It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well… another busy week is behind us. So with that in mind, let’s get this party started!

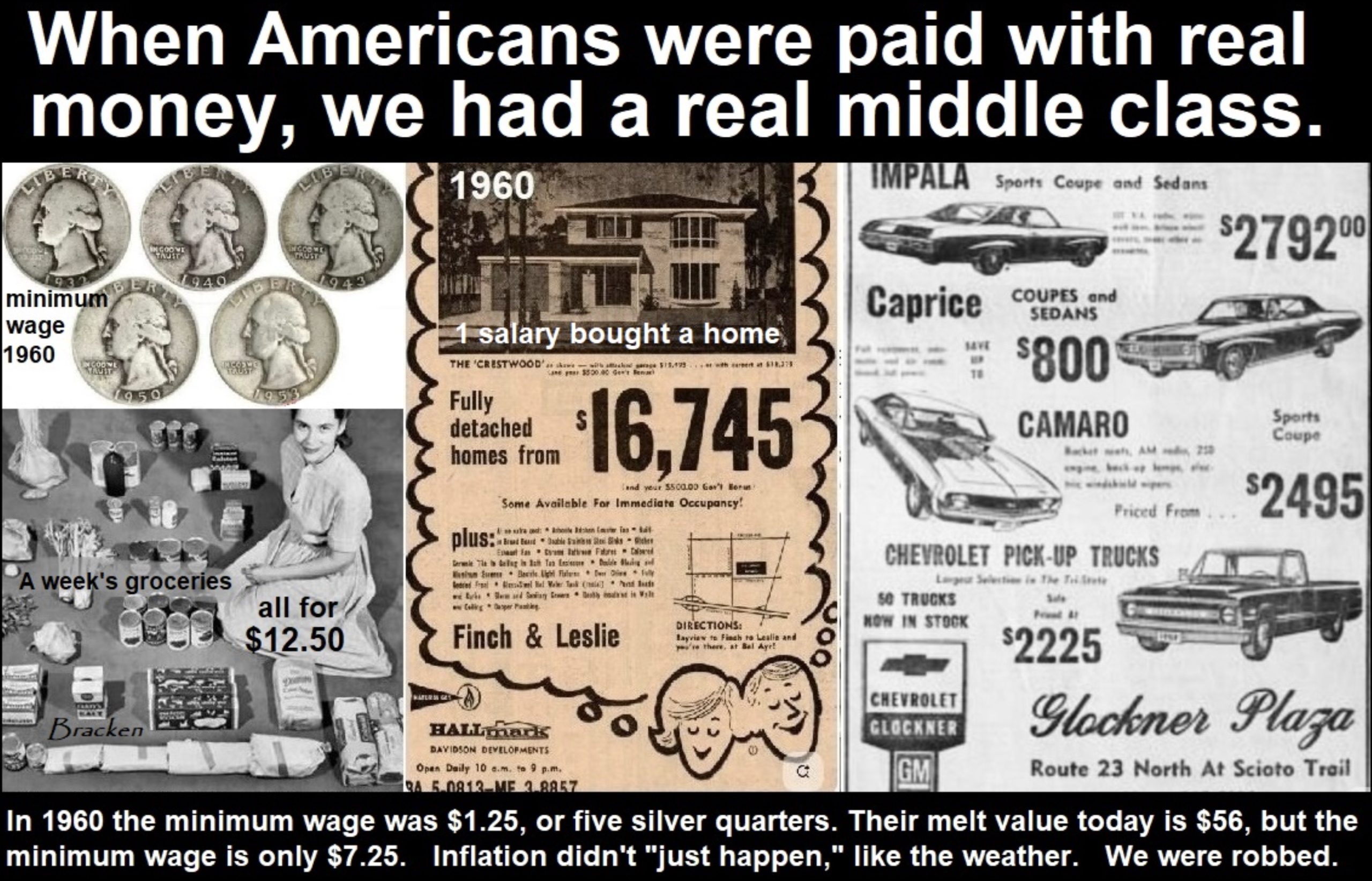

Whenever destroyers appear among men, they start by destroying money… seizing gold and leaving to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold is an objective value, an equivalent of wealth produced; paper is a mortgage on wealth that doesn’t exist, backed by a gun aimed at those expected to produce it. Paper is a check drawn by legal looters upon an account which isn’t theirs: upon the virtue of the victims. Watch for the day when it bounces, marked: ‘Account Overdrawn.’

— Ayn Rand, Atlas Shrugged

Credits and Debits

Debit: Did you see this? Anheuser-Busch announced that it is closing its Newark, New Jersey, brewery which opened in 1951 early next year, along with two other breweries in Fairfield, California, and Merrimack, New Hampshire. The good news is the company is offering full-time jobs and relocation packages for the 475 employees currently working at those three facilities to its other US breweries; and workers who don’t want to move will be given a severance package. Just don’t tell that to one particular consulting firm’s employees…

Credit: Oh… and speaking of employment options, Americans spent an estimated $2.6 billion on OnlyFans subscriptions in 2025. No, really. Be sure to keep that in mind if you’re ever thinking about starting a lucrative side hustle.

Credit: Last week, sagacious macro commentator Franklin Sanders shared this little story with his readers: “Sometimes small events hold large portents. Here’s another small harbinger with huge forebodings. Saturday in the grocery store for the first time I beheld the cashier’s screen showing ‘rounding up.’ No more pennies, they’re too dear to mint and too cheap to track. Just round to the next nickel. Next it will be the nearest dime, or quarter, or dollar. The omen speaks: The US dollar (USD) is perishing.” Well… it sure seems that way, Mr. Sanders.

h/t: @Matt_Bracken48

Debit: Of course, the Fed has completely abandoned any pretense of working to maintain the purchasing power of the USD and is actually only hastening the fiat currency’s demise. That’s because last week they ramped up their loose monetary policy by lowering their benchmark Fed Funds Rate by 0.25%. If that wasn’t enough, they also tacitly admitted they’ve restarted quantitative easing (QE) – that is, putting their money printers in overdrive – by regularly buying T-bills again. Even so, that hasn’t stopped the usual loose money proponents from claiming that the Fed’s latest policy change absolutely positively isn’t QE.

Credit: Then again, the rapid debasement of the USD shouldn’t be a shocker to anyone because, as macro analyst Matthew Piepenberg points out, “all debtors – including Uncle Sam – prefer a debased currency to pay down fixed debt. And desperate governments are more desperate today than ever before.” Indeed they are. These governments are stealing purchasing power of the their citizens and they don’t care. Oh, and speaking of stealing …

Credit: According to precious metals analyst James Turk, the gold and silver prices “in the late 1970s were driven by currency destruction, which sent the precious metals higher. We’re seeing currency destruction again, with the ongoing erosion of purchasing power of every fiat currency as the debts of governments around the world soar.” In other words: The fraudulent debt-based monetary system – which has been around since 1971 and is the cause of the mess we are now in – is, blessedly, is clearly on its death bed. Which is why gold and silver priced in USDs has risen more than 70% and 100%, respectively. This year alone.

Credit: So how did we get here? Well… last week, macro analyst Craig Tindale pointed out the new reality of today’s world in that, “We have entered an era of complex constraints, where the physical availability of (commodities) – not the availability of credit – sets the limit on national power.” It sure looks that way. Although we expect most Western governments to fight that paradigm shift in the hope that their fiat currencies will continue to preserve government economic power until the bitter end. Note: Under no circumstances should “Government economic power” be confused with the citizenry’s purchasing power…

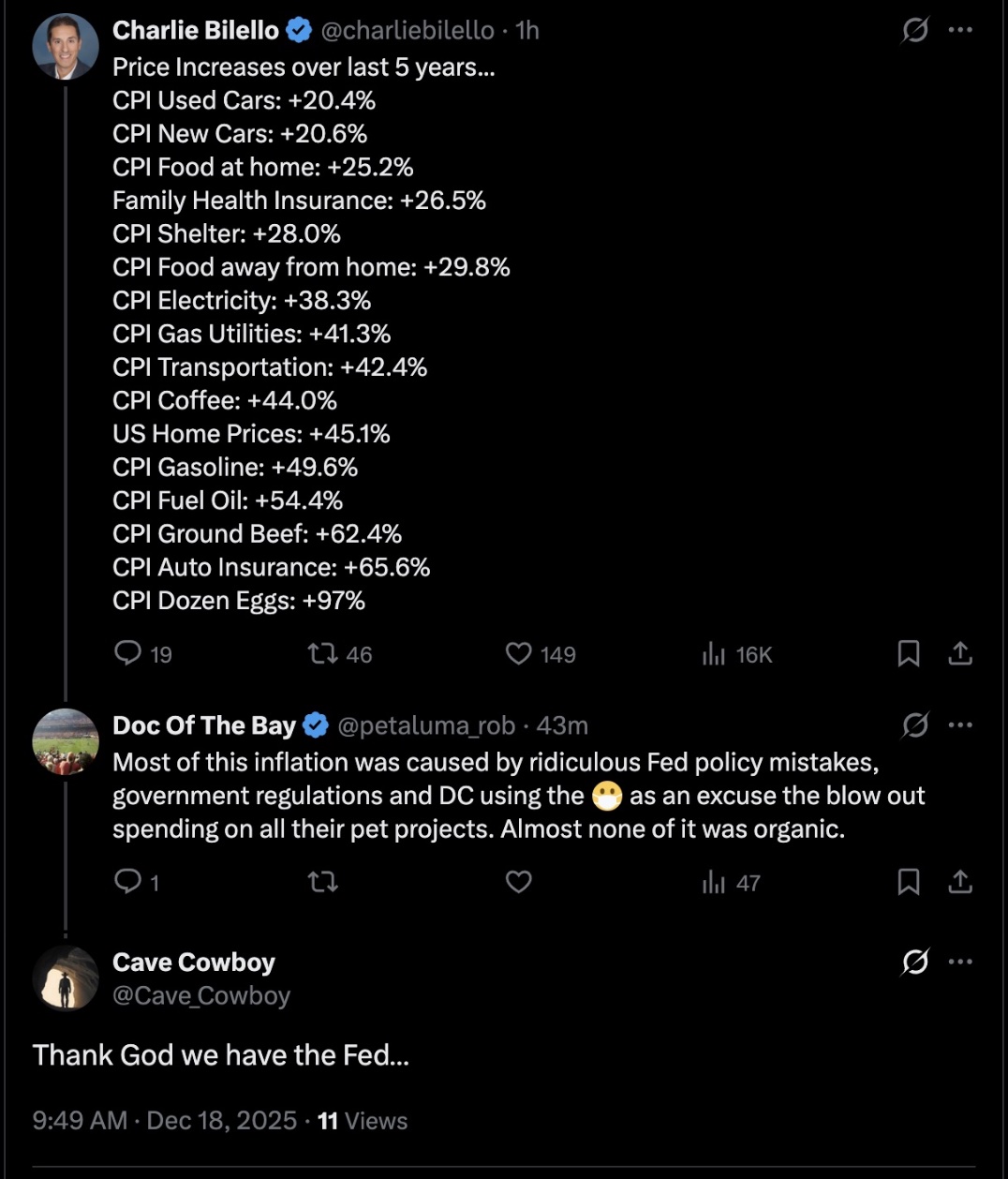

Debit: By the way, Tindale wasn’t finished, noting that “the West adopted a financial system that has effectively disarmed its security. Inside that intellectual frame, dismantling the domestic material-productive economy looked efficient and profitable. But in the real world of global politics, geography and supply shocks, it was a slow-motion act of strategic self-harm that hollowed out the industrial base required to sustain a conflict or a protracted crisis.” Yep. And now here we are. The bad news is that until the system is fixed, living standards will continue to fall for most Americans. So… how low can they go? Apparently, very, very low:

Credit: The good news is that beginning next year, a rule change will allow gold and silver, to be held inside 401(k) plans for the first time in modern history. As precious metals analyst David Morgan points out that isn’t the only good news for current precious metal owners because the rule change doesn’t force employers offering 401(k) plans to act, “but it removes the regulatory barrier that kept precious metals at zero exposure for decades. So even modest adoption inside a $9 trillion system introduces a new source of long term, structural demand” for gold and silver.

Credit: Not coincidentally, this week macro analyst Vince Lanci observed the new reality before us, remarking that “The global economy has changed its rules; wages no longer buy security and debt no longer bridges any shortage of income.” Instead, Lanci explains that, with our fraudulent debt-based monetary system now in its final death throes, “a new asset-based order is taking shape where ownership of those assets determines who advances in society, who treads water, and who gets left behind.” Indeed. And while it may sound frightening, the coming change is actually a good thing – but only for those who are willing to adapt.

Credit: We’ll finish our final round-up of 2025 by observing that it’s looking increasingly likely that the US is going to revalue its gold to help relieve some pressure. With that in mind, Mr. Piepenberg suggested this week that the US “could legally reprice gold at $20,000; a deliberate number which would revalue the US gold hoard to $5.2 trillion, which is the valuation needed to match the assets and liabilities of America’s most liquid monetary base (M0).” If he’s correct, the yellow metal still has a long way to run from its current market price. It also means that if you’re still thinking about buying a little wealth insurance that will bridge the transition to the new system, you may want to purchase it sooner rather than later.

By the Numbers

With average auto loan interest rates rising 2.3% last quarter, here are the ten states where auto loan interest rates are increasing the most:

10 Pennsylvania

9 Nevada

8 Mississippi

7 Colorado

6 South Carolina

5 South Dakota

4 Minnesota

3 Washington

2 Vermont

1 Wyoming

Source: WalletHub

The Question of the Week

Last Week’s Poll Result

-

Weeks in advance 63%

-

Months in advance 26%

-

Last minute 11%

More than 1900 Len Penzo dot Com readers answered last week’s poll question and it turns out that 1 in 9 of you still haven’t started your holiday shopping yet. I’m happy to say that I’m all done. Now if I can only coax somebody to wrap them for me.

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Miracle Can

A man was driving along the highway, and saw a rabbit hopping across the middle of the road. He swerved to avoid hitting the rabbit, but unfortunately the rabbit jumped in front of the car and was hit. The driver, being a sensitive man as well as an animal lover, pulled over to the side of the road, and got out to see what had become of the rabbit.

Much to his dismay, the rabbit was dead. The driver felt so awful, he began to cry. A woman driving down the highway saw the man crying on the side of the road and pulled over. She stepped out of her car and asked the man what was wrong.

“I feel terrible,” he explained, “I accidentally hit this rabbit and killed it.”

The woman told the man not to worry; she knew exactly what to do. So she went to her car trunk, and pulled out a spray can. She then walked over to the limp, dead rabbit, and sprayed the entire contents of the can onto the rabbit.

Miraculously the rabbit came to life, jumped up, waved its paw at the two humans, and then hopped down the road. About 50 feet away the rabbit stopped, turned around, waved at the couple, and then hopped down the road. Another 50 feet later, the rabbit turned and waved again before hopping into the roadside brush for good.

The man was astonished. He turned to the woman and demanded, “That was a miracle! What did you spray on that rabbit?”

The woman handed the can to the man so he could read the label. It said: “Hair spray. Restores life to dead hair. Adds permanent wave.”

(h/t: Jennifer)

Squirrel Cam

This week our friend Ricky stopped by the backyard looking to dig up some nuts he had previously squirreled away…

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Whether you happen to enjoy what you’re reading — or not — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

This week Brenda dropped a nice note in my inbox to introduce herself — and ask this question:

Love your blog, Len! Why didn’t you give it a fancy name like all the other (personal finance) blogs out there?

Well… because “John Smith dot Com” was already taken.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len,

Thanks for all the cuppas you served up this year! My Saturday mornings wouldn’t be the same without them.

Judging from your last credit, it looks like you are taking next week off? So I’ll close by wishing a Merry Christmas and Happy New Year to you and all my fellow readers here!

Sara

Thanks, Sara! Yes, my next Black Coffee edition will be in 2026. Not sure if it will be January 3rd or the 10th. It depends on how distracted I am with other stuff between Christmas and New Year’s Day. I’ve been neglecting my model railroad for long time and I’ve been feeling it tugging me to return to it! It’s only about 25% complete.

Merry Christmas & Happy New Year!

Merry Christmas to you and yours, Len.

Same to you, Sam!

I’ve been to a couple of businesses that are rounding up to the nearest nickel. The way things are going, probably won’t be long before they start rounding up to the nearest dime.

I haven’t come across that yet, but I’m sure the time isn’t far away. Merry Christmas, Victor.