Having a solid credit score is more important than ever. If you don’t, there’s no hope of receiving a decent mortgage, renting the apartment of your dreams, or getting a lease on a reliable car for the family. Whether you have a good, bad, or merely average credit score, the number exhibited on your credit score report means a great deal. That number is a determining factor in your future financial endeavors.

Having a solid credit score is more important than ever. If you don’t, there’s no hope of receiving a decent mortgage, renting the apartment of your dreams, or getting a lease on a reliable car for the family. Whether you have a good, bad, or merely average credit score, the number exhibited on your credit score report means a great deal. That number is a determining factor in your future financial endeavors.

The main reason for a poor credit score is the failure to keep up with it. Many people don’t know what their credit score even is. Some individuals have never even checked it! Maybe staying in the dark about your credit works for you right now, but it could keep you from success in the future.

The Importance of Good Credit

We all know that good credit is important, but why? The main reason is that a person’s credit score is the entire overview of his or her financial well-being. A low credit score essentially points to the fact that a person is not financially stable. Maybe this doesn’t concern you, but it will certainly concern any financial partners you have in the future. Here are a few reasons why good credit is essential:

- It leads to much better loan deals from bank lenders

- It gives you more power to negotiate

- It makes you a better candidate for rental properties

- It has a major impact on your future employment opportunities

- It offers access to the best credit cards

On top of all this, having good credit can lead to a major boost in confidence whenever you’re handling financial matters. You won’t have to worry about receiving the mortgage for your dream home or driving away from the dealership in a safe and reliable vehicle.

Utilizing official credit monitoring services like TransUnion or Equifax is the best way to check a credit score. These bureaus typically allow you to check your credit score for free once annually. Simply visit one of these bureaus’ official websites, type in the requested information, and your current credit score should be immediately displayed.

If you’re hoping to access your credit score more than once per year, you’ll have to pay each time you request a new credit report. Also, if you’re in a pinch and need your credit score immediately, you might have to use an external service. The most well known external credit score provider is Credit Karma; all you need to do to receive an official FICO score from them is to visit their site and leave the requested details. Another popular credit score provider is Mint.

A Step-by-Step Guide to Boosting Your Credit Score

If your credit is anywhere is less than 720, then it could use some improvement; and if your credit score is below 650, then improvement is absolutely necessary.

Some of us aren’t so lucky to have a credit score in the 700s. For instance, if you’ve been taking risks with gambling online since 2000 and completely forgot about a late payment to an online casino, your credit score could now be in the gutter. The same goes for late phone bills, overdue car payments, and failure to pay mortgages.

Thankfully, all is not lost. If your credit score needs some improvement, follow these steps below to make that happen:

Determine Where the Negative Credit is Happening

With a full credit report, you’ll be able to go through and see where the negative credit is occurring. It’s a good idea to print out the report so that you can take a look at a hard copy. Then using a highlighter, go through the entire report and highlight anything with a negative balance.

Pay Off All Credit Card Balances

The next step is to pay all of your credit cards off so that all balances are at $0. If you’re unable to do this, boosting your credit score quickly will be extremely difficult.

Make Phone Calls to Collection Agencies

You should be able to see from your credit report if there are any collection agencies out to get you. When you speak to a collection agent, ask for something called a “delete payment.” This means you are willing to pay the balance due and the agency will remove it from your credit history entirely. If they agree, be sure to get it in writing somehow.

If the agency does not agree to a “pay to delete” agreement, do not pay the owed balance. This might sound odd, but you should never pay a balance without the pay to delete promise. The only way to drastically improve a credit score is to remove the late payment altogether.

Make the Necessary Disputes

If you’re a victim of faulty credit report information, then its time to make a few phone calls. Credit bureaus are often willing to remove disputed items right away after investigating for no more than 30 days.

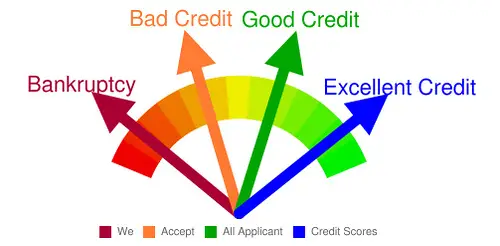

Photo Credits: Match Financial

Question of the Week