It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Let’s get right to it, shall we?

“In all our quest of greatness, like wanton boys, whose pastime is their care, we follow after bubbles, blown in the air.”

— John Webster

“I would as soon leave my son a curse as the almighty dollar.”

— Andrew Carnegie

Credits and Debits

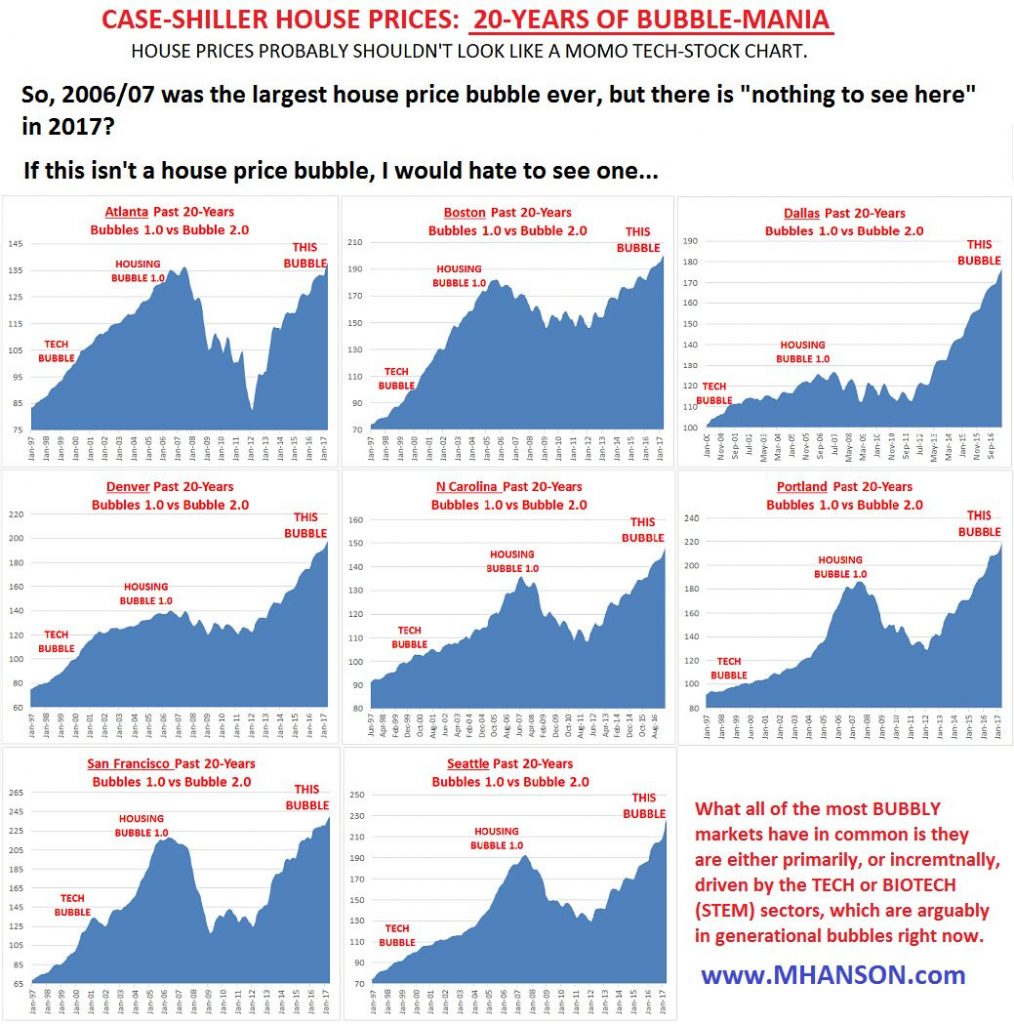

Debit: As if the spate of new house-flipping shows on HGTV isn’t a big enough sign that we’re in the middle of a housing bubble, here’s another: reports of a 13-year-old buying his own home. Uh huh. For $552,000, no less. I strongly suspect he didn’t actually use his own money — but the story itself is a sure sign another home-buying mania is upon us. (click to enlarge)

Credit: Speaking of bubbles, I see the S&P 500 hit another all-time high on Tuesday. Hey … why not? It doesn’t really seem to matter whether the economic news is good or bad — with few exceptions, stocks only travel in one direction anymore: up. Thanks, Fed!

Debit: In fact, today’s stock market is so unhinged from reality that Facebook has become the world’s largest publisher, Netflix is worth twice as much as CBS, and Tesla’s value is supposedly on par with General Motors. No, really.

Credit: On Thursday, Amazon’s soaring stock price vaulted CEO Jeff Bezos over Bill Gates to become the world’s richest man. The feat didn’t last long, however — before the day was over, Amazon’s stock price retreated, dropping Bezos back to number two. Heh. Loser.

Debit: Sadly, Mr. Bezos’ climb to the top of the world’s-richest list is more a testament to the central banks’ easy-money policies than his business acumen. Behold:

Credit: By the way, Bezos’ wealth accumulation isn’t the only sign of the Fed’s easy-money policy. As David Stockman points out, “The Fed and its crew of traveling central banks around the world have gutted honest price discovery entirely, turning global financial markets into outright gambling dens of unchecked speculation.” Well … yeah.

Debit: That’s not all Stockman had to say about the Fed; he also noted that, “The combined $15 trillion of central bank balance sheet expansion since 2007 amounts to monetary fraud of epic proportions.” Frankly, it’s hard to disagree with him; take another look at the chart above.

Credit: It’s too bad those trillions of dollars conjured out of thin air by the Fed haven’t found their way to Main St. — instead, almost all of it continues to be fed to Wall St. and the crony capitalists in Washington DC. If you’re looking for the primary reason why the wealth gap between the rich and poor is larger than ever, you can start right there.

Debit: Meanwhile, the US economy is doomed to secular stagnation and never-ending recession as long as real income for all segments continues to stagnate or decline. The trouble is, that won’t change until our dying dollar-based international monetary system re-anchors itself to gold. Or implodes beforehand.

Credit: The Fed also pushes the mantra that a low level of inflation is a good thing. It’s not. Consider this: even an annual inflation rate of 2% will halve a currency’s purchasing power in just 34 years. Now you know why it’s so difficult to save enough for retirement. It also illustrates why you should think about keeping at least a portion of your long-term savings in the ultimate store of wealth: gold and silver.

Debit: Since 99 out of every 100 Americans save only constantly-depreciating US dollars, maybe it’s a good thing that 37% of California households have no savings. Okay … maybe not. But it’s probably why so many clueless Californians continue to be hoodwinked by statist politicians who offer to take care of their every need — with earnings from the state’s dwindling producers, of course.

Credit: In another socialist bastion, Venezuela’s currency meltdown is getting worse. This week, the black-market rate for the bolivar fell to 8700 per dollar; it was 1000 last year. Five years ago, it was just nine bolivars to the dollar. I know it’s hard to believe, but the same fate awaits the US dollar. After all, every fiat currency eventually returns to its intrinsic value: zero. The math proves it — and history confirms it.

Debit: Unfortunately, thanks to the reckless monetary policies of the Fed and the world’s other colluding central banks, the dollar’s demise is happening in plain sight — but 99.9% of the American public remain blissfuly unaware. Sadly, most will remain that way until it is too late.

By the Numbers

Here’s a refreshing change: Foxconn is bringing a $10 billion electronics plant to Wisconsin as the company takes its first step into America. Here’s a closer look at the deal:

11 Number of football fields that will fit within the plant’s 20 million square feet.

2020 Year the Foxconn plant will become operational.

3000 Number of workers who will be employed initially.

13,000 Workers expected to be eventually employed at the plant.

$53,000 Average salary that the workers will be paid.

$700,000,000 Expected annual payroll once the plant is fully staffed.

$7,000,000,000 Expected annual impact to the Wisconsin economy.

Source: TMJ4

Last Week’s Poll Results

Have you ever been fired for cause from a job?

- No (83%)

- Yes (17%)

More than 1100 people responded to last week’s question and, I’m happy to say, fewer than 1 in 5 Len Penzo dot Com readers have been fired for cause by an employer. That’s actually somewhat higher than both reader Oscar and myself expected. After doing a Google search, our suspicions seen to be well-founded — according to a 2014 BLS study, the total employee discharge rate was 1.4% — and that included layoffs and dismissals for cause. I am certain the vast majority of those discharges were layoff-related.

The Question of the Week

[poll id="174"]

Other Useless News

While you’re here, please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading why Coke Rewards are for suckers, Mike left this comment:

When I had 4000 points I tried to make a deal: I would relinquish all 4000 points for two Coke Zero 400 tickets at Daytona. Well, I never got a reply back. Maybe they didn’t want to answer me, but at a buck a Coke that’s $4000! Figure that out you all! Makes no sense!

Actually, Mike, it makes lots of sense.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-

Multimillionaire or billionaire, it doesn’t really matter. These guys have more money than they could ever spend in an entire lifetime. It’s hard to fathom being so rich!

Have a great weekend Len!

Sara

Even in today’s low-interest low-return environment, I think people who intend on living a modest lifestyle can definitely get by with relatively little difficulty on several million bucks today. For now, anyway. That will change when all of those dollars circulating around the world come back to these shores when the currency implodes.

Don’t know whether its useful or not to keep repeating my mantra: Get you lifestyle adjusted to be as free as possible from the need to be subject to the financial system.

Counter culture. Dismissed.

You’ve got it, Dave. Living within your means solves a lot of problems.

We’ve been indoctrinated to believe that deflation is bad. I don’t know about you but I love paying less for things today than I did yesterday. It also makes the money in my wallet worth more valuable.

The problem is not natural deflation but deflation caused by central banks. They cause inflation by creating debt, but the debt itself is a deflationary force.

Oscar, for those of us who have no debt and cash on hand, deflation is great. For those who bought a home at inflated prices and then have to sell at lower prices after the bubble bursts, deflation is not so great.

Deflation is the enemy of debtors because it makes their loans more expensive. When you realize that, it’s easy to see why the central banks abhor it.

Deflation would also eventually destroy our debt-based monetary system, since it is a Ponzi scheme that depends on an ever-increasing quantity of dollars to keep the ruse going.

4000 Cokes is not only a lot of money – it’s a lot of sugar. Another reason why their rewards are for suckers.

Coca-colas produced in the US have been made with high fructose corn syrup since the mid 1980s — but I get your point, Wilson.

Most stores today, however, do sell Cokes from Mexico that are made with real sugar. I much prefer the Mexican Cokes; there is a noticeable difference in taste, IMO.

Never ever trust a prophet making a profit !!!!

TSLA stock seems approximately correctly priced. Assuming they will produce 5,000 Model 3s week (starting sometime in 2018), sell them at an average price of $45k wth a 25% profit margin. Apply a multiple of 20, which is pretty conservative with current valuation levels and you’ve reached 58B market cap, which is 10% higher than what the current one.

If they ramp up to the 1 million cars a year, then they are way under valued. On the other hand, if they aren’t able to replicate the Model S margins on the model 3, then they may be very overvalued.

Maybe, mp2c, but that’s a lot of assumptions and “ifs!” And what happens subsidies are phased out? Will EVs still sell? Recent evidence in Sweden suggests that if you take them away, sales plummet.

Financial analyst Dave Kranzler continues to closely analyze Tesla every month. Here is a quick comment he recently made: “Tesla burns over $1 billion per year in cash and its financials are riddled with what would have been considered accounting fraud 20 years ago. It sold 72.6 thousand cars in 2016. Compare this to GM, which has a market cap of $51 billion and sold over 3 million cars in 2016, and Ford, which has a market cap of $44 billion and sold 2.5 million cars in 2016.”

Can TSLA become profitable? Maybe. But only time will tell.