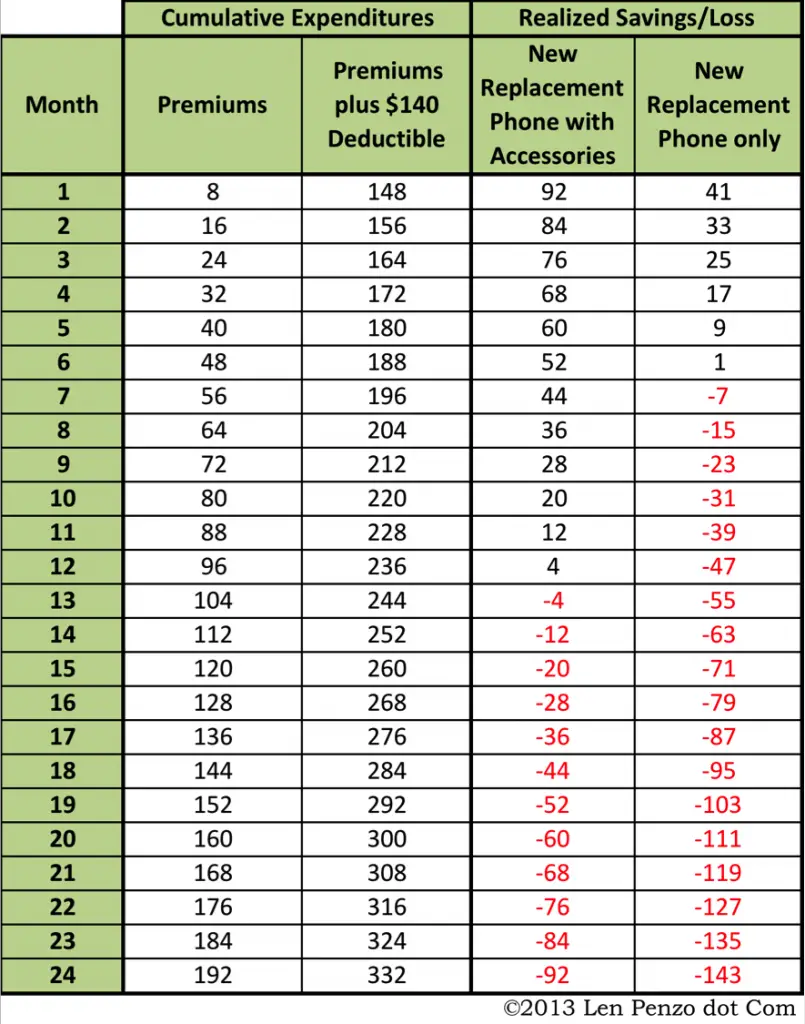

Here are the cumulative expenditures incurred after insuring a single phone over the entire two-year period, and the resulting realized savings (or losses) had I instead chose to bypass the insurance altogether and pay full price for a new phone on eBay:

As you can see, getting a replacement phone in the first month makes the insurance a fairly good deal; at that point I’m ahead either $92 or $41, depending on whether or not the replacement phone came with the accessories.

Even so, as time wears on, the cell phone insurance quickly becomes a losing proposition; I’d save a minimum of $92 by simply avoiding it altogether, assuming I required fewer than two replacement phones over the entire two-year period.

In fact, for me to come out ahead with the cell phone insurance, I would eventually have to either:

- Make two or more separate claims over the two-year contract period.

- Stop carrying the insurance as soon as six months — or no later than 12 months — after initiating the contract. (Depending on the price of the replacement phone.)

Admittedly, my kids haven’t had the best record when it comes to taking care of their cell phones; over the past few years they’ve had more than a couple of “oops” moments. But they’re older now and significantly more responsible too. At least they should be.

The bottom line is that sometimes the potential benefits derived from insurance policies aren’t worth the premiums when compared to the actual risk.

In the end, I decided to throw caution to the wind and decline the cell phone insurance. Frankly, it was a no-brainer because the premiums and deductibles couldn’t compete with the relatively low cost of replacing the phones with money from my own pocket.

After all, insurance is supposed to protect you from losses you cant afford to replace.

Now, if the wife and kids each end up having to replace their phones more than once over the next two years, I’ll obviously lament my decision.

I’m not worried though because, as the old saying goes, sometimes being too cautious can be the biggest risk of all. This is one of those times.

Photo Credit: Yeray Hernandez

Cell phone, and along those same lines insurance for any electronics, is probably something I will never consider. There is usually some sort of limited warranty buit in, so that covers the malfunctioning of the device. After that time, it is probably old and not worth as much since the new thing is now out. I guess it protects you against damage you may accidentally cause, but that comes at a high price.

Good to point that out, I was actually thinking the same some time ago. Would be great if everyone had the will to make these charts and then to make an educated decision – rushed times call for rushed actions, unfortunately.

Agree, Chris. It’s amazing how being methodical and using a spreadsheet — or even laying things out the old fashioned way with paper and pencil — helps make decision-making so much easier.

You can also take your broken/damaged iPhone 4 to any apple store and receive an immediate replacement for $169 when you are out of warranty or for free within the 1 year warranty period. They will replace just about anything except an iPhone that has literally broken in half. Water/broken screen/broken home button. I have done this twice in 5 years. Both times for my wife’s phone. Once was free, broken home button within a year of purchase. Once paid, dropped in the toilet after about 2 years use.

Good to know, James. Thanks for the tip.

I just got rid of my cell phone all together. It has been about 4 days and I do not miss it one bit.

I am no longer concerned with: Where the heck is my phone at? OMG, did I leave it at the store, in my car, where is that darned thing? I didn’t drop it in the toilet did I? Darned it, my battery is low again! Darned butt dialing! Oh there it is, in the bottom of my purse again! Geesh, what are these charges on my bill? I guess it is time to call and argue with some low paid worker out of India! Darned it, local taxes went up again on my cell!!

I just emailed my boss to let him know I no longer am available 24/7/365 for his security – at my expnse. If he wants me to have a phone than he can arrange for our employer to pay for my availability.

Yeah…call me weird, but this is one expense I am glad to remove from my monthly budget.

As for cell insurance, I bought it and never used it. What a waste of money that was!

You go girl! How did we ever get by before everybody kept a cell phone tethered to their hip?

It’s hard to believe we all got by just fine without them.

On cell phone insurance: When our kids were younger, we had the insurance and made two claims — so it ended up being a good deal. The smaller deductibles were the key.

I would never buy cell phone insurance. I found that my insurance on my iPhone 5 was $100 upfront, plus $200 if/when it breaks. Ha not worth it to me!

Cell phone insurance isn’t really much more than a money grab these days. I heard (unverified) that if you make too many claims and they lose money on you that they will drop you.

I saw this very thing in the fine print of my cell service back when I had Sprint. My deductible was $50. Limit was 2 claims in any moving time frame, per cell number.

Although it can’t insure against loss or theft, why not PROTECT your phone? My wife and I have used a case (named after an aquatic mammal that likes to crack clams on its chest) that has protected our iPhones from 1.) gasoline spilling on the phone, 2.) falling off the top of the car, and 3.) my 18-month-old throwing it across the room into the brick fireplace. A $45 or less investment (less than 6 months’ insurance) will protect you from more than half the losses reported from T-Mobile. Take care of your stuff yourself, don’t put it in other people’s hands, and pocket the cash!!

We did exactly that, Paladin. I bought three of those heavy duty iPhone “otterbox” cases off eBay for about $30 each.

I don’t think having insurance on smart phones is worth the money. You can back up your contact and sales data to your online storage. These two items are the most important features of the cell phone especially smart phone.

Even better, the one they replace it with is refurbished, anyway. :/ I’m declining it when I get my first smart phone at the end of the month, too.

Us too, Jenny. Our kids got refurbished phones after we put in a claim.

Normally I’m all over saving money with these insurance plans, but having witness my better half get TWO replacements within one year, I thank my lucky stars that he had the insurance plan.

Now, of course, he’s been kicked off the plan, but it was soooooooooooooo worth it. Me? My phone is too cheap to even consider getting insurance for it. If your phone costs less than $100 it won’t hurt when you break it or lose it.

My policy has always been to avoid the insurance, but if I break it, then I deal with the consequences of getting a crappy phone until my contract allows me to upgrade.

That’s another good idea, Mike!

No smartphone. Life is simpler that way. Too much meaningless ambient chatter. I’m tethered to the computer at work anyway. I find conversations or interactions via texting very inefficient. Your article reminded me of how much money I am saving!

My CBB contributor Katrina shared her views on CBB in her post titled Do You Really Need Cell Phone Insurance and for her she wished she had it. She has a new phone now and has insurance on it and shared why she wishes she had it and the money she spent because she didn’t. I think it’s a personal, peace of mind option just like any other insurance. For some it’s worth the cost and others, they could care less and would pay out what they owe on a phone and then buy another. I don’t own a cell, but the wife does with no insurance as she owns her phone and it’s very old, nothing fancy so it wouldn’t be worth it.

Completely agree, and on a family plan, someone’s upgrade is never far away.

For the same reason, I recently cancelled our renter’s insurance. It doesn’t cover earthquakes, which is what I’d fear most, but we also don’t have many valuable items in our apartment. I doubt someone is going to steal our china, and while it would be terrible to have our laptops stolen, they’re replaceable for the cost of the insurance anyway and I expect less than one theft each year.

I love this from a wider perspective: insurance, in general, is a “pay small amounts monthly to receive a lot at one time” game. I think many forget that EVERY insurance has a crossover point. The insurance companies have already done their spreadsheets and use the law of large numbers to ensure a nice profit. You use your cash reserve to determine whether the cost (getting hit with a claim) is something you can shoulder yourself.

I love how you took the time to do the math and research to be fully educated prior to making a decision. Too many of us make emotional purchases without thinking it through. Great job.

What your analysis does not take into account is the fact that if you do not have the $8 a month insurance, replacement phones will run you $699 on the newest iPhone. This is why older model iPhones go for insane prices on ebay because people end up saving on replacement costs for damaged/lost phones.

Is $8 a month plus a $140-$175 deductible a rip off? Absolutely. But the break even point is much higher than 24 months assuming the full retail alternative to not having full coverage.

In this example, I assumed the replacement cost of the same fourth-generation phone we were given as part of our contract. We avoided buying the latest fifth generation phones and I do not know what the insurance premium would be if I had.

The costs are baked into the calculations, depending on whether you buy a brand new fourth generation replacement phone with accessories ($240) or without ($189).

Len: I just found your blog and I love it! Keep up the great work!!!