It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well… another busy week is behind us. So with that in mind, let’s get this party started!

Credits and Debits

A robber who justifies his theft by claiming that he actually helped his victims because his spending gave a boost to retail trade, would find few converts. But when this theory is clothed in Keynesian equations and impressive references to the ‘multiplier effect,’ it unfortunately carries more conviction.

— Murray Rothbard

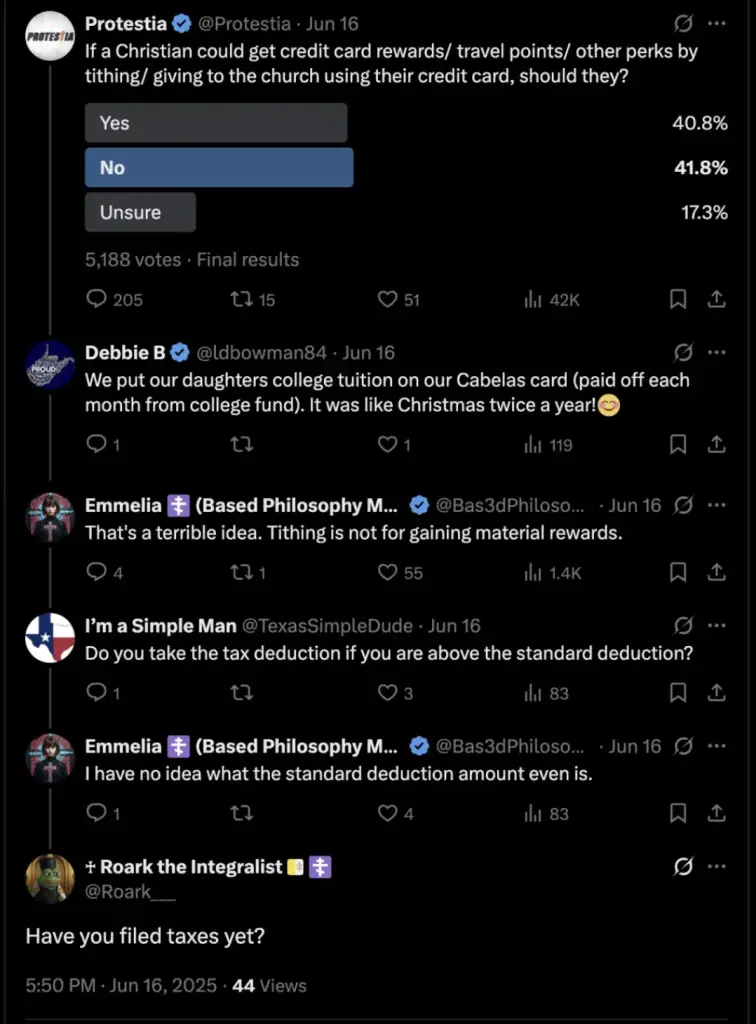

Credit: Did you see this? A new survey by Bank of America found that 70% said the best perk a credit card can offer is cash back. However, among consumers with premium cards – defined as those with an annual fee of at least $250 – just 33% valued cash back most, while 52% had more appreciation for card points. Either way… these bonuses encourage many people to get very creative when considering ways to use their cards. For example …

Credit: By the way, the survey also found that 45% of credit cardholders reported having an annual fee of any size, which exceeded analysts’ expectations because the Consumer Protection Bureau has estimated in the past that fewer than 1 in 3 consumers had credit cards that charged an annual fee – and that consumers with excellent credit were being charged, on average, $129 per year annually for cards offering a bonus of some kind, whether it’s cash back, hotel points – or airline miles…

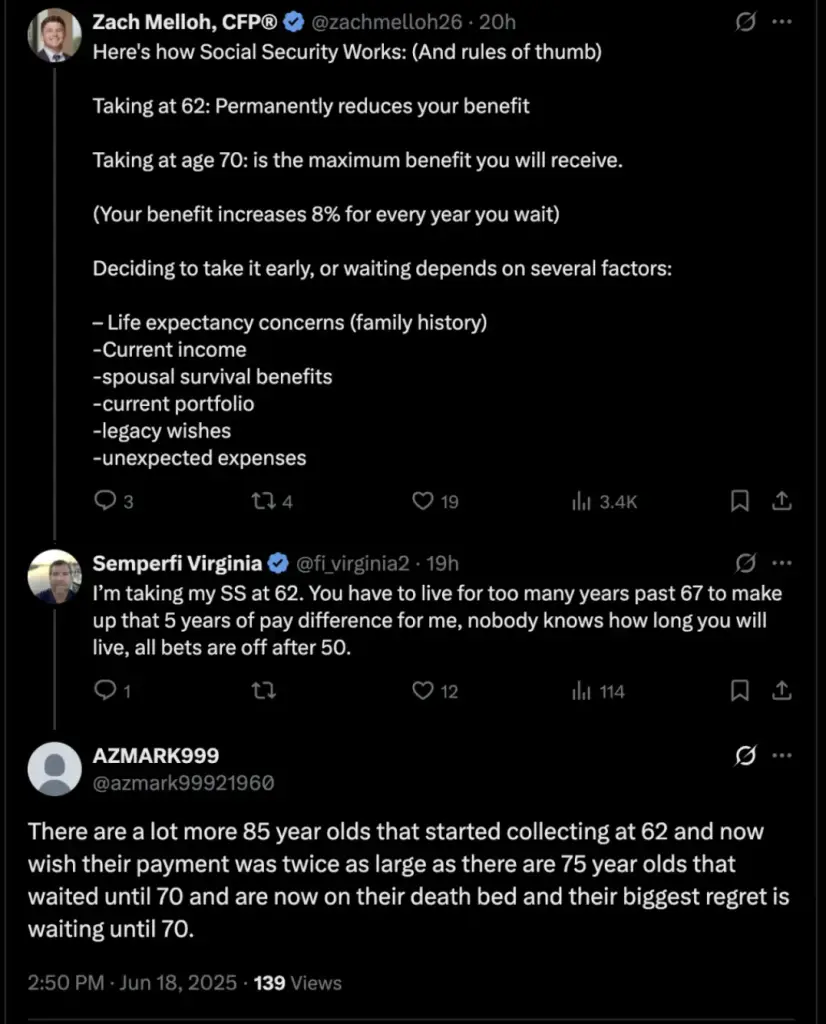

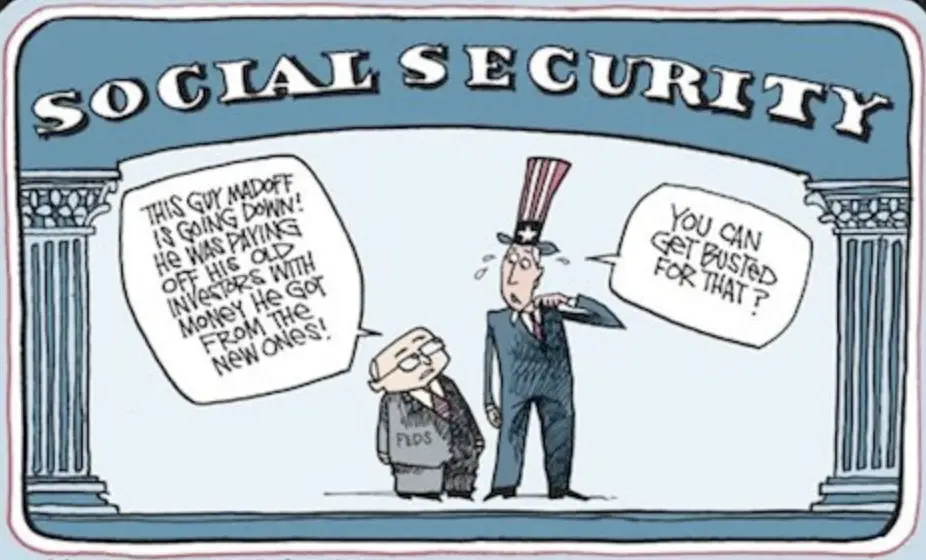

Debit: Meanwhile, a new analysis shows that more Americans are filing for retirement benefits earlier; the latest Social Security Administration (SSA) show that a record number of Americans have been dipping into their retirement accounts during the first seven months of fiscal year 2025. Taking benefits prior to reaching “full retirement age” can result in up to a 30% reduction in benefits and hurt recipients’ long-term retirement security. Even so, for many people, waiting for a higher benefit check isn’t a convincing argument, either because they’re afraid they aren’t long for this world – or the Social Security System itself isn’t.

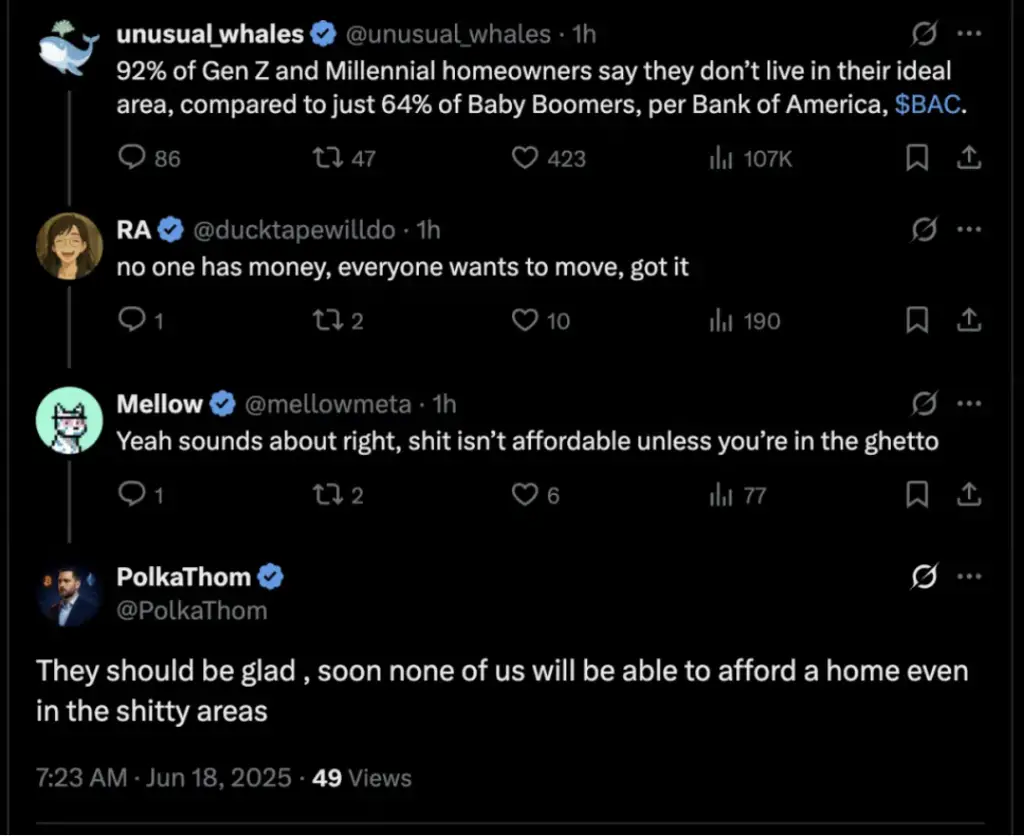

Debit: In other news, with potential homebuyers deterred by high mortgage rates and high asking prices, confidence among US homebuilders fell in June to the lowest level since December 2022. Imagine that. Nothing changes until the housing market suffers from a much-needed correction – or worse.

Credit: On a related note, luxury home-furnishing manufacturer RH – previously known as Restoration Hardware – announced this week that it is moving its production operations from China to the United States and Italy to avoid tariffs. Wall Street cheered the results, sending the company’s shares up 7% after the announcement. Imagine that. It’s really not rocket science – at least it isn’t for most people…

h/t: The Far Side by Gary Larson

Debit: Speaking of the stock market, the major indices gainsaid each other on Friday with the S&P 500 and Nasdaq down, but the Dow up. However for the week all three indices finished in the red, with the Nasdaq falling 1.1%, the S&P 500 down 1,3%, and the Dow 1.8% lower.

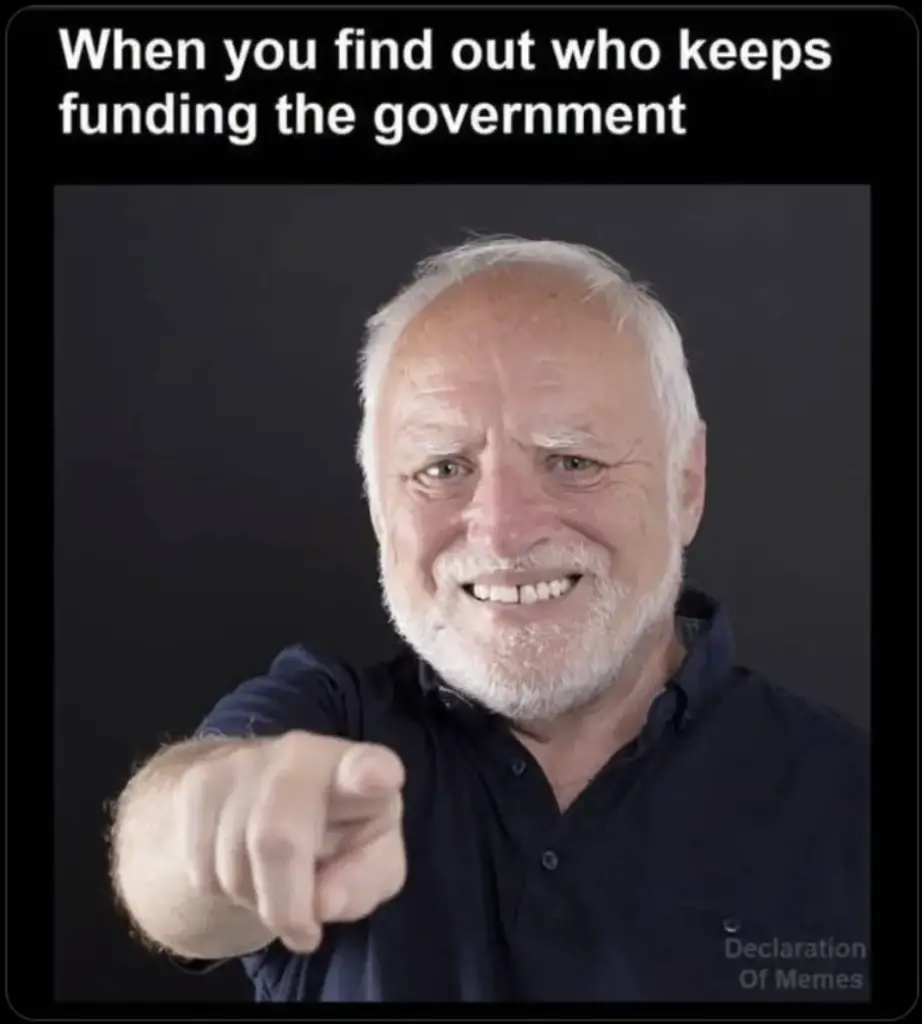

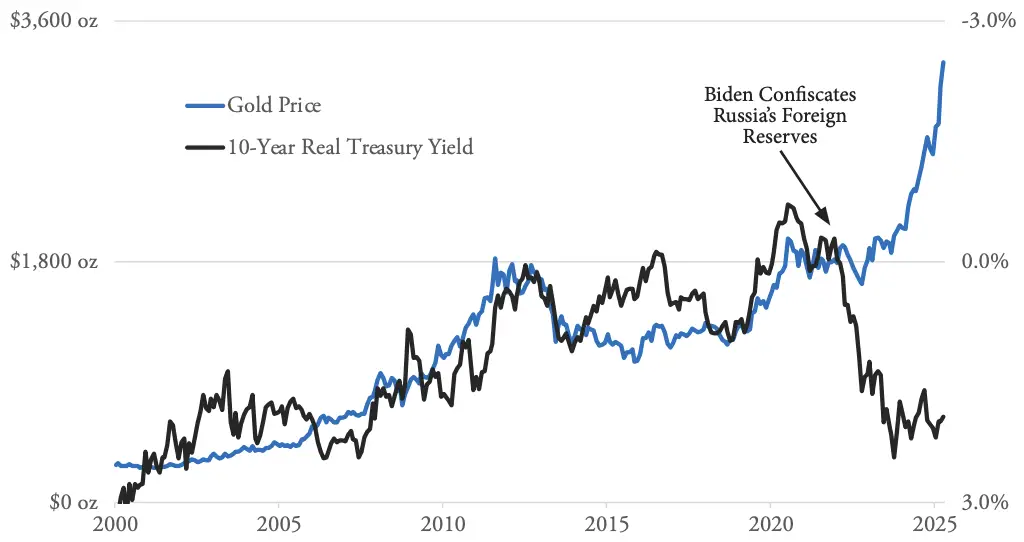

Credit: As macro analyst Daniel Oliver points out, in February 2022 the US “confiscated Russia’s US dollar (USD) reserves in February 2022, and the long-term relationship between real interest rates and the gold price ended abruptly, heralding the USD’s demise as the primary international reserve asset.” Yep… and that’s bad news for the bond market. Anybody care to guess who’s going to pay for all of those US Treasury bonds if the world isn’t in the mood for them? Well… here’s a hint:

Source: Myrmikan Research

Credit: More from Mr. Oliver: “Gold is still cheap. At $3300, gold comprises just 13% of the Fed’s assets, the same level as in 1971 – (and) the market demands one-third backing in normal times, assuming that the bank’s other assets are sound. These aren’t normal times, and the Fed’s other assets aren’t sound.” Then again, we think anyone with a lick of horse sense who’s been paying attention knows that. Right, boys?

Debit: By the way, the federal government’s balance sheet isn’t so good either – with the US National Debt quickly approaching $37 trillion and a debt-to-GDP ratio of more than 130%.

h/t: @semisimulacrum

Credit: Here’s the bottom line: Gold is the premier safe haven because it will help preserve hard-earned wealth you’ve accumulated over your lifetime. That’s important to know. Especially if you’re like us and have very serious concerns about the continuing viability of the USD.

By the Numbers

A new study has identified the ten states where the risk of credit score damage and vehicle repossession is increasing the most, based upon the percentage increase in 30-day auto-loan delinquencies on consumers’ credit reports across all 50 states between the third and fourth quarters of 2024:

6.5% Arizona

6.7% Massachusetts

6.8% Alabama

6.9% Washington

7.0% Colorado

7.2% Oklahoma

7.3% Montana

7.4% New Hampshire

7.9% Kansas

8.8% Delaware

Source: WalletHub

The Question of the Week

Last Week’s Poll Result

What is your favorite season of the year?

- Autumn 50%

- Spring 29%

- Summer 15%

- Winter 6%

More than 1900 Len Penzo dot Com readers answered last week’s poll question and it turns out that a slight majority say autumn is their favorite time of the year. What’s not to love? Colorful foliage, Halloween, Thanksgiving and the lead-up to Christmas. It truly is a magical time of year!

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: The Angry Cowboy

A cowboy went into a saloon and bought a drink. When he finished it, he saw that his horse had been stolen. So the cowboy went back into the saloon, flipped his gun into the air, caught it above his head without looking, and then fired a shot into the ceiling.

With everybody’s attention secured, the cowboy calmly announced, “Alright. I’m gonna have another beer, and if my horse ain’t back outside by the time I finish, then I’m gonna do what I done in Texas! And I don’t want to have to do what I done in Texas!”

And with that, the cowboy stepped up to the bar and had another beer.

After the cowboy finished his beer, he walked outside and saw that his horse had been returned to the saloon’s hitching post. As he started to ride out of town, the bartender ran outside and asked, “Say, pardner! Before you go… what happened in Texas?”

“Well,” the cowboy said, “I had to walk home.”

(h/t: Dave)

Squirrel Cam

Say hello to one of our newest California ground squirrels. This little one can’t be much more than a month old …

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Alberta (2.10 pages/visit)

2. Saskatchewan (1.92)

3. British Columbia (1.87)

4. Manitoba (1.62)

5. Yukon (1.61)

9. Prince Edward Island (1.39)

10. New Brunswick (1.35)

11. Nova Scotia (1.32)

12. Newfoundland & Labrador (1.27)

13. Northwest Territories (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Alberta, eh) — or not (ahem, you hosers living on the frozen Northwest Territories tundra) — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on Twitter. You can also follow me on Gab!

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by visiting my sponsors’ ads!

Thank you so much!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

After reading my article on how to get credit card interest charges waived, Vicky S. left this comment:

I’m still not sure how I ended up here, but I thought this post was really good. Cheers!

To tell you the truth, Vicky… I’m still trying to figure out how I ended up here myself.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len,

Thanks for the cuppa!

I’m leaning toward taking social security when I turn 62 just because I think the whole system will implode before I get to 67 or 70. With my luck it will probably be gone before I get to 62.

Have a great weekend everybody!

Sara

I wouldn’t worry about Social Security going anywhere, Sara. Politicians will fix any funding issues before they ever cut promised nominal benefits (although they won’t necessarily maintain the purchasing power of those benefits). They may also increase the retirement age again.

“When you visit the meth house park at the meth house!”

I used to live in that same neighborhood. LOL

Sorry to hear that, Sam. Glad you escaped!

Hi Len, another good cuppa Joe this weekend. I had NO idea that so may folks still pay an annual fee on their credit card! We’ve started using our ‘rewards’ card for more everyday stuff like groceries & gas, to use the rewards for gift shopping and travel (those VISA gift cards can be used just about anywhere!)

Sara’s logic is why my husband took SS at age 62. We computed the $ difference between taking at ages 62, 65 and 70, and discovered that hubby would need to live to age 78 before ‘breaking even’ (good calculators at the SS site!) After he applied, I began receiving “spousal” SS based on his acct., and deferred MY SS until I turned 67 this year. IMO, win/win! Enjoy your Sunday, everyone! 🙂

Thanks, Lauren. A lot of people say those annual fees are more than made up for by the credit card rewards (assuming they pay off their balances in full every month). It all depends on how much you spend.

Anecdotally, it seems like there is a growing number of people who are planning to take – or already have taken – early SS bennies. For many of them, they have perfectly good reasons. My late mother-in-law took her benefits at 62 because she was diagnosed with cancer a few years prior to her 62nd birthday because she figured she’d never live to see her breakeven date. As luck would have it she actually lived into her late 70s!

I like the sign posted on the pole. If you’re going to the Meth House park there.