It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Another busy week is crossed off the list. So without further ado, let’s get right to the commentary (mature audiences advised) …

It’s difficult to get a man to understand something when his salary depends on his not understanding it.

— Upton Sinclair

Some people think the truth can be hidden with a little cover-up and decoration. But as time goes by, what is true is revealed, and what is false fades away.

— Ismail Haniyeh

Sooner or later everyone sits down to a banquet of consequences.

— Robert Louis Stevenson

Credits and Debits

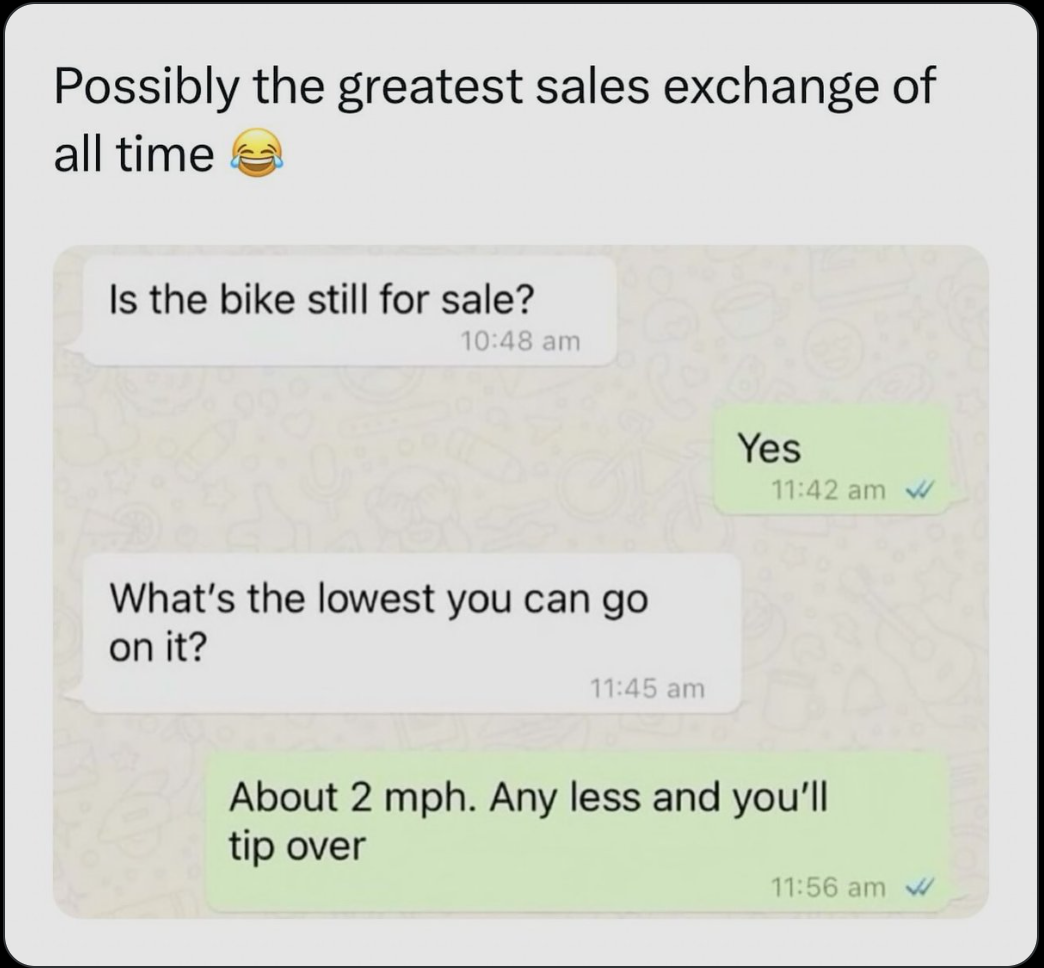

Credit: Did you see this? Amazon is trying to crack a crowded, unforgiving big-box market with plans for a 230,000-square-foot mega-store in the Chicago suburbs that would be larger than the average Walmart and nearly big enough to swallow two Targets whole. The store says it will split the massive building into two distinct sections: one side for groceries, household staples, and prepared food, and the other to fulfill online orders for those who prefer Amazon’s stay-at-home convenience. You know what that means: Somebody is going to be reviewing a lot of new job applications in the near future. Er… or not.

h/t: @LostTourist3

Debit: In other news, there is a new trend that’s emerging among newbies trying to break into the housing market for the first time: People are co-buying homes with friends and family members. In fact, data collected from July 2024 to June 2025 shows that first-time homebuyers consisted of 25% single women and 10% single men, while the share of married couples remained flat at 50%. Compare that to the pool of all homebuyers, where 61% are married couples, 21% are single women and just 9% are single men. If only there was some rock-solid financial advice people could follow to avoid having to so financially creative…

Gary Larson – The Far Side

Debit: Did you know that Verizon first entered the Dow Jones Industrial Average in April 2004, replacing its primary rival, AT&T? It did. However, analysts say the company is likely to be jettisoned in 2026. Why Well… because, since joining the Dow, Verizon’s shares have gone virtually nowhere. In fact, in 22 years, its shares have gained just 17%. As a result, as of last week the communication giant only accounted for 241 out of the Dow’s 49,077 points. In other words: Verizon now has almost zero impact on the rest of the Dow Jones index. As for its expected replacement? One analyst suggests it will be Google spin-off Alphabet.

Credit: Speaking of stocks, over on Wall Street. … So capitalism isn’t dead yet. That being said, let’s check in to see what’s happening in one of the few remaining Latin American bastions of anti-capitalism… (GET LINK)

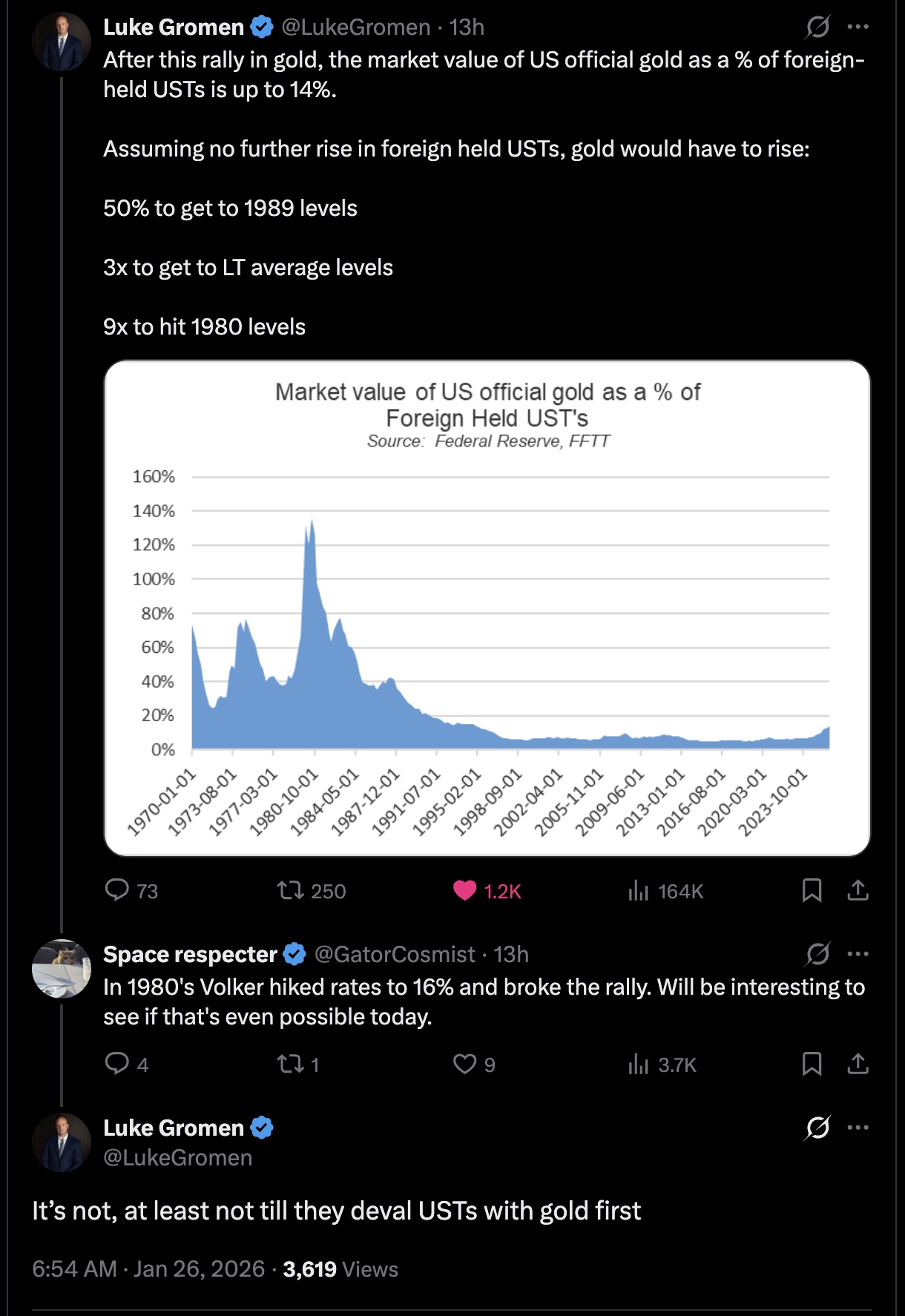

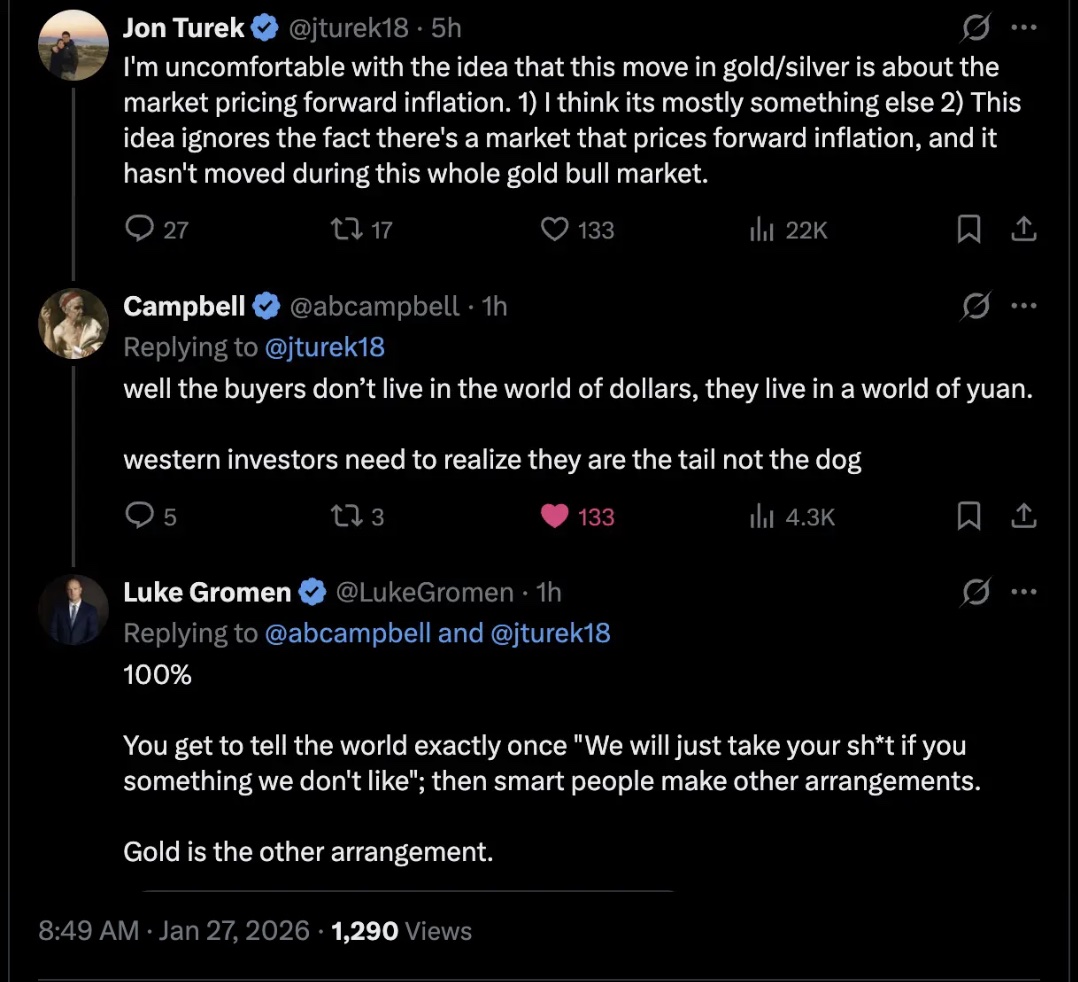

Credit: Gold has beaten the holiest of holies, the S&P 500 average, rising more than 300% versus the S&P’s 267% over the last 10 years – yes, even after Friday’s 8% plunge. So… how much higher can gold go? Well, if you believe macro analyst Luke Gromen, this high…

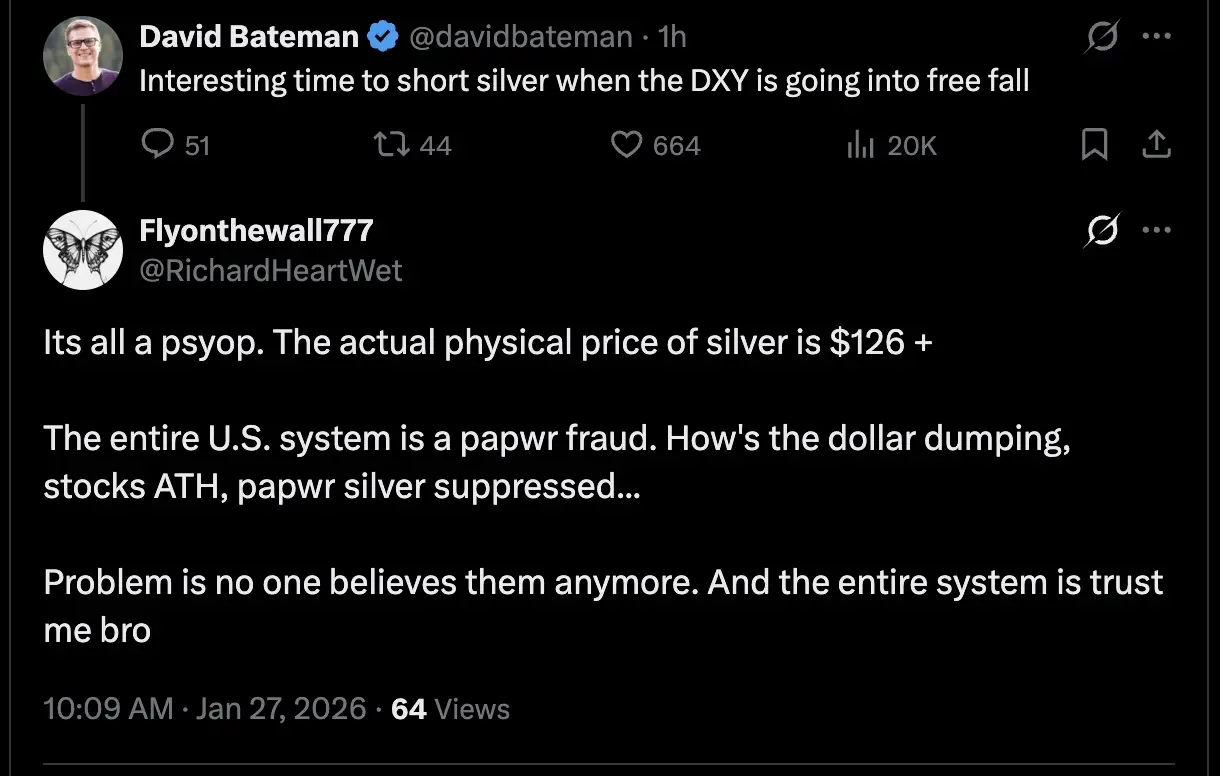

Credit: Meanwhile, after rising 165% last year, silver has been telling gold to “hold my beer.” And the white metal’s surge is a problem because silver analyst David Jensen is predicting that ”the 2 billion ounces of unbacked cash contracts standing in the London market means some banks will end up as mere historical artifacts as physical delivery demand accelerates.” Even so, that isn’t stopping the magic money tree (MMT) crowd from insisting that shorting silver is still a good idea. It certainly was on Friday, with the white metal falling 30% (sic) to finish at $78. Then again, $78 was the West’s corrupt paper market price – and 47% lower than the $115 price that was quoted simultaneously in China for real silver…

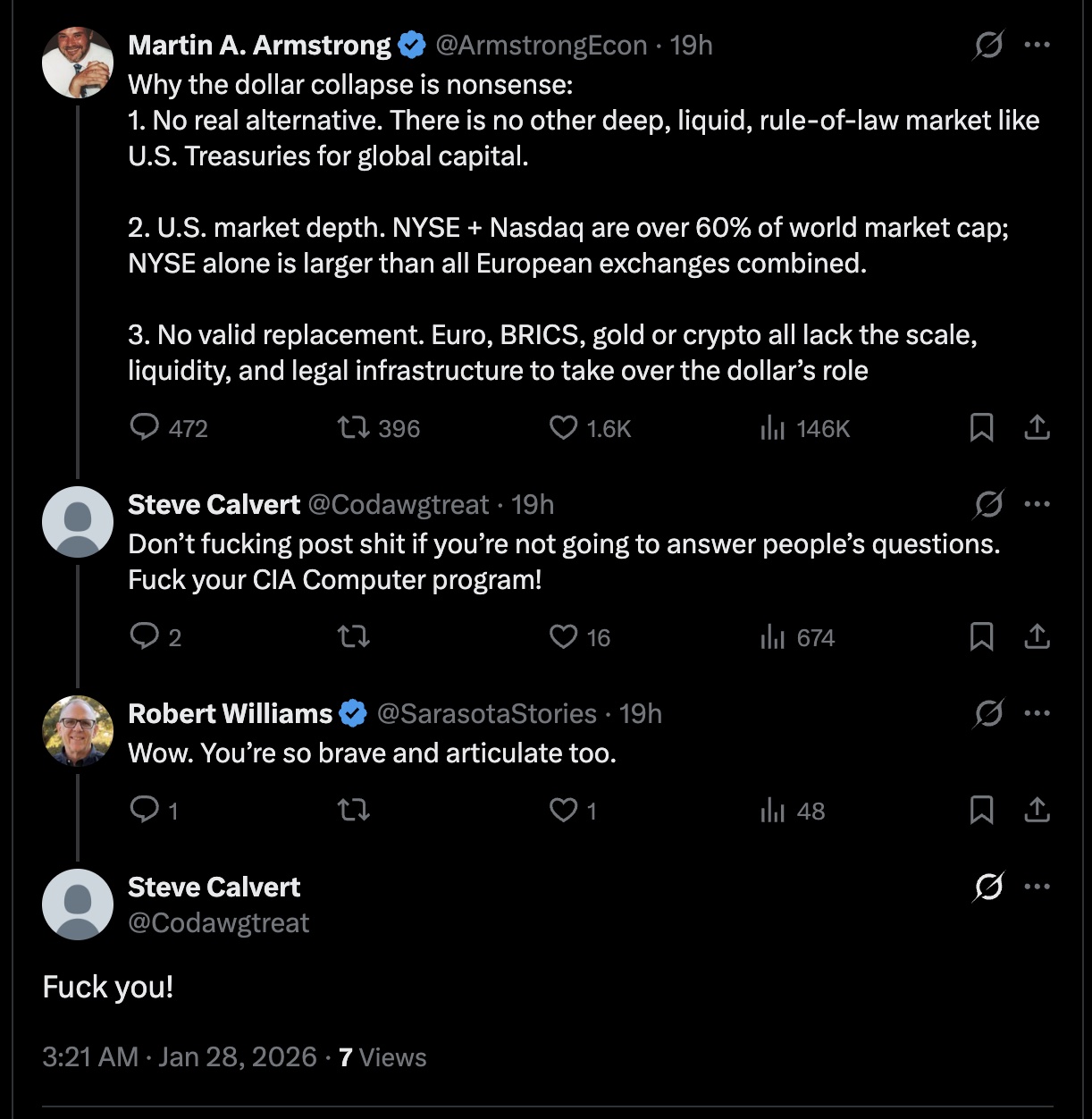

Credit: Friday’s big drop in metal prices notwithstanding, what’s going on with their sharp increase since last November? Well… sagacious micro analyst Franklin Sanders says you can blame “lunatic central bank mismanagement. The Bank of Japan (BoJ) is the poster child, as it owns over half of Japanese government debt, it’s the largest owner of Japanese stocks, is a top ten shareholder in 90% of the Nikkei 225, and has a balance sheet larger than Japan’s GDP. The BoJ now is where other central banks will be shortly, with the choice being: hyper-inflate or lose control of the debt markets.” Uh huh. They just don’t know it yet – and that includes the Fed…

Credit: For its part, the Fed – in concert with the US Congress – has been actively destroying the purchasing power of the USD since 1971. Why? Because, as macro analyst Greg Mannarino explains, “USD currency devaluation isn’t a side effect, nor a policy error – it’s the funding mechanism of the US government. That is the definition of a failed state.” He goes on to say that, in order to keep the state running, we can expect capped yields, “with fake, non-productive liquidity windows, backstops, and expanding debt.” True – but the stock market is still pushing all-time highs. So there’s that.

Debit: Not coincidentally, Germany is facing a growing chorus of voices who are calling for the nation to withdraw the remaining 1250 tons of gold it is storing in US vaults for safekeeping. That gold has a current market price of $200 billion – and the value continues rising as the USD continues to lose purchasing power. This is yet another sign of global confidence in the US – and debt-based monetary system – completely breaking down.

This Wall Street Journal headline didn’t age well. For those who can’t see the date, it’s barely three years ago: 20 September 2022.

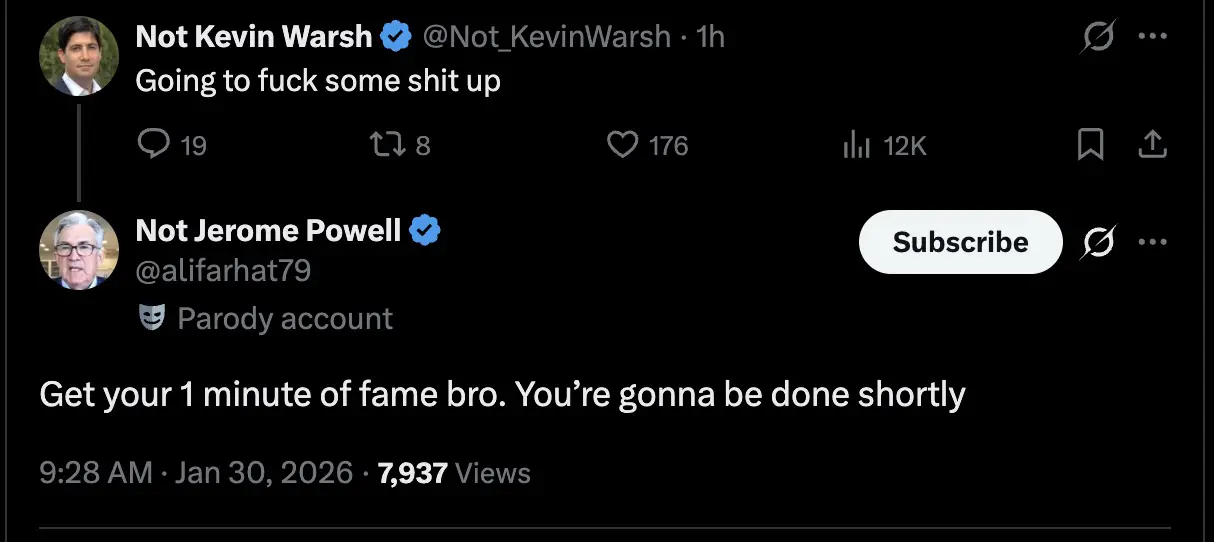

Credit: We’ll close with a little wisdom from billionaire Ray Dalio, who opined last week that what we’re experiencing is a mass exodus from fiat currencies in favor of real money with zero counterparty risk – that is, physical (not paper) gold and silver. Why? Because nations no longer want to hold each other’s debt for fear of sanctions – see: Russia’s assets being frozen by both the EU and US in 2022 – while other investors no longer are willing to hold any debt-based currencies for fear of lost purchasing power via massive government deficit spending, aided and abetted by central bank debt monetization. How about you? In the meantime, all hail the new Fed Chair nominee!

By the Numbers

While the US remains the country with the largest official reserves of the precious metal in 2025 at 8100 tons – on a per capita basis, the US ranks only 12th, at 0.75 troy ounces per person. With that in mind, here are the world’s ten richest nations on a per capita basis through the end of 2025 (troy ounces of gold per person):

0.99 Austria

1.07 The Netherlands

1.12 Singapore

1.17 France

1.18 Portugal

1.20 Qatar

1.28 Germany

1.33 Italy

1.58 Lebanon

3.73 Switzerland

Source: BestBrokers

The Question of the Week

Last Week’s Poll Results

-

68°F or lower 66%

-

71°F 18%

-

70°F 7%

-

72°F or higher 6%

-

69°F 3%

More than 1900 Len Penzo dot Com readers responded to this week’s poll and it turns out that 7 in 10 of you set your thermostat below 70°F during the winter season. In our house, its 70°F during the day and 66°F during the evening sleeping hours.

Last week’s question was submitted by reader Frank. If you have a question you’d like me to ask the readers here, send it to me at Len@LenPenzo.com — and be sure to put “Question of the Week” in the subject line.

Useless News: The Friendly Skies

(h/t: Honeybee)

Squirrel Cam

If at first you don’t succeed…

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Thank you!!!! 😊

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Tim Sanders left the following rebuttal in the Len Penzo dot Com comment section after he read my article explaining why corner lots are for suckers:

You are an idiot. I just wasted three minutes of my life reading this.

Make that four minutes of your life, Timmy — because I just deleted your comment.

If you enjoyed this, please forward it to your friends and family. I’m Len Penzo and I approved this message. 🙂

Photo Credit: stock photo

Hi Len,

Thanks for the cuppa!

So as you said, we got a BIG SMASH on Friday of 30% – it feels terrible. And yet silver still ended the month up 7%! Gotta look at the bright side! Last time I checked, the silver shortage is worse than ever.

Have a great weekend everybody!

Sara