It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I’ve got another busy weekend ahead of me, so let’s get right to this week’s commentary …

Those pieces of fiat paper – which should have been gold – are a token of honor; your claim upon the energy of the men who produce. Your wallet is your statement of hope that somewhere in the world around you there are men who will not default on that moral principle, which is the root of money.

– Ayn Rand

Credits and Debits

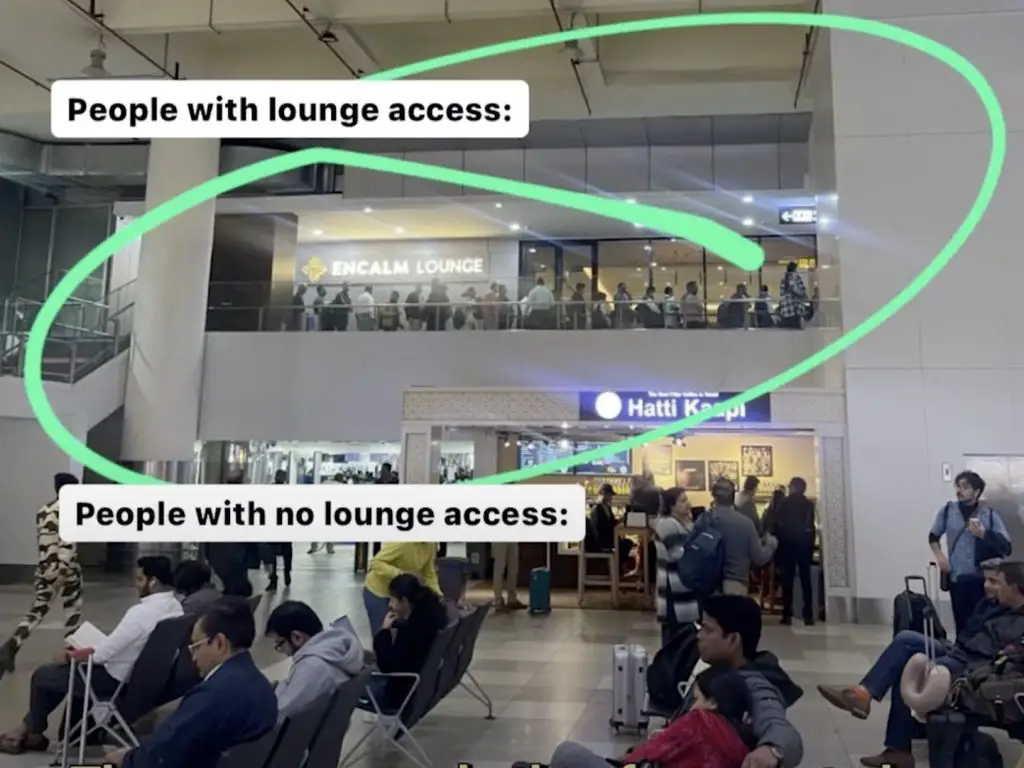

Credit: Did you see this? A recent op-ed piece in the New York Times laments the decline of airport lounges: long waits, sad buffets, and weak drinks that hardly justify the hype. Lounges used to be a perk reserved for business travelers, but now everybody is using them. As a result, there are long lines for access to what has become overcrowded gathering spots that do nothing to reduce stress, while offering substandard drinks and buffet fare. This is just more proof that when everyone is “special” then nobody is. Thankfully, airlines are quietly raising lounge costs in an attempt to bring back exclusivity and make lounges a place to relax with superb service.

h/t: Mint

Debit: On Friday, the government’s Bureau of Labor Statistics (BLS) reported that the US added a paltry 22,000 jobs in August. But that wasn’t the worst of it – the BLS also revised its June figures, which showed a net loss of 13,000 positions for the month. That’s the first net jobs loss for any month since 2020. Uh oh. The latest jobs data has pushed the odds of a September rate cut by the Fed to more than 95%. And speaking of odds…

Debit: On a related note, a new study by Stanford University found that workers who are just starting their careers between 22 and 25 face a disproportionate threat to job loss from the widespread adoption of generative artificial intelligence (AI). In fact, on average young workers have experienced a 13% decline in employment in job sectors that are most vulnerable to AI replacement, with software developers between 22 and 25 seeing a 20% decline. Then again, the outlook is even worse for telemarketers…

Debit: By the way, the same study also found that customer service representatives are also at risk from the significant proliferation of AI deployment. On the bright side, work for more experienced employees in the same sectors continued to grow. In the meantime…

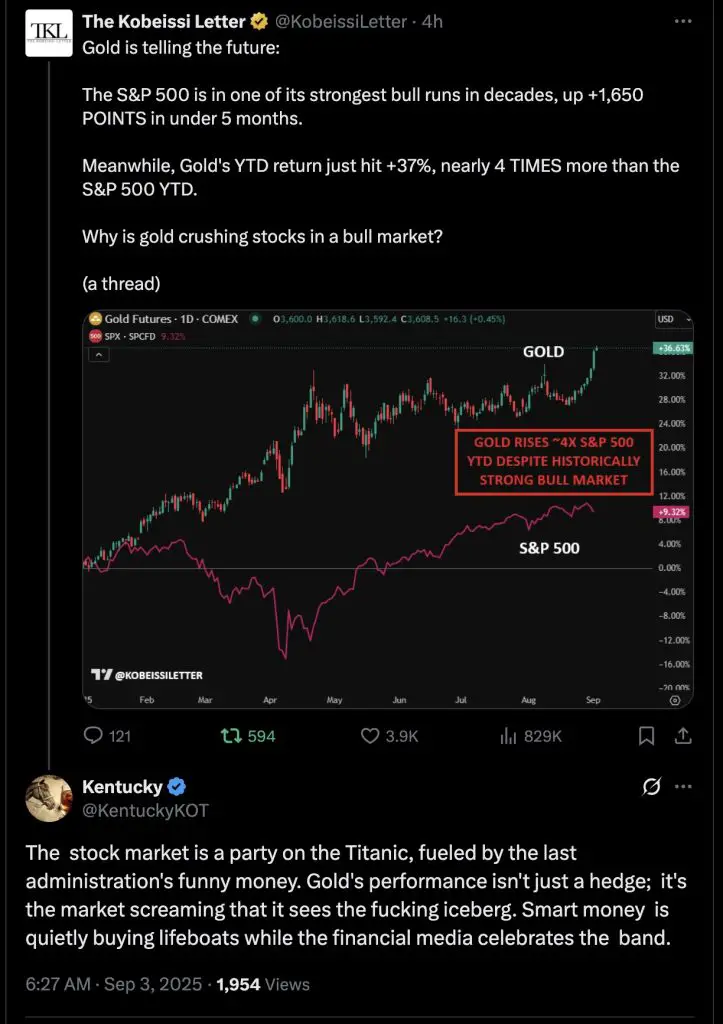

Debit: On Wall Street, despite a down day on Friday, both the S&P and Nasdaq finished the week with gains, rising 0.3% and 1.1%, respectively. The Dow, however, saw losses on the week; it ended the week 0.3% lower. Unfortunately, it is patently obvious that market asset values have been irrevocably tied to the Fed’s printing press since the Great Financial Crisis – which is why the Fed will soon be cutting rates, despite ongoing inflation risks. In other words: ThE paRtY wiLL cOnTiNuE!!!

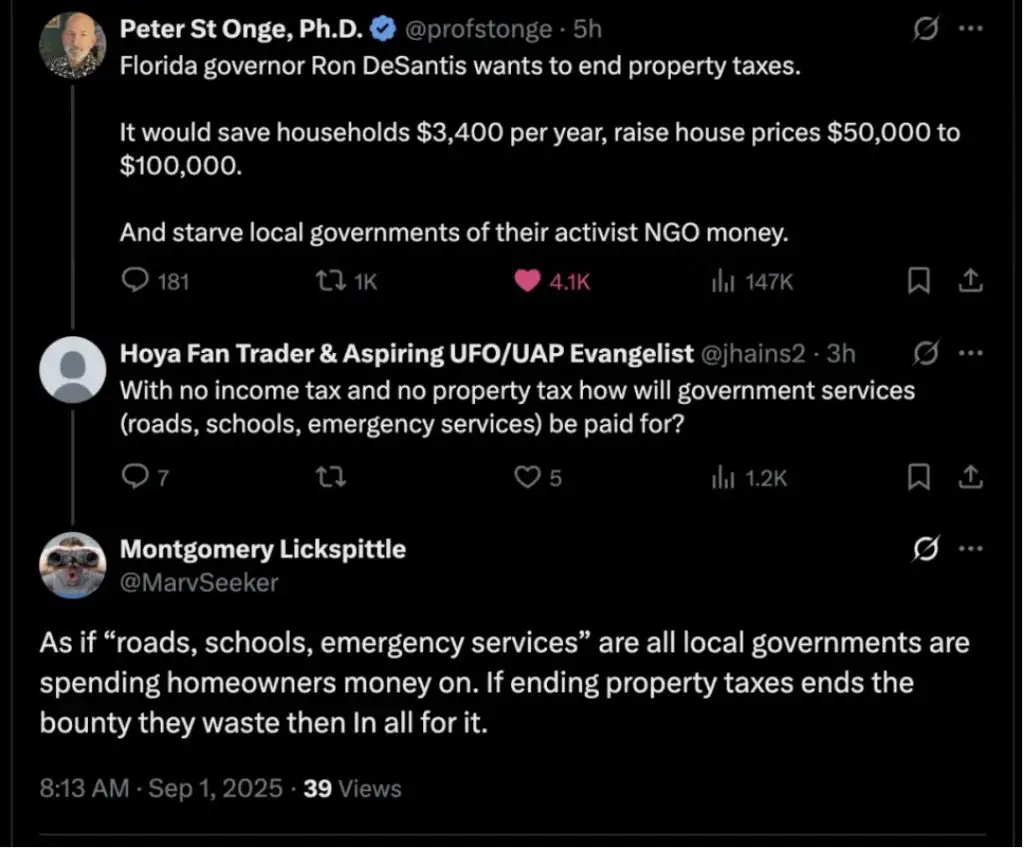

Credit: In other news, it looks like Florida may soon eliminate property taxes – and they’re not alone. The Sunshine State, along with Illinois, Kansas, Montana, Pennsylvania, and Texas are all trying to significantly cut or even abolish the property tax. According to Yale professor David Schleicher, the march to eliminate property taxes is “largely a response to the run-up in house prices, particularly in the suburbs and exurbs.” In reality, the movement is in response to the absurd run-up in property taxes. But point taken.

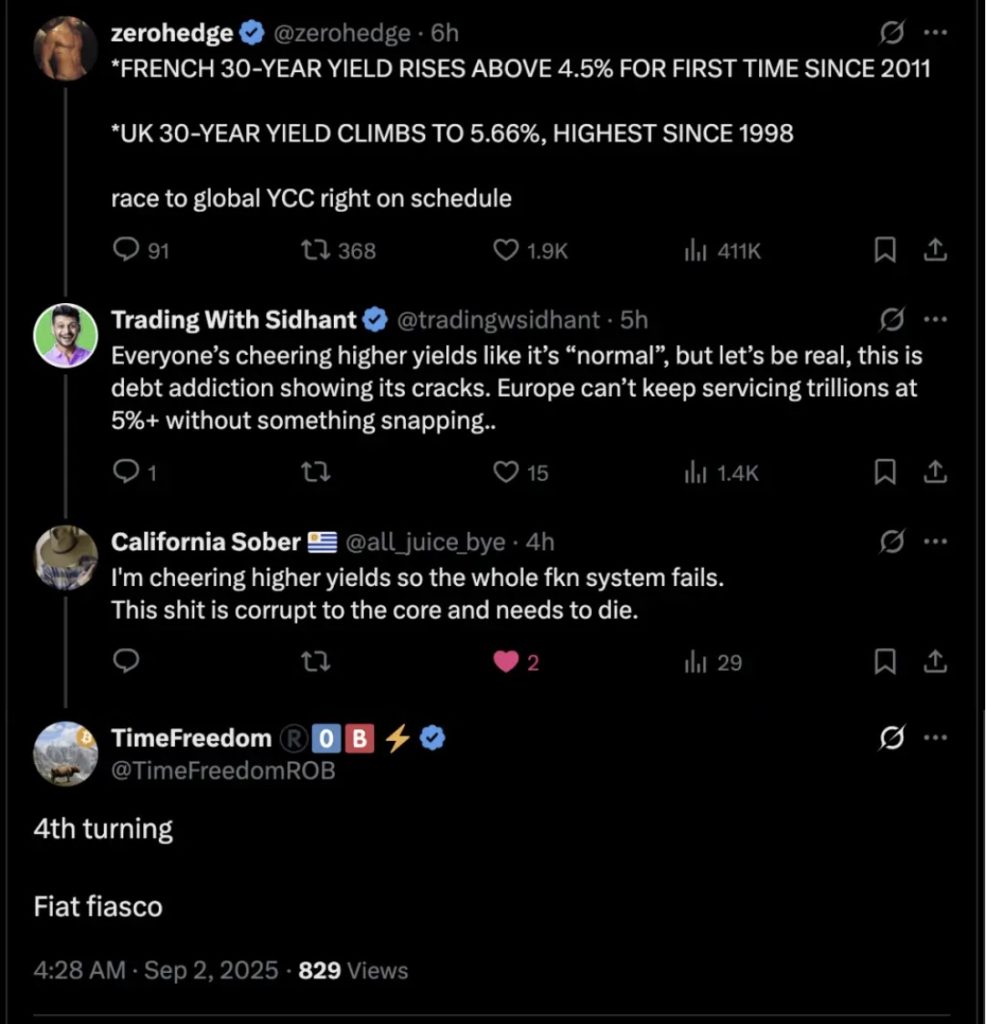

Debit: Meanwhile, British, German and Japanese long bonds all touched their highest yields in a decade – or even longer – this week. Translation: Yield curve control (YCC) is coming. It also means that the world is finally waking up to the fact that using central bank printing presses to pay for everything – including every financial crisis that rears its ugly head – eventually destroys the purchasing power of fiat currencies. As a result, any bonds denominated in those same fiat currencies are no longer being considered as monetary system safe havens. In fact, investors who are looking for safety today are buying gold. Imagine that.

Credit: Anyone who’s paying attention knows that our fraudulent debt-based monetary system has just about run its course. As James Howard Kunstler points out, the money men “are staring into the abyss staring back at them, with their hair on fire and their eyes bugging out. Just about everything is out of whack: stocks, bonds, the fun-house of shadow banking, collateral (if it’s even there), currencies, perhaps even the fate of nations. France, for instance, is chattering about an imminent IMF bailout. Well, if that one goes, what do you think happens in Germany, Britain, Italy, Spain, the Netherlands, and Belgium?” Yep. Exciting times for sure.

Depending on the perspective, what many people believe to be a “doom and gloom” scenario is seen by others as something to be embraced.

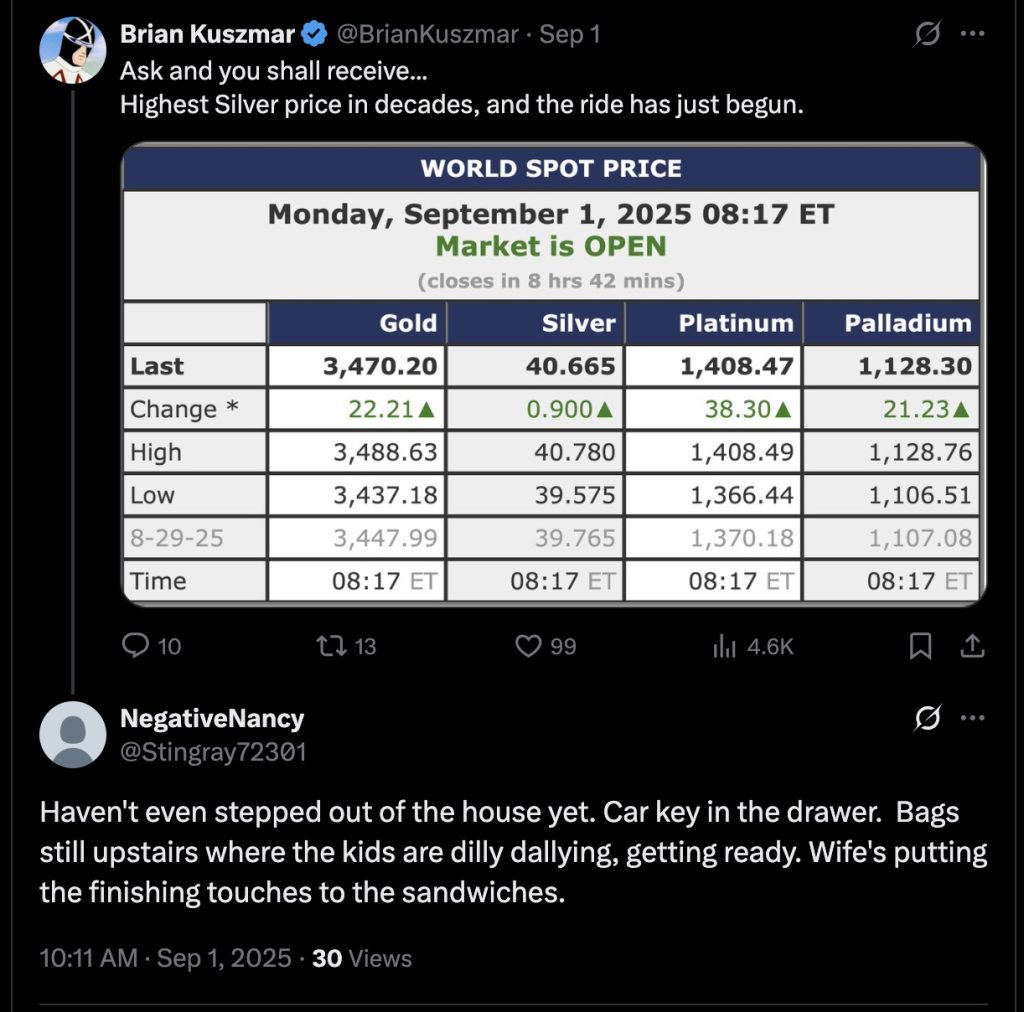

Credit: The US government added both copper and silver to its draft 2025 List of Critical Minerals last week. As sagacious metals analyst Franklin Sanders notes, “This puts silver in the same strategic category as lithium, uranium, and rare earth minerals. Within four years of receiving this designation, uranium climbed from $20 to over $100 a pound and lithium from $10,000 to $70,000 per metric ton. What do y’all think this will do to the price of silver over the next two years? Think triple digit silver.” Eventually. In the meantime …

Credit: On a related note, experts say that the US government is signaling that a gold revaluation may be coming sometime within the next 12 months. How high could the yellow metal actually be revalued to? Well… that depends on how low the US government wants its debt-to-GDP ratio to go, keeping in mind that any ratio over 90% is considered by economists to be both unhealthy and unsustainable. In any case, here’s a chart that sums the situation up nicely (and the markets appear to be sniffing this out)…

Source: GoldSilver.com

Credit: So … what price will the US ultimately revalue gold to? According to GoldSilver, gold would need to be revalued to $3981 per troy ounce just to lower the debt-to-GDP ratio a measely 3% – that is, from 119% to 116%. Alternatively, the US would have to revalue the yellow metal to $34,000 just to get debt-to-GDP to the maximum “sustainable” level of 90%. And it would take a gold revaluation to $86,000 to return America’s debt-to-GDP back to where it was in 2007, prior to the Great Financial Crisis. Got gold?

By the Numbers

As we’re officially into September, let’s take a look at the year-to-date performance (through August 31st) of some select major asset classes:

-7.0% 10-yr US Treasury proxy (TNX)

+5.3 Russell 2000

+7.1% Dow Industrials

+9.8% S&P 500

+11% Nasdaq Composite

+32% Gold

+39% Silver

+75% Silver miners proxy (SIL)

+79% Gold miners proxy (GDX)

Source: Yahoo!Finance

The Question of the Week

Last Week’s Poll Results

- Yes 27%

- To each his own. 25%

More than 2000 Len Penzo dot Com readers responded to last week’s question and it turns out that almost 3 in 4 of you would never look down your nose at someone who orders a pizza with pineapple. That’s nice to know, considering I love pizzas with pineapple and Canadian bacon or sausage!

If you have a question you’d like me to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Quick Thinker

One day a wife went into the garage, where her husband was under the car, struggling to fix a pesky motor. “Honey,” she said, “if you were asked to describe me, what would you say?”

Without hesitating or stopping his work, the busy husband replied from under the car, “ABCDEFGHIJK.”

Bewildered by her husband’s seemingly thoughtless response, the wife asked, “What on earth does that mean?”

As he continued his wrench-turning, the husband again replied without any hesitation whatsoever: “Adorable, beautiful, cute, delightful, elegant, fashionable, gorgeous, and hot.”

The wife began to blush and said, “Aww, thank you, Honey! That’s really sweet!”

The man continued to work on the car. A few seconds later, the wife said, “Honey …”

“Yes?” replied her husband, still working furiously.

“What about IJK?”

The husband said, “I’m just kidding.”

(h/t: Sam I Am)

Squirrel Cam

Last week I shared a shot of Ricky looking into the camera to let us know that the picnic table was missing. Lucky for him, the Honeybee saw him. Here is the follow-on video …

.

Buy Me a Coffee? Thank You!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X.

3. Become a fan of Len Penzo dot Com on Facebook too!And last, but not least …

4. Please support this website by clicking on my sponsors’ ads! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my article explaining why jacuzzi-style tubs are a waste of money, Chung offered this counterpoint:

I think whirlpool tubs are simply sublime in soothing us from throbs.

Well, now… that’s certainly an interesting way to put it.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: public domain

Good morning Len, and thanks for another good cuppa Joe! South Dakota is also grappling with the ‘property tax’ question, since property values have increased dramatically as people moved here during CoVid lockdowns. Some lawmakers want to abolish it here, but we don’t want to trade ‘no property taxes’ for ‘higher sales taxes’! Interesting times, for sure.

Also, I remember when platinum was worth more than gold, but it’s been worth less for many years now. What happened to it, and is it still a good ‘safe haven’ investment? Because it seems like a pretty good deal these days!

Hi Lauren. Personally, I stay away from platinum and stick with physical silver and gold. But your point is well-taken; until recently, platinum had almost always sold for a higher price than gold (at least over the past 100 years or so).

A nice compromise to property taxes is something similar to California’s Prop 13, which limits property tax increases to 1% annually (excluding local bond fees passed by the electorate). The property tax resets to appraised value only after the house is sold to a new owner. For an example of how well it works, consider my situation: I bought my current Southern California home in 1997 for $199,000. The house is currently appraised at almost $1 million, and yet my annual property tax this year is less than $5000. I think it was just over $2400 back in 1997.

Len, that IS a pretty good compromise on the CA property taxes. I’ll have to research it a bit, and then may bring it up at the next mtg on the subject; thanks!

One correction: The max increase is limited to 2% per year (it can be less, and varies based on an inflation factor). Still, as you can see, it is a godsend for homeowners and allows them to stay in their homes even if they are on a fixed income and the housing market reaches absurd heights.

Working under the car add on….another useless news anecdote, but a true story.

One summer I was working up north, Yukon. Small town. 900 people. 1/2 the town partying alcoholics, and 1/2 regular church attendees bordering on rigid and strict….no fun. One day, a husband in the latter camp asked a mechanic buddy for help on his truck. Unaware to the wife, the mechanic under the truck on a creeper was wearing the same type/colour coveralls her husband always wore. This no fun wife decided to change things up and walked over to the truck, rubbed her foot up and down the inside of her husbands thigh, all the way to his crotch, and said, “Hey honey, what do you say we get you out of those coveralls later on and see what happens? Laughing pretty hard, she went back into the house and watched the truck from the kitchen window to see what would happen next. She then saw her husband walk out of the barn, pound his hand on the truck fender, and called out for his buddy to have coffee. In the house.

Wife bailed. Gone all day for some reason. She spent the day at my bosses house.

LOL! Great story, Paul! Thanks for sharing that!

Great cuppa this week Len. Thank you for starting my Saturday mornings off with your thoughts

Lately I have been rewatching one of my favorite sit coms, Barney Miller. One episode this week concerned a woman wanting to have her husband arrested because he was selling their assets and hoarding gold. It was humorous to see the various detective’s reactions to the thought of economic collapse and the demise of fiat currency way back in 1978. Dietrich got it, Harris wanted in on the gold rush and purchased one of the gold fan’s 50 Peso coins for $250. I chuckled at the cost back then.

I am wondering if this was the start of my distrust in the monetary system back then. lol

Hi David. I’ve seen a lot of Barney Miller episodes, but I missed that one. That episode is a reflection of how widespread the public’s awareness of the gold was back in 1978. By then, gold was in the final years of its decade-long bull market where it ran from $35 in 1971 to $850 in 1980. Gold’s biggest move came between 78 and 81 when it jumped from ~$225 to $850. Compare that to today, and most Americans are still not really even paying attention to gold yet.

Those gold reval numbers assume that the U.S.A. has all the gold in Fort Knox that it claims to have.

Yep. If the US has less than 8333 metric tons, then those gold prices have to be adjusted even higher.

Len, you are on fire with some of your posts lately and this is another cracker!

Thanks, Jimmy!

Hi Len!

I’m happy the weekend is finally here. While everything seems to be slowly melting down, I’ll just continue to keep my head down and collect silver on a steady basis.

Have a great weekend everybody!

Sara

Good plan, Sara. Carry on!

Len

Always a joy to read this column. Have to adk: would you consider doing a podcast with some of your diehard readers calling in to ask questions or offer sane, sagacious comments. You would be the best podcast anywhere if you decided to do this. I know it’s a tall order given your schedule but do please consider. Cheers.

Hi Ron… I appreciate your suggestion. I’ll have to think about it. Podcasts are a lot of work and I’m not sure I have the gumption to work that hard! That being said, I have toyed around with the thought of starting up a YouTube channel based on this Black Coffee column – but that’s a bit of work too. (I’m getting lazy in my old age!) But that may still happen. Requests like yours are hard to ignore.