It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well… another busy week is behind us. So with that in mind, let’s get this party started!

Fire is the test of gold; adversity, of strong men.

– Lucius Seneca

Credits and Debits

Credit: Did you see this? This week the IRS unveiled the higher federal tax brackets for 2026 to adjust for inflation, with the top rate of 37% applying to individuals with taxable income above $640,600 and married couples filing jointly earning $768,700 or more. The standard deduction will also increase – from $16,100 for single taxpayers all the way to $32,200 for married couples filing jointly. Even better, the long-term capital gains tax rate for annual investment earnings under $49,450 for singles and $98,900 for married couples is zero. (Psst. Please don’t spoil the party and tell that to Congress.)

Debit: In other news, a new study by Wells Fargo Securities has determined that the insured losses due to this year’s Southern California wildfires is $30 billion. Within that total, about 85% of losses are expected to come from homeowners’ insurance policies, while 13.5% are commercial property and 1.5% are personal auto losses. The trouble is, very few building permits in the burn zones are being issued thanks to local and state government bureaucrats who are strangling these poor homeowners with miles of red tape. You can bet the system wouldn’t be so gummed up if this was 1930…

Debit: Speaking of building permits, they have been falling steadily since late 2021 – this is a historically-reliable recession signal. Maybe that’s why Google searches for “help with mortgage” have surpassed the level seen during the 2008 housing crisis. Uh oh. Then again, there are plenty more recession signals out there – for those who are looking…

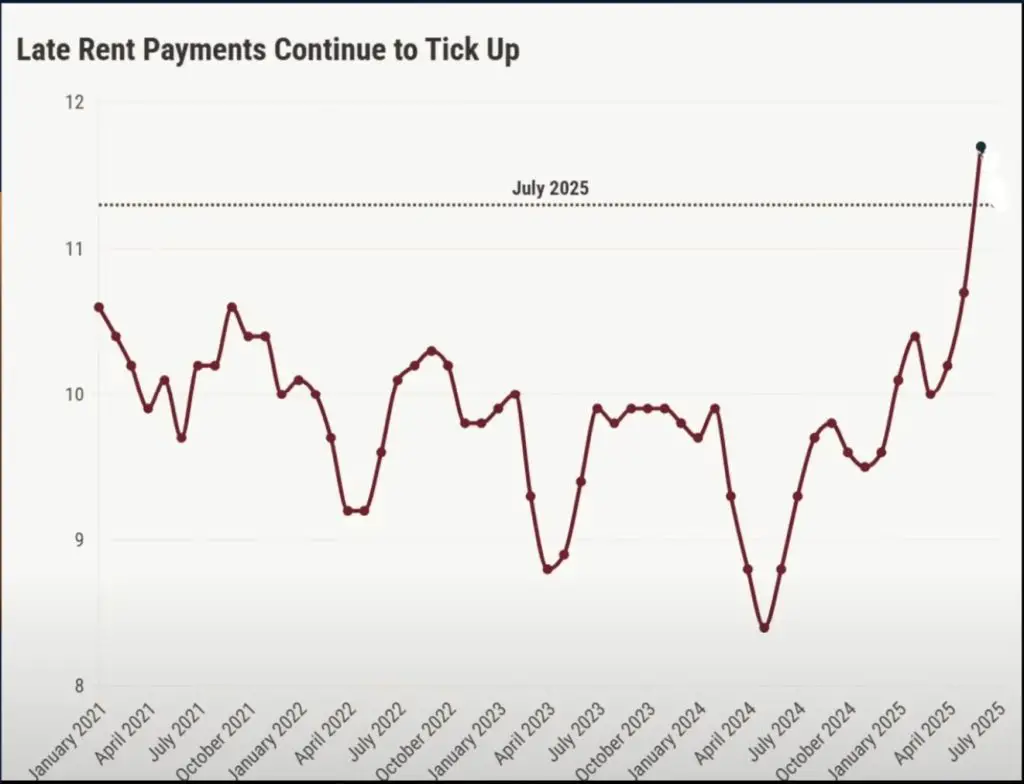

Debit: Of course, it’s not just homeowners with mortgages who are struggling to stay afloat financially – many renters find themselves drowning in a sea of red ink too. In fact, late payments by apartment renters have been steadily rising since April 2024. The good news is the stock market is still toying with new all-time highs almost every week! Then again, so is this:

h/t: Mike Maloney

Debit: The commercial real estate (CRE) market is on even shakier ground, with the national office vacancy rate surging to an unprecedented 21% at the end of June, according to the most recent available data. However, in many major big cities the vacancy rate is far worse. For example, in Charlotte and New York City, it’s 23%, while in San Francisco it’s 28% and Denver is a staggering 37%. That being said, CRE isn’t the only thing that seems to be crumbling before our eyes…

h/t: @spillthememes

Debit: The good news is that there is a new financial technology firm out there that lets people with terrible credit scores tap into the equity in their depreciating used cars at a 30% interest rate, even if it’s not paid off, in which case the entire auto loan is transferred. After signing up, the company – known as Yendo – issues the borrower a credit card which incurs an additional 3% fee if used at an ATM to pull cash out. The good news is it also rewards its suckers – er, customers – with 1.5% cashback on all purchases!

Debit: Speaking of paying the bills, US tax revenue has increased more than six-fold since 1980; that’s not a revenue problem. The trouble is that America’s debt has gone up 38 times over the same period. Try running your household like that. On second thought, if earning income by printing counterfeit currency was actually legal for us private citizens, I’d probably definitely use that strategy too. After all, it sure beats earning a living by the sweat of your brow – especially on days like this:

Debit: Fed Chair Jerome Powell was asked this week about his thoughts about the sharply rising price of gold in light of the fact that former Fed Chair Alan Greenspan used to view the price of gold as an indicator of market perception of inflation risk. Not surprisingly, Powell refused to respond. That’s because bankers will never admit publicly that they’ve been running an immoral monetary scam since 1971 – and that scam is finally being exposed by the yellow metal. As for silver, for those who haven’t noticed, there’s a supply squeeze that’s happening right now…

Credit: Macro analyst Matthew Piepenberg warned last week that the current global debt-based monetary system’s “endgame is in sight. It’s deliberate policy theft; the engineered demise of the US dollar (USD) as unsustainable debt hits a breaking point. This is the currency’s ‘Stalingrad moment,’ where the credit balloon pops and your savings “melt like an ice cube.” If only there was a proven safe haven where investors could find shelter from the storm. Oh, wait…

Debit: Indeed, the illusion of prosperity is finally crumbling. We know this because despite the USD being down more than 10% and declining economic data, stocks keep rising. At the same time, gold and silver are both up more than 50% this year alone, while the Fed is cutting rates into inflation. This isn’t prosperity; nor is it an economic boom. It’s a flight from fiat; a currency crisis unfolding in slow motion. More to the point: We’re witnessing the death throes of a system, priced in paper and powered by the monetary hocus-pocus of USDs being conjured out of thin air to “pay” for real things produced by real people…

h/t: @jameshenryand

Credit: We’ll close this week’s round-up with this factoid: Did you know that since 2019 there has been a 92% correlation between bitcoin and the Nasdaq 100? It’s true – which further bolsters many analysts claims, including mine – that bitcoin is not a safe haven, but a highly speculative risk asset pretending to be one. Sorry, crypto bros – but the facts don’t lie. Only precious metals can save your hard-earned nest egg from a devastating currency crisis. Even the CEO of JP Morgan Chase, Jamie Dimon, understands that. Well… at least he does now. Got gold (and/or silver)?

By the Numbers

Here are the current 10 highest mortgage delinquency rates across 260 metropolitan areas and all 50 states:

5.3% Yuma, AZ

5.4% Charleston, WV

5.5% Dover, DE

5.8% Shreveport, LA

6.2% Beaumont, TX

6.3% Lake Charles, LA

6.5% Baton Rouge, LA

6.7% McAllen, TX

7.1% Florence, SC

10.3% Laredo, TX

Source: Construction Coverage

The Question of the Week

Last Week’s Poll Result

-

6 – 7 hours 47%

-

8 – 9 hours 28%

-

Less than 6 hours 24%

-

More than 9 hours 1%

More than 1900 Len Penzo dot Com readers answered last week’s poll question and it turns out that, like me, 7 in 10 of you get by on less than 8 hours of sleep each night. Six to seven hours is usually more than enough for me.

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Wall Street Merger

NEW YORK, (AP) — In a move that rocked Wall Street today, Bert and Ernie announced that they have merged to form Bernie, a giant conglomeration of felt that will move them into the Number 2 spot, ahead of Big Bird and just behind Barney.

In recent years the two had lost sponsorship from the letter P and the number 5; analysts say the merger will help improve their market share.

“This is a logical move for us,” Bert said. “‘Share’ is our favorite word.”

(h/t: Barbara)

Squirrel Cam

When there is a bully at the picnic table, it pays to be patient …

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Nova Scotia (2.05 pages/visit)

2. Newfoundland & Labrador (1.98)

3. Prince Edward Island (1.86)

4. Northwest Territories (1.75)

5. Alberta (1.52)

9. Ontario (1.34)

10. Saskatchewan (1.33)

11. Yukon (1.28)

12. Nunavut (1.25)

13. Quebec (1.13)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Nova Scotia, eh) — or not (ahem, you hosers living on the frozen Quebec tundra) — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on Twitter. You can also follow me on Gab!

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by visiting my sponsors’ ads!

Thank you so much!!!! 😊

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

After reading my post on how to find a pest control company that won’t rip you off, Jeff Madison left this comment:

My wife and I have a terrible ant problem in our home, so maybe we should find someone who is licensed.

You should if you want me to invite you to my next picnic.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len, today’s Coffee is another winner in my book! We just returned from 2 weeks camping and WOW, I was shocked at the gold & silver values upon our return! I told hubby we should go away more often to see if there’s a correlation… 😉

Meanwhile, is anyone else giving “other than chocolate” Halloween treats this year? The prices for chocolate candy are getting ridiculous.

Reeses peanut butter cups at my house. I live in a very rural area, so I only get a handful of kids, but the ones that show up get the king size packs with 4 cups each in them.

King size Reeses’s? 😛

What’s your address, Cowpoke? I’ll be sure to stop by. 😉

Hi Lauren… glad you enjoyed the cuppa! I’m going to be out of pocket for the next couple of weeks, so this will be the last Black Coffee until November 8th.

I will be home to be passing out the Halloween candy. It’s going to be chocolate… and what we don’t give away I will probably end up eating a lot of it (if my family doesn’t get to it first)!

I’m going to Cowpoke’s place if he’s giving the king-sized Reese’s (“No Kings” be damned! 😉 )

We give any leftover Halloween candy to our church for the CCD classes; keeps them behaving and saves us from eating it.

Enjoy your time off, Len!

Look like the national debt sign will have to be replaced to add another digit…..

Yep. Same as it ever was.

We used to have a terrible aunt problem in our home. haha

I’m surprised the squirrels have put up with the bully. I’ve seen them gang up on a bully and whoop them. A whoopin’ is worse than a whippin’. A whoopin’ leaves you with two black eyes and knuckle bumps on your head. It’s what Big Mable Murphy said.

LOL! I’ll remember that one.

I used to live halfway between Beaumont and Lake Charles. It doesn’t surprise me about Beaumont and Lake Charles being on the mortgage delinquency list. They are both highly dependent on oil refining and the petrochemical industry. Those jobs have been disappearing since the 1980’s. Plus, regular one income household houses are not being built there. You need a 2 to 3 income household to afford what’s being built there. Add to that, Lake Charles has been slammed badly by more than one hurricane in just a couple of years period.

Very interesting, Bill. Same thing happened in SoCal back in early 1990s when they laid off a huge number of aerospace engineers (SoCal used to be an aerospace hub – but not any more).

Hi all! I just returned home from a week in Cabo San Lucas. For those who are wondering, I will post the next Black Coffee on November 8th (since I didn’t pay any attention to the headlines or Twitter/X this past week).