It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well… another busy week is behind us. So with that in mind, let’s get this party started!

Just because you got the monkey off your back doesn’t mean the circus has left town.

– George Carlin

Credits and Debits

Credit: Did you see this? In 2016 an Italian artist created three fully functional 18 karat gold toilets. No, really. One was stolen shortly after being installed in Blenheim Palace. The good news is that for people looking to buy a toilet made of gold, one of the remaining two will soon be auctioned in New York City at Sotheby’s. The toilet weighs 220.5 pounds – that is, 2411 troy ounces pure gold and the estimated starting bid is $10 million. And we thought the housing market was out of control. The good news is, the powers that be are working on “fixing” that problem…

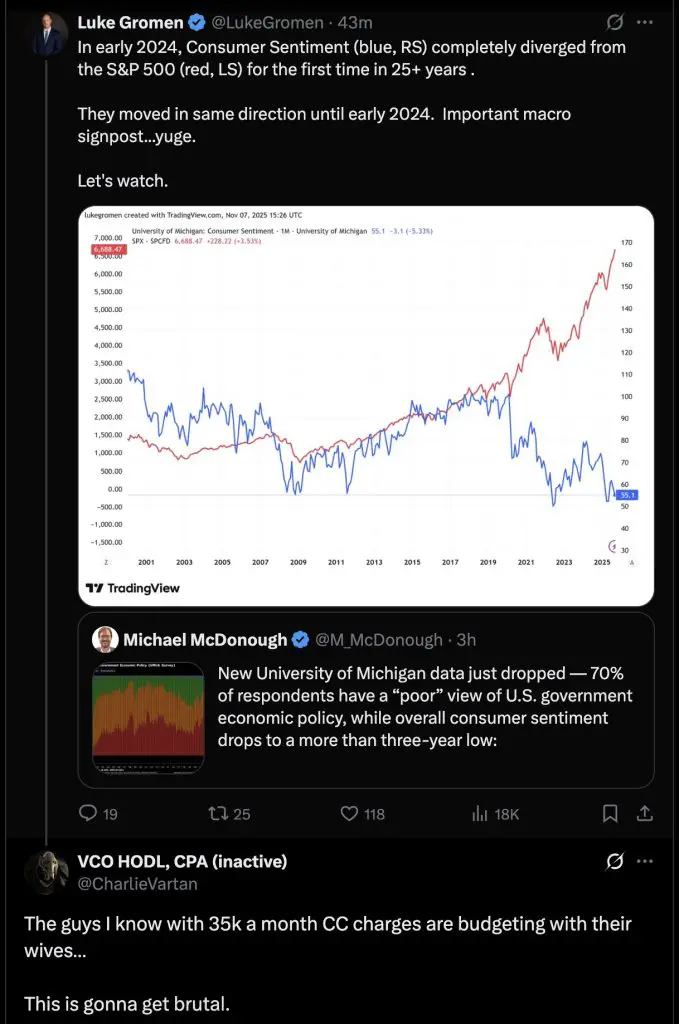

Debit: Meanwhile, the level of stress within American households is rising as evidenced by a 29% decrease in consumer sentiment from the previous year – that is the lowest consumer sentiment reading in nearly three years. Uh oh.

h/t: @roots_n_reason

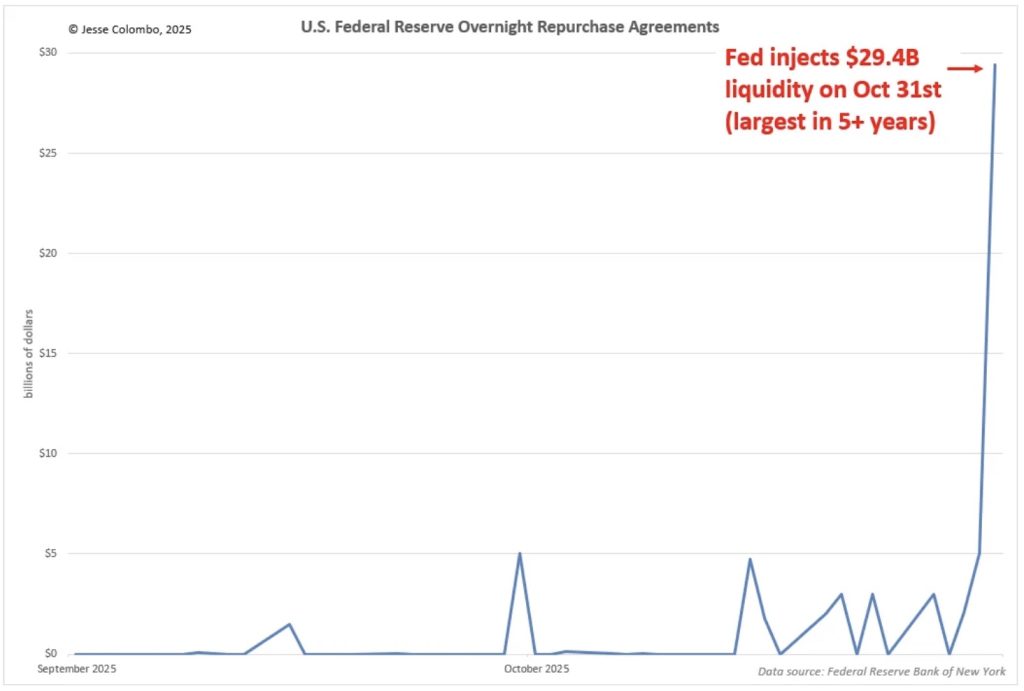

Credit: Speaking of stress, according to macro analyst Jesse Colombo, “stress is building beneath the surface of the US financial system as evidenced by overnight (cash) demand by banks spiking to $29.4 billion on October 31st. A similar development took place in September 2019 and ultimately played a key role in the Fed’s launch of the major quantitative easing (QE) programs just months later, introduced under the cover of COVID-19 stimulus.” Then again, we all know how that worked out. Oh… and speaking of banking movies we’ve seen before…

h/t: Jesse Columbo substack

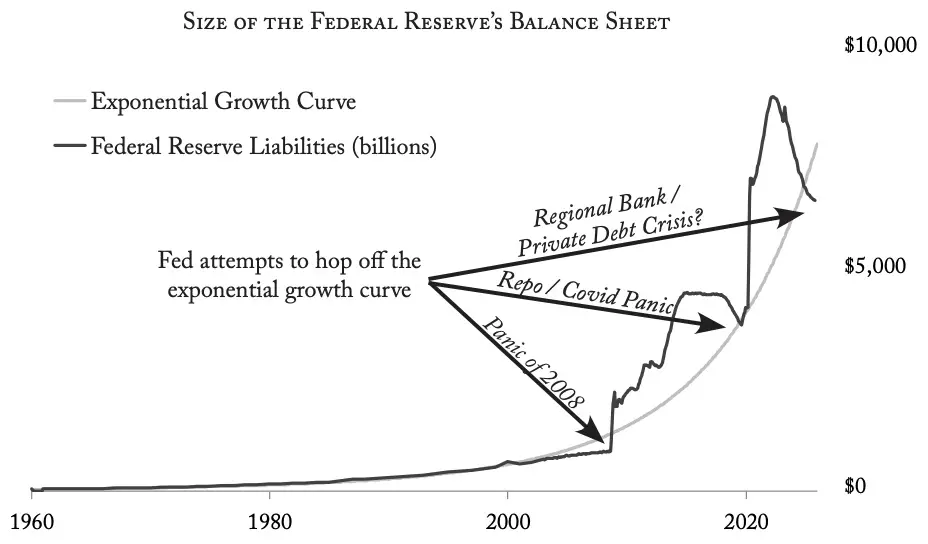

Credit: Indeed, as macro analyst Daniel Oliver noted this week, “every time the Fed tries to hop off the exponential growth curve of money, there is a financial crisis. We’ve just crossed the line again, and already the Fed’s repo lines are ramping up – it had to deploy $80 billion into the banking system last Friday.” Perhaps that’s why the current administration is floating their latest trial balloon…

h/t: Myrmikan Research

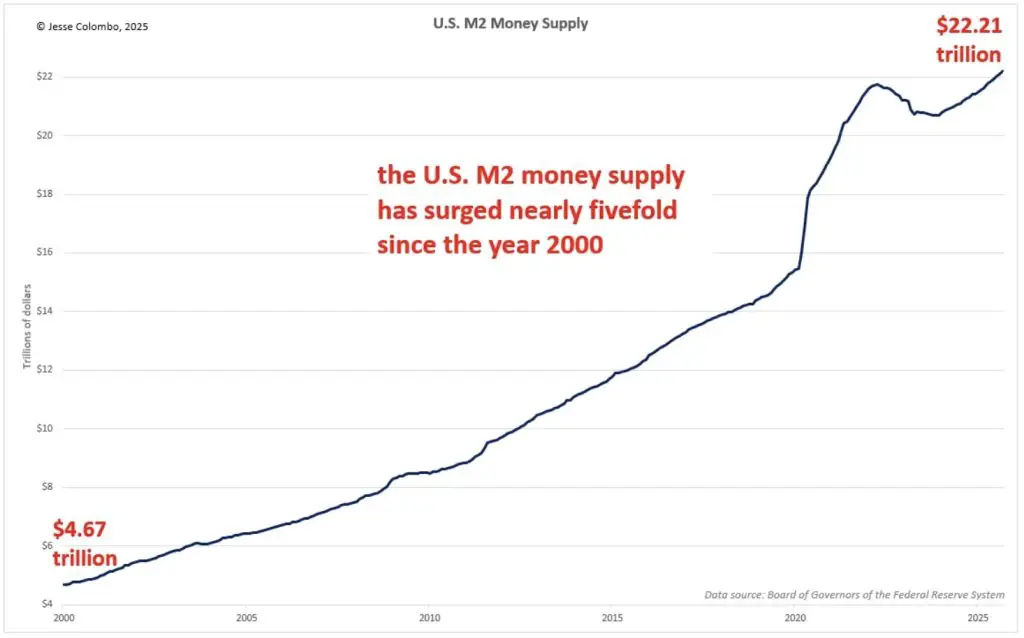

Debit: Needless to say, even without QE, the US money supply (M2) continues to climb – and the pace is only to going to increase once the Fed restarts its QE, which they are now hinting will commence within the next couple of months. We can only imagine how much worse our financial and monetary systems would be without the sage guidance of the ivory tower academics who are managing them.

h/t: Jesse Columbo substack

Credit: In other news, macro analyst Doug Casey observed this week that, “Most of the money that’s been made for the last couple of generations has been in the financial markets, not by creating real industry and real wealth the way Carnegie, Vanderbilt, and Rockefeller did. This is because the major US export since 1980 hasn’t been computers, or Boeings, or soybeans – it’s been US dollars (USD). The trade deficit is now close to $1 trillion per year – and those USDs outside of America (are) US liabilities.” And it’s only a matter of time before those liabilities result in painful cramps for the US financial system. Oh… and speaking of cramps…

Debit: By the way, Casey also notes that, “If foreigners want to dump those USDs, they’re going to come back home to America to buy real goods – shares of businesses, buildings, (and) farmland. And when that happens, the amount of real wealth owned by Americans will plummet, while the amount of fiat USDs inside the country will explode.” Yep. Sadly, that’s going to come as an ugly surprise to the vast majority of the US middle class. In fact, by the time they finally recognize what is truly happening, there won’t be any options left for effectively handling what lies in front of them. Well… other than this:

Credit: With all of this in mind, nobody should be surprised that gold is up more than 50% this year, while silver is up nearly 70% in 2025. As Sprott’s precious metals analyst Paul Wong points out, “investors are increasingly recognizing that the US, Europe, and Japan are unlikely to rein in public debt and are instead expanding fiscal deficits to even higher, and more concerning, levels. These economies are entering a state of fiscal dominance, in which fiscal priorities shape monetary policy rather than the other way around.” Uh huh. And while that’s bad news for the financially unprepared, remember that there are actual existential problems out there too…

Credit: As for those of who insist that the USD price of gold is actually in a bubble, keep in mind that during the secular bull market of the 1970s, gold measured against the M2 money supply rose by 888% over 113 months. In the 2000s secular bull market, it gained 305% over 125 months. In comparison, the current secular gold bull market is up only 140% over just 36 months. One thing is certain: Billionaire hedge fund manager Ray Dalio isn’t worried about gold being in a bubble – and for good reason:

Credit: We’ll close this week with James Howard Kunstler, who points out that, rising “precious metals (prices) are sending a distress signal, even while (stock) markets worldwide melt up. That’s got to be a bad combo. Something is going wrong with (fiat) money everywhere. The overarching question is: Will it be worth anything? Money that’s increasingly worthless leads to the worst social and political outcomes imaginable.” Indeed it does. Let’s hope the authorities reject the current dying debt-based monetary system and replace it with something more honest before one of those outcomes actually comes to pass. Got gold?

By the Numbers

At a time when many people are concerned about their financial future, a new survey has found that nearly two-thirds of Americans say they would enjoy the holidays more if people didn’t exchange gifts. The good news is that you can buy popular gift cards at a discount, which can save gift givers money. With that in mind, here are the five gift cards with biggest percentage discounts:

6% Sonic

7% Dairy Queen

12% Old Navy

22% Starbucks

22% Michaels

Source: WalletHub

The Question of the Week

Last Week’s Poll Result

-

No 53%

-

Yes 47%

More than 1900 Len Penzo dot Com readers answered last week’s poll question and it turns out that a slight majority of you didn’t participate in at least one sport during high school. As for me, I played on the high school golf team for three years. Unfortunately for me, that was also when my skill peaked in that sport. I was an 8 handicap, and actually got my first – and only – hole-in-one while I was on the team. It was the only period when I was able to break 40 over nine holes. These days, I just a miserable hacker – which is why I rarely play anymore!

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: A Pirate’s Life

A pirate walked into a bar and the bartender said: “Hey, I haven’t seen you in a while. What happened? You look terrible!”

“What do you mean?” said the pirate. “I feel fine.”

“Well … what about the wooden leg?” asked the bartender. “You didn’t have that before.”

“Oh, that.” said the pirate. “We were in a battle off the coast of Tripoli and I got hit with a cannon ball, but I’m fine now.”

“Okay,” replied the bartender, “but what about that hook? What happened to your hand?”

“We were in another battle off the coast of Morocco; I boarded a ship and got into a sword fight. My hand was cut off. When we got back to port I was fitted with the hook. But I’m fine, really.”

“So what about the eye patch?”

“We were at sea, hot on the tail of a Spanish galleon,” the pirate explained. “Suddenly, a huge flock of birds flew overhead. When I looked up, one of them shit in my eye.”

The bartender was incredulous. “You’re kidding, right? You mean to tell me you lost an eye because of a little bird shit?”

“Well,” the pirate said, “it was my first day with the hook.”

(h/t: Bill)

Squirrel Cam (After Dark)

This week we had a special evening visitor stop by to say hello …

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Whether you happen to enjoy what you’re reading — or not — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

After reading my article on 36 amazing uses for plastic grocery bags, Felicia Luburich shared a clever — if not slightly unrelated — tip of her own:

To pick up dog poo, use shiny coupon pages.

Great idea! I’ll use two-for-one coupons so I can pick it up twice as fast.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Good morning Len, I hope you enjoyed your week! In spite of all the anxiety in the world, we found a somewhat bright spot: Folgers “Classic” coffee is now MORE expensive than Costco’s “Kirkland Signature Colombian” coffee, so we’re back to drinking straight Kirkland again (YAY!) Been drinking that Kirkland coffee for decades, and Costco even ships it for free since we buy over $75 worth at a time; WIN! 🙂

Given the economy, is anyone else going for more practical gifts (again) this Christmas? Clothes, GOOD shoes, etc? After losing power for 6 hrs. the other day, I’m asking Santa for a couple more camping lanterns! 😉 Y’all have a good weekend!

Hi Lauren! I’m a Dunkin’ Donuts coffee drinker – the rub is that our local Costco only stocks it intermittently, so when they do have it, we end up buying a few of them. Lucky for me we have about six-months of Dunkin’ coffee in reserve – just in case Costco goes into a prolonged period of not carrying it. 😉

As for practical Christmas gifts, I think most of us who are older than 30 appreciate nice clothes, shoes and even warm socks and underwear at Christmas time. I know I do! 🙂

Hi Len,

Wow! I can’t believe they are thinking about 50-year mortgages. Desperate measures for desperate times. I wonder what the interest rate would have to be on those considering inflation over 50 years. I’m betting pretty high!

Have a great weekend everybody!

Sara

That we’re even talking about 50-year mortgages, Sara, proves the housing market – and almost everything else in this financialized economy – is completely broken and in need of a major reset.

Still laughing at that “monkey never craps” video. Really funny!

Who is that guy? I don’t remember seeing him during the World Series this year.

That video is at least a decade old, Mike. His name is Munenori Kawasaki and he has several really funny videos out there. I may just feature another video of his that I stumbled upon next week.