It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Another busy week is crossed off the list. So without further ado, let’s get right to the commentary …

The silver market is nothing but a swindle, wrapped in a scam, surrounded by fraud.

– Craig Hemke

More and more people are asking if a gold standard will end the financial crisis in which we find ourselves. The question isn’t so much if we’ll resort to gold, but when. All great inflations end with the acceptance of real money – gold – and the rejection of political money – paper.

– Ron Paul

Credits and Debits

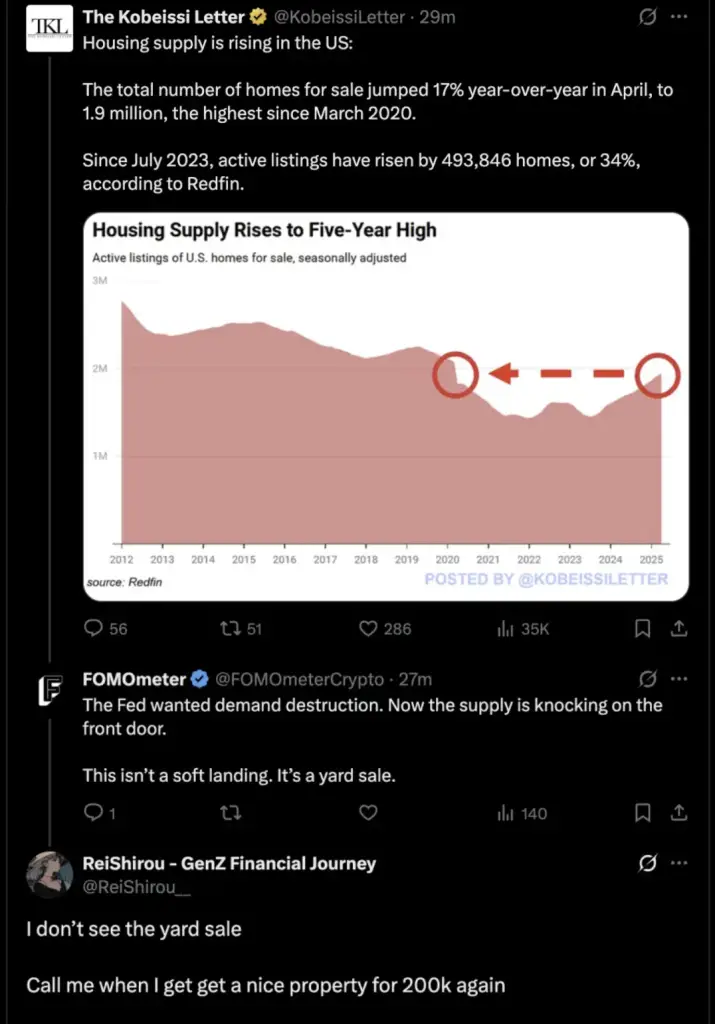

Debit: Did you see this? The inventory of existing homes for sale increased nearly 21% from a year ago, but the increase in home listings failed to spark homebuying. In fact, US home sales fell to their slowest pace since April 2009, which was the in the depths of the Great Financial Crisis. Probably because the increase in supply also failed to bring prices down; the median sales price climbed 1.8% from a year ago to $414,000. This is just more proof that the housing market is completely broken – not that you have to tell that to young people looking to buy their first homes. And it looks like only a significant market crash can fix it.

Credit: Perhaps ridiculously-high home prices are why approximately 17% of Americans now shop at thrift stores annually. Among those pre-owned product consumers, 93% primarily shop online, with bargain hunters spending an average of $1760 a year. Last year, America’s second-hand market generated $53 billion in revenue. As for the most popular second-hand product? It’s clothing. Since 2023, the apparel resale sector has grown 15 times faster than the overall retail clothing industry – that’s even faster than the artificial intelligence (AI) industry. Although that seems rather hard to believe these days …

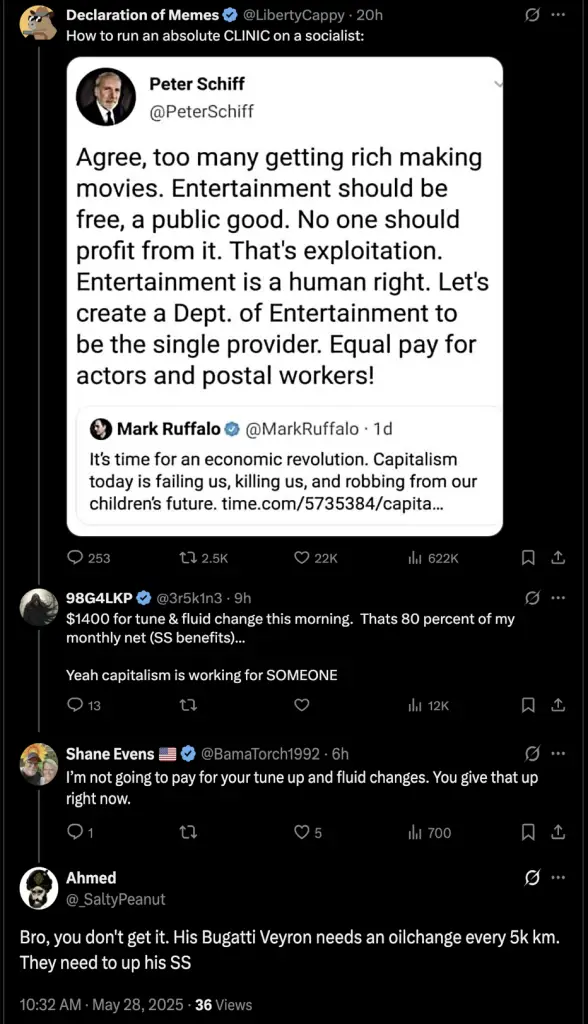

Credit: On the other hand, while a growing number of Americans are shopping at second-hand stores, a new study found that the share of registered voters saying their household financial situation is worse than the year before fell to 31.8% – that’s the lowest figure since January 2022. So more people believe things are looking up (at least on the surface). Just don’t tell that to Bernie and Ben & Jerry. Oh … and apparently actor Mark Ruffalo too:

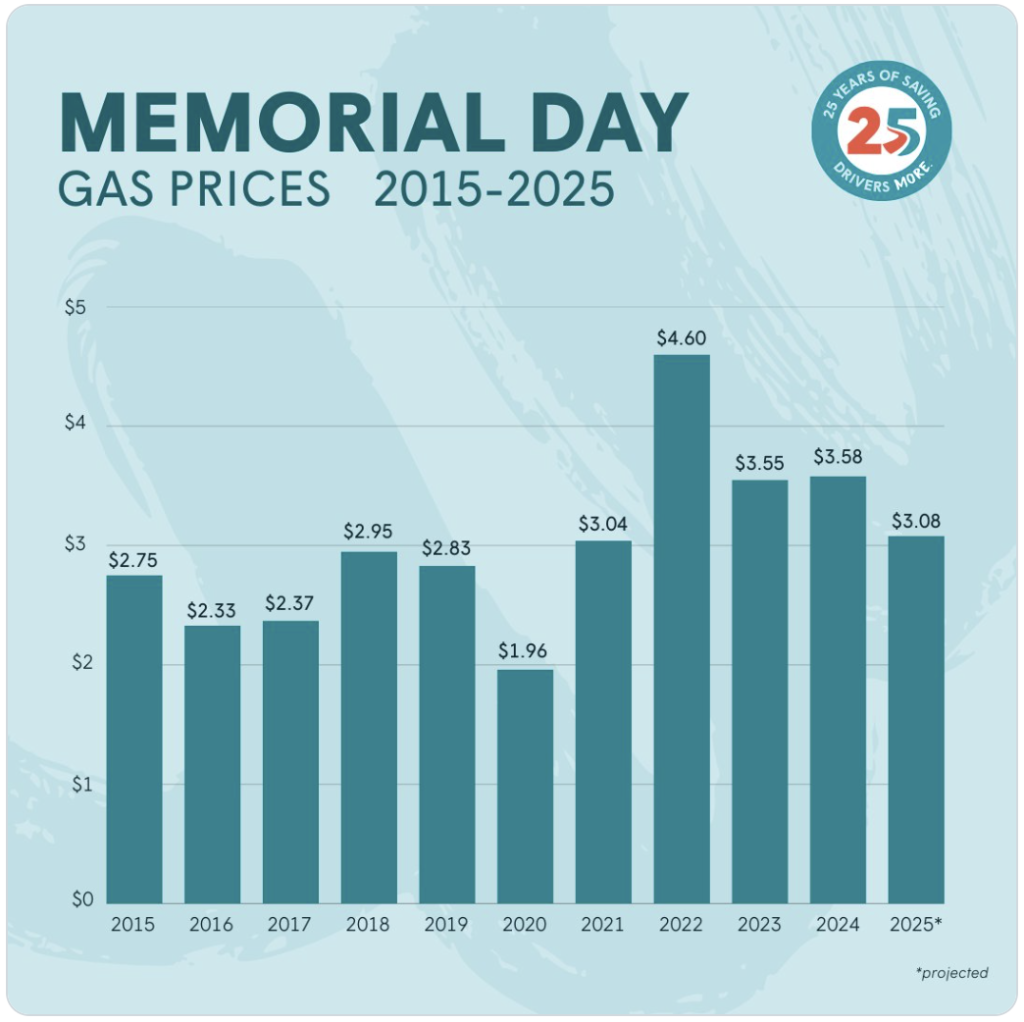

Credit: It’s possible rising economic sentiment is tied to falling energy prices. That’s because gasoline prices hit their lowest inflation-adjusted price level in more than two decades on Memorial Day. The average pump price was the lowest nominal level since 2021 and the lowest inflation-adjusted price since 2003. Well … except in states like California that are seeing little to no relief at the pumps, and gasoline prices that are almost as high as they’ve ever been. Ask us how we know.

Source: GasBuddy

Debit: Speaking of low prices, over the past several months, silver has been near a historic low relative to gold. The current gold-to-silver (GSR) ratio is currently at 100. Compare this to most of recorded history, when the GSR rarely exceeded 16. Today’s ratio is increasingly exhibiting extremes that defy the historical norm. As a result, market analyst Bart Brands notes that with the GSR at 100, “silver is dirt-cheap; the GSR makes no logical sense given silver’s utility.” Indeed. Which is why it’s important for current holders of physical silver advocates to maintain their strength of conviction until prices normalize — or else:

Credit: In other news, the US National Debt will soon reach $37 trillion. As for how we got here, James Howard Kunstler correctly points out that we Americans “fooled ourselves into thinking that we could replace … factory production with financial games based on jiggering interest rates and innovating ever more complex swindles. That merely produced a fantastic divide between the financial gamesters raking in billions while the former factory workers were left broke (and) demoralized.” Indeed. Now you know why Treasury Secretary Scott Bessent admitted this week that spending cuts can’t fix this; instead the US needs to “grow” – a.k.a. borrow – its way out of the situation.

h/t: @the_niall_r

Credit: Meanwhile, macro analyst John Rubino warned this week that, “We’re in the early stages of a currency death spiral where interest rates start to go up and the government can’t control that. Then their debt goes parabolic until everything breaks down. There are going to be currency crises, which we’ve never seen in our lifetimes.” And it’s not just the US dollar (USD) – it’s every other national fiat currency too. In the meantime …

Credit: With that in mind, nobody should be surprised that, after a long hiatus, central banks have been heavy buyers of gold for the past four years because they know gold is the ultimate protection from monetary tail risks, regardless of whether it’s catastrophic deflation or inflation — although emeritus Fed Chair, Ben Bernanke, will never admit it because, in order to sell their fiat-currency snake oil, he needs you to believe central banks buy the yellow metal for an entirely different reason:

Credit: Needless to say, it’s also no coincidence that, thanks to the growing lack of trust in the current USD-centric debt-based monetary system, the BRICS nations are in the process of creating of a multi-jurisdictional gold custody network using certified vaults that are currently under construction or negotiation in China, Saudi Arabia, Southeast Asia, and Africa. As macro analyst Vince Lanci reports, “These vaults will act the structural backbone of a new settlement system where gold is the primary collateral asset, replacing US Treasury (UST) bonds as the standard bearer of trust.” Meanwhile, back in the United States …

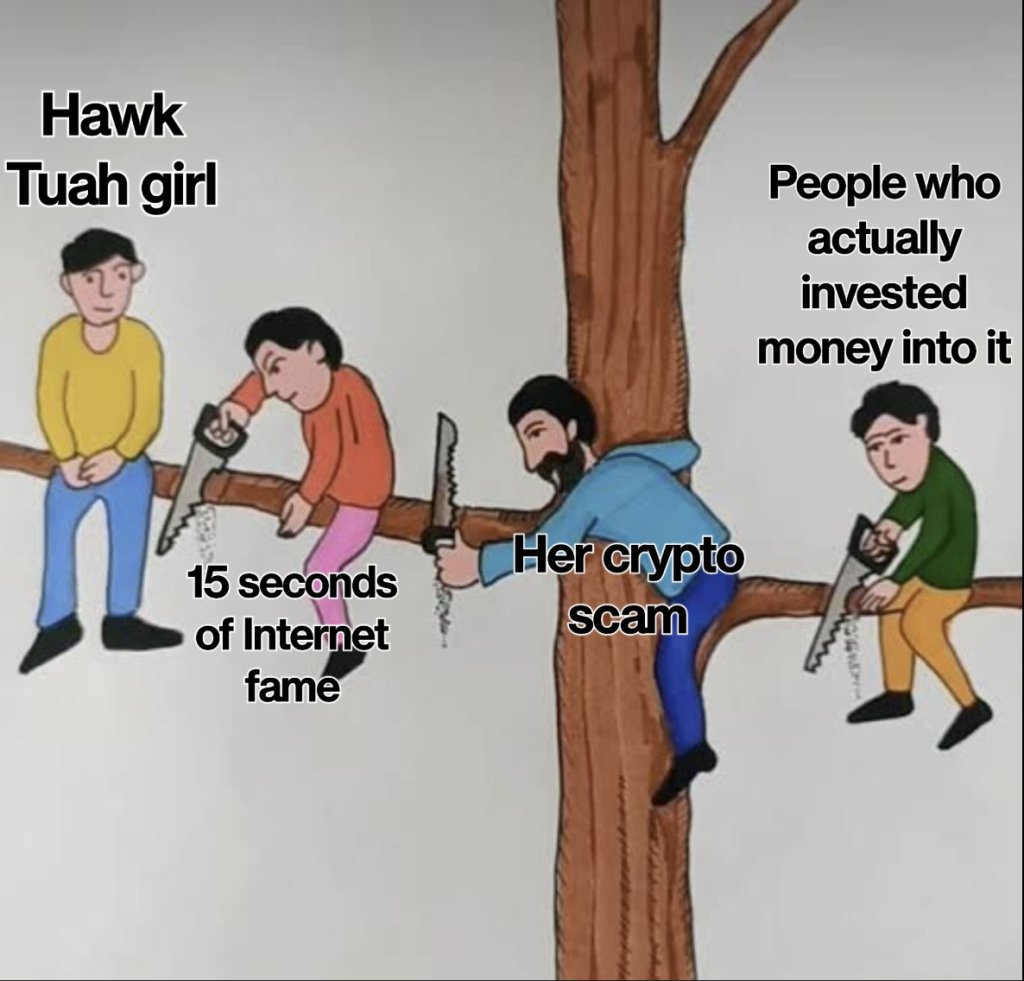

Credit: The new BRICS system under development, participants will not be required to convert yuan (and presumably other BRICS currencies) into gold, but they may do so, thereby introducing a convertibility layer into any BRICS currency by mimicking the gold window of Bretton Woods without forcing a formal gold standard. On the other hand, there are lots of “experts” out there who insist that the BRICS nations are making a mistake by using gold to anchor their new system because cryptocurrencies are the ultimate answer to the world’s monetary woes. So there’s that.

Debit: Of course, the BRICS planned move to gold is yet another signal that the end of the USD as the world’s premier reserve currency is drawing nigh. And until the US can reestablish its domestic manufacturing base, a loss of reserve currency status will result in at least a temporary reduction in American living standards. No matter what happens, the good news is gold holders can sleep soundly knowing that it doesn’t take a significant amount of the yellow metal to ensure that they’ll be properly compensated for a sharp drop in the USD’s future purchasing power.

By the Numbers

Researchers at the US Census Bureau looked at how many residential homes are vacant compared to the total number of homes in each state. Here are the states with the highest – and lowest – home vacancy rates:

50 Connecticut (vacancy rate: 6.7%)

49 Oregon (6.8%)

48 Nebraska (6.9%)

47 New Jersey (7.0%)

46 California (7.2%)

5 West Virginia (13.9%)

4 Florida (14.2%)

3 Alaska (16.0%)

2 Vermont (18.1%)

1 Maine (18.7%)

Source: US Census Bureau

The Question of the Week

Last Week’s Poll Results

Do you plan on taking a summer vacation this year?

- No 44%

- Yes 43%

- Maybe 13%

More than 1900 Len Penzo dot Com readers responded to this week’s poll and it turns out that the decision to take a summer vacation this year is split almost evenly – with 1 in 6 of you still on the fence. As for yours truly, I will not be taking a trip this summer – but I do plan on taking one in autumn, when temperatures a bit milder.

If you have a question you’d like me to ask the readers here, send it to me at Len@LenPenzo.com — and be sure to put “Question of the Week” in the subject line.

Useless News: Same As It Ever Was

The madam opened the brothel door in Elko County, Nevada, and saw a rather dignified, well-dressed, good-looking man in his late forties or early fifties.

“May I help you, sir?” she asked.

“I want to see Valerie,” the man replied.

“Sir, Valerie is one of our most expensive ladies. Perhaps you would prefer someone else,” said the madam.

“No,” he insisted, “I must see Valerie.”

Just then, Valerie appeared and announced to the man she charged $10,000 a visit.

Without hesitation, the man counted out $10,000 in crisp $100 bills and gave them to Valerie. Then they went upstairs and, after an hour, the man calmly left.

The next night, the man appeared again, once more asking to see Valerie.

Valerie explained that no one had ever come back to see her two nights in a row, as she was so very expensive. She also told the man that there were no discounts and the price was still $10,000. But the gentleman didn’t blink an eye. Again, he pulled out a wad of cash, gave it to Valerie, and they went upstairs.

After an hour, he left.

The following night the man was there yet again. Of course, everyone in the brothel was absolutely astounded that he had come to the Elko County brothel for a third consecutive night. For her part, the madam was certain the man was on the verge of setting a new record in the history of brothels in Nevada, which dated back to the early 1800s. And so it was — without hesitation this mystery man paid Valerie another $10,000. Then off they went, upstairs for another hour of bliss.

After their session, Valerie said to the man, “No one has ever been with me three nights in a row. Where are you from?”

The man replied, “Billings, Montana.”

“Oh, really?” she said. “What a coincidence — I have family in Billings.”

“I know,” the man said. “I regret to tell you this, but your sister died. I’m her attorney, and she instructed me to give you your $30,000 inheritance.”

As for the moral of the story, it’s that three things in life are certain: death, taxes and being screwed by a lawyer.

(h/t: Kenny)

Squirrel Cam

Last week we caught this talented red squirrel practicing his magic act on our porch. Frankly, it’s quite a trick! I just wish I knew how he did it.

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on Twitter.

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by visiting my sponsors ads!

Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

I want to thank John, who took some time to drop the following comment in my inbox about this weekly Black Coffee column:

I’m officially an addict. To me, the way you break down what’s going on in the financial world reads like Shakespeare.

Thanks, John — but I really think you’re making much ado about nothing.

If you enjoyed this, please forward it to your friends and family. I’m Len Penzo and I approved this message. 🙂

Photo Credit: stock photo

I had to laugh when I saw that realtor meme. When we bought our last house the realtor’s picture on her business cards, advertisements and even the “for sale” sign had a picture of her that had to have been taken when she was in her 20s. She was in her 50s or maybe even 60s.

Glad you enjoyed it, Robert. I LOL’d too!

Hi Len,

A very tasty cuppa this week!

We all know why DOGE isn’t going to be allowed to cut a lot from the government. The entire system depends on them blowing the biggest debt bubble on Earth!

Have a great weekend everybody!

Sara

Truer words were never spoken, Sara. I hope you had fun at Indy last week!

Hey, Len! What kind of bank gives out toasters and clocks for opening a new account? 🤔

To answer your question: Banks from long long ago, Madison. It was actually quite common prior to the 1990s. Back in the day, banks also gave away kitchenware and other gifts to entice people to open an account with them.

Good morning Len, and happy Summertime! I couldn’t eat breakfast after reading this column, thanks to your pic of “why you should wash your hands after pumping gas”! Ew!

Re: the increase in thrift store shoppers, I think it’s not just about inflation, but also about folks trying to avoid things made in China, and about people wanting more VALUE for their hard-earned money. Over the last several years a LOT of clothing has succumbed to shoddy, flimsy fabrics and lousy workmanship, while the prices have continued to rise. Same with housewares. Give me a gently used 15 year old wool blazer and a “Made in USA” set of Corelle Ware any day! 🙂

Don’t get me started on poor-quality clothing. My biggest pet peeve is with Levi’s. Sometime in the late 80s or early 90s they moved their manufacturing out of the US and the quality took a marked turn for the worse. T-shirts aren’t what they used to be either; all thin and last maybe 50 washings. Believe it or not, I still have a couple of favorite old quality tees that are about 30 years old.

As for that gasoline pump photo, I similarly learned why money was dirty back when I was a teenager working a cashier counter at my local supermarket. Rather than using their wallets, purses or pants pockets, customers would pull wads of cash to pay for their groceries from some very yucky, smelly, sweaty places (surprisingly, women more so than men). So gross!

Len, Wrangler is still making good jeans, although only certain models are made in the US these days. Virtually all the ranchers/cowboys wear them around here, so they’re still made for tough work and rodeos!

As for your story about the folks and their money in your younger days, I think I’ve seen those same people at my Walmart! 😉

During the hot humid summer months, stores post signs that say “No sock, bra or underwear money!”. It will soon be time for them to appear.

If you accidentally wash some cash in your pants pocket, the money comes out clean and crisp. If that doesn’t teach you about the filthiness of money, nothing will.

Very interesting about the signs, Bill! I know Federal Reserve Notes are made from a paper-cotton fiber hybrid for durability. I bet they would really look sharp if you ironed them after they came out of the wash. 😉