Your savings are a long-term investment, and whether you have accounts for short term purchases to furnish your home, or fill your wardrobe — or whether you have your emergency fund and bill payment funds saved in the same place — you’ve worked hard to earn your money.

You’ve also been disciplined enough to save it in the first place — so why would you allow your savings to be eroded by fees?

The easiest mistake to make when it comes to choosing a savings account is thinking that account fees won’t make much difference to your overall savings.

Consider a $10,000 investment in a higher-interest savings account, over 12 months. This investment amount and term will give you a very good illustration of how seemingly insignificant fees can adversely affect the return you get on your savings investment.

Here is a breakdown of the assumptions:

- An interest rate of 4.11%. Don’t laugh. Yes, the rate is higher than what is currently offered on the market today, but it represents an approximate average over the years. This rate doesn’t include a bonus or promotional rate, as a 12 month investment is a long term savings plan, and a bonus rate would not apply for the entire time.

- Transaction fees. A higher-interest savings account is just like any other bank account in that it allows you to make deposits and withdrawals at any time. Online higher-interest savings accounts and linked transaction accounts have a certain number of free transactions included. However, if you use more than your designated number of transactions, you’re charged a small transaction fee which can range from 25 cents to $1; in the second scenario we’ve assumed two additional transactions per month, at 25 cents each.

- Monthly fees. If an account charges a monthly fee you generally have all of your access and transactions included for this amount; for the third scenario we’ve assumed a reasonable average monthly fee on savings accounts of $5.

- Transaction fees and monthly fees. To show the culmination of fees on your savings account, our fourth scenario combines the monthly savings account fee charges and transaction fees described above.

Here’s an example of how various fee scenarios can affect your savings account return on investment (ROI):

| No Fees | 2 x $0.25 per month | $5 Monthly Fee | Monthly Fee + Transaction Fee | |

| Original Investment | $10,000 | $10,000 | $10,000 | $10,000 |

| Total Fees Over 12 Months | $0 | $6 | $60 | $66 |

| Return on Investment (ROI) | $419.54 | $407.27 | $358.21 | $345.94 |

| ROI Losses Due to Fees | n/a | $12.27 | $61.33 | $73.60 |

.

Even a seemingly small monthly fee or insignificant transaction fee can significantly affect your savings account ROI. It’s also important to note that the difference in ROI when savings were invested in an account with fees that were more than the amount of the fees. This is because in a higher-interest savings account, interest is calculated daily; so while a monthly fee of $5 and transaction fees totaling 50 cents per month add up to only $66 in fees annually, the difference in your ROI is more than $73 because you’re missing out on that compounding interest.

To get the best return on your investment:

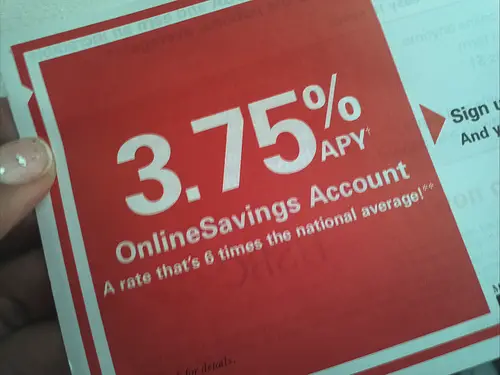

- Take the time to find a fee-free online savings account. Choosing a dedicated higher-interest savings account allows you to avoid all fees which will affect your ROI. An online savings account will have no monthly service fees and will not charge you transaction fees for making deposits or withdrawals, no matter what the amount.

- Link to a fee-free transaction account. Making sure your higher-interest savings account is fee-free is only the first step as fees can eat away at your savings from the outside too. The account you use to make deposits to your savings fund may attract monthly or transaction fees and these eat into your overall funds, and can affect the amount you are able to contribute to your savings each week.

- Make regular deposits to your savings. As mentioned earlier, compounding interest means that every day your balance grows so too do your interest earnings, increasing your return on investment. Therefore, each day or week that you can make a deposit to your savings gets you closer to a higher ROI, rather than you making one larger deposit at the end of each month or quarter.

- Choose a savings account which rewards you with a higher ROI. If you know you can make regular deposits to your savings fund, choose an account which offers you bonus interest when you fulfill a minimum deposit requirement. Or, if you know you won’t be making withdrawals, choose a higher-interest savings account which offers you bonus interest to boost your ROI in the months you don’t make withdrawals.

Photo Credit: ursonate

I find it amazing that so many banks get away with charging all these fees. Isn’t it puzzling that their customers accept these fees? I suppose these fees are usually so small that you don’t notice them but they do add up. A while ago a colleague of mine told me that he switched from Chase after he tallied up the fees they charged him in a year. He came close to $500.

@Ctreit: I think it is the Chinese – or maybe it was the Hungarians – wo call it, “death by a million paper cuts.”

It’s amazing how quickly fees can erode away the benefits of savings. There are plenty of online saving accounts charging no fees it seems crazy to pay fees.

It does seem crazy, Richard, but many people are just too preoccupied (to put it nicely) to spend a little time to do the research necessary to avoid paying those fees.

The best way to clear hurdles and build your savings is to stop making excuses and get started.

The fees are my reason to stay clear of banks and have my money in credit unions. All my credit union accounts have zero fees of zero fees if you stay above a minimum balance. The only bank I use now is for my home mortgage because the rate was way better than I could get from my credit unions.

I like credit unions!