It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Let’s get right to it …

“Never forget that only dead fish swim with the stream.”

— Malcolm Muggeridge

Credits and Debits

Debit: Did you see this? Kaiser notes the average deductible for an employer-sponsored plan increased 400% since last year, employee deductible payments increased 229%, and co-insurance payments rose 89% — while wages increased by just 31%. You know, this could have been avoided if we had only allowed the government to get involved with the healthcare market. Oh wait …

Debit: In other news … First came fake money, then came fake news. Now comes fake markets. Then again, if you’ve been paying attention here at Len Penzo dot Com, you already knew that.

Debit: Obviously, billionaire bond king Bill Gross reads this column. Okay … no, he doesn’t. But this week Gross excoriated misguided central bank policies that have forced investors to make increasingly irrational decisions in their quest for higher yields — leading to the insane situation where European corporate junk bonds are now yielding less than matched-maturity US Treasuries. Voila! Fake markets.

Credit: It’s not just bonds. If you ask finance writer Raul Ilarji Meijer, “The S&P is a bloated corpse increasingly filling up with gases that will eventually cause it to explode, with guts, blood, body parts and fluids flying all around.” Raul is right, you know. I just wish that he would learn to express his opinions in a more colorful manner.

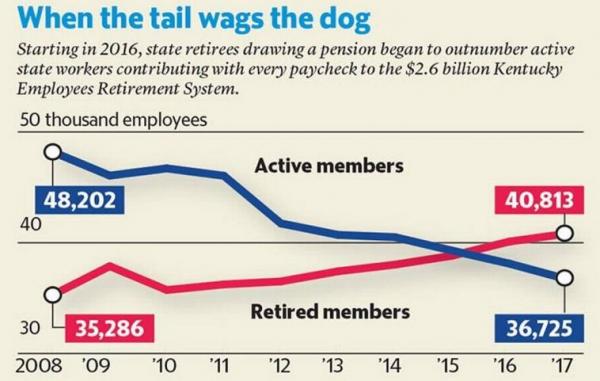

Debit: Speaking of bloated corpses, as Zero Hedge notes, this chart showing the status of the Kentucky Employees Retirement System succinctly illustrates how Ponzi scam artists like Bernie Madoff — and most public pensions — eventually meet their demise:

Credit: Unfortunately, most defined-benefit plans today are Ponzi schemes. As such, they’re vulnerable to the demographic issues plaguing them; the combination of an increasing number of retiring Baby Boomers and technological advancements limiting the number of retirees who need to be replaced will result in a wave of public pension failures. If only robots paid taxes …

Credit: Meanwhile, financial analyst Dave Kranzler wonders if the world is about to get reacquainted with gold — whether it likes it or not. Frankly, the world has no choice; our debt-based fiat monetary system is dying because the growing amount of newly-generated debt required to keep the scheme going has nearly reached its tipping point.

Credit: For his part, billionaire businessman Hugo Salinas Price is quite certain that if China’s stated plan is to offer both yuan for oil, and gold for yuan, using gold bought in world markets, then a monetary revolution leading to the dollar’s demise is close at hand. At least in terms of current purchasing power. (Psst. That’s another way of saying, at some point, American living standards are going to fall precipitously.)

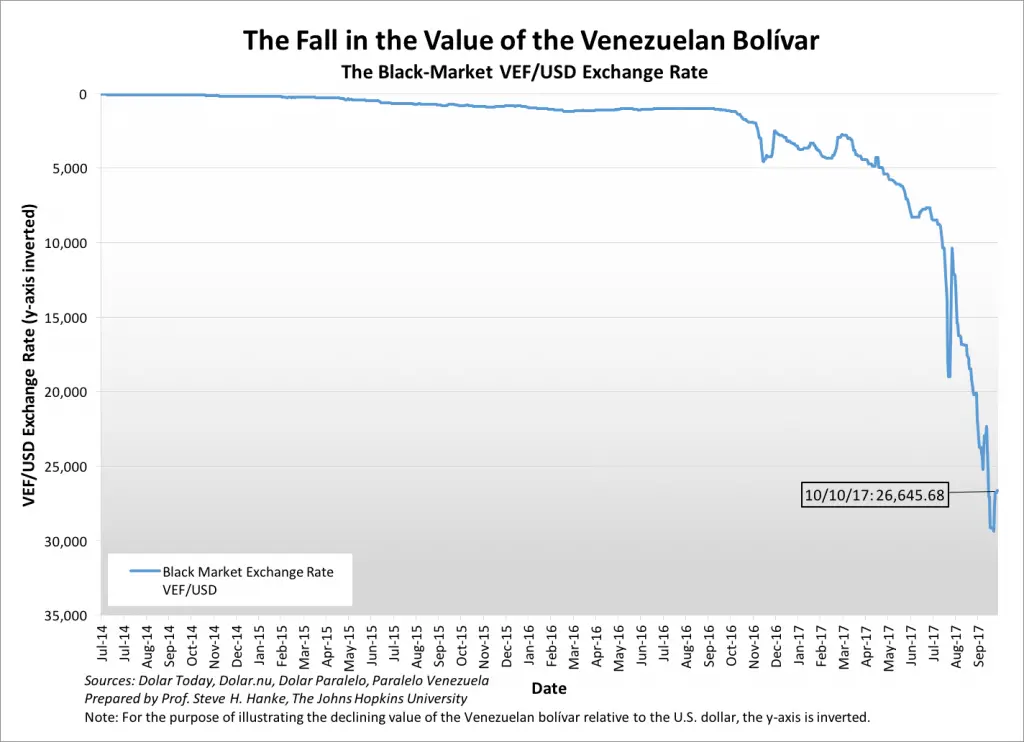

Debit: Of course, the primary symptom of any dying currency is rapid price inflation. The IMF estimates Congo’s inflation rate is 44%, which is the second-highest in the world. Who’s number one? Well … that would be the People’s Socialist Paradise of Venezuela, where their bolivar is in hyperinflation; Venezuela’s current annual inflation rate is roughly 720% and is expected to surpass 2300% next year. Ouch.

Debit: This graph of the bolivar’s purchasing power perfectly illustrates the death of a fiat currency. Notice how it initially declines at a relatively benign and tolerable pace. Then, like a bolt from the blue, the exponential portion of the curve arrives. That’s when a nation’s social fabric frays, and the real misery begins — especially for savers, retirees and those on fixed incomes.

Credit: It’s not just the bolivar. Sadly, the public doesn’t seem to notice that the dollar is under duress too, despite the warning signs — and many who do notice insist everything is under control. After all, they say, the markets are still near all-time highs. So is consumer sentiment — in fact, it’s been 13 years since shoppers were in such a good mood! Hey … who says stodgy (central) bankers don’t know how to throw a party?

Credit: I know what you’re thinking: Despite the risks associated with buying near a bull-market peak, the urge to join the party and get a piece of the action is utterly irresistible. It’s true. As Adam Taggart reminds us, waiting for the irrational exuberance to end is painful. It’s ridiculously easy money and everybody seems to be making a buck. The question is: Do you have the fortitude to endure the wait?

By the Numbers

Consumer confidence hasn’t been this high since 2004. With that in mind, how many of the Top 10 movies of 2004 have you seen?

1 Shrek 2

2 Spider-Man 2

3 The Passion of the Christ

4 Meet the Fockers

5 The Incredibles

6 Harry Potter and the Prisoner of Azkaban

7 The Day After Tomorrow

8 The Polar Express

9 The Bourne Supremacy

10 National Treasure

Source: IMDb

The Question of the Week

[poll id=”184″]

Last Week’s Poll Result

Do you think college still offers the best opportunity for financial success?

- No (45%)

- Yes (31%)

- I’m not sure. (24%)

More than 1200 people chimed in for last week’s question and it turns out that just 3 in 10 Len Penzo dot Com readers say that college is still the best way to land a lucrative career. That may be true for STEM majors; otherwise probably not. Honestly, most kids today would be much better off going to vocational school and learning how to be a professional electrician, carpenter, plumber — or even a chef. After all, those professions are always in demand. Best of all, with university costs in the stratosphere, acquiring those vocational skills offer a much better return on investment compared to most college degrees.

Useless News

From the police blotter — or, what a beat cop deals with every day:

- A deputy responded to a report of a vehicle stopping at mailboxes. It was the mail carrier.

- A woman said her son was attacked by a cat, and the cat would not allow her to take her son to the hospital.

- A resident said someone had entered his home at night and taken five pounds of bacon. Upon further investigation, police discovered his wife had gotten up for a late-night snack.

- A man reported that a squirrel was running in circles on Davis Drive, and he wasn’t sure if it was sick or had been hit by a car. An officer responded, and as he drove on the street, he ran over the squirrel.

Source: Uniformstories.com (via rd.com)

Other Useless News

Here are the top — and bottom — five states in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. South Dakota (2.60 pages/visit)

2. North Dakota (1.78)

3. Hawaii (1.72)

4. Maine (1.69)

5. Arkansas (1.65)

46. Rhode Island (1.25)

47. Nevada (1.23)

48. Oklahoma (1.22)

49. Missouri (1.20)

50. Wyoming (1.16)

Whether you happen to enjoy what you’re reading (like my friends in South Dakota, for the second month in a row!!) — or not (ahem, Wyoming …) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

This week, Jack sent me an email with the subject “Black Coffee” — and he got right to the point:

“You complain too much.”

I’m not complaining, Jack; I’m just trying to tell it like it is.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Len, how far do you foresee American’s living standards falling? Will the US end up like Greece? Or Mexico? Or God forbid Haiti?

I can’t say for sure, but the dollar is clearly over-valued today. I’ve seen estimates from 30% to 90%. If I had to guess, I suspect the dollar will lose at least half its value before this is all over. And if a panic ensues and confidence in the currency is broken, resulting in hyperinflation, then the percentage will be 100%.

To get a feel for how that would affect you, take your current annual income and reduce it by a number in that range. For example, if you earn $50,000 per year and the dollar suffers a 50% devaluation, then you will need to learn to live on the equivalent of roughly $25,000 in today’s money. One bright spot is that existing loans instantly become less expensive to pay off (because you are paying them off in cheaper dollars).

I’m still in the stock market through my 401k, but my exposure is lower than usual. I am kind of itchy to up my stock allocation because it seems like nothing negative affects stocks anymore. I don’t remember the last time there was a meaningful correction.

It’s been quite awhile, Sam. But the reason why is no mystery, in my opinion. (Thank you Fed, Swiss National Bank, and other central bankers!)

College is definitely not the bargain it once was Len. I’m with you on learning a vocational trade like plumbing. My uncle was a plumber and he made a very comfortable living!

Sara

Yes they do … and rightly so.

Len,

Watched Mike Pento on USAWatchdog with Greg Hunter and he plans on being 50% invested in metals and miners by mid 2018. I am also hearing of many insiders getting out of the market, so smart money is exiting. I think the cover of the 1988 Economist just could co e to pass in 2018! What say you Len?

Jared

I hate making hard predictions, Jared. It’s hard enough trying to open people’s eyes to what’s going on in this manipulated fraudulent financial environment without constantly being called a “fear-monger,” or a “broken clock,” or a “perma-bear,” or a “chicken little,” etc. etc. etc.

(As an aside: I wasn’t always this way; I believed in the power of “the Almighty dollar” — I only came to these conclusions after recognizing something wasn’t right with the current system and doing a lot of research on macroeconomics. Bill Holter put out a great article last week on his subscription service that mentioned the exact same thing!)

Back to your question: At this point, if I had to guess, I’d say there is a 40% chance of the Economist’s 1988 prediction coming to pass in 2018.

The Fed claims it is going to start the tightening process this month. If that’s true then there will be less Fed money going to the markets. A decline should logically follow unless earnings pick up to make up the slack.

I have a hard time believing the Fed is going to tighten … if they do, they need other central banks to pick up the slack. If they don’t, the markets are going to suffer the consequences. Remember, in a bull market, the entrance door is big and able to take all comers. Of course, everybody thinks they will get out when the market turns — but the exit door is very small; most people who try to flee when the fire starts raging will be trapped.

Len, the stock market and public pensions are permanently intertwined at this stage of the game because if the stock market fails, a mass pension collapse will soon follow. The Fed isn’t going to let the stock market fall ever again because a bankrupt pension system is a non-starter.

Well … they will try to keep the markets propped up — but, unless they want to destroy the dollar, the market is ultimately big enough overwhelm their intentions in a panic.

Their bolivar is toast but I believe the Venzulea stock market is the best performing market in the world at the moment.

It is in nominal value. In real value, however, that is another story. Yes, the price of those stocks is increasing, but not fast enough to offset the falling purchasing power of the bolivar. For that reason, Venezuelans who don’t save in gold or silver are better off holding their wealth in the stock of trusted companies rather than cash (bolivars) or bonds.

A soaring stock market is another symptom of a hyperinflating currency. For example, if the dollar implodes, the Dow will quickly climb to 100,000 and beyond.

Click here for a story on the Venezuelan market.

“Bulls & Pigs Make Money, Bears Get Slaughtered (Again)”

But then, their are Galapagos tortoises.

Tranquilly moseying along for a lifetime in their self-grown shells …

That there are, Dave. And you’re a great example of that!

and never trust a prophet making a profit !!!

Your survey doesn’t include those with NO house payment. Gosh I love saying that!

Amen. Been mortgage free here since 1991, and that loan was on the farm land only….we built the house for cash from the proceeds of the sale of the previous house, which we also built. Haven’t had an actual house payment since 1981.

Amen for me, too.

No mtg. pmt. for years, now.

No house payment = “Less than $500”

And good for you, Rick! That is a proud accomplishment!

Len,

In my self defense, I have sent you several notes and queries recently but I am not the Jack who said you complain too much. Must be my alter ego! I will use JAK from now on😀

Oh, I know, Jack. No worries, or need to defend yourself! Besides, I thought the other Jack’s note was pretty funny!

So, people are being forced to share more of their medical costs with higher copays and higher deductibles ….

Isn’t that what every economist agrees as the no 1 problem (amongst the many problems) with US healthcare? …. the agent problem …. disconnect between person footing the bill vs person getting the benefit?

This is a good thing. Unless people realize that hospitals charge them 400$ for bandages and get away with it, no market reform can occur. Price discovery and then, ability to shop around (HDHPs, full blown market reform), etc are a necessary step.

I think the number one problem with healthcare is government got involved with insurance — and I am not talking about just Obamacare. I am talking Medicare. Once gov’t began backstopping the healthcare industry, then the prices started rising because the gov’t had the “deep pockets” to reimburse the higher prices. College costs went off the rails for the same reason. End the gov’t loans and the prices will fall out of necessity.

Oh, the other question I had:

Explain to me why an extremely productive and hardworking population and resource rich country like US would suffer a standard of living decrease? Don’t we have pretty much everything we need inside this country?

If nobody wants dollars to buy/sell, then China’s trillion dollar holdings go to zero cause they can’t do anything with it. So, will every other foreign dollar holdings. Who cares if the people outside the country lose their shirt?

You and me can still use the dollar to trade inside the country, can’t we?

Now, imports will go really crazy and we can’t wear european fashions and drive japanese cars and south korean electronics … but as long as we are producing voluminous quantities of wheat, oranges, nuts, entertainment, technology, why would it be bad for us?

I don’t think American manufacturing is dead dead, people are just choosing to do different things. Given a chance (like a 50% change in import cost), it will blossom to full bloom in a matter of few years, no?

The living standard will fall because the purchasing power of the dollar will be reduced. Yes, import prices will necessarily skyrocket — and that will encourage the return of domestic manufacturing, which will in turn increase exports, which will in turn increase the purchasing power of the dollar and raise living standards. The trouble is … it’s going to take some time to rebuild the manufacturing base.

Rome was not built in a day!

Before Obamacare I had yearly premium increases but my deductibles and co-pays were stable. It was a great plan. $200 deductible and $30 co-pays. I knew the premium increases were coming so I could kind of plan for them. The new plan was a triple whammy. Higher premiums, deductible increase up to $750, co-pays up to $50, and out of pocket went from $1000 to $5000. That’s what has hurt my family so much. You can plan for premiums. Hard to plan for 70-300% increases on the other parts. And God help those who don’t have insurance. I got a prescription filled last week. My cost was $15. Without insurance it would have been $153. I’ll stop now so I can go take those BP meds (a bit more than $15).

What you are saying doesn’t make any sense unless you also believe there is a magical fairy in the insurance company premium calculations that randomly ups the premiums as soon as they hear the word Obama ….

Insurance is actually an industry that is based on mathematics and statistics and risk management and probability that they will have to foot your medical bill.

And always a good idea to differentiate between apples and oranges. You would have a point if you said “my benefits didnt change but prices / deductibles went up” but Im willing to bet that is not the case. Calling it a great plan doesn’t make it so.

The simpler explanation? You had a poor plan that wouldn’t cover most of the things before. Your deductible was 1000$ before because there was no way your insurance company was going to pitch in for some heavier expenses or perhaps cover pre-existing conditions, etc, etc. Now that they are forced to provide benefits, they know it doesnt make actuarial sense unless they up your share of costs.

Do you know why that is the simpler explanation? Because I have another anecdotal data point just like you. Me. My employer’s plan cost didn’t change by more than medical inflation. And you know what? I had pre-existing condition coverage even before Obamacare. That is how I know why my benefits remained largely the same and that is why my premiums didn’t go up by more than medical inflation.

Rick’s explanation makes perfect sense, Kyron. Obamacare introduced subsidized healthcare insurance to millions who never had it previously. Who do you think helps subsidize those folks? (Hint: People like Rick, and me — whose company plan premiums have also increased much faster after O-care became the law of the land, than before.)

Here is the real problem with America. Everybody thinks they are subsidizing others.

1, Federal debt and Medicare / device surtaxes are subsidizing poor people’s insurance. Not your premium or Rick’s.

2. If you believe your insurance premium is subsidizing poor people now, then you also have to believe you were subsidizing uninsured people depending on ER pre-Ocare.

But let’s say you and Rick are right and you are subsidizing the others for a second.

Explain to me why my premiums didn’t go up. (and by the way, my company’s health care costs didn’t go up significantly… it is not like costs did go up and they were shielding me by subsidizing me more).

Obamacare took out non-comprehensive plans, catastrophic coverage plans, so sorry, insurance will get expensive for that reason.

And age rating did make plans costlier for younger people. But unless your company hired only young people, any other company with a reasonable mix of ages and good comprehensive coverage should have seen average company costs remain similar, notwithstanding medical inflation.

I doubt we would agree on the issue. I know the plan I had and it was a very good plan. But you apparently know more about it than I do so I’m sure you are right.

As an experiment I looked in to Obamacare bronze plan for me and my family. Long story short: My premiums were more than $10000 per year. The deductibles were $5000 for each family member — that means I could potentially pay $30,000 per year before I would be reimbursed a single dime. Who in their right mind would pay $10,000+ per year for insurance like that? I’d be much better off taking that $10,000 and socking it away in savings account that I would only tap for health issues as they come up.

All Obamacare did was screw the middle class at the expense of those who previously had no insurance.

Len, seriously, which rock are you living under? Why are you surprised that your health care plan is 10000$/yr. Remember …. 400$ bandaids? …. and really, what did you think the plan was pre-Obamacare? 3.50$?

Go check your insurance plan from your company. Im willing to bet it is also 10000$, my guess – even costlier. Your company gives you a hefty subsidy as part of your compensation. Another of the banes of our healthcare system. Tax deduction for healthcare costs.

My company’s cost of healthcare per employee is 16000$. That is not including my cost (premium, deductible, etc).

That is the sad reality of us living in a “use insurance for everyday expenses” system instead of reverting to the roots of “use insurance for catastrophic expenses”.

And one more thing I forgot to add.

People always mix apples and oranges ….

You need to compare the cost of individual market insurance before and after obamacare.

Not individual market rate for you today if you are unemployed vs the price your company pays for you today as a bulk purchaser.