It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well… another busy week is behind us. So with that in mind, let’s get this party started!

He who is quick to borrow is slow to pay.

– German proverb

There are three kinds of people: the haves, the have-nots, and the have-not-paid-for-what-they-haves.

– Earl Wilson

Credits and Debits

Credit: Did you see this? A new survey was released last week that reveals the average US household was in debt to the tune of $152,653 at the end of June 2025. While the headline was supposed to convey shock, if one considers mortgage debt, then this total seems more than reasonable. On the other hand, for household that don’t hold a mortgage, that figure is indeed a bit problematic. Behold, Exhibit A …

Debit: By the way, the same survey found that two out of every five American households admit that debt was a source of conflict in their homes. Hopefully, those households will be able to sort our their troubles before it breaks them up because divorce lawyer bills will only make their debt mountain higher.

Debit: On the other side of the ledger, just 1 in 4 consumers making more than $80,000 annually have enough savings to cover a year’s worth of living expenses. Even worse, more than half (56%) wouldn’t last six months. Sheesh. You’d expect high earners to be better prepared – especially in this softening job market – but that’s not always the case. Frankly, we’re not willing to speculate on where to put the blame for this sorry statistic because we simply don’t have enough clues to make an informed assessment. Unlike here …

h/t: @spillthememes

Debit: It’s possible that Americans’ savings status may grow more tenuous if you consider that US stores are now reportedly shuttering their doors at an annualized pace that surpasses even the rapid business closings during the pandemic years. During the first six months of this year, 5822 store closures were recorded. Probably by someone like Miss Jones …

Credit: Needless to say, in many places across America, there are an increasing number of abandoned buildings dotting the landscape. That’s not surprising when you learn that the total amount of retail space that has been permanently shuttered in 2025 has reached a staggering 120 million square feet. We suspect the primary reason for this is not a sharp decline in economic activity. In fact, it can be explained in a single word: Amazon. For many people, allowing Amazon to become the behemoth it is today has been a rotten deal, but they’ll learn to like it. Eventually …

Debit: This is just more evidence why, between Amazon and the work-from-home movement, commercial real estate (CRE) is going to be a tough sell over the coming years. Then again, it’s not just brick-and-mortar companies that are in for a rough ride marketwise – Amazon is working hard to put its online competition out of business too. Anyway … speaking of rough rides:

Credit: On a related note, dying shopping malls are seeing a resurgence by replacing abandoned anchor stores with a variety of different businesses, from restaurants like The Cheesecake Factory, to large retailers like Dick’s Sporting Goods, entertainment options like Dave & Buster’s, hotels and even more experiential endeavors such as bowling alleys, laser tag, churches and apartments. No, really. Let’s just hope there are consumers still around with enough disposable income left over to spend …

Credit: In other news, of the estimated 2 million metric tons of tomatoes Mexico will export in 2025, 90% will end up in American grocery stores. In response to a new 17% tariff, Mexico has decided to lower the legal minimum price its farmers can sell their exported tomatoes in order to protect its domestic producers. Imagine that.

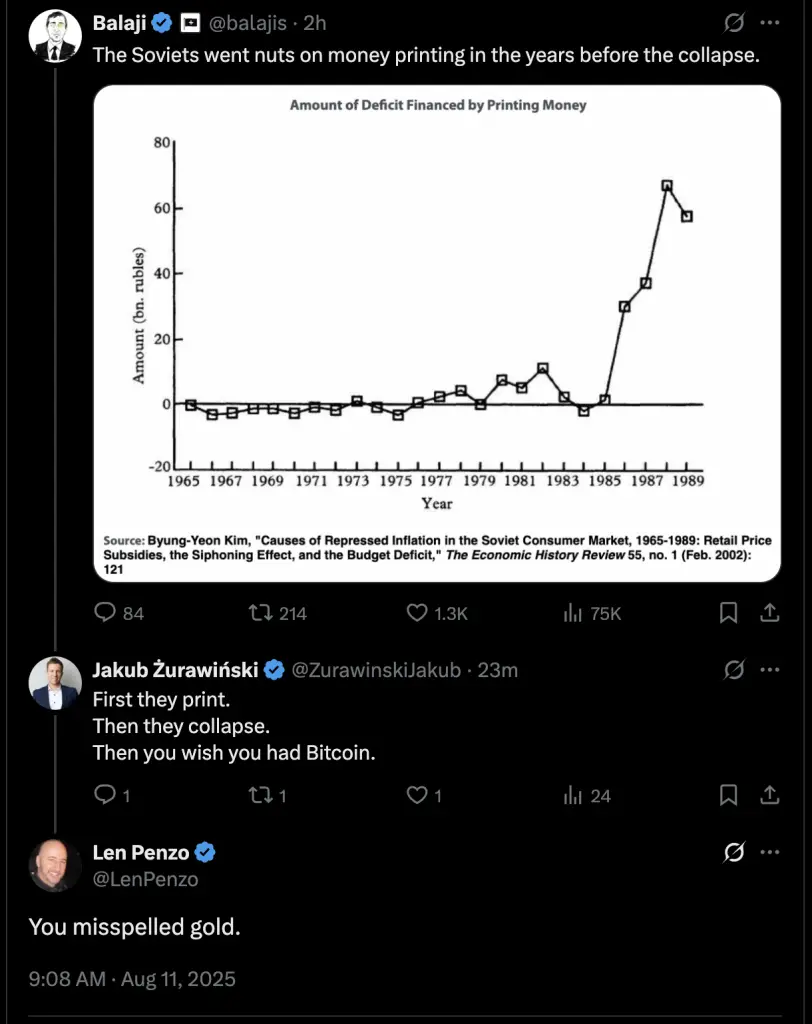

Debit: Meanwhile, Friday was the 54th anniversary of Richard Nixon’s infamous decree that “temporarily” broke the gold anchor with the US dollar (USD). And it’s no coincidence that America’s manufacturing base and fiscal health has been declining ever since. In fact, the federal government’s debt situation has become so onerous that the US National Debt is now growing at the staggering rate of more than $1 trillion every 100 days. Admittedly, the ever-expanding debt load is getting to be more than a bit tiresome. Then again, it appears as if we’re clearly not the only ones who are getting fed up with the same ol’ same ol’…

Credit: Speaking of the National Debt, The Silver Academy observes that although the United States was once the world’s premier creditor nation, it “now borrows just to pay the interest on previous borrowings. At what point does a nation resemble a cornered gambler, drawing cash advances from one credit card to pay off another, while the casino waits for its pound of flesh?” And on a related note …

h/t: @alifarhat79

Credit: We’ll end this week with an observation from macro analyst Brandon Smith, who notes that “It’s impossible to keep the USD globally dominant when everything is working against (it) right now, and there’s a lot of people who question if it’s even worth saving. But, the USD is all we have until a tangible safety net can be established.” Of course, it’s becoming increasingly obvious to almost everyone now that the tangible safety net is physical gold held in your possession. In fact, the yellow metal will be the bridge that carries us across the debt abyss to the next monetary system – whatever, and whenever, that may be.

By the Numbers

In 2025, the average 5-year-old car will keep just 54% of its original value, highlighting how some vehicles depreciate once they hit the used market. A new study analyzed the depreciation of 40 popular electric vehicles (EVs) and internal combustion engine (ICE) car models between 2020 and 2025. Here are the ten cars with the highest depreciation percentage over a maximum of five years. (EVs in bold red):

46.5% Nissan Ariya

48.1% 2022 F-150 Lightning

48.3% Audi Q8

48.7% Mercedes EQE sedan

49.4% Porsche Taycan

49.9% Toyota Crown

51.2% Volvo XC40 Recharge

51.9% Nissan Leaf

52.5% Nissan Juke

57.8% BMW i3

Source: NexusMedia

The Question of the Week

Last Week’s Poll Result

-

4 to 6: 30%

-

1 to 3: 23%

-

10 or more: 24%

-

7 to 9: 14%

-

None! 9%

More than 1900 Len Penzo dot Com readers answered last week’s poll question and it turns out that 1 in 3 of you have had no more than three cavities during your lifetime – and 1 in 11 have had none. You can put me in that last group. Yes, it’s true, I’ve never had a cavity despite being old as dirt! However, I’m absolutely convinced my lack of cavities has more to do with mouth chemistry than how well I take care of my teeth. I only say that because I know people who diligently floss and brush after every meal and still get cavities. Do you agree?

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: The Pillsbury Doughboy (1950 – 2025)

The Pillsbury Doughboy died yesterday in Minneapolis of a yeast infection and traumatic complications from repeated pokes in the belly. He was 71.

Doughboy was buried in a lightly greased coffin. Dozens of celebrities turned out to pay their respects, including Mrs. Butterworth, Hungry Jack, Duncan Hines, the California Raisins, Betty Crocker, the Hostess Twinkies, and Captain Crunch. The gravesite was piled high with flours.

Aunt Jemima delivered the eulogy and lovingly described Doughboy as a man who never knew how much he was kneaded.

Born and bread in Minnesota, Doughboy rose quickly in show business, but his later life was filled with turnovers. He was not regarded as a very smart cookie, wasting much of his dough on half-baked schemes.

Despite being a little flaky at times, he still was a crusty old man and served as a positive roll model for millions.

Doughboy is survived by his wife, Jane Dough, and three children: John Dough, Play Dough and Dosi Dough, who has a bun in the oven. He is also survived by his elderly father, Pop Tart.

The funeral was held at 3:50 for about 20 minutes.

He will be remembered for always rising to the occasion and cheering up someone having a crumby day and kneading a lift.

(h/t: Dave)

Squirrel Cam

Some of the finches in our neighborhood have taken a liking to walnuts. Here’s a mama bird showing her baby one of the local lunch stops …

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Alberta (2.25 pages/visit)

2. British Columbia (1.88)

3. Manitoba (1.73)

4. Newfoundland & Labrador (1.67)

5. Quebec (1.62)

9. Ontario (1.47)

10. Yukon (1.40)

11. Nova Scotia (1.33)

12. Prince Edward Island (1.30)

13. Northwest Territories (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Alberta, eh) — or not (ahem, you hosers living on the frozen Northwest Territories tundra) — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on Twitter. You can also follow me on Gab!

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by visiting my sponsors’ ads!

Thank you so much!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

I’m not sure why, but this week I clearly struck a nerve with Mary Sue, who felt compelled to drop this little piece of advice into the Len Penzo dot Com complaint box:

Your blog costs money. Get rid of it because you’re clearly not qualified to give rational advice.

Actually, in the blogging world … being unqualified makes me over-qualified.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len,

Thanks for another tasty cuppa!

I can almost see the day when everything you need for everyday living (and then some) is supplied by Amazon. You can find almost everything there.

Have a great weekend everybody!

Sara

Hi Sara! Sure seems that way, doesn’t it? It’s hard to believe Amazon was struggling to survive for many years in the early aughts. Now it’s a juggernaut.

I couldn’t afford to get divorced, but I did anyway. These days I’m broke, but happy.

Good for you, Cowpoke. I guess that makes you living proof that you can’t buy happiness?

Not surprised most of the cars on that list were EVs. They’ll be completely unsellable after 7 or 8 year when their batteries need replacing. Who wants to spend $25,000 for a battery replacement in an older tired car when they can a get brand new one?

Not me, Sam.

Hi Len, another fun cuppa Joe this morning! I struggle to understand how so many folks seem to have almost nothing in savings, yet virtually EVERYONE I know has cable TV or streaming svcs. (or both), eats out occasionally, has kids buying school lunch daily and enjoys things like Starbucks regularly. Hmm, maybe there’s a connection…

Honestly, since nothing makes sense anymore, I’m glad you’re finding so many humorous things to sprinkle into your “coffee”! The Star Wars clip is hilarious, as is the Pillsbury Doughboy’s obit!

I hope everyone enjoys their weekend! 🙂

Thanks, Lauren! It’s all about priorities. I’ve actually been told by a couple of younger people that it makes no sense to save since they won’t have enough when they retire anyway. What a defeatist attitude!

I hope you are enjoying your summer in beautiful South Dakota!

Have you ever heard of the GDP being pegged to energy with a 1:1 ratio? This is what Nate Hagens from The Great Simplification discusses as often as you discuss gold. I mention the podcast and Nate because there was recently a discussion of gold on that podcast by investment strategist Lyn Alden and I thought of all the black coffee you’ve served over the years. I feel like you both ride on the same coin (different sides) of economic doom. I’d love to hear your thoughts on his work. Please and thank you.

Thanks for the comment, SJ!

I’m not familiar with Nate; I’ll have to check out his work. “Energy” is a broad term. Is he referring to “energy” as the USD price “oil”? Or the realized cost of generated/consumed power (in Watts) across all energy realms? Or something else? I am loathe to tie GDP to anything other than currency printing since the formula is flawed (because it includes government spending); it is my opinion that GDP’s only legitimate functional use is as an indicator of a sovereign nation’s borrowing (currency printing) capacity via the debt-to-GDP ratio – that is, a national credit rating.