It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Are you ready? I know I am, so here we go …

“You can fool all the people some of the time, and some of the people all the time, but you cannot fool all the people all the time.”

— Abraham Lincoln

“Everybody sooner or later has to drop the luggage of illusions.”

— Carlos Santana

Credits and Debits

Debit: On Friday, the Bureau of Labor Statistics (BLS) reported that the 4.1% unemployment rate is at its lowest point in 17 years. Then again, the devil is in the details because because nearly one million (!) Americans dropped out of the labor force last month. As a result, there are now a jaw-dropping 95,385,000 people not working. That’s an all-time record.

Debit: To show you how the government’s statistical hocus pocus keeps most people in the dark, consider this: Although October employment rolls dropped by nearly a half-million Americans, the unemployment rate denominator dropped even more — which translated into an actual decrease in the unemployment rate. By the way, the government’s inflation numbers are even more misleading.

Debit: Meanwhile, the yield curve between 5- and 30-year Treasuries is at its flattest point since November 2007. Flattening curves are not only a reflection of the trillions in currency printed since 2008 — as that cash desperately looks for somewhere “safe” to hide — but they also forecast economic recessions with 100% accuracy. Yes, 100%.

Credit: Those flattening yield curves don’t seem to be bugging the gainfully employed — which is 95.9% of all Americans if you believe the number necromancers at the BLS. The latest consumer confidence survey found that the number of folks who plan on taking a vacation within the next six months spiked to the best level on record, dating back to 1978. It’s unknown how many of those are permanent vacations.

Debit: Speaking of the gainfully employed, as the Daily Bell notes, “Just because a Ponzi scheme is run by a government doesn’t mean it won’t collapse; and the situation in Kentucky serves as a dire warning about larger pension systems including Social Security.” There’s a reason why many Kentuckians are now retiring in droves: They want the pension cash they were promised before their fund goes bust. Smart.

Credit: The good news is, it appears California politicians are finally waking up to the pension problem they created. Sacramento finance director, Leyne Milstein, says his city’s pension costs will double in seven years. The strong real estate market has increased the city’s revenues — but they haven’t increased as much as pension costs. “It’s not sustainable,” Milstein said. Ya think? Welcome to reality, Leyne.

Debit: Of course, the world’s central banks continue to use the printing press to stave off the coming pension crises, and solve every other financial problem that plagues their debt-based Ponzi scheme masquerading as the International Monetary System — but it’s going to come back to bite us all in the end. And in ways most Americans could never imagine.

Debit: I guess the good news is that as long as those central banks can keep control of the markets by printing unlimited amount of fiat currency, asset prices will continue to climb, as evidenced by US home prices, which rose in September at the fastest pace in more than three years.

Debit: Then again, US homes have never been less affordable — especially for everyone trying to make ends meet on Main Street.

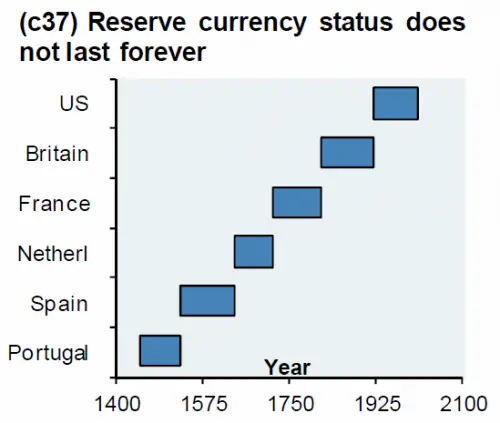

Credit: The day is coming when when the world finally recognizes that more dollar-denominated debt has been issued than can ever realistically be paid back — and that’s the day the “Almighty Dollar” will become no better than the Mexican peso. After all, it’s not as if this hasn’t happened before. Behold:

Debit: Hyperinflation isn’t a monetary phenomenon — it’s a psychological one, characterized by a loss of confidence. As John Rubino points out, there are growing signs that too many people have too many dollars — and they’re itchin’ to get rid of ’em. For example, two short notes handwritten by Albert Einstein just sold for $1.8 million. And this week Paul Newman’s watch fetched a cool $17.8 million. No, really.

Credit: I know what you’re thinking: With Einstein’s notes and Newman’s wristwatch gone, what else can I buy before all of the dollars I’ve accumulated lose their value? Well … for $7200, you can buy a bitcoin — or more than 400 troy ounces of silver. I know … I think that’s pretty funny too.

Debit: Apparently, people who are anxiously looking to rid their bank accounts of excess dollars are investing in butter too. Uh huh. Believe it or not, since 2016 global butter prices have almost tripled to more than $8100 a ton. It’s definitely a tempting investment — in more ways than one. Unfortunately, my refrigerator isn’t big enough.

Debit: Finally … this week President Trump wasted a chance for real change by selecting Jerome Powell to replace Janet Yellen as the next Fed chair. Who should he have picked? Ron Paul would have been a great choice, but in the end it really doesn’t matter. Nothing significant will change until the US abolishes the Fed and returns to a monetary system backed by precious metals. Don’t hold your breath waiting.

Insider Notes: It’s Chat with Len Time!

Hey! You need to be an Insider to view this section! If you’d like to join, please click “Insider Membership” at the top of my blog page.

By the Numbers

For all you spinach lovers out there:

6 Weeks it takes spinach to grow from seed to harvest.

11 Average number of leaves on a spinach plant that is ready for harvesting.

74 Percentage of US-grown spinach that comes from California.

85 Percentage of the world’s spinach that comes from China.

3 Nutrition multiple gained by cooking spinach. Yes, it’s actually more nutritious when cooked; the body can’t completely breakdown the nutrients in raw spinach.

2 Minutes of boiling required to reduce the effects of the oxalic acid that is found in spinach. Oxalic acid blocks the absorption of calcium and iron.

33 Percentage increase in US spinach consumption during the 1930s. US spinach growers credited the increase to Popeye.

1937 Year that grateful spinach growers in Crystal City, Texas, erected a statue of Popeye.

Sources: Care2.com; Top Food Facts

The Question of the Week

[poll id="187"]

Last Week’s Poll Results

Homeowners: How long until your mortgage is paid off?

- More than 20 years (31%)

- My mortgage is paid off! (28%)

- Less than 10 years (23%)

- 10 to 20 years (18%)

More than 1100 Len Penzo dot Com readers responded to last week’s question, which was submitted by reader Michele, who wanted to know how many people reading this blog owned their home free and clear. Well, Michele, nearly 3 in 10 of those who took the time to answer count themselves among the fortunate ones with a paid-off mortgage. Now, if we could all get out from paying property taxes …

Other Useless News

Programming note: Unlike most blogs, I’m always open for the weekend here at Len Penzo dot Com. There’s a fresh new article waiting for you every Saturday afternoon. At least there should be. If not, somebody call 9-1-1.

Hey! If you happen to enjoy what you’re reading — or not — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Don’t forget to subscribe via email too! Thank you.

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider!

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

The other day I found this invitation from Jamie sitting in my inbox:

I’m hosting a (chat group) to discuss buying a new car on Thursday, August 153th at 1 pm. Interested?

Pardon my pedantry, Jamie, but it’s “August 153rd” — and, unfortunately, I’m going to be out of town that day.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Everybody sooner or later has to drop the luggage of illusions.

When ? I’m 86 …

P.S. I’m in for the conference call, if I remember …

Any chance of a wakeup email 11/9 or so, from the sponsor?

But I’ll put it on my calendar, anyway. Hope I remember to look at it …

Of course, Dave! I’ll make sure I give you a courtesy note on the big day.

As I tell young women who hold the door open for me at WalMart: Thanks! Us old folks can use all the help we can get …

I can take or leave spinach Len. I usually leave it though. Thanks for another great cup of Black Coffee!

Sara

I leave it too. The rest of my family loves it though.

I’m confused. First you say almost 1 million people dropped out of the workforce last month, then you say almost a half million fell off the October employment rolls. Which one is it?

The sleight of hand is confusing, Steve. I know. The larger figure includes people who have given up and stopped looking for work because they can’t find a job. The smaller figure only includes people who were employed in October, but are no longer.

If people can’t rely on SS or pensions in the future, and if holding cash is too risky then what is the point of saving?

If you save in hard assets like gold and silver you have nothing to worry about:)

Although we have a fair amount of hard assets, we have also chosen to put a lot of our excess funds in our homestead and it’s infrastructure.

Good growing soil, for example, doesn’t exist in the thin topsoil over clay of east TN, so I’ve added dump trucks loads of manures, sand, etc to our gardening areas while the cost of trucking is still (pardon the pun) dirt cheap.

Run water lines all over. Built a 3,000 gal storage system fed by gravity spring (water w/o power).

Lots of fencing/animal housing/pasture improvements.

Couple of greenhouses to raise things like that spinach year round so when it becomes impractical energy-wise to import it from far off, we still eat.

Solar powered the whole place so if the grid goes, or gets prohibitively expensive, we’ll still have a basic level of electric power.

I realize not everybody can, or wants, to live like we do….but as time goes on, I suspect a whole lot more folks will wish they had.

andy,

I’ve been looking for your story in Len’s “How I Live On $40K” series. Where is it? I’m really interested!

Everybody needs to set aside a portion of their income for the future, Gina. It’s the responsible thing to do. The fact that our current corrupt monetary system penalizes savers is no excuse to throw up our hands and stop saving altogether — although the world’s central banks would love it if everyone would do EXACTLY that.

I think both Jared and Andy offered some excellent alternatives. (Thanks, guys! I love my readers!)

You cannot create wealth by borrowing it into existence, which is why the current system must eventually fail. Bitcoin’s current price is a reaction to all of that fiat debt created to date.

The dominance of the US dollar is the root cause of the current global financial troubles and future economic crises.

Disagree. The idea that people can become rich without working for the money is the cause of our current financial and economic crises. Bankers are the prime example.

Printing money out of thin air without an equivalent contribution in the form of real tangible products or services is fraud against everyone in society who uses that money. Only the value of real labor can balance the world. An honest day’s pay for an honest day’s work.

If someone can’t provide something of real value to society, then they should be living at the BOTTOM of the pile. Not the TOP.

I’m with Wide Awake on this one.

Len,

The reserve currency time span chart is very interesting to me. I don’t recall encountering that information so purely presented anywhere before.

Correlating the world power of each country with the reserve status of its currency: Exact correlation! Dominant currency with dominant power and vice versa.

Isn’t it though? You, sir, have made the critical connection!

By the way, that chart has been occasionally displayed on Zero Hedge for many years now. (Yeah, I shamelessly “borrowed” it from them.)

You are right. The financial system uses a dollar/debt based fiat currency, which allows the US to print and spend unlimited amounts of new debt to retire old debt. It is insane but by doing so the government can devalue the existing pool of dollars by increasing the amount in existence. That results in true monetary inflation (not to be confused with price inflation which is a symptom of monetary inflation). As it was mentioned above, the Fed is in a bind because the economy cannot expand enough anymore to absorb the excess currency they’ve injected into the system. This is a time bomb waiting to go off. All that’s needed is the loss of confidence by one financial whale to bring America to its knees. When that day comes everyone will feel the effects within a week.

“Time bomb” is an apt description. I can’t quibble with anything you said.

If there are about 310 mil. people in the U.S. and more than 1/2 are either children, housewives, house husbands, retirees, fulltime college students who aren’t working, disabled or those who don’t need to work or don’t want to work (many homeless), etc. that would seem to me to leave only about 150mil. people who are able and need or want to work. Are you saying 95.4 mil. of that approx. 150 mil. can’t find work?

Sam: There are 254 million Americans age 16 or older. Only about 8 million of those 95.4 million working age Americans who are categorized as not in the workforce are unemployed despite their best efforts. The majority who are categorized as not being in the workforce includes: retirees, the disabled, those who don’t work because they are taking care of a family member(s), or are in school/college.

A society with only 37% of its working age population actually working is a real problem.