It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Here’s a friendly tip: If you’re going to be out of town on any of the twelve days of Christmas this year, try not to miss Day Five.

Okay … and with that, we’re off and running!

“Inflation is the crabgrass in your savings.”

— Robert Orben

“All paper money eventually returns to its intrinsic value: nothing.”

— Voltaire

Credits and Debits

Credit: China plans to roll out a yuan-denominated crude oil futures contract that can be converted to gold on a domestic exchange by the end of the year. This week they held market-wide training simulations to prepare for the big event. Amazingly, the news, which has dire consequences for the US dollar — and most Americans’ standard of living — was barely an afterthought for the US mainstream media.

Debit: Meanwhile, I see the wealthiest 1% of American households own 40% of the nation’s wealth — that’s more than at any time in the past 50 years. If you don’t think that’s a problem, then you need to think again.

Debit: On a related note, according to the Census Bureau, the five richest US counties by median household income are all suburbs of Washington, DC. Surprised? You shouldn’t be. Now you know where the bulk of your federal income taxes end up. Hardly seems fair.

Debit: Speaking of income — or a lack thereof — for the first time since November 2009, real average hourly earnings have tumbled for four consecutive months. That begs the question: Why are Americans’ wages falling if the nation is supposedly at full employment?

Debit: Despite the establishment’s continuing claim that the US labor market is rosy, by every reasonable standard, it isn’t even close. The truth is, after adjusting for the number of new jobs created in 2017 to account for the geometric progression of population gains, employment growth today is less than two-thirds of what it was in the 1990s. It’s also less than half the growth of the 1980s. But you already knew that.

Debit: I suspect you don’t need to see the latest Fed data that shows financial asset values are as high as ever — and rapidly outpacing growth in nominal income — because you’re aware of that too. Uh huh. I thought so.

Credit: By the way, according to the latest Fed figures, household net worth was 670% of income as of this July — which means it’s poised to go higher because asset values have only continued their upward trajectory. In case you’re wondering, the current net-worth-to-income ratio surpasses the previous high of 654% that occurred during the last housing bubble in 2006.

Debit: In other news … Just when you thought bitcoin mania couldn’t get any nuttier, there’s this: According to the New Zealand Herald, a 30-year-old IT professional recently sold his house and used the $60,000 in equity to purchase high-powered computer equipment required for bitcoin mining. I know. To each his own, I guess. I’m sure my Australian friends can find a sheep joke somewhere in there.

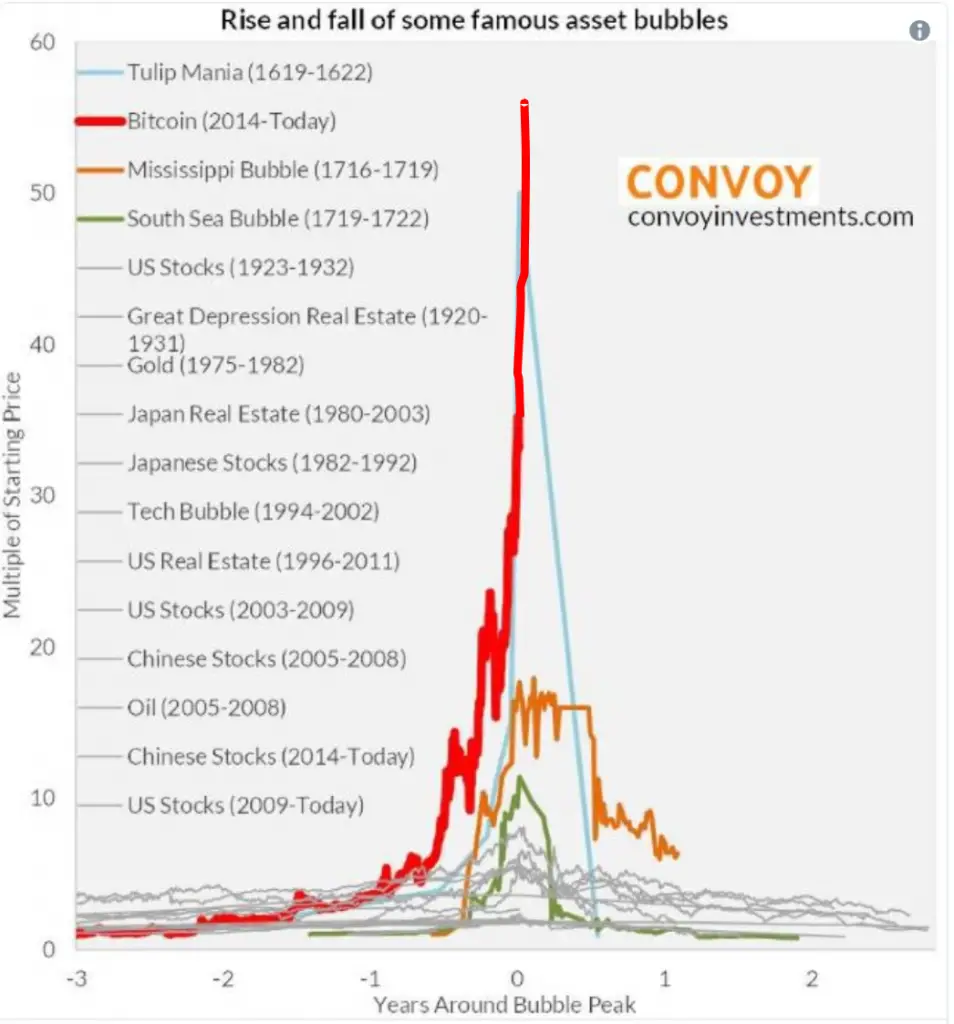

Credit: Then again, I guess cryptocurrency craziness shouldn’t be a surprise anymore now that bitcoin is officially the largest financial bubble in history. That’s right; the Bitcoin Bubble is now bigger than the previous “Mother of All Bubbles” — that is, the infamous Tulip Mania of 1636-1637. But, hey … maybe an ethereal bitcoin really is worth more than 1000 ounces of physical silver. Or not. Yeah … not.

Credit: Of course, it’s not just bitcoin. Long-time hedge fund manager Doug Noland says, “The granddaddy of all bubbles has reached the heart of money and credit,” and warns of “tremendous losses” hitting all assets classes once “central banks lose control of the monster they created.” Yep. That’s when they’ll have to start printing more cash or try to hold yields down. Regardless, Noland says: “There will be no way out.”

Credit: Actually, there will be a way out — but it will require the reintroduction of precious metals to the monetary system. However, as Alasdair Macleoud notes: “A return to sound money will only occur when the purchasing power of (fiat) currency is sliding in the midst of a global crisis.” At that point, he says, a panicked public will demand gold-backed currency. Sadly, by then it will be too late. Well … for most people.

By the Numbers

FedEx, UPS and the US Postal Service (USPS) expect to deliver record numbers of packages this holiday season:

15,000,000,000 Pieces of mail the postal service will deliver between Thanksgiving and New Year’s Day.

400,000,000 The number of packages FedEx will deliver over the holidays.

750,000,000 The number of packages UPS will deliver during the holiday season.

850,000,000 The number of packages the postal service will deliver over the holidays.

10 Percentage increase in the number of packages the postal service is is delivering in 2017, compared to last year.

6,000,000 The number of packages the postal service will deliver on Sundays this December.

Source: USA Today

The Question of the Week

[poll id="193"]

Last Week’s Poll Result

How many employers have you had during your lifetime?

- 5 to 10 (57%)

- Less than 5 (28%)

- More than 10 (15%)

More than 1300 people answered this week’s survey question and it turns out that slightly more than 1 in 7 Len Penzo dot Com readers have had more than 10 employers during their lifetime. I’m not sure if that is a reflection of a booming job market — or a decline in the types of jobs that offer good wages and benefits.

Useless News

An old man, a boy and a donkey were going to town. The boy rode on the donkey, and the old man walked.

As they went along they passed some people who remarked, “What a shame, the old man is walking, the boy is riding.”

The man and boy thought maybe the critics were right, so they changed positions.

Later they passed some people who remarked, “What a shame, he makes that little boy walk.”

So they decided they’d both walk.

Soon they passed a few more people who remarked, “They’re really stupid to walk when they have a decent donkey to ride.”

So they both decided to ride the donkey.

Then they passed some people who shamed them by saying, “How awful to put such a load on a poor donkey.”

The boy and the man figured they were probably right, so they decide to carry the donkey. As they crossed the bridge, they lost their grip on the donkey … and the donkey fell into the river and drowned.

The moral of the story: If you try to please everyone, you might as well kiss your ass goodbye.

(h/t: billhilly)

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Quebec (2.74 pages/visit)

2. Newfoundland and Labrador (2.31)

3. Alberta (1.80)

4. Manitoba (1.79)

5. Ontario (1.72)

9. Nova Scotia (1.42)

10. New Brunswick (1.39)

11. Prince Edward Island (1.35)

12. Yukon Territory (1.33)

13. Nunavut (1.00)

Whether you happen to enjoy what you’re reading (like those crazy French Canadiens in Quebec, oui, oui!) — or not (ahem, you hosers living on the frozen Nunavut tundra) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

Last week, after reading my article on the drawbacks of waterbeds, Trisha shared her thoughts on waterbed sex. This week, Al added two cents of his own:

I’m asexual so I don’t have to worry about having sex on the waterbed.

Congratulations, Al … I think.

I’m Len Penzo and I approved this message.

Photo Credit: (coffee) breweddaily.com

Hi Len. Maybe the US capital should rotate between different parts of the US every year to help spread the wealth around!

Thanks for another entertaining Black Coffee!

Sara

I think you may be on to something, Sara.

Oil contracts priced in yuan is a HUGE story yet nobody is covering anywhere as far as I can tell except a handful of alternative websites. There’s a reason why gold trades 24 hours a day while the stock market is open less than 8 …. it’s the only way to keep the true price supressed with respect to the dollar. The dollar’s days are numbered. Most people can’t imagine a world without it, but when it goes belly up it will make them poorer. Then they’ll believe. Tick tock.

Oil contracts denominated in yuan may or may not be a catalyst for gold to break free from the price manipulation. If you see the Saudis announce they are selling oil for yuan, then you have a new development that is notable. Until then who knows? I do think we’re getting close to the breaking point though.

Did I miss something? How are oil contracts in yuan related to price of gold?

Unlike the Western exchange paper price of gold, the yuan contracts can be converted to physical gold on China’s gold exchange. In theory over time that should lead to true gold price discovery.

I can’t see this going on for another five years myself, Steve. It will all depend on how much gold the West is willing to let leave their vaults in order to keep the charade going by depressing prices. Even the old London gold pool manipulation scheme during the 1960s eventually collapsed.

Bitcoin price about to top $19,000 again. All aboard!

Sure, Kenny … Everybody on the train! There’s lots of easy money to be made!!!

By the way, I just added a graphic (above) based on the linked ZeroHedge article that illustrates what everyone is dealing with when they speculate on bitcoin.

http://www.zerohedge.com/news/2017-12-16/bitcoin-hits-new-all-time-high-after-burst-asian-buying-market-cap-soars-above-300-b

Wow, there are only 19 million people in Romania and the population is declining. Why don’t we digitize them and call them Romcoins? They will be worth a fortune!

Jack … that just. Might. WORK!

Funny thing about bitcoin…..whenever they have an internet article about it, they usually show a gold (or at least shiny metallic) colored coin with a $ and B superimposed over each other….why is that ?

Because unlike gold, or silver, or copper, or even stupid fiat paper, no ACTUAL PHYSICAL BITCOIN exists…just a set of 1’s and 0’s in digital space….yet they feel the need to show a coin !

Tell ya what….stick 15 REAL ONE OUNCE GOLD EAGLE COINS in one hand, and nothing but air in the other (or maybe a flash drive with one BC in it), THEN try to convince someone they both are worth the same.

Yeah….good luck with that…..ahahahaaa.

Sometimes I carry a tube of 20 one ounce eagles around for demo purposes (and yes….I have a Glock 19 one one hip…ahahaa) when I think I’m gonna get in a discussion about money.

Have a person hold out their hand and grip the tube, which you can almost close your hand around….then tell them “that is 25 grand of real money”….that is a new, mid-priced car in your hand.

Then open the tube and stick a few of the beautiful things in their hand. Tell ya right now….my VISA card (with same limit) or some binary code on a flash drive won’t come close to the gleam in the holder’s eye….and most have never seen a gold coin. It’s like it triggers something in your DNA about real value !

I love doing this…….

Absolutely correct, Andy. I’ve asked the same question regarding why bitcoin is represented by a gold coin; of course, the answer is self-evident.

People instinctively understand that gold (and silver) are real wealth … and it is truly obvious when they see and hold it — especially a one-ounce gold coin (or 20).

(By the way, I carry a Glock 19 too.)

When was the last time stocks and bonds were both at the top of a bubble?

Shaun … I assume you mean “at the same time.” That is a good question. The short answer is “not very often, if ever.” I did find this article that says stocks and bonds had negative returns in the same year only three times:

1931 (stocks: -44%; bonds: -2.5%)

1941 (-13%; -2.0%)

1969 (-8.2%; -5.0%)

The author says both stocks and bonds “getting crushed during the next crisis” is a “low probability event.”

I think he is suffering from a severe case of normalcy bias; I think both stocks and bonds will be absolutely pummeled. The difference is, I believe a currency crisis will, somewhat ironically, eventually cause stocks to rise to new heights (but only in nominal terms, not in real terms). As the currency fails, however, bonds will not be able to get up off the mat.

So, if bonds are no longer a safe haven, where will the money flow? To the ultimate safe haven asset: precious metals.

Len,

Have you noticed the Fed buying up all the bonds being sold off the last few months? Lynette Zang also points out the insiders have began to evacuate over the last few months. They are barely holding this crap shoot together! The cover of the 1988 Economist will come true in 2018, take that to the Bank (pardon the pun) 😂

Jared

I haven’t noticed, Jared. But I am not surprised.

“…employment growth today is less than two-thirds of what it was in the 1990s. Its also less than half the growth of the 1980s…” – Len

That’s because the elite who own most of the world’s wealth don’t need many workers to produce it anymore:

https://wolfstreet.com/2016/10/25/why-jobs-arent-coming-back/

It’s true … which is why it’s more important than ever for young people to learn valuable skills that can help them get buy in a lean economy.

Thankfully, some skills will never be completely replaced by robots. Think tradesmen: mechanics, plumbers, electricians, and carpenters. Also think: farmers, nurses, doctors, engineers, and technicians.

Len, I’m sorry but your question sucked. Did I buy a present , wrap it, and then send it to someone by USPS? Nope. But did I buy a present on line(Amazon), paid to have it wrapped, and had it sent to someone? Yep. About 20. Enjoy your blog. Merry Christmas!

LOL! You’re right … I’ll try to come up with a better question next week.

Merry Christmas to you and yours too, Rick!

Len, I love ya, but you’re getting lapped. The economies of the world are in full expansion mode. The US is about to pass monumental tax reform – both corporate and personal. Don’t fight the trend. There will inevitably be a day of reset, but that day may still be several years ahead. In the mean time, people sitting out of fear are missing one of the greatest moves upward in many years.

Thank you, Scott. I appreciate your comments. However, just to be clear, I’m not advising anybody to go “all in” on precious metals; diversification is always a good idea. I am simply pointing out the obvious: that the markets are extremely over-valued by any measure, that global debt is off the charts and completely unpayable, and that the US dollar’s reserve currency status — which allows the US to maintain its insane trade deficits without causing hyperinflation — is in severe jeopardy.

I also claim nobody knows when the fit will hit the shan, but when it does, most people who are fully invested in the paper markets will not have time to save themselves with physical precious metals.

Thanks, Len. I truly do appreciate your reply. I too hedge a bit with precious metals, but it only comprises about 5% of my total portfolio. Just one more question, if you have the patience with me…

I know you prefer holding physical precious metals (or at least I think you do), but what are your thoughts on mining ETFs like RING or SLVP? When the fit hits the shan, I assume those stocks will behave much like the metals themselves, but they are still just an electronic record. You seem to be pointing toward an economic armageddon where food, water, bullets and an underground shelter will be the rage.

Mining stocks (and indices) typically magnify physical precious metal returns by many multiples — up or down. Like I said … diversification is good.

As for your impression on how I see things unfolding, you must have missed my earlier writings on what I think will happen when the monetary system resets. I do not expect a Mad Max world; monetary resets have happened many times in the past and man has survived them all.

I expect this time will be no different.

Hopefully, it is a controlled reset, where authorities from around the world first meet in some fancy hotel to hammer out the details of a new monetary system (as they did at Bretton Woods in 1943). If it is, then there shouldn’t be any significant disruptions — although most Americans will feel the pain of a lower standard of living that comes with the loss of reserve currency status.

However, if the world waits until the dollar collapses and credit markets seize up, then I do expect a temporary disruption of supply chains (I am planning for three to six months) until a new monetary system can be set up on the fly. In that case, life will be difficult for everyone until the new monetary system is in place, but those who are prepared will be able to weather the storm with only minor difficulties.

Scott, there is at least one person (me) who is “siting it out”, but not because he’s fearful – quite the contrary:

“Don’t be greedy – it’s important to know when enough is enough”

https://lenpenzo.com/blog/id22017-how-i-live-on-less-than-40000-annually-ralph-from-west-virginia.html

My question, hopefully you find it interesting.

What do you think of applying for a new credit card associated with a merchant for a one time discount, then cancelling the card as soon as it is paid in full?

Background: I purchased a $600 snow blower from ‘Blain’s Farm and Fleet, and applied for the card and received 10 % off. I cancelled the card as I have no use for a card with no rewards that has a 29.9% rate if I ever carried a balance. (I don’t)

I think what you did is very clever and perfectly acceptable, Harry.