It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Let’s dive right in this week …

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

— Ludwig Von Mises

The essence of the Ponzi scheme is that it’s like an addictive drug. Once someone enters into one, he finds it psychologically impossible to face the reality of its statistical unsustainability. He refuses to get out in time, and his participation fundamentally changes his outlook toward reality.

— Gary North

Credits and Debits

Debit: On Friday, America saw the first change in the executive branch of government since 2009 — and during that time, the nation fell $10 trillion deeper into debt. That’s double the amount of red ink that was racked up in the previous eight years between 2001 and 2008.

Debit: Unfortunately, the international monetary system is a Ponzi scheme, which is why I expect the National Debt to double yet again to $40 trillion by 2025 — assuming the system survives that long. There’s really no alternative. We’re on a runaway train; any attempt to slow — or reverse — the accumulation of debt will only hasten the inevitable collapse. On second thought, I guess that’s a good thing.

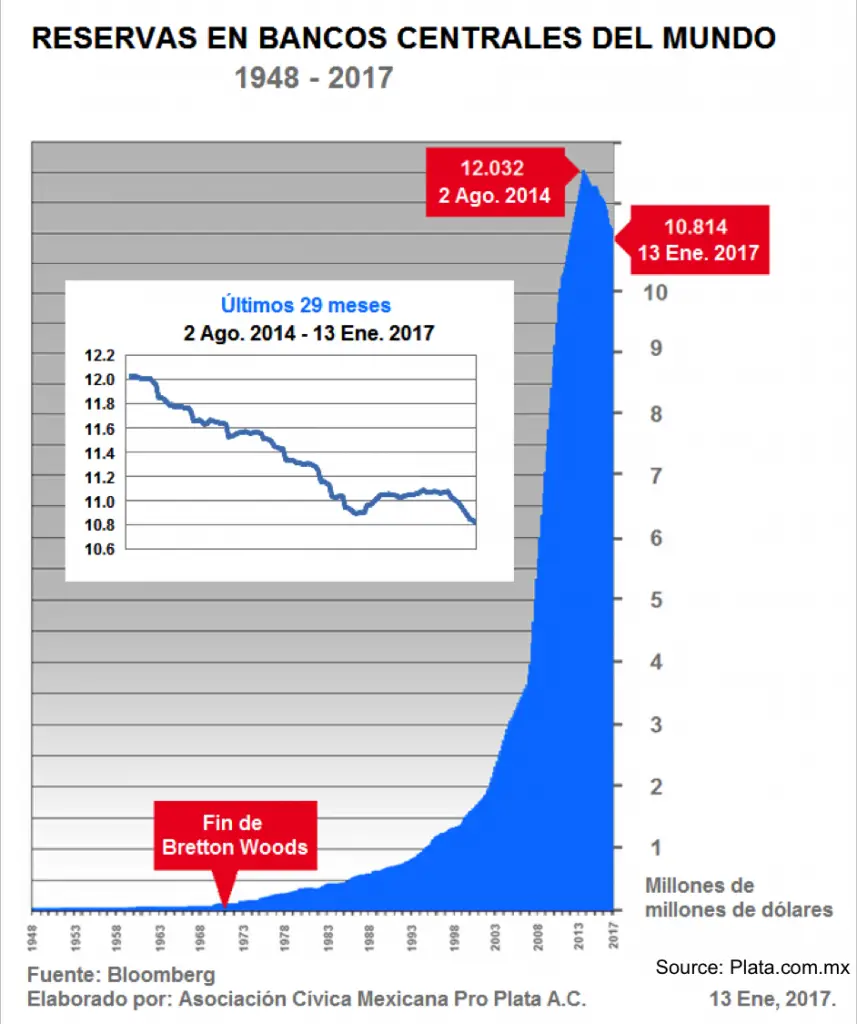

Debit: Indeed, if the US makes a concerted effort to reduce its trade deficit with the rest of the world, it will only exacerbate the decrease in dollar reserves held by the world’s central banks; those reserves have already declined 10% since reaching their peak on August 2, 2014. As Hugo Salinas Price points out, “The decline of International Reserves is a clear sign of world credit contraction.” Indubitably.

Credit: The following chart from Mr. Salinas illustrates the decline in reserves — and even though it’s in Spanish, it clearly shows the Ponzi scheme unleashed after Nixon closed the gold window in 1971 will be ending soon. Remember, as the rate of descent in US dollar reserves increases, the end of the “Almighty Dollar” — and America’s day of reckoning — approaches at a faster pace too. Got gold?

Credit: As financial analyst Andy Hoffman notes, the current financial system is in its death throes, as exemplified by, “Financial ‘markets’ which are so over-the-top manipulated, that even the average person — who has little or no capital invested — is starting to realize it.” Wait a minute, Andy! Some of us average people have seen this coming for awhile now.

Debit: Our failing monetary system is why, despite being better educated, millennials now earn 20% less than boomers did at the same stage of life in 1989. I hate to rain on the new president’s inaugural parade, but it’s also why the general economic malaise will continue. Real reform cannot begin until our current debt-based monetary system is scrapped and replaced with something new.

Debit: Of course, the Fed and its fellow central bankers, in their quest to keep the Ponzi alive for as long as possible, are doing their best to flood the world with additional credit. As a result, prices continue to rise for the things we all need to survive — including already-soaring rents, which are now rising at their fastest pace since 2007.

Debit: By the way, if you think rents are high, just be thankful you aren’t looking to buy a home — or a mansion. One particular 38,000 square-foot, 12-bedroom, 21-bath Bel Air home with three kitchens, a 40-seat movie theater, an infinity pool and 270-degree hilltop views is going for $250-million. I know … but what did you expect for a quarter-billion?

Credit: Did you see this? After being given a seemingly-endless runaround by his local DMV, a Virginia man decided to submit his tax bill in person — using five wheelbarrows loaded with 300,000 pennies. It took DMV personnel an entire day to tender his payment. Heh.

Credit: Oh, and before you feel sorry for those DMV workers who had to count all of those pennies, try putting yourself in the shoes of the poor guy standing in line behind the “wheelbarrow man.”

Debit: Finally … It looks like California Governor Jerry Brown and his inept budget office double-counted certain budgetary cost savings while “forgetting” to incorporate other expenses, resulting in a $1.6 billion budget deficit. They’ll probably make up the shortfall by imposing higher taxes on the “wealthy.” Hey … how come we never hear about the government making a mistake on the surplus side?

By the Numbers

The American Dream is gone and won’t be returning until we get a new monetary system. Here are some numbers on how the failing system has affected America’s middle- and lower-class:

68 The percentage of US income growth since 1980 that went to the top 10% of earners.

0 The percentage of US income growth since 1980 that went to the bottom half of earners.

117,000,000 Americans whose income failed to keep pace with inflation over the past four decades.

45 The percentage of middle income millennials who currently earn more than their parents did at the same age, adjusted for inflation.

90 The percentage of middle income Americans who, in 1967, earned more than their parents did at the same age, after adjusting for inflation.

50 The percentage of Americans today who make up the middle class.

61 The percentage of middle class Americans in 1971.

Source: ABC News

Last Week’s Poll Result

What is your employment situation right now?

- Employed Full Time (55%)

- Retired (27%)

- Unemployed (11%)

- Employed Part Time (7%)

More than 1100 people answered last week’s survey question. The Bureau of Labor Statistics continues to insist that the US unemployment rate is under 5%, but Len Penzo dot Com readers aren’t as fortunate as almost 1 in 5 of them are either unemployed or working intermittently. Another 27% are retired … I hope blissfully.

The Question of the Week

[poll id="147"]

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Manitoba (1.63 pages/visit)

2. Ontario (1.42)

3. Newfoundland and Labrador (1.41)

4. Alberta (1.40)

5. Nova Scotia (1.36)

9. Quebec (1.24)

10. New Brunswick (1.19)

11. British Columbia (1.16)

12. Prince Edward Island (1.13)

13. Yukon Territory (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Manitoba, eh) — or not (ahem, you hosers living on the frozen Yukon tundra) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

Ozzy574 wrote in to tell me why he refuses to buy precious metals:

Hasn’t anyone told you that you can’t eat gold?

Many times. Then again, I bet you don’t have any Federal Reserve Note recipes either.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Well, hopefully, the wealthy that Gov. Moonbeam raises axes on are those idiot movie stars and silicon valley execs who think that socialistic confiscation of money (they a seem to love Cuba, don’t they

?) is such a good thing. They all never seem to make voluntary donations to the treasury, do they? However, I can’t have too much sympathy for the rest of the citizens in the state as they helped to vote him into office.

Hey … have some compassion for me, Kathy! LOL I didn’t vote for the Big Government clown either time … but I suffer with the results of his socialist policies every day.

(Er, not that I’m wealthy, but California considers me so.)

Everyone but you, Len.

Wouldn’t it be interesting if only the ones who voted for him had to pay? It is easier to vote that way when someone else’s ox is being gored.

Thanks for another great weekend edition Len! The debt situation really is scary. And if the new administration follows-through on its spending plans we could see even more debt added to the pile. Yikes! Also appreciated your point about global central brink USD holdings. Overall I think the Eurodollar market could be in for some tough times.

Yep. The euro dollar shortage is already causing lots of problems, Jay. Trump has smart people in his circle of advisors who understand the flaws of the current International Monetary System; I think in the end he will understand that closing our trade deficit with the rest of the world will only hasten collapse of the current monetary system. Hopefully, this will be made clear to him; if it is, short of Ron Paul, he is the best person America could want to have in office for those looking for a new monetary system based upon sound money.

Wow! I love every cup of joe you serve each week but this Black Coffee was a real eye opener Len!

Looks like the financial reset is closer than most people think.

Have a great weekend!

Sara

Thanks, Sarah! No telling when the reset gets here, but if I had to guess I think it will be before the end of Trump’s first term in office.

Dumb question Len. Why can’t the Fed print more dollars and give them to the other central banks so their reserves keep going up?

They can, Marcie. That’s basically “monetizing” the debt — and it will ultimately result in hyperinflation by further devaluing the existing dollars already in the system. Remember, in a perfect world, new currency should only be printed to keep pace with the creation of new goods and services in the economy.

The US hasn’t been a good credit risk for long time. We’re like a destitute family with ten kids and the breadwinner is unemployed. We have $250,000 in credit card debt, the mortgage is six months in arrears and we’re still looking for new loans so we can replace our two year old Escalade with a brand new one.

We have two choices as a country. Either keep borrowing and accept ever decreasing growth, or implode the system today by paying down debt which contracts the money supply. This is what Len explained here. The Fed is going with the former. You and I can’t get away with this because there are consequences. Central banks can though.

Good answer, Bill. I would only add that central banks can get away with it — but only for awhile. The trouble starts when:

1. those extending credit (e.g., other nations buying US Treasuries to settle American trade imbalances) lose confidence in the dollar

2. those extending credit begin calling in their loans by selling US Treasuries that they already have in their possession

3. Corporations and the public refuse to borrow more because they have reached a level of debt saturation (i.e., they are unable or unwilling to take on any more because they are tapped out)

Item 3 has already occurred. Item 2 is now in progress. Item 1 is the next — and final — domino to fall.

Love it, WA! Great example.

Looks like its getting serious.

Would growing the GDP help pay down This debt? Say 5% avg GDP?

Yes, Matt, it would. However, the US — and the rest of the developed world — economy has some serious headwinds that will make the return of those kind of GDP numbers hard to realize. Over-regulation, a huge government bureaucracy that acts as a boat anchor around the private sector and high taxation can be fixed if the political will is there. However, two others can’t easily be swept away: 1) the huge debt overhang, and 2) demographics. In the US, huge numbers of baby boomers are entering retirement, buying less, selling second homes, and downsizing into smaller primary homes; that selling and pull-back in spending puts downward pressure on future growth.

I’ve been a high school Librarian for 30 years. Ok ,those are my credentials.I really feel you should write a book-it would benefit the public and guaranteed to be a non-fiction best seller.Partially with your help, I now own a house in Brooklyn , condo in Atlanta, and 3 in Ft. lauderdale-great revenue streams and landlord friendly.

The “By the Numbers” are interesting as always.

But Im a little cynical about how we are letting the lower 50%ile not take personal responsibility for their status …

People who take the trouble to get advanced training like trades, skills, services or advanced education in STEM, law, finance, economics, business, etc are not in the lower 50%ile. They are high income wage earners and business owners.

Should we blame government, politicians, monetary policy, etc for the lot of the lower 50%ile? Should we blame more educated graduates from outside US for their lot? Should we not encourage people that the 70s normal where you could have raised a family working on low level manufacturing / service jobs CANNOT be the new normal?

I agree the tax code needs revision and tax loop holes that benefit rich / corporations must be closed and the tax rates must be appropriately progressive (or even close to flat) but Im not sure the lower 50%ile are completely blameless victims of the predatory rich.