It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had a wonderful week. And with that, let’s get right to this week’s commentary, shall we?

America’s abundance was created not by public sacrifices to ‘the common good,’ but by the productive genius of free men.

— Ayn Rand

Servitude, in many cases, is not forced upon by the masters, but by a temptation of the servants.

— Indro Montanelli

Credits and Debits

Debit: Did you see this? Walmart announced lat week that it plans to roll out electronic shelf labels to 2300 stores by the end of this year. The company said the technology allows employees to update shelf prices using a mobile app algorithm, reducing a price change that typically takes an associate two days to a matter of minutes. If you think about it, that’s a mixed blessing, as we will assume that – like gasoline – prices will be programmed to rise much faster than they are allowed to fall. We assume the algorithm has already endured rigorous beta testing. Oh, and speaking of algorithms…

Credit: Meanwhile, with housing affordability a top issue for many Americans, first-time buyers may be excited to learn that the current administration is unveiling a new plan this week that will allow Americans to use their 401(k) accounts to be used for down payments on homes. This is especially good news for prospective homebuyers who are struggling to increase their savings to cover that downpayment – or anything else for that matter. Talk about a great idea! Heck… dare we say it’s almost as financially savvy as this? (We said “almost.”)

Credit: On a related note, a new bill has been introduced in Congress that would exclude all capital gains from federal taxes. No, really. The question is: Will it pass? Under current law, individual homeowners may exclude up to $250,000, and married couples up to $500,000 in capital gains if they have lived in the home for at least two of the past five years. Believe it or not, those caps haven’t been adjusted since 1997 – so those numbers aren’t as big as they used to be, at least in real terms. As for those who dare to ask why that is, our only response is, well… the answer should be obvious. Kind of like the answer to this:

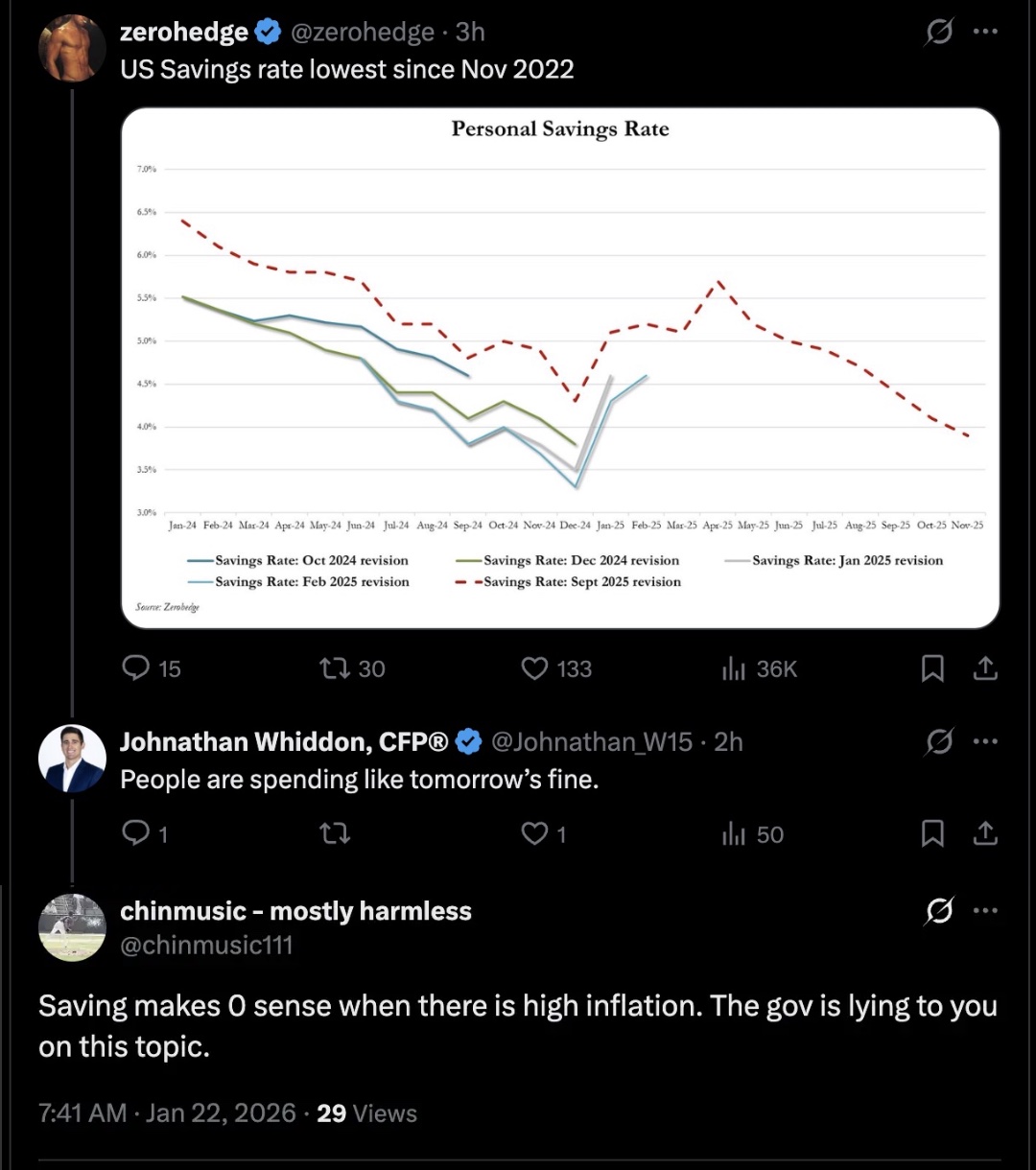

Debit: In other news, a new survey found that 1 in 4 Americans took on debt this holiday season with a median balance of $500. Then there’s this: 34% of Americans say they plan to take on a side job in 2026 in order to pay off their debt, while 48% feel stressed from their spending. We wonder why. Oh, wait – no, we don’t….

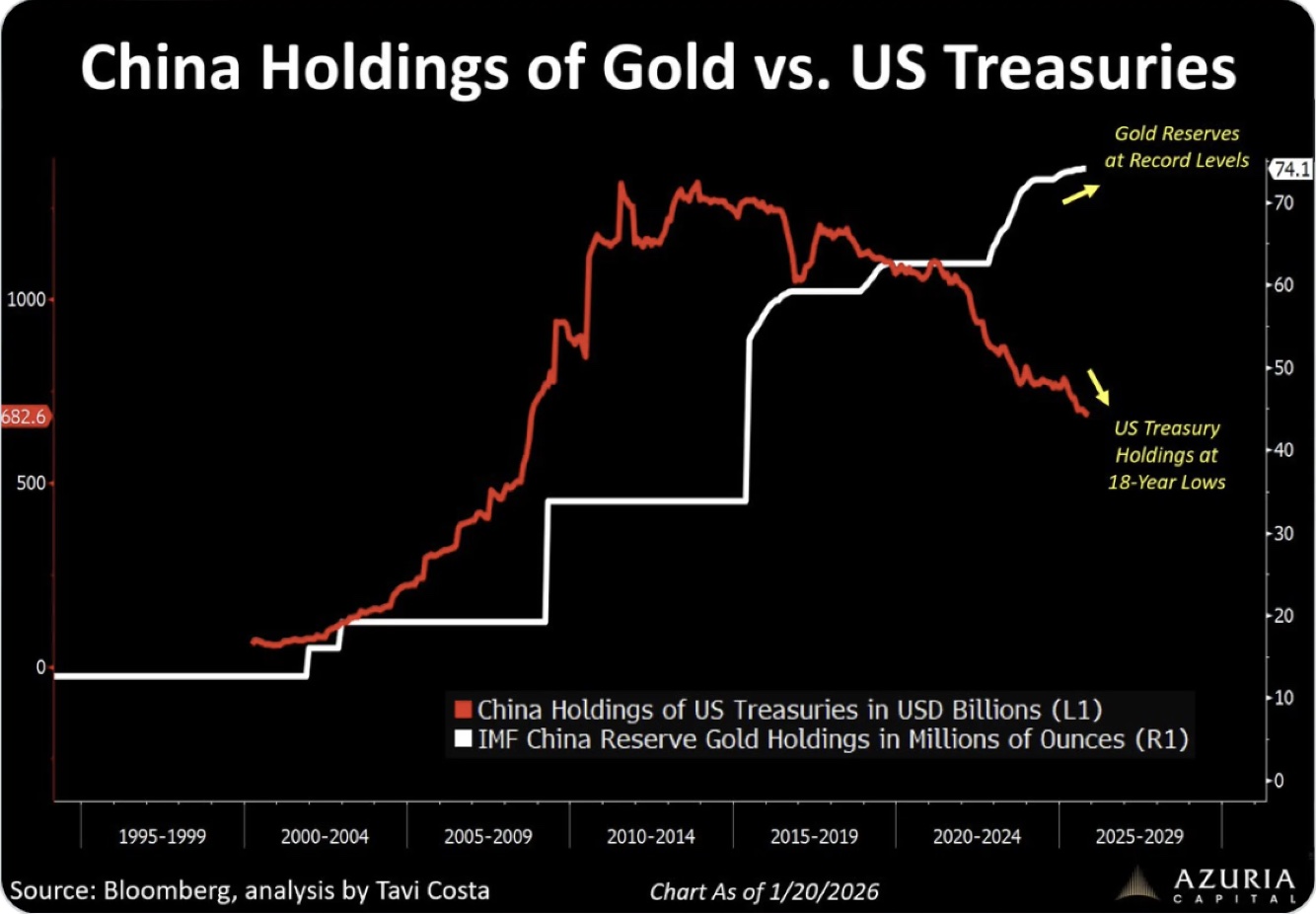

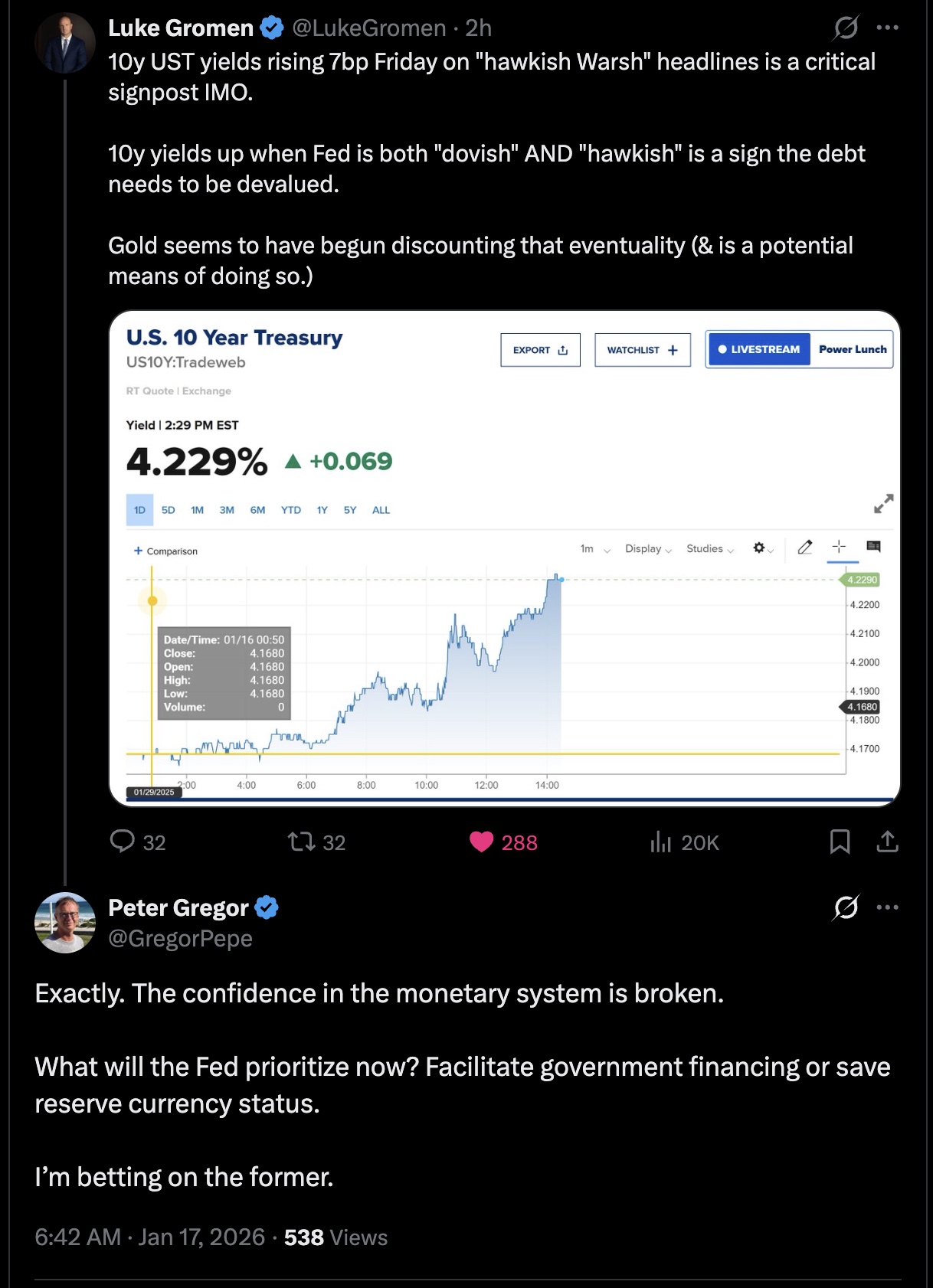

Debit: Not coincidentally, last year the US National Debt increased by $2.2 trillion – and it’s currently growing by about $71,800 per second. Unfortunately, America’s creditors are finally starting to notice, as long-term US Treasury (UST) bond rates are continuing to climb despite the Fed’s recent short term interest rate cuts. Imagine that. As for how we got here, it’s becoming increasingly likely that this is yet another “crazy conspiracy theory” that – like almost all of the others before it – will eventually end up being true:

Credit: And as sagacious precious metals analyst Franklin Sanders notes. “Like those far off jungle drums in a 1930s Tarzan movie, those rising interest rates are signaling trouble to come for the economy – and for the US dollar (USD).” Indeed they are – which is why you should consider protecting yourself with a little wealth insurance while it’s still available. The good news is it’s certainly easy to do. After all, the process really isn’t much different from buying other kinds of insurance. For example …

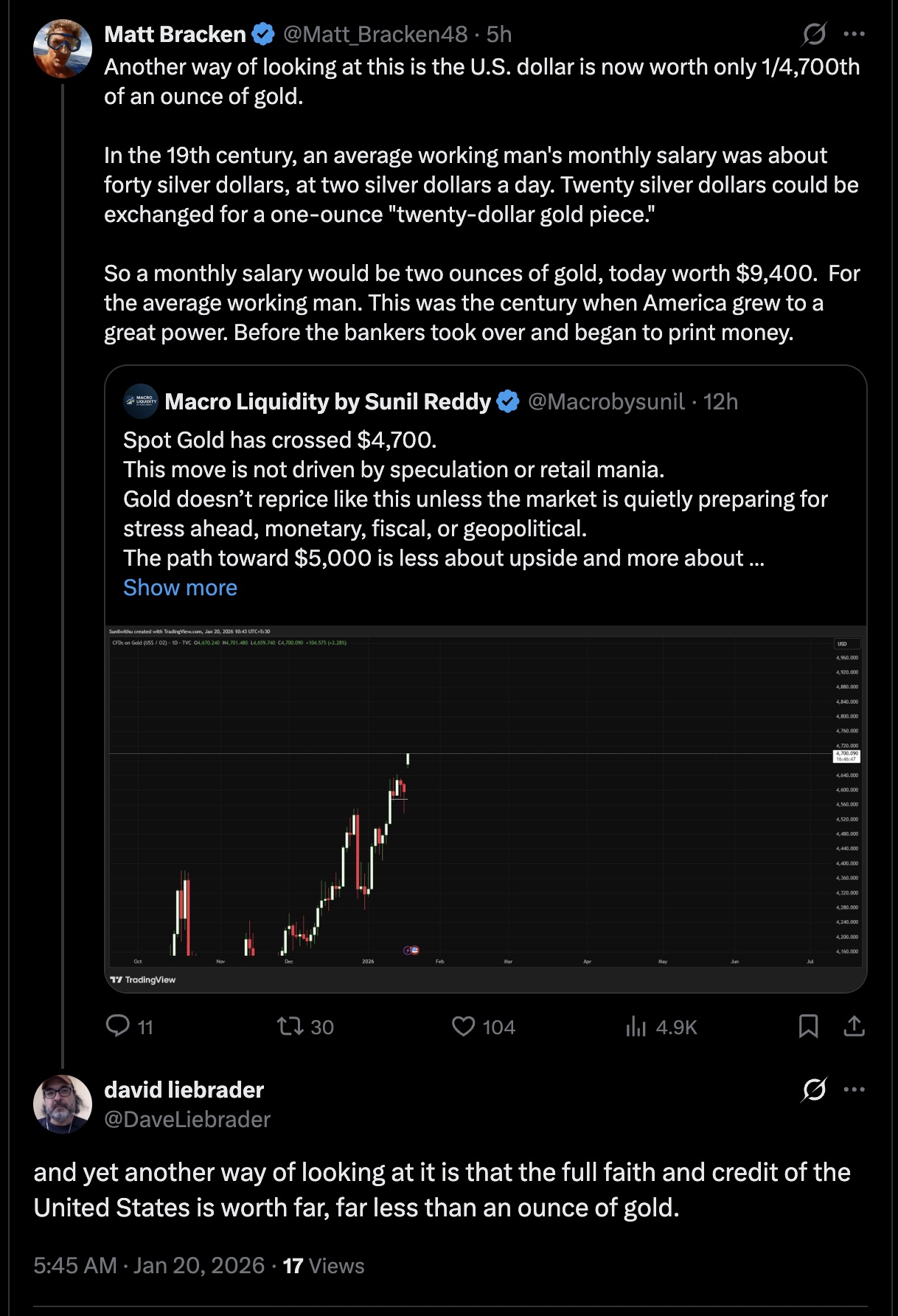

Credit: On the other hand, there will always be those who still believe in the invincibility of the “Almighty Dollar.” But as macro analyst Daniel Oliver warns, “The UST bond complex has ruled the world since the 1960s because other countries hoard USTs as reserves. But if this mechanism breaks – and it appears to be teetering – then the full weight of debasement will hit the US. The market is already tearing up Congress’s credit card. Until 2022, the market allowed increasingly large deficits in gold terms. But whereas the nominal deficit remains at crisis levels, the gold-denominated deficit” has been increasing sharply ever since.

Gary Larson – The Far Side

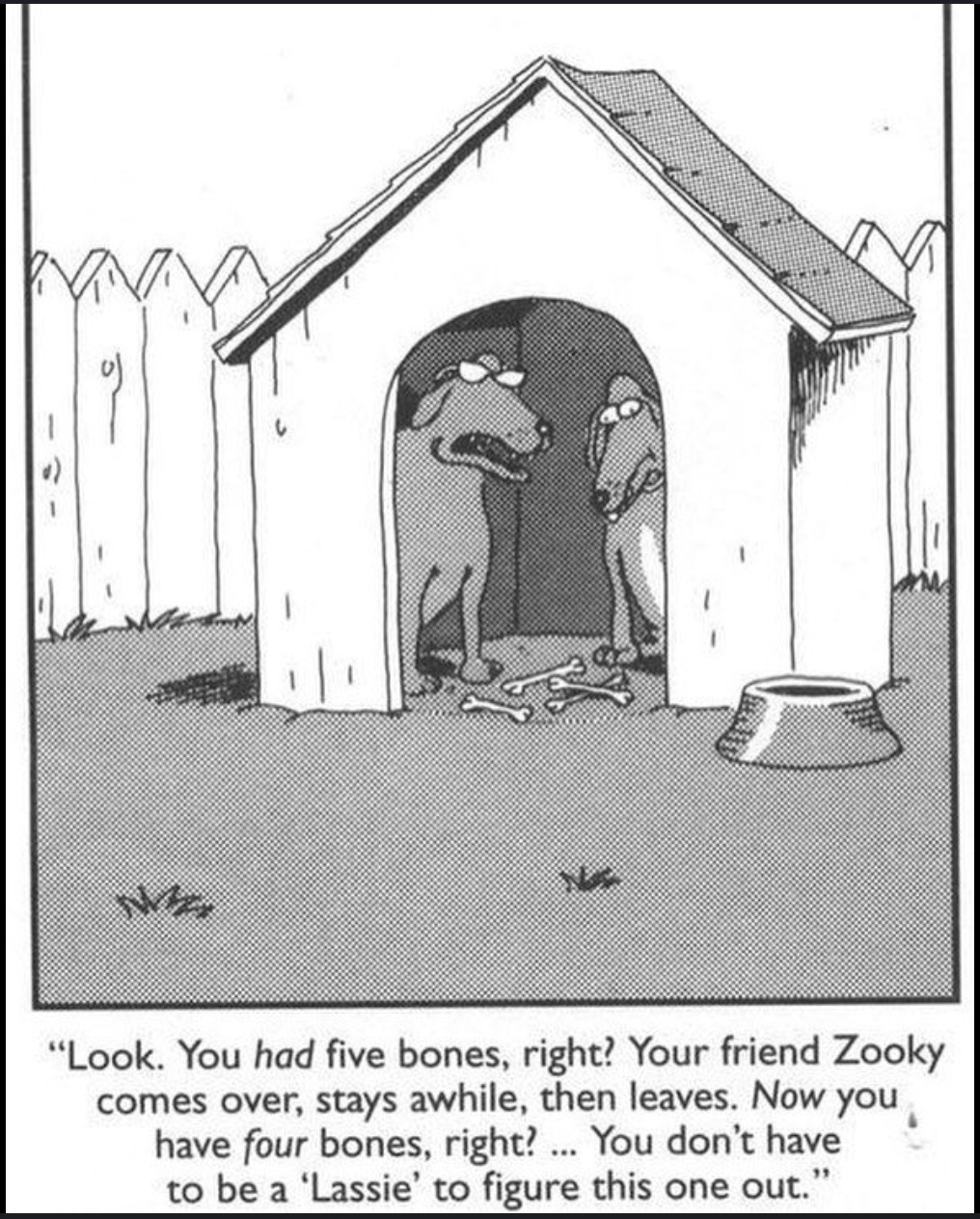

Debit: Of course, as Mr. Oliver points out, valuing the US deficit in gold clearly illustrates that that “the market is reducing the capital it will allow the government to borrow. In what world would that market advance a profligate spender with declining economic power exponentially more capital?” As a result, he concludes that it’s “unlikely that the market will continue to allow deficits at even current levels with respect to gold, which means that the nominal deficit must be cut (also unlikely) or gold must continue to rise.” We agree; it’s the latter. But we’re sure most people won’t figure that out for quite some time — if at all. Then again, others will:

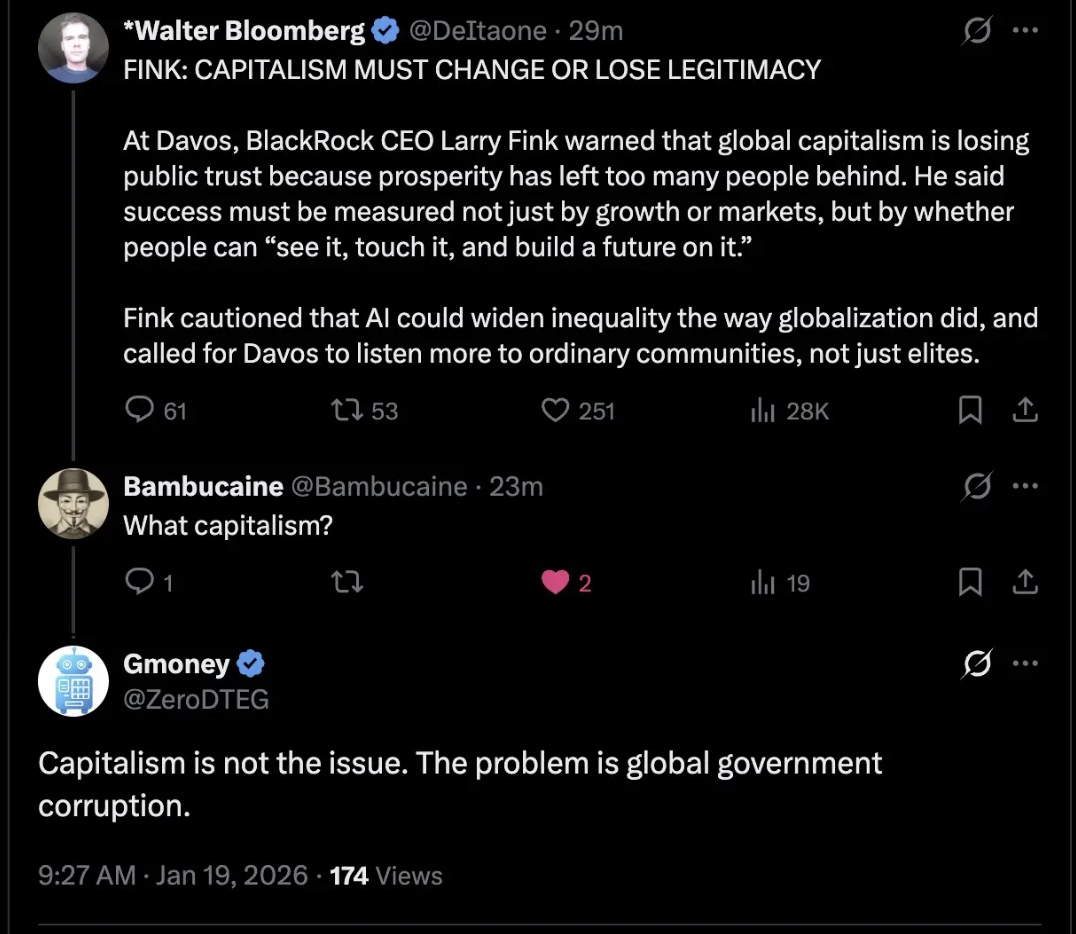

Debit: Unfortunately, as Mr. Sanders points out, “Few people understand that in our fiat monetary system all currency is borrowed into existence … with an interest burden, so the system must keep inflating – otherwise the interest can’t be paid, the debt bubble bursts, money supply deflates, and depression ensues. And the immoral buzzards of fiat money are coming home to roost, thick and fast.” Indeed they are. The sad thing is, governments and central banks around the world have known this forever – but they allowed it because it benefitted them. Er, despite what the destroyers are trying to tell you…

Credit: Why are so many people oblivious to the fact that they are on a runaway train to that is destined to destroy their wealth? Well… as Mr. Oliver explains, “Whereas gold responds immediately to changing monetary conditions, it can take months or years for these changes to fully work their way through supply chains.” In other words: Gold is providing a very early warning to anyone who hears the alarm bells signaling that a painful loss of USD purchasing power is on its way. Thankfully, there’s still time to preserve your wealth. But the clock is definitely ticking.

By the Numbers

Collection accounts remain on an individual’s credit report for seven years and can seriously harm their credit score. With that in mind, a new study identified where Americans’ financial well-being may be most at risk, based upon on the states with the most collection accounts per capita. Here are the current top 10:

10 North Dakota

9 Rhode Island

8 Idaho

7 Florida

6 Georgia

5 Arizona

4 Nevada

3 Montana

2 Alaska

1 Wyoming

Source: WalletHub

The Question of the Week

Last Week’s Poll Results

-

American 61%

-

Something else 14%

-

Italian 12%

-

Mexican 8%

-

Chinese 5%

More than 2100 Len Penzo dot Com readers responded to last week’s question and it turns out that 1 in 7 of you were having something other than “the Big 4” cuisines for dinner on your poll night.

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Homeward Bound

A man spent the entire night drinking at a pub. When he finally stood up to leave at 2 a.m., he fell flat on his face. He then tried to stand one more time, but to no avail; he fell flat on his face again.

The man then decided to crawl outside, hoping that the chilly fresh air would sober him up. However, after a few minutes soaking in the cold early morning air, he stood up only to fall flat on his face yet again.

So, unable to sober up, the man decided he would crawl the four blocks from the pub to his home.

When he finally arrived at his front door, he stood up and fell flat on his face again.

Eventually, the hopelessly drunk fellow managed to get the door open, where he proceeded to crawl into his bedroom.

When he reached the side of the bed, the man struggled again to stand up. As before, he managed to briefly pull himself upright, then quickly fell again — although this time he mercifully landed on the bed, where he passed out the instant his head hit the pillow.

The next morning the man awakened to see his wife standing over him, shouting, “So! I see you’ve been out drinking again!”

“Why would you ever say that?” the man asked, feigning innocence as best as he could.

“Because the pub called,” his wife replied. “You left your wheelchair there again.”

(h/t: Gregga)

Squirrel Cam

When the food is away, the squirrels will play…

DAVE.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

From Benjamin:

Hello, Len. First time reader here, and I must say, you’re Black Coffee round-ups are frightening me.

No need to be scared, Benjamin. Most people have said for years that I have no idea what I’m talking about.

If you enjoyed this, please forward it to your friends and family. 😊

I’m Len Penzo and I approved this message.

Photo Credit: public domain

Good morning Len! I needed this strong cuppa Joe on a pretty chilly morning (it’s currently -13° outside). Last week a financial advisor admitted that he, too, is now out of the stock market and leaning on commodities, Treasuries & PMs for the near future. First time for THAT!

Sadly, I suspect our Gov’t., being the money-grubbers that they are, will take the path of “WE need to fix things by throwing more $ and adding more legislation, taxes, etc.”, making matters worse just like they’ve done with the ACA. 🙁 Time will tell…

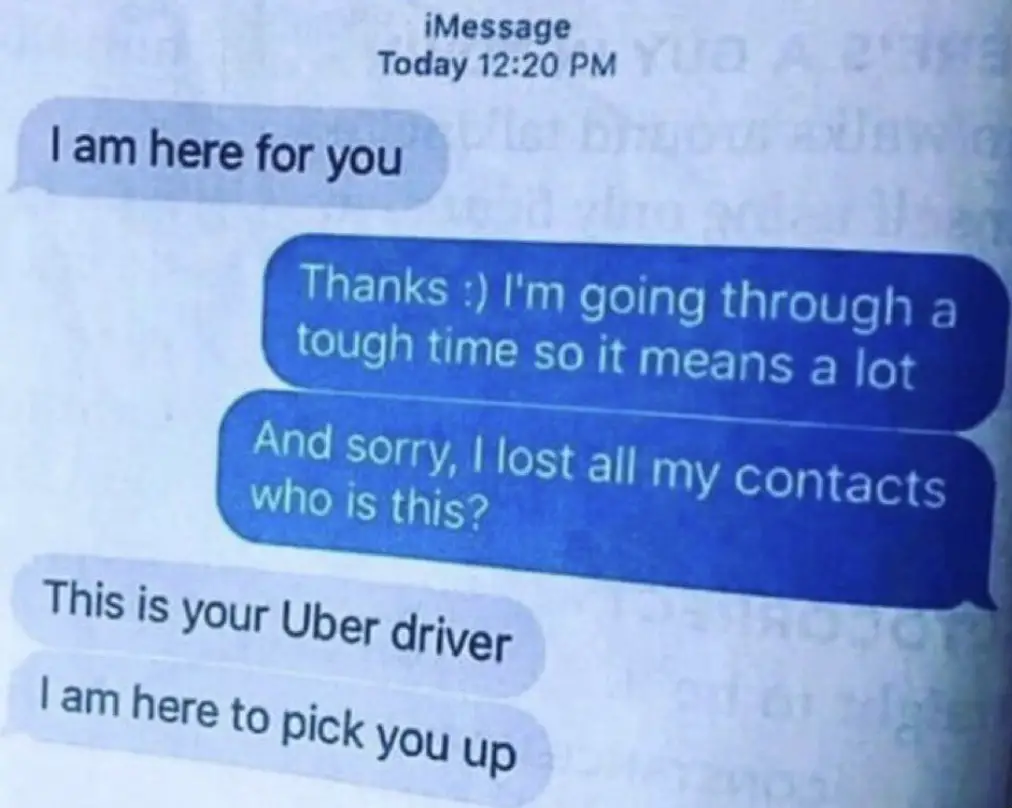

Meanwhile I almost choked on my coffee laughing at the Uber driver; thanks for that!

Enjoy your week, everyone!

Government’s solution to all problems is more money. Always. All that does it increase their payroll and make things even worse.

Stay warm in beautiful South Dakota!

I’ve seen electronic price tags at a couple of stores in the past year. I’m sure it won’t be long before they all have them.

I think you’re right, Nathan. Dynamic pricing is a double-edged sword, but I think we’re all going to become very familiar with it in the coming years.

Hi Len,

Thanks for another delicious cuppa.

So…….. $103 for an ounce of silver. Can you believe it?

Have a great weekend everybody!

Sara

Monday morning… spot price is now $113. Decades of paper price suppression are finally coming home to roost – there is a real shortage of physical silver needed by industry, and these over-issued paper contracts can’t be used to build solar panels, batteries, and other electronics. What we are seeing is called honest price discovery. Unfortunately, the paper shenanigans that resulted in that mispricing, signaled to the market that there was little need for dedicated silver mines. So let the prospecting begin! Of course, it takes a decade or more for new mines to come on line, so the price of silver will have to rise to meet current demand until it can coax investors to let theirs into the market. What is that price? Who knows?

Since Lauren is at -13 deg, I won’t complain about it being -2 degrees here in Nebraska.

Good idea. I won’t complain that the forecast here in SoCal is 72 today.