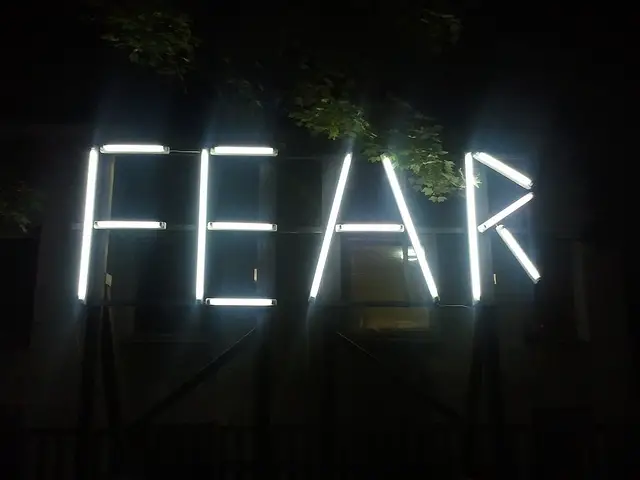

It’s hard to stay level-headed when headlines are screaming about crashing markets, rising interest rates, and global uncertainty. One minute, everything seems fine. The next, you’re refreshing your bank app and wondering if you should pull your money out of the stock market altogether. Meanwhile, you’re looking or tricks on how to stay calm.

It’s hard to stay level-headed when headlines are screaming about crashing markets, rising interest rates, and global uncertainty. One minute, everything seems fine. The next, you’re refreshing your bank app and wondering if you should pull your money out of the stock market altogether. Meanwhile, you’re looking or tricks on how to stay calm.

In times like these, panic can creep in quickly – especially when you’re reading things like ASX index updates today and seeing red arrows everywhere. But here’s the thing: reacting emotionally to economic downturns often leads to worse outcomes than the downturn itself.

Learning how to stay calm when the economy looks shaky isn’t just about peace of mind – it can help protect your financial future too.

Why Panic Doesn’t Pay

Let’s get one thing clear: economic dips are normal. Markets go up and down; that’s just part of the cycle. The problem is, when people panic, they make rushed decisions. Selling investments at a loss, hoarding cash out of fear, or abandoning long-term strategies can do more damage than the downturn itself.

The truth is, most investors who pull out during a crash miss the eventual rebound. They lock in losses and often re-enter the market too late; after prices have already bounced back.

Instead of reacting impulsively, the goal is to pause, assess, and make measured choices that align with your long-term goals.

Ground Yourself With Perspective

When markets are falling, it’s easy to feel like you’re watching your future evaporate. But step back for a moment and look at the big picture.

Here are a few facts that help put things in perspective:

- Every major market downturn in history has eventually recovered.

- Volatility is a normal part of investing; not a sign that something is broken.

- Staying invested over the long term generally yields better results than trying to time exits and entries.

This doesn’t mean you should ignore what’s happening. But it does mean you don’t need to act on every headline or short-term swing.

Practical Tips to Stay Calm and Focused

When the economy looks uncertain, here are some simple, evidence-based steps to help keep your cool:

1. Check Your Timeline

If you’re investing for the long term — retirement, buying a home, future goals — short-term dips shouldn’t derail your strategy. Your money has time to recover.

2. Focus on What You Can Control

You can’t control global markets, but you can control your spending, savings, and investment habits. Tighten your budget if needed. Keep contributing to your portfolio. Those actions add up.

3. Limit the Doomscrolling

There’s a difference between staying informed and spiraling into anxiety. Choose a few reliable news sources, check in once a day if needed; then log off.

4. Stick to Your Plan (or Adjust It With a Clear Head)

If you already have a diversified investment plan in place, this is when it earns its keep. If you don’t, now might be a good time to speak with a financial adviser. Just make sure any changes you make are thoughtful, not fear-based.

5. Don’t Go It Alone

Talk to someone — a trusted adviser, a financially savvy friend, or even your partner. Sharing concerns can help you feel more grounded, and you might get a useful perspective you hadn’t considered.

Reframe What a Downturn Can Mean

An economic downturn isn’t always bad news for long-term investors. In fact, some see it as an opportunity.

Lower market prices can mean good buying conditions if you’ve got a solid plan and a cool head. Regular contributions during a dip (sometimes called “buying the dip”) can work in your favour over time through dollar-cost averaging.

Think of it this way: If you’re shopping for quality shares and they’re on sale, that’s not necessarily the time to walk out of the store – it might be the time to stock up.

Economic uncertainty can rattle even the most confident investors. But staying calm, keeping perspective, and focusing on what you can control is one of the best financial habits you can build. Whether the market is surging or sliding, your mindset matters just as much as your money.

Needless to say, no one enjoys seeing their balance drop. But with the right approach, you don’t have to let short-term turbulence shake long-term success.

Photo Credit: dryhead

Good article! I was taught about “dollar cost averaging” a few decades ago, and I started only looking at the markets every few days so I wouldn’t get too nervous about the swings.

Hopefully everyone invested in the Markets these days also knows to diversify their holdings, and I KNOW everyone reading HERE knows to keep some $ in gold & silver, too!

That’s the key, Lauren. Don’t look at your statement too often. I try to visit my portfolio once a quarter and I rebalance my accounts once a year. Otherwise it will drive you crazy!

I look at my portfolio once a month. It only gets rebalanced if things get really out of whack.

People stay glued to media and it works them up into anger and fear. It’s a ploy of the media to raise viewership, so they can charge advertisers more. Turn off your media, get a life! Read a book. Go out and do something. Read the Constitution! People were quoting to me something from Article III of the Constitution that isn’t even in there. I could tell immediately that they’d had an inferior education and could not read cursive.

The only thing to fear……..is going to hell!

Great advice, Bill!

I feel no one should care about your money as much as you do and only put in the market so you can sleep and not worry over. The only time I lost money was when I had a broker advisor, I use Vanguard and have for years and am happy!

Agreed, John!