It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well … another busy week is behind us. So with that in mind, let’s get this party started …

In economics, things take longer to happen than you think they will – and then they happen faster than you thought they could.

– Rudiger Dornbusch

Credits and Debits

Debit: Did you see this? US bureaucrats are proposing tighter fuel-efficiency regulations that “would save Americans hundreds of dollars at the pump, all while making America more energy secure and less reliant on foreign oil.” Car manufacturers, however, aren’t on board with the idea. They say that the tougher requirements will add $3000 to car prices. According to the carmakers, “The plan exceeds reason and will increase consumer costs with absolutely no environmental or fuel savings benefits.” Of course. So to sum things up: Consumers will pay $3000 extra at the dealership in order to “save hundreds at the pump.” That’s government math for you.

Debit: While government bureaucrats are working hard to increase living costs by imposing more senseless automobile regulations, price inflation is continuing to run rampant on just about everything else. So it shouldn’t be a surprise to anyone that a recent study has found that 64% percent of American adults say they are spending less on non-essentials, while an equally high share say they pay more attention to bargains or deals. As for the other end of the consumer spectrum, only 11% of respondents say they haven’t changed their behavior at all. Curiously, nobody admitted they have resorted to shoplifting. Yet.

(h/t: @WillCity_)

Credit: On a related note, the ex-CEO of WalMart warned this week that, after a long period of cheap money cut short by the Fed’s rapid rate hikes, consumers are now beginning to buckle. According to Bill Simon, “Consumers had an incredible 12-year run. Markets were buoyant, interest rates were low and money was available.” But now, he is warning that the music has stopped – save for a handful of key stocks keeping the market afloat – and the party is grinding to a halt. Thanks, Captain Obvious – but I don’t think many folks needed a CEO to tell them that. Besides, a CEOs job is to think outside the box. You know … like this:

Debit: Speaking of rising prices and buckling consumers, the National Association of Realtors’ latest housing affordability index fell to its lowest level ever. Okay … at least it’s the lowest level since they started accumulating data in 1989. For those counting at home, the index is sitting at 91. For comparison purposes, 100 is the point where the median income can qualify for a mortgage with a 20% down payment; currently that income threshold is about $107,000. Put another way: Only higher-income American households that earn at least six-figures annually are now able to comfortably buy a home. Yikes.

(h/t: @Retro1upArmy)

Debit: Of course, inflation is merely a symptom of something more sinister: Government theft of your purchasing power, courtesy of spendthrift politicians. The US National Debt is now more than $33.5 trillion, which comes out to $99,847 per citizen and $258,000 per taxpayer. Keep in mind this does not include unfunded liabilities such as Social Security, Medicare, and government pensions. Frankly, Americans’ total financial burden is hard to comprehend when those liabilities are included; today, that’s an astonishing $578,000 for every US citizen. Ouch. If only Congress was as inept at stealing others’ money as this guy …

Credit: Alas, as macro analyst Michael Maharrey notes, “The prevailing attitude is that the US can borrow and spend indefinitely because it hasn’t caused a problem so far. So there’s a widespread belief that the US dollar (USD) is invincible – but it isn’t. A long fuse can burn a long time before it finally reaches the powder keg. I don’t know how long we have until the debt bomb explodes, but we get closer every day. And sadly, very few people care enough to address the problem.” Yep. That’s especially true for the stubborn Magic Money Tree goats, who will tell you until they’re blue in the face that the debt doesn’t matter because “we owe it to ourselves.”

Debit: The truth is, Americans who see the “Almighty Dollar” as invincible should take a close look at what’s going on in the world. For example, last week the BRICS economic bloc – via its official development bank – announced a three-year plan to completely end its reliance on the USD by settling trade in local currencies rather than the USD. Then again, judging by how Treasury bonds have been melting down over the past month, it seems like a lot of investors are betting that the USD may run into trouble long before 2026 gets here. Although it seems China has felt that way for quite a while now …

Debit: Despite offering lower returns than stocks, bonds are typically held by equity investors for their return-smoothing properties during economic downturns. Even better, they’ve tended to rally in a recession, mitigating any steep losses experienced by stocks. Yet during inflationary periods, stocks and bonds usually fall together. As a result, the stock-bond correlation is now positive after years of being negative. This means that rather than bonds having a dampening effect on the volatility of a traditional 60/40 portfolio of 60% equities and 40% bonds, they’re amplifying it. Not that anybody seems to be worried. It’s all so confusing …

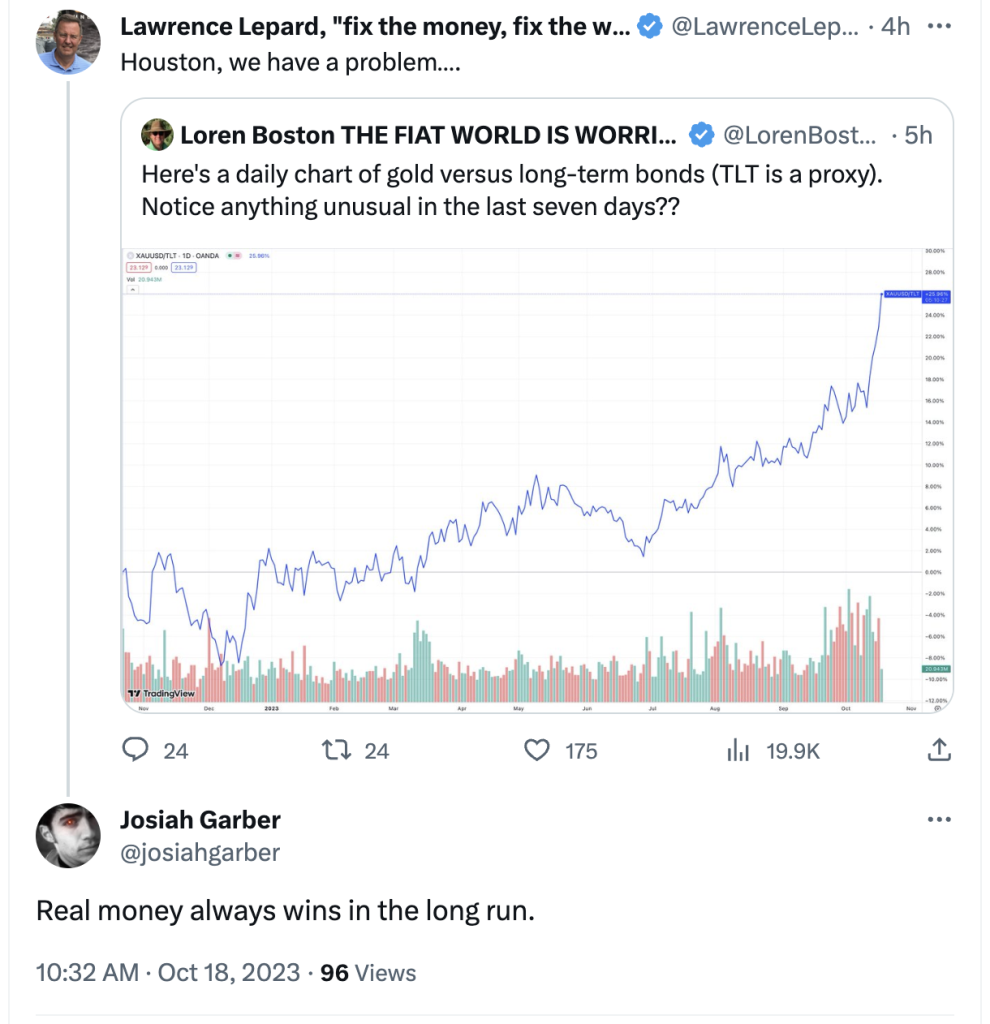

Credit: So what’s an investor to do when bonds lose their effectiveness as a safe haven? Well … according to Bloomberg macro strategist Simon White, “Real assets – commodities, gold and TIPS – are better positioned than bonds to act as a portfolio and a recession hedge in an elevated inflation regime. For investors without capacity or liquidity constraints, they’re an improved alternative to Treasuries in a 60/40 portfolio.” Imagine that. Perhaps not coincidentally, look what was trending on Twitter – er, I mean “X” – on Sunday …

Credit: Indeed, as former Fed governor Kevin Warsh explained last week, “The US is courting trouble. The federal government is 43% larger than it was four years ago, and it’s expanding mightily. More than a third of the surge in investment spending can be traced to government subsidies, credits and handouts. And the coming supply of Treasuries required to fund future deficits will likely be substantially larger than official estimates. So purchasers of Treasury debt will demand higher yields, at least until something breaks in the economy.” One thing is certain: the banks have their tender parts in a vice that’s squeezing ever tighter. See for yourself:

Debit: Needless to say, we’re literally watching the terminal phase of a debt-based fiat monetary paradigm real time in our lifetimes. Well … at least those of us who are paying attention.

Credit: As macroeconomist Daniel Lacalle reminds us, “All empires believe their currency is (invincible). But when confidence collapses, the impact is sudden and unsurmountable. Global citizens start to accept other currencies or gold-backed securities, and the myth of eternal debt demand vanishes. Sound money can only come from fiscal responsibility; currently, we have none.” Yes. It’s also true that fiscal responsibility can only come from sound money; we don’t have that either. But we will. The only question is whether it enters the monetary system gracefully – or is forced into it by the chaos of collapsing fiat currencies.

Last Week’s Poll Result

What percentage of your investment portfolio is comprised of physical precious metals?

- 0% (43%)

- Less than 5% (31%)

- 5% to 10% (15%)

- More than 10% (12%)

More than 1900 Len Penzo dot Com readers answered last week’s poll question and it turns out that slightly 3 in 4 of you have less than 5% of your investment portfolio in physical gold and/or silver – including 43% who currently are flying without any bullion wealth insurance. Clearly, those folks are braver than I am.

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

The Question of the Week

[poll id="497"]

By the Numbers

A recent study analyzed data detailing home improvements expenditures, as well as Instagram hashtag data for various rooms in the home to determine the most popular types of home renovations. So … which home renovations are the most popular? Well … here are the top eight home room renovations, based upon the total number of posts on Instagram:

1,800,000 Kitchen

1,400,000 Bathroom

84,400 Basement

63,000 Bedroom

30,500 Living room

17,200 Garage

5000 Dining room

1000 Home office

Source: AgentAdvice.com

Useless News: Career Decisions

A father was worried about his 22-year-old son because he was still unable to decide about his future career. So he decided to do a small test. He grabbed a ten-dollar bill, a bible, and a bottle of whiskey. Then he put them on the table in the entry hall.

The father took his wife aside and explained the plan: “If our son takes the money, he’ll be a businessman; if he takes the bible, he will be a priest; but if he takes the bottle of whiskey, I’m afraid our son will be a drunkard.”

And with that, the parents waited nervously, hiding in the nearby closet.

Peeping through the keyhole, the parents finally saw their son arrive. He immediately went to the table and picked up the ten-dollar bill; he looked at it against the light, and then slid it into his pocket.

After that, the young man took the bible, and flicked through several pages.

Next, he grabbed the whiskey bottle, opened it, and took a whiff, to be assured of the quality.

The son then left for his room, carrying all three items.

The wife looked to her husband and asked, “So … What does that mean?”

The husband said, “Obviously, it means our son is going to be a politician.”

(h/t: Sam I Am)

Buy Me a Coffee!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. New Brunswick (2.29 pages/visit)

2. Saskatchewan (2.22)

3. Manitoba (2.05)

4. Nova Scotia (1.88)

5. Newfoundland & Labrador (1.75)

9. Prince Edward Island (1.61)

10. Yukon (1.50)

11. New Brunswick (1.44)

12. British Columbia (1.41)

13. Ontario (1.38)

Whether you happen to enjoy what you’re reading (like those crazy canucks in New Brunswick, eh) — or not (ahem, you hosers living on the frozen Ontario tundra) — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter! (It’s easy! See the big green box in the sidebar at the top of the page.)

2. Make sure you follow me on my new favorite quick-chat site, Gab! Of course, you can always follow me on Twitter.

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by visiting my sponsors’ ads!

Thank you so much!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

From Terri, who left an urgent request in my inbox this week:

Pick me! Pick me! Pick me! PICK ME!

Okay, Terri … I’m picking you! But if this ends up being the highlight of your week, then we really need to talk.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len! Big move in gold and silver this week! I know I know. You don’t worry about the price! But do you think gold and silver prices will be at the end of the year? Humor me Len!

Michael Oliver is very good technical analyst and he says gold to $2,550 by end of year and silver to $35.

Hi Len,

Put me in the poll group that has cut back on spending due to inflation. Last winter I cut way back on my energy use too and wore more sweaters. Kind of sad people have to do that, but what are you going to do?

Have a great weekend everybody!

Sara

Hi, Sara! We cut back last winter … and will probably do the same. 🙁

One area we won’t cut back though is the grocery bill. Of course, that pinches a bit too … but we refuse to sacrifice on that front. And our food bill reflects that; food inflation has been north of 35% for more than a year.

Look around you. Most people are completely oblivious to US financial situation. If the dollar ever DOES collapse, there are going to be a lot of shocked faces in the crowd.

Yes, indeed. And you can bet the blame will not be placed on where it should be. Rather, it will be blamed on producers and other innocent parties.

Middle east war made things interesting this week. Here’s how I see it. Bond yields still screaming higher and will continue to do so until Jerry Powell decides to step in and print more money to lower rates. That will be match that ignites gold and sends it to the moon.

Looks to me like gold is on verge of taking over safe haven bid from bonds. If it does, watch out.

Totally agree, Hubbard. I can’t see how it can credibly play out any other way.

What is the Game of Thrones line. Winter is coming. I would add that it is coming soon. Everyone thinks you are crazy…until the unfortunate event or events occur. Everyone keep up your efforts to make your household and community a bit better. Thanks for the Cuppa Len.

My pleasure, CO2. Thanks for stopping by.

Yes, winter is coming. In more ways than one, I’m afraid.

I suspect the auto makers don’t like the fuel economy regs because they will primarily effect trucks more than any other segment of the car market. They are selling more hybrids and EV’s so the auto segment average fuel mileage is increasing w/o regs. Note that foreign auto makers typically do not complain. I for one would love to see fewer of these bloated monsters on the road. Dangerous (to others), wasteful, and rarely used to haul/tow anything.

Hi, Frank. The auto makers are also complaining about plans to change how they calculate milage efficiency for EVs.

As for those trucks on the road … I hate the over-sized ones too. I still have trouble thinking anyone would pay $70k or $80k for a truck these days.