Sitting US presidents may be considered the most powerful men in the free world, but they still put their pants on one leg at a time. And while some American presidents were financially successful during their lives, there were others who encountered serious financial troubles. To prove it, I present this panoply of personal finance facts about US presidents:

Sitting US presidents may be considered the most powerful men in the free world, but they still put their pants on one leg at a time. And while some American presidents were financially successful during their lives, there were others who encountered serious financial troubles. To prove it, I present this panoply of personal finance facts about US presidents:

- Long before he became the 33rd president of the United States, Herbert Hoover was a mining engineer. It turned out to be a wise career choice. Not long after graduating from Stanford, Hoover went to work in Australia’s goldfields. His starting inflation-adjusted annual salary: $157,000.

- Hoover eventually moved up the ranks to become a mining industry executive. He was also a shrewd investor — so much so that Hoover eventually amassed an inflation-adjusted net worth of $84 million.

- Speaking of smart investors, in 1989 George W. Bush paid $600,000 to become a co-owner of Major League Baseball’s Texas Rangers. Shortly before being elected America’s 43rd president, Bush sold his stake in the team for approximately $15 million.

- Since 2001, sitting presidents have received an annual base salary of $400,000. They also get a $50,000 annual expense account, and a $100,000 nontaxable travel account.

- The President also gets $19,000 annually for entertainment. That’s enough cash to pay for 31 rounds of golf at Pebble Beach. Don’t scoff; it comes with a cart.

- Who says a US President’s salary is excessive? If the current US president received the same annual rate of pay as George Washington did back in 1789 — 2% of the US budget — he would be collecting a cool $116 billion this year, give or take several billion. But who’s counting?

- Of course, Washington didn’t really need his presidential salary. Before becoming president, he was one the richest men in North America.

- Washington can thank his his wife, Martha, for his early wealth. She had become a very wealthy widow after her first husband, Daniel Parke Custis, passed away. For what it’s worth, Custis was an extremely successful planter who also happened to be 20 years older than Martha.

- It’s a good thing Washington was wealthy. He loved spending it and lived an aristocratic lifestyle.

- Unfortunately, shortly after marrying Martha, Washington’s tobacco export profits began drying up. As a result, he racked up large debts to a London merchant named Robert Cary, who was responsible for selling Washington’s tobacco overseas.

- Within a few years, Washington eventually clawed his way out of debt by cutting back on his expenses, diversifying his income stream, and paying more attention to his finances. Washington successfully expanded his tobacco farming business to include other crops. He also diversified his operations into other areas including fishing, horse breeding and even whiskey production.

- Washington wasn’t the only president with occasional money problems. Thomas Jefferson was in debt for much of his life. Upon his death in 1826, Jefferson owed $100,000 to his creditors. That’s equivalent to more than $2 million today, after adjusting for inflation.

- In 1893, William McKinley declared bankruptcy in Ohio while serving as governor of the state. That didn’t stop McKinley from becoming the nation’s 25th president just three years later.

- As a young man, Abraham Lincoln decided to foray into the grocery business with a partner named William F. Berry. Upon Berry’s death, Lincoln was stuck with so many unpaid bills that the future president called it “The National Debt.”

- Speaking of bad business deals, after serving as America’s 18th president, Ulysses S. Grant invested his money with a brokerage firm run by Ferdinand Ward. Unfortunately for Grant, Ward was a swindler who ran the company as a Ponzi scheme, a la Bernie Madoff. When Ward’s scheme finally unraveled in 1884, Grant was left nearly penniless.

- After losing his money, Grant sold all of his Civil War mementos in an attempt to make good on an outstanding personal loan for $150,000 that he had received from railroad mogul William H. Vanderbilt. Although Grant was unable to raise enough funds to completely repay the loan, Vanderbilt declared the loan paid in full.

- The 33rd president of the United States, Harry S Truman, lost $30,000 after his clothing store failed in 1922. That’s equivalent to $472,000 in today’s money. Even so, he never declared bankruptcy. It took Truman a dozen years before he was finally able to get his finances back in black.

- By the way, Harry’s middle initial doesn’t stand for anything. I know; that’s not a personal finance fact about a US president. But it would have been if his parents had named him Harry $ Truman.

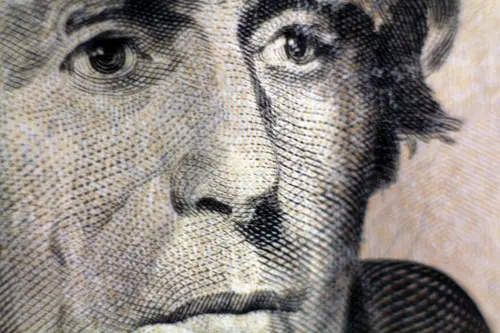

Photo Credit: Sh4rp_i

That’s a lot of fun. History isn’t my strong point and I didn’t know George Washington was so well off. It’s great that he was able to diversify his income and enjoy living it up.

I know this is off topic a little bit, but that pebble beach golf course looks amazing!

Interesting read. I think I knew a few of those facts you posted but found most of them to be be pretty interesting. Thanks!

Teddy Roosevelt lost $60,000 (1880’s dollars) in cattle ranching during the winter of 1885-1886. His wife, Edith, would give him an allowance, because he was a fool with money.

He’s my life coach otherwise! Love him, he was a most fascinating individual.

This is an awesome article. It is fun to read about how our presidents also had issues with money. Some were very good with it and others poor.

You forgot “hemp farmer” on the list of Washington’s other modes of income. Although, he did know the difference between the male and female plants meaning that tobacco wasn’t the only thing he smoked.

Great Read!! Don’t learn this in history class thats for sure!! Im curiouse how much they had to spend back then to run for president. Today if they all put that together you’d prob put a dent in the debt!

I had no idea that Presidents get entertainment money! That is quite a bit of cash for sure. Thanks for this insightful list!

Wow, I can’t believe Hoover was working in Australian gold fields. This post is super entertaining. It does make them seem like they’re not much different than regular folks when it comes to personal finance. Thanks Len.

Haha — Harry $ Truman! I had no idea about some of these presidential facts. Pretty cool stuff!

I am not a big history buff either, but those tidbits you dug up about the presidents are very interesting. You are right, they really were just ordinary guys, but they happened to dream big enough to become who they wanted to be. Interesting thought.

Number 6 is quite interesting. Thankfully the 2% figure has changed over the years. That’s a good list thanks for sharing.

Interesting facts. Yes, it’s important to remember that anyone can experience the typical financial issues that preoccupy everyday people. You could be the President, a famous athlete, actor, successful entrepreneur, etc. However, the decimal point may likely be a few more places to the right for such individuals.

To me, Harry Truman is a legend.

Faithful in the best sense of that word to his wife Bess.

Defender of progeny – took on the music critic of the Washpost when he panned daughter Margaret’s singing.

A student of history.

Enabler of George Marshal’s plan for the reconstruction of Europe.

Made the hard choices, Hiroshima and Nagasaki among them, in a straightforward, no looking back fashion.

Socio-political fallout? Harry didn’t care and neither do I.

Motto on his desk: “The buck stops here.”

I like how George Washington got out of debt pretty much the same way someone would today – by cutting back on expenses, diversifying income streams, and paying more attention to finances.

Me too, Joe!

Interesting article. It shows that every one of us can face debt problems in some point of our life. However, at the same time, we can work towards becoming debt free and be successful.

When the tobacco nightmare hit GW, he decided to diversify into crops that would be sold in the USA and not be dependent on exports. Growing cash crops had exhausted the soil of Virginia. He conducted experiments in crop rotation to enrich, and protect the soil. It was one of the things he most wanted to be remembered for in life.

Thomas Jefferson had to be financially rescued multiple times or he would have lost Monticello. He was always increasing the grandness of his home, and spending foolishly on a lifestyle he could not support. When he died, he left everything to his grandson. After selling everything off, the grandson still had to bear the burden of a large debt.

Sure sounds like a lot of people these days. Some states have archaic laws requiring grown children to be responsible for some of their deceased parents debts. I am glad that Texas is not one of them.