It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I’ve got another busy weekend ahead of me, so let’s get right to this week’s commentary …

It’s diamonds in your pockets one week, macaroni & cheese the next.

– Jolene Blalock

The only free cheese is in a mousetrap.

– Anonymous

Credits and Debits

Credit: Did you see this? Black Friday shoppers were seeing red last week after Walmart customers quickly discovered that Kraft’s new limited-edition “Mac Friday Box” had sold out only seconds after going on sale for $19.37 at midnight Friday. The novelty item, designed to look like a 65-inch flat-screen – no, really – featured 65 boxes of classic Kraft Mac & Cheese inside. Savvy shoppers recognized that, at that price, each box inside cost approximately 29 cents – which is 75% off the regular grocery shelf price.

Debit: Speaking of the holiday shopping season, temporary Christmas hiring in the US is at its lowest pace since tracking began in 2012. In fact, retailers are expected to bring on as few as 265,000 seasonal workers this year, compared to 442,000 in 2024. And that’s really bad news for this recently-unemployed magician…

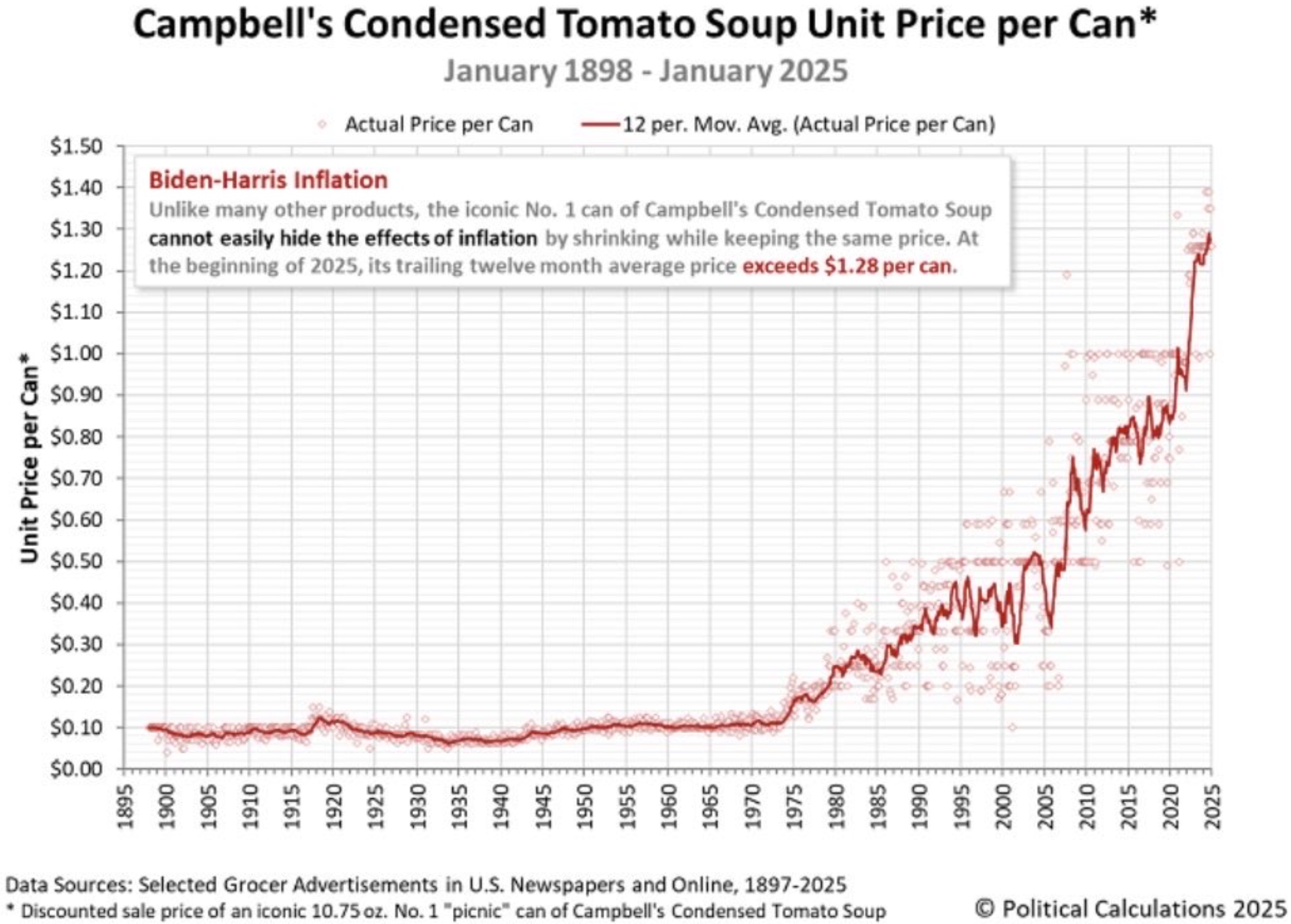

Debit: On the “bright” side, the latest inflation data – which is a bit stale because of delays resulting from the government shutdown – shows that core prices in September were up “just” 3% compared with a year ago. That is the lowest inflation level going into a holiday shopping season since 2020. Never mind that the public would be far better served in an environment of mild deflation. Oh, and speaking of inflation…

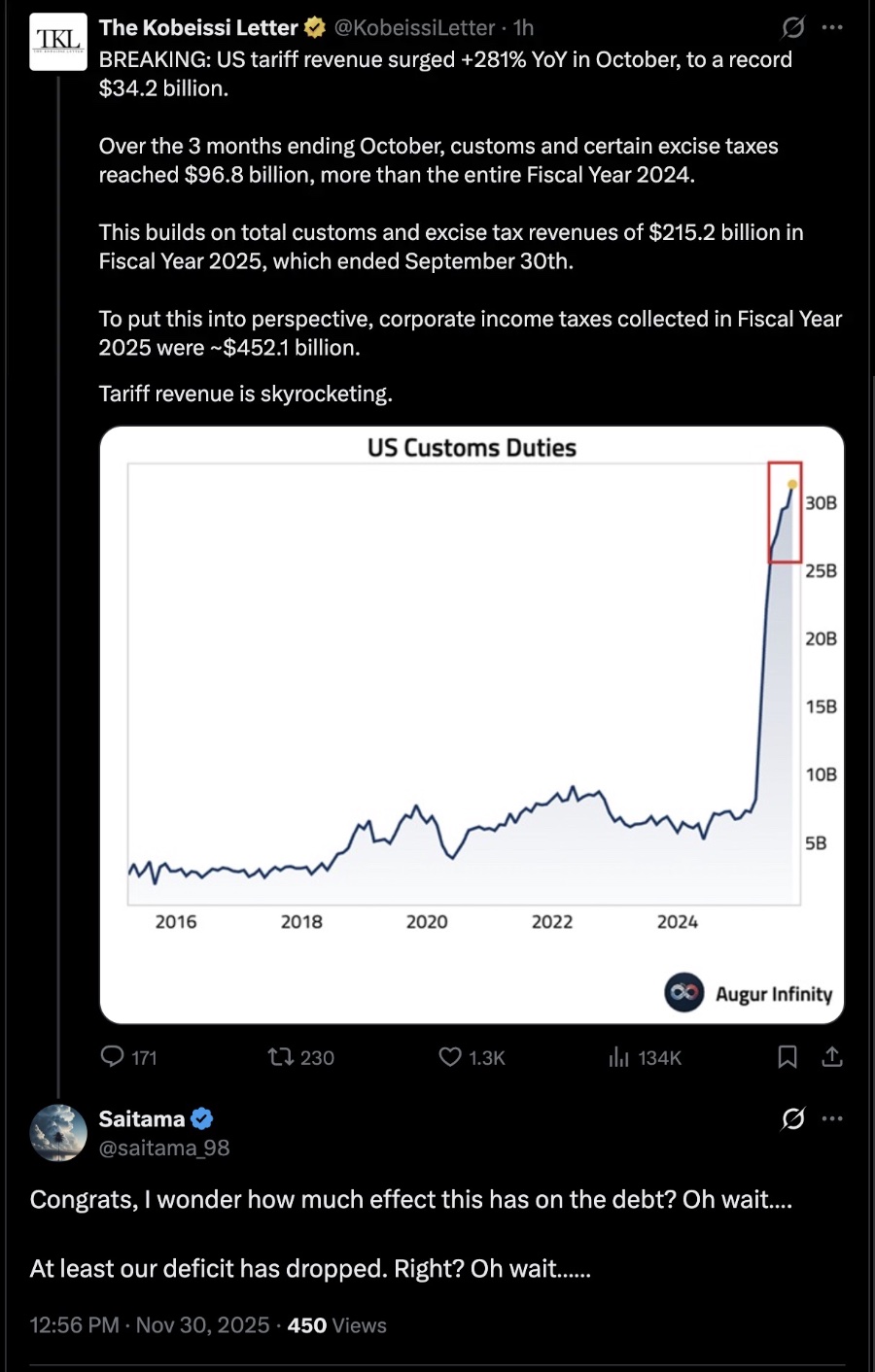

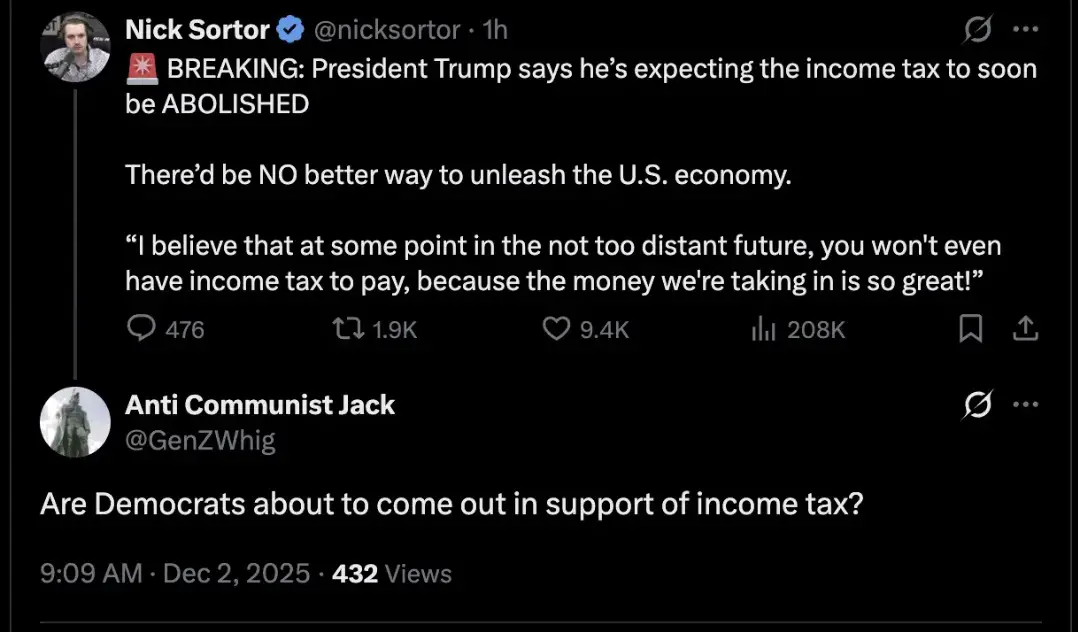

Credit: Hey… and here’s some more good news: US tariff revenues surged to more than $31 billion in October, setting a new monthly record. Hooray!

Debit: Unfortunately for the US, October’s record tariff revenue is nowhere near enough to fix the federal government’s fiscal situation, which is so bad that fully 24 cents of every dollar in collected taxes goes to pay interest on the debt.

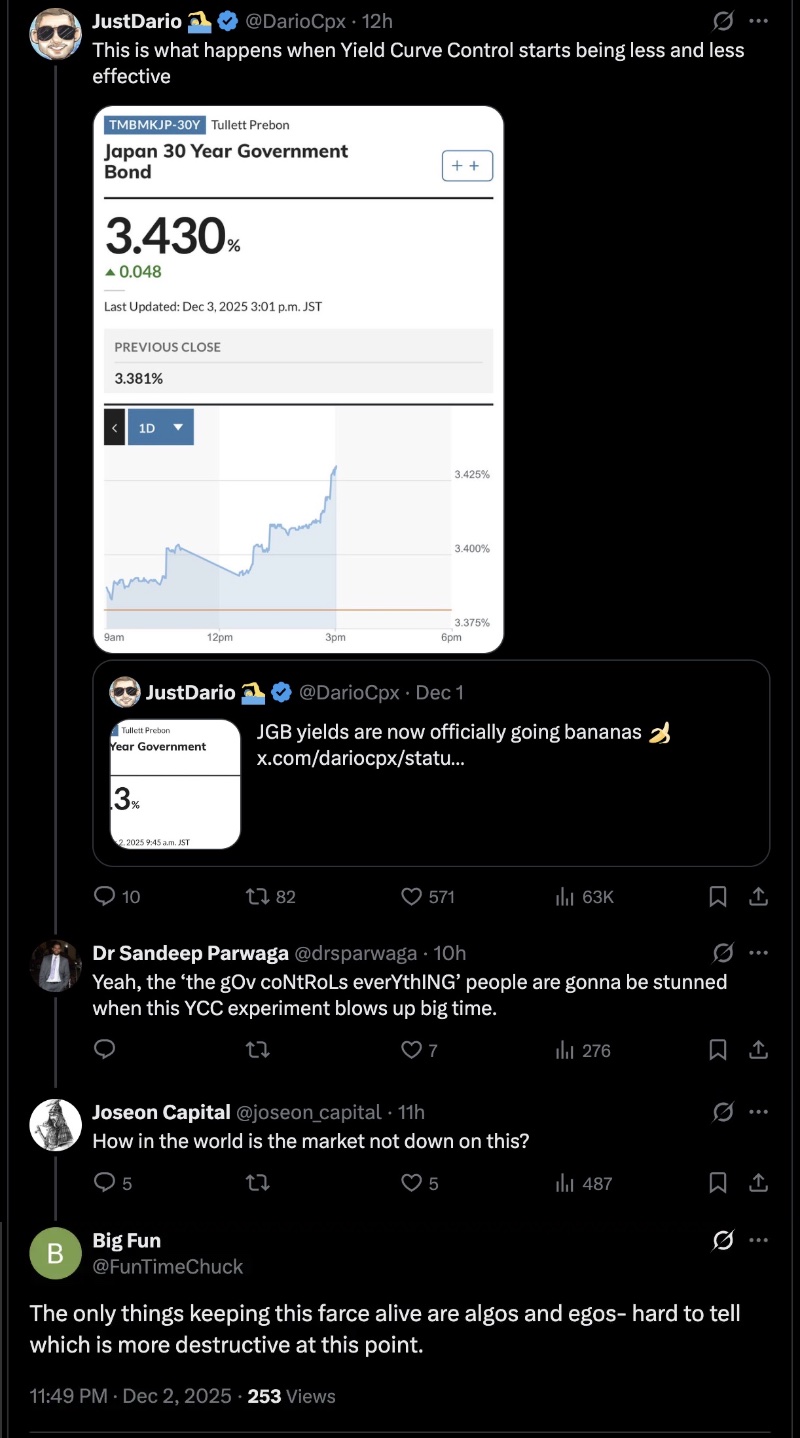

h/t: @Daniel_Hall

Credit: According to market analyst Gregory Mannarino, the recent US Treasury – Fed partnership gives them enormous power because, “When the same alliance issues the debt (US Treasury) and the funding (the Fed), then you no longer have price discovery, risk premiums, or even default risk – just a managed illusion pretending to be a market (because) natural debt buyers are deliberately pushed away” due to yield curve control (YCC), socialized risk, insider front-running. As a result, the “market becomes an offshoot of policy, not a reflection of reality.” In other words: fraud. Not that it matters. Well… until it does. (Just ask the Bank of Japan…)

Note: And now the Fed and US Treasury doesn’t care anymore either.

Debit: By the way, Mannarino expounds on his initial point, warning that, by keeping yields pinned below where free markets would set them, This “unholy merger between the Fed and Treasury is only serving to offload inflation onto savers, workers, and retirees as the US debt balloons even faster. Instead of openly admitting insolvency, it’s a quiet default. And as usual, it’s the (citizenry) who pays.” If only the media would take a lesson from these guys on how to challenge monetary officials with some probing questions that might inform the public about what’s actually happening:

Debit: Then again, we argue that Americans have been paying for their spendthrift government over many decades. This can be seen by examining gold-adjusted income, which shows the real purchasing power. Despite steady rises in US dollar (USD) salaries, the average American’s purchasing power, when measured in ounces of gold, has plummeted by 77% since 1998. We also suspect that most of you already were aware of that on an intuitive basis. The good news is, there’s still money to be made in the stock market. At least for some people…

Debit: Not coincidentally, last week silver market trading was halted on the Chicago Mercantile Exchange (COMEX) under highly-dubious circumstances after price soared more than 6% to new a all-time high of almost $57. For market analyst Niko Moretti, the COMEX shutdown “is an indictment. The ‘Crimex’ nickname exists because the very exchange that pretends to ‘discover’ the silver price has been weaponized for years to manufacture fake supply, cap rallies, and keep real money chained to a dying fiat order. But those chains have now snapped and the crime scene is finally visible“ to everyone. Oh, and speaking of crime scenes…

Credit: Here is the cold reality: The people who will eat the losses in a monetary system reset – regardless of whether it’s a controlled USD devaluation against gold or a chaotic currency collapse – will be those whose savings, retirement, and/or portfolio holdings are tied to fiat currency and government bonds. As for the winners? That will be those who are holding precious metals. Got gold?

By the Numbers

Let’s take a look at the year-to-date performance (through Nov. 30th) for some select major asset classes. And, no… the figures for gold, silver, and their respective mining stocks are not missing a decimal point:

-11% 10-yr US Treasury proxy (TNX)

+11% Dow Industrials

+12% Russell 2000

+12% S&P 500

+21% Nasdaq Composite

+61% Gold

+101% Silver

+140% Gold miners proxy (GDX)

+142% Silver miners proxy (SIL)

Source: Yahoo!Finance

The Question of the Week

Last Week’s Poll Results

-

$100 to $500 31%

-

More than $1000 28%

-

$501 to $1000 26%

-

Less than $100 15%

More than 2000 Len Penzo dot Com readers responded to last week’s question and it turns out that 5 in 9 of you plan to spend at least $500 on gifts during this holiday season. As for me, my original budget was $500, but it looks like I am going to exceed that number this year by a slight amount.

If you have a question you’d like me to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Prescription Fill

This lady noticed that her dog could hardly hear so she took it to the veterinarian. He determined that the dog’s problem was hair in its ears. So he cleaned both ears and the dog could hear fine.

The vet then proceeded to tell the lady that if she wanted to keep this from recurring she should go to the store and get some hair remover, and then gently rub it in the dog’s ears once a month.

After receiving the vet’s instructions, the lady went to the drug store to get some hair remover.

At the register the pharmacist says, “If you’re going to use this under your arms don’t use deodorant for two days.”

“I’m not using it under my arms,” said the lady.

“Well … if you’re using it on your legs, don’t shave for five days.”

“I’m not using it on my legs either,” the lady said. “If you really must know, I’m using it on my schnauzer …”

The pharmacist replied, “Then be sure to stay off your bicycle for at least a week.”

(h/t: Sam I Am)

Squirrel Cam

It’s only four seconds long, but when the camera was on, this little fella was ready for his close-up!

.

Buy Me a Coffee? Thank You!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

This week Motzmotz submitted this grievance to the Len Penzo dot Com Complaint Department:

No one reply to the comment I leave here, and possibly nobody care the comment I leaved. [sic]

Not true! Anyone who leaved a comment can rest assured that I readed it.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: public domain

Good morning Len, and happy Christmastime! I don’t know where you find your info, but that Kraft Mac & Cheese story, wow. Who needs that much Mac & Cheese? Or maybe they planned to use most of it as Christmas gifts? 😉

Anyway, your last “Credit” makes me wonder if I should replace ALL bank/bond/etc. assets with PMs! Sure is something to consider…

Enjoy your week, everyone! 🙂

Hi Lauren! Merry Christmas! I love mac & cheese, but I don’t think I could eat 65 boxes of mac & cheese before it went bad. Regarding bonds vs physical PMs, only you can choose what is right for you. I still am holding a portion of my portfolio in T-bills because they are more liquid. But the bulk of my portfolio’s “safe haven” allocation is in PMs.

Hi Len!

I can attest to silver doubling this year! I’m reminded of it every time I look at the balance of my silver “savings account”!!! It’s beautiful!

So glad I have been stacking all these years. Hard to believe I started when silver was selling for under $18.

Merry Christmas everyone!

Sara

Hi Sara! Merry Christmas! I know you have been an avid silver stacker. I am very happy for you! (And me too!) 😉

I can’t believe anybody eats that Kraft cheese powder. Mac & cheese is good stuff but only when it is homemade.

Cowpoke: You do know that you’re supposed to mix the cheese powder with milk and butter, right? 😉

🤣 🤣 🤣

Merry Christmas to all! We just got back from Switzerland and Germany to visit extended family and the Christmas markets. With regard to financial matters, we can confirm that Switzerland is expensive. Meanwhile, we thought Germany was very reasonable for things like local bottled beer (1.19 euro for 0.5L) and 1.79 euro for a hazelnut and chocolate filled croissant in a local grocery store. Those items are lower in cost and of better quality than what we can get locally here in suburban US. Now about automobiles…there’s a 19% sales tax…so for an Audi S7 the Value Added Tax (VAT) alone is about 22,000 euros. All in all, spouse and I would live in Germany if we had to live somewhere else.

Thanks for the info, Maverick! Very interesting. I’m not surprised that beer is very affordable in Germany – I bet they drink more of it per capita than anywhere else. European VAT taxes are crazy over there.